Contrary to most other (European) countries, Sweden mainly relied on voluntary measures rather than binding restrictions in its fight against the coronavirus. This ’soft’ anti-corona strategy was applauded by some, but there is not yet overwhelming evidence that it has drastically reduced economic costs. There are indications that the milder lockdown has spared the domestic economy a little. However, a number of countries with more severe lockdowns have also mitigated the economic damage. Moreover, as a small, open economy the Swedish economy was not immune to weakness from abroad. Moreover, the relative economic ’success’ raises questions if health results are also taken into account. Sweden’s soft anti-corona strategy is based on the confidence of policy makers in the rationality and social cohesion of Swedish society. However, the approach is under fire due to the relatively high mortality rates, which also raise doubts as to whether social cohesion will be strong enough to overcome the virus.

It will only be possible to make a final assessment once the virus has been brought fully under control and the economy has recovered. An interim assessment suggests that the economic cost will ultimately be determined by the collective ability of the population to continue to exercise an appropriate level of caution. Indeed, the economic impact of the pandemic is determined not only by the measures taken to contain it, but also by the public’s support and spontaneous behaviour. Countries can draw of the experience of others to help choose future measures that will optimally balance the fight against the virus and the related socio-economic costs. Sweden’s situation also reminds us that in small, open economies, such as Belgium’s, budgetary stimulus is not very effective in stimulating economic recovery, and the focus on competitiveness is all the more important.

In the fight against the Covid-19 virus, Sweden is regularly in the spotlight. Unlike most other (European) countries, Sweden did not resort to formal lockdowns. Although meetings of more than 50 people were banned, primary schools, shops and restaurants remained open. Working from home was recommended and non-essential foreign travel was restricted under EU rules. As a general principle, the policy mainly used recommendations instead of coercive measures.

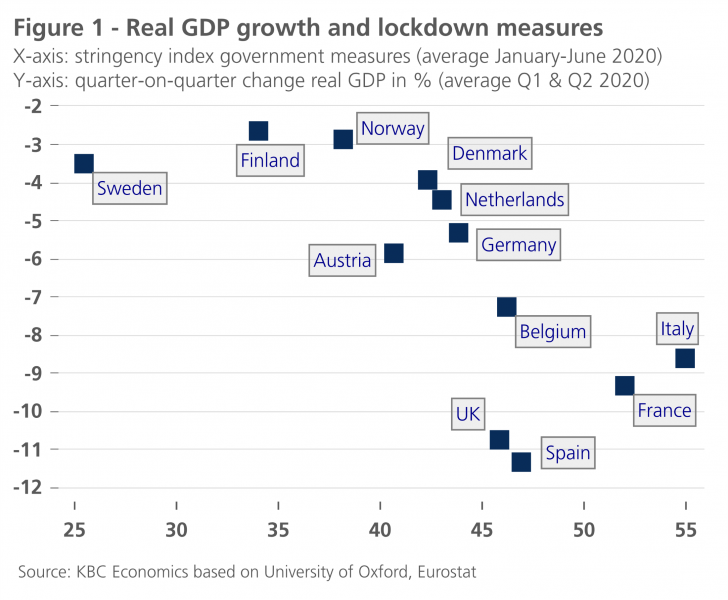

Oxford University calculates an index for more than 180 countries on a daily basis that reflects the stringency of various government measures used to combat the spread of the coronavirus, such as the closure of schools, businesses or public transport, restrictions on freedom of movement or a ban on mass gatherings. Figure 1 shows the average value of this index for 12 European countries in the first half of 2020. It thus gives an idea of the average stringency of government measures. According to this yardstick, Sweden had the ’softest’ lockdown during this period.

Initially, it seemed that this approach would limit the economic damage caused by the coronavirus. While the global economy contracted sharply in almost all countries as early as the first quarter of 2020, Sweden was still experiencing modest economic growth. Real GDP was marginally higher than in the fourth quarter of 2019. However, the figures for the second quarter painted a more nuanced picture. The Swedish economy contracted by 8.3% quarter-on-quarter. This is significantly less than the euro area average (-11.8%), but a bigger economic downturn than in the neighbouring countries of Finland, Norway and Denmark.

Figure 1 also shows the average quarter-on-quarter change in real GDP in the first and second quarters of 2020. On balance, the economic slowdown in the first half of the year remained significantly smaller in Sweden than in Spain, the UK, France and Italy, which experienced much more severe lockdowns at the time. However, with a significantly tighter lockdown, the Danish economy held up almost as well as the Swedish economy. In the Netherlands and Germany, too, the lockdown was significantly more severe than in Sweden, while the overall economic downturn was not that much stronger. In fact, the Finnish and Norwegian economies held up better than the Swedish economy with a stricter lockdown.

