This policy brief summarizes a research paper with the same title. The full paper can be accessed at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2229702

Abstract

How do firms learn to forecast future business conditions after major structural changes to the economy? How long does it take? We exploit German Reunification as a natural experiment, where firms in the East are treated with ignorance about the distribution of market states, to test a Bayesian learning framework. As predicted, we find that Eastern firms initially forecast future business conditions worse than Western ones, but this gap gradually closes over most of a decade following Reunification. The slow convergence stems from differences in forward expectations rather than realized market conditions. These results warn of costly and drawn-out firm-level adjustments to contemporary regime changes, such as trade wars.

Virtually all firm decisions, either implicitly or explicitly, depend on forecasts of the future. Most inputs need to be procured before production takes place and investment returns depend on future outcomes. Getting forecasts right matters for productivity and profitability.

Future business conditions are always uncertain and often cyclical, but occasionally the economy changes so severely that firms must learn the market anew. Recently, it seems, `occasionally’ has become `often’: 2016 brought the Brexit referendum, 2018 the US-China Trade War, 2020 the COVID19 pandemic, 2022 the Russian invasion of Ukraine, and the end of a long low-inflation environment, which according to The Economist “is playing havoc with [Amazon’s] ability to predict the future”. These events are unlikely to be one-off shocks but are expected to permanently change international economic relations or even consumer and firm behavior. With these upheavals to supply, demand, and trade conditions as a backdrop, we ask, “How do firms learn to forecast again after a structural change to the economy? How long does it take?”

At first blush, measuring the rate at which young firms’ forecasts improve over time seems simple, but since firm age correlates with unobserved firm and market attributes affecting forecast quality, any such estimate of the learning rate would be biased. For example, in addition to new firms being smaller (for which we can control), their employees also tend to be younger and have different human capital, and their markets tend to be newer and utilize different technologies. Thus, another approach is required.

The ideal experiment would exogenously place a cross-section of naive firms into a new market environment alongside very experienced but otherwise similar counterparts and compare their forecasts of subsequently shared market conditions over time. The unique microdata from a German firm survey, the ifo Business Climate Survey (Geschäftsklimaindex), allows us to quantify how fast East German firms learn to forecast business conditions under the quasi-experiment of German Reunification.

The widely cited ifo survey has been collecting the near-term expectations and assessment of business conditions for a large cross section of German manufacturing establishments. Reported firm expectations and realizations allow us to calculate monthly, firm-level forecast errors, a proxy for uncertainty. We can then analyze how Eastern firms’ forecast errors develop relative to Western ones after Reunification.

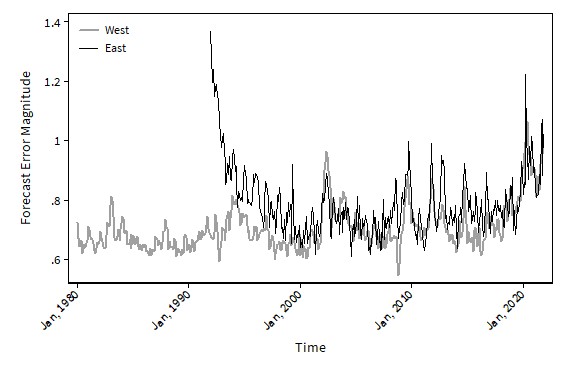

Figure 1 illustrates our results. It plots forecast error magnitudes (no direction) by Western firms since 1980 and Eastern ones after Reunification and provides evidence for the impact of Reunification on Eastern firms and their subsequent learning. Initially, Eastern firms made much larger forecast errors than those in the West. Note that there is no unusual spike in Western forecast errors, due to the shock of Reunification or any other reason. Over time, forecast errors in the East decreased and converged to Western levels. We see that real-world convergence took a decade, despite the fact that formal institutions converged immediately, and business conditions converged very quickly. Also, note that over the 40 years we observe, only the Covid19 shock in early 2020 caused forecast error magnitudes comparable to those of Eastern firms after Reunification. Since Covid19, forecast error magnitudes remain quite high, but not different between East and West.

Figure 1. Forecast Errors in East and West Germany

Notes: This graph plots the monthly average forecast error magnitudes for East (from 1992) and West Germany. Forecast errors are constructed from qualitative survey questions on business condition (Geschäftslage) expectations and realizations.

We do not explain the technical details of the learning process here, but one can use the following analogy. Suppose one must predict the weather after relocating from a valley (planned economy) to the mountains (market economy). Weather in the mountains is generally more volatile than in valleys and hence harder to predict without specific information. Weather forecasts, or signals, help prediction but are noisy themselves. Finally, though, the longer one lives in the new location, the better one understands the weather patterns and aggregate information from various sources. Once the weather pattern is learned the remaining forecast errors only depend on signal noise and weather volatility.

However, there is a worry that Reunification left Eastern firms not only with different understandings of the market, but different market conditions altogether, than Western ones. This is implausible as we only include manufacturing industries and the East immediately joined all Western institutions, i.e. there was no institutional transition as in other East European countries. Also, our results are robust to using the subsample of exporting firms for whom market conditions were identical (assuming their domestic markets are not overly important, and they export to similar destinations). Previous research suggests that after Reunification, Eastern firms did not sell into different markets, but rather Eastern firms swiftly reoriented their exports from planned to market economies. Around Reunification just under 60 percent of Eastern firms’ sales were domestic. Eastern firms in 1987 made only 7 per cent of their revenue from exports to Eastern Europe. By 1992 the number had fallen to 1.6 per cent.

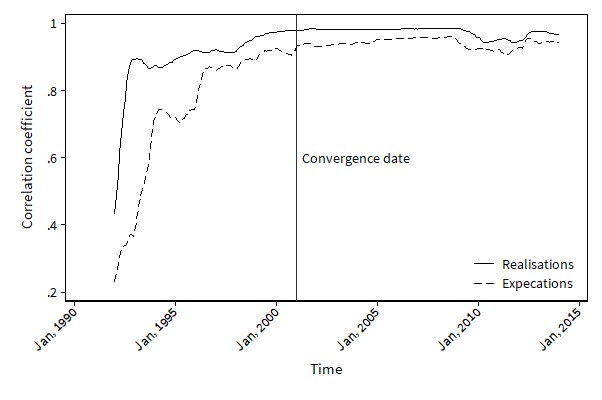

Our data also indicates that the market states did not differ substantially between the two regions. Figure 2 plots the time series for the correlation coefficients between Eastern and Western aggregate realizations and expectations, respectively. It also plots the convergence date according to our formal analysis. The correlation between Eastern and Western aggregate realizations rises rapidly above 0.8 almost immediately after Reunification and increases only slightly thereafter. Correlations between aggregate expectations reach similar strength only after 1997. This suggests that markets between regions homogenized quickly, and the convergence in forecast errors, does not come from alignment of actual market conditions but rather expectations, which took longer to converge.

Figure 2. Convergence between East and West Germany in Market State Realisations and Expectations.

Notes: In this graph the lines plot the rolling correlation coefficients (8-year windows) between East and West. The solid line is for aggregate realizations and the dashed line is for aggregate expectations.

Also, Eastern firms might learn their idiosyncratic states rather than market conditions. We make the common assumption that firms know their own productivity and our empirical results do not refute the predictions of Bayesian firm learning for a model where firms only learn a common market state. Also, Eastern firms probably learned their productivity during the privatization process. The national privatization agency (Treuhandanstalt) carefully screened firms and only firms deemed competitive were privatized. Finally, our formal regressions (see the full paper) control for self-reported firm idiosyncratic circumstances as reported on the same survey. Restricting our sample to Eastern firms that survived until 1999 shows that convergence is not purely due to survival of the best forecasters either. Finally, our explanation for forecast error reduction in the East aligns with several pieces of circumstantial evidence, including Eastern managers’ recognition of a deficiency in their understanding of market economies. In 1991 West German firms hosted East German managers as interns. About 70 percent of these interns self-reported having a poor knowledge of market economics; more than 85 percent of their Western hosts shared that assessment.

Our study is not without limitations. Although we measure the learning of Eastern firms that live through Reunification, the reasons why firms learn remain somewhat obscure. In particular, given that our natural experiment shocked not just Eastern firms, but the individuals and non-firm institutions, we cannot ultimately disentangle organizational learning from individual learning. Although we have ruled out survival of the fittest at the firm level as primary driver of the observed improvements, we cannot rule out that better forecasting managers (many Eastern firms replaced top management with Westerners) displace worse ones within firms.

Our results stress that firms need time to learn to operate in new settings, which is relevant for policy making that relies on managing expectations. Policy makers do not only have to overcome inattention they also need to wait until firms understand. The lessons of this switch to capitalism, though more drastic than most changes to business environments, may help set realistic expectations for how quickly firms adjust to other sweeping market changes like the net zero economy, new trade rules, or redrawn political boundaries.