This policy brief summarises three key lessons for policymakers, modellers, and forecasters from recent work on forecasting real housing investment (Cañizares Martínez et al., 2023a and 2023b). Our study offers a new approach to conditionally forecast residential investment in the largest euro area countries and the euro area. We estimate many models using a wide set of determinants and select the 50 best performing models. This forecast averaging approach addresses considerable model uncertainty in the case of residential housing investment.

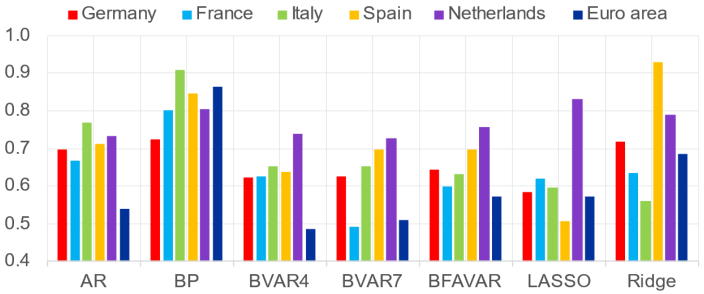

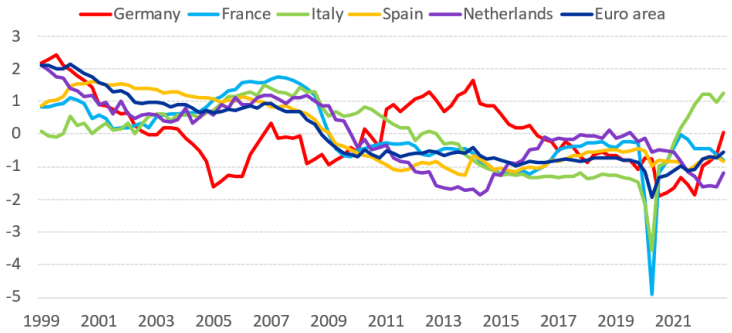

In a nutshell, our forecast averaging approach is based on selecting among many model equations the best performing ones in terms of four in- and out-of-sample selection criteria. The first selection criterion is the existence of a co-integration relation between residential investment and three long-run drivers: Tobin’s Q, income, and credit. All three long-run drivers can be measured in different ways, and we therefore consider three to five different measures of each. A novelty is that among the income measure we also consider a housing affordability index, which combines the joint impact of income, house prices, and mortgage rates in one variable. This results in 119 long-run equations of which we only keep those that show a cointegration relationship. As potential short-term drivers we not only consider the earlier mentioned three categories, but also four other groups: mortgage interest rates, macroeconomic variables, demographic and wealth series, and unemployment rate and uncertainty. Again, various measures of each group are considered, in total 15 series. To further select among the more than 100,000 potential equations, we apply an autocorrelation test as a general model misspecification test (second selection criterion), the individual significance of Tobin’s Q and income long-run coefficients (third selection criterion or restrict them to one in an alternative restricted model specification we consider), and at least a 10% out-of-sample forecast outperformance of an AR benchmark (fourth selection criterion). Three lessons emerge from our forecast averaging tool.