We study the effects of a temporary increase in the inflation target in a model with adaptive learning and imperfect credibility of the central bank. In such a setup the private sector has to learn the model governing the economy and assess if the change in the interest rate is due to a standard interest rate shock or to a persistent shock to the inflation target. We find that the analytical condition that guarantees asymptotical expectational stability under full credibility is the same that we obtain for the calibrated version of our model under imperfect credibility. Under full credibility the transition to the long-run equilibrium is faster and the variance of inflation is lower. Our results are consistent with the view that increasing the inflation target can be used as a policy instrument without unanchoring expectations.

The recessionary and deflationary consequences of the Great Recession stimulated the debate on the desirability of the increase in the inflation target. On one hand, raising the inflation target from two to four percent eases the constraints on monetary policy arising from the zero lower bound on interest rates1, while more recently, Evans (2020) pointed out that “periods with above-target inflation are essential to achieving the dual mandate goals over the long run”. On the other hand, Governor Bernanke at the 2010 Jackson Hole Symposium underlined that a higher inflation target could unanchor inflation expectations.

In the aftermath of COVID-19 crisis, in August 2020 the Federal Reserve adopted an average inflation targeting regime which calls for a deliberate overshooting of the 2% inflation target following episodes of below-target inflation, so as to ensure that average inflation rates are closer to the target. In this regime the inflation target should be reached only on average within a time span and deviations from the target should be accepted for some time, as explained by Powell (2020).

In a recent paper2 we study if a persistent increase in the inflation target unanchors expectations in the long run, studying expectational stability. We believe that expectations are a crucial channel to assess the consequences of changing the inflation target. To that extent, uncertainty about the timing of the end of a recession may induce greater caution in private sector’s forecasts of inflation, as it could be harder, for the central bank, to revert the inflation target quickly to the previously announced long-run target. Therefore, a lack of credibility to quickly revert to the long-run inflation target may determine uncertainty about the persistence of the deviation and, therefore, the need for the private sector to estimate it.3

We use a New Keynesian model where the persistence of the increase in the inflation target is not known in real time by the private sector because of central bank’s lack of credibility. The economy is subject to two different shocks: a standard interest rate shock and a (more persistent) shock to the inflation target, whose true persistence is unknown to the private sector. If the central bank is imperfectly credible, the private sector can only observe a combination of the two shocks and, by a signal extraction procedure, estimates them separately. The signal-extraction procedure is accompanied with a real-time adaptive learning procedure determining private sector expectations: we study the asymptotic convergence of expectations after a shock to the inflation target around a long-run value. In this way we assess how expectations are affected by the signal extraction procedure when the changes in the target become persistent.

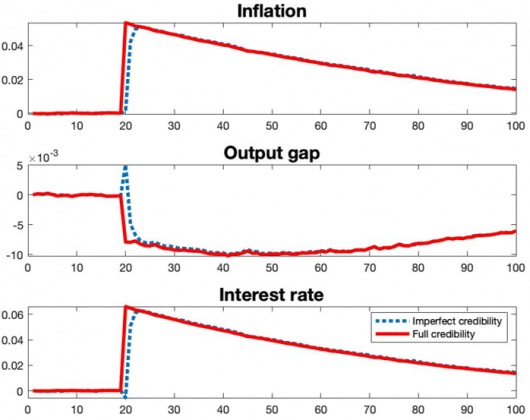

We show that under full credibility the Taylor principle ensures asymptotic learnability of the rational expectations equilibrium. However, an imperfectly credible central bank is less successful in managing private sector’s expectations: agents take more time to correctly assess the actual size and the persistence of the shock and this is reflected by a higher volatility of inflation and output gap. Figure 1 shows the median among 10,000 randomly-generated realizations for each of the two credibility regimes: the simulation is conducted under the assumption that the value of the target is 0% in each period until period 20, when it is raised to 2%. By means of stochastic simulations it can be observed that the median series shown in Figure 1 do not diverge and remain stationary around the equilibrium trajectory, after the target shock occurring in period 20. The peak value of inflation after the shock to the inflation target is similar under both full credibility and imperfect credibility, but in the latter case it takes more time for the private sector to understand the magnitude as well as the persistence of the shock realization. In this setup, agents cannot distinguish in real time between a shock to the inflation target and a monetary policy shock, and they learn over time which component influences a change in the interest rate. Under imperfect credibility, a positive shock to the inflation target is initially interpreted (at least partially) as a negative monetary policy shock: to that extent, the figure shows that in the aftermath of the shock the interest rate turns negative (in deviation of its steady state). Output gap, in turn, initially increases, differently from what happens under complete information. The converging path too is affected by the credibility regime: under imperfect credibility, after the initial lower inflation and higher output gap, inflation stays slightly above the path followed under full credibility. Subsequently, output gap stays (slightly) below the path followed under full credibility.

Figure 1: Inflation, output gap and interest rate under full credibility (continuous line) and imperfect credibility (dashed line)

Summing up, imperfect credibility makes agents worst off since information flows more sluggishly through the economy than under full credibility, while full credibility allows a more rapid transition after a persistent change in inflation target. Imperfect credibility affects significantly the short-run trade-off between inflation and output, mainly due to the cost of learning the true model and the inflation target.

Ball, L. M. (2014). The case for a long-run inflation target of four percent, Vol. 14–92. International Monetary Fund.

Blanchard, O., Dell’Ariccia, G., & Mauro, P. (2010). Rethinking macroeconomic policy. Journal of Money, Credit and Banking, 42, 199–215.

Erceg, C. J., & Levin, A. T. (2003). Imperfect credibility and inflation persistence. Journal of Monetary Economics, 50(4), 915–944.

Evans, C. L. (2020). Summary of president Evans presentation on countering downward bias in inflation delivered at the central banking conference in Mexico city. (Link)

Marzioni, S., & Traficante, G. (2023). Learning with uncertain inflation target. International Review of Economics & Finance, 84, 624-634.

Powell, J. (2020). New economic challenges and the fed’s monetary policy review. Remarks by Jerome Powell, Chair, Board of Governors of the Federal Reserve System, at “Navigating the Decade Ahead: Implications for Monetary Policy,” an economic policy symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming (via webcast).

See Blanchard, Dell’Ariccia, and Mauro (2010) and Ball (2014).

See Marzioni and Traficante (2023).

In a setup used to describe the Volcker disinflation period, Erceg and Levin (2003) consider the issue of central bank’s credibility.