References

Benoit, S., J. Colliard, C. Hurlin, and C. Pérignon (2017). Where the risks lie: A survey on systemic risk. Review of Finance 21, 109–152.

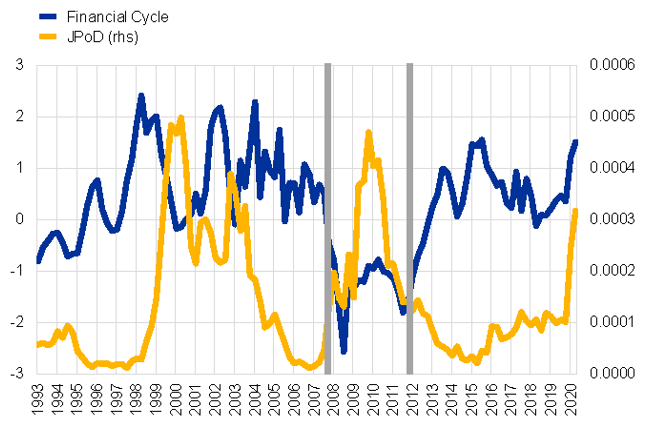

Bochmann, P., Hiebert, P., Schüler, Y., and Segoviano, M. (2022): Latent fragility: Conditioning banks’ joint probability of default on the financial cycle. ECB Working Paper 2698.

Boissay, F., F. Collard, and F. Smets (2016). Booms and banking crises. Journal of Political Economy 124, 489–538.

Claessens, S., A. Kose, and M. Terrones (2012). How do business and financial cycles interact? Journal of International Economics 87, 178–190.

Schularick, M. and A. Taylor (2012). Credit booms gone bust: monetary policy, leverage cycles, and financial crises, 1870–2008. American Economic Review 102, 1029–1061.

Schüler, Y., P. Hiebert, and T. Peltonen (2015). Characterising the financial cycle: A multivariate and time-varying approach. ECB Working Paper 1846.

Schüler, Y., P. Hiebert, and T. Peltonen (2020). Financial cycles: Characterisation and real-time measurement. Journal of International Money and Finance 100, 102082.

Segoviano, M. (2006). Consistent information multivariate density optimizing methodology. FMG Discussion Paper.

Segoviano, M. and C. Goodhart (2009). Banking stability measures. IMF Working Paper.