Figure 1 generally suggests a negative relationship between the severity of the lockdown and the economic downturn. But there are exceptions and Sweden is one of them. Certainly in comparison with neighbouring countries, the Swedish growth figures do not at first sight provide overwhelming evidence that the less stringent anti-coronavirus approach is drastically reducing the economic cost. There are various explanations for this.

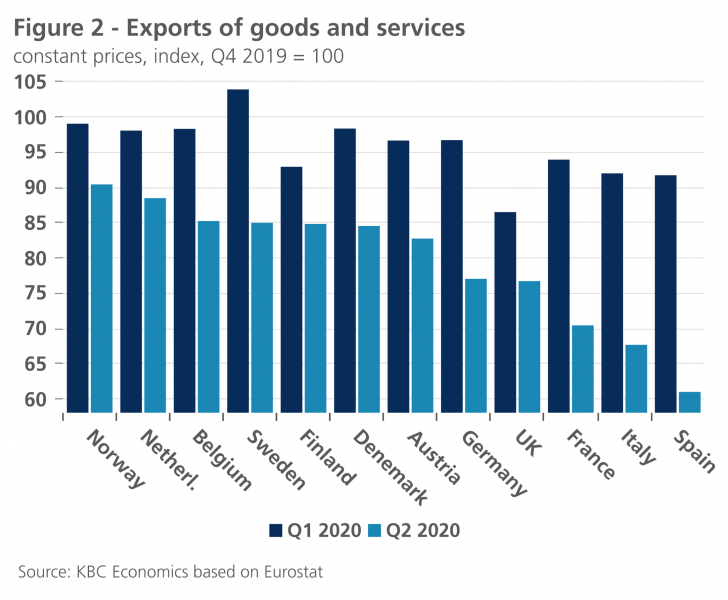

Through foreign trade, economies are strongly interlinked. This is certainly true in the EU, which forms a common market. Figure 2 illustrates that the relatively strong result of the Swedish economy in the first quarter was made possible by its export performance. However, exports fell very sharply in the second quarter. Thus, due to international trade, the Swedish economy did not remain immune to the impact of the crisis on its trading partners.

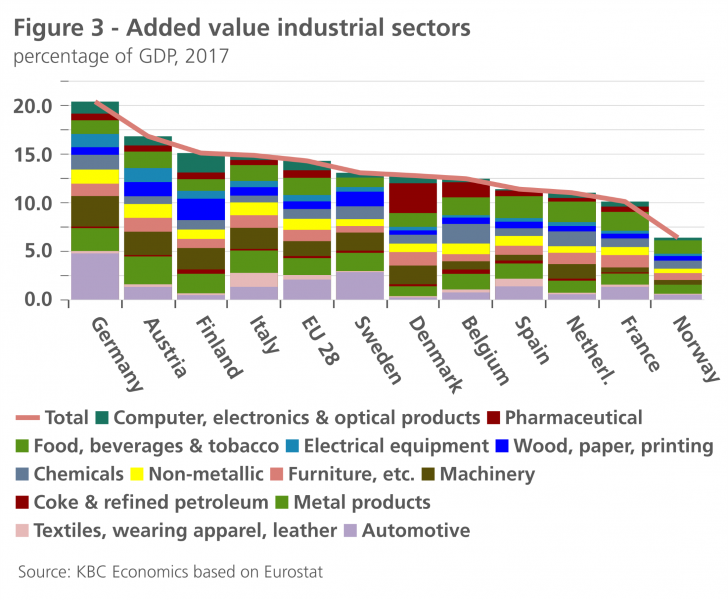

The economic structure of the countries plays a role in this. International interdependence is greatest in the industrial sectors, although the importance of international trade in services should not be underestimated. Figure 3 illustrates the share of the added value of the various industrial sectors in GDP.2 Sweden occupies an intermediate position in terms of economic dependence on industry. In Finland the share of industry is higher and in Denmark it is hardly any smaller. Norway has the smallest dependence of the countries shown.

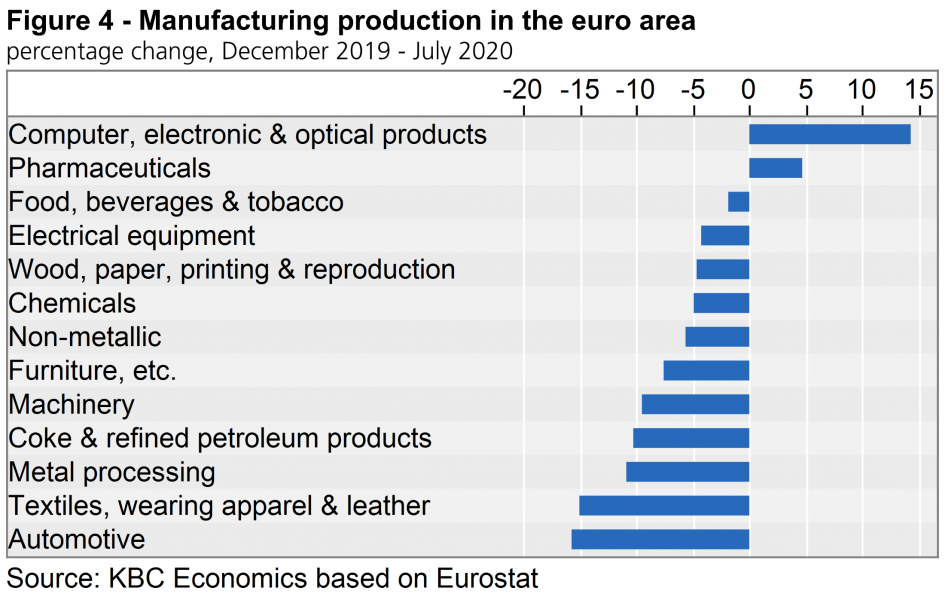

The sectoral composition of industry varies greatly from country to country. This is important, because the economic malaise in recent months has differed greatly from one sector to another. Measured by the percentage difference in industrial production in the euro area between December 2019 and July 2020, the recession hit the automotive and textile industries hardest (Figure 4). Metal processing and machinery were also hit hard. These sectors account for more than half of Swedish industry. The automotive industry, in particular, accounts for the difference with neighbouring countries. After Germany, Sweden is the country with the second largest car industry as a share of the economy. In Norway, Finland and Denmark it hardly plays a role at all. In Finland, on the other hand, the electronics sector is important, and in Denmark it is chemicals. These are the only sectors that have seen significant growth in the euro area in recent months.

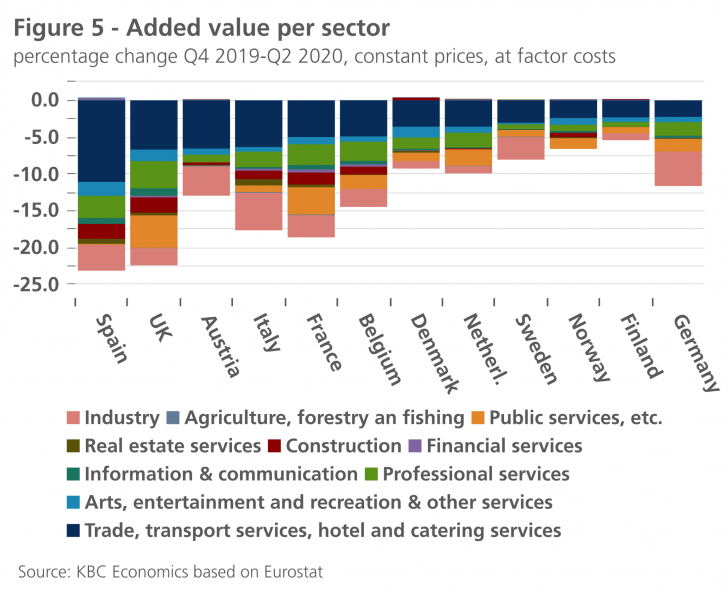

Figure 5 illustrates that nearly half of the economic downturn between the fourth quarter of 2019 and the second quarter of 2020 in Sweden was caused by the contraction of value added in industry. This is comparable to the contribution of industry to the economic downturn in Germany. In the other countries shown, the contribution of industry to the economic contraction was much smaller. Thanks to sectoral specialisation, this was also the case in Denmark and Finland, despite the greater importance of industry in Finland. This also explains why the economy held up relatively well in both countries.

Striking is the big difference in construction dynamics between the countries. This is a second reason why some economies held up better against the coronavirus malaise. In Sweden, Germany, the Netherlands and Finland, there was hardly any decline in added value in this sector. In Denmark, there was even slight growth. In the UK, Spain, France and Belgium, on the other hand, value added in the construction sector fell rather sharply. A priori, there seem to be few reasons why the immediate impact of the coronavirus on construction activity should be different in one country than in another. The nature of public measures or the way in which they are implemented, however, seem to make a big difference here.

In general, however, the economic malaise was mainly caused by the decline in value added in the service sectors, in particular retail and wholesale trade, transport services and the hotel and catering industry. Professional services and public services also suffered a major downturn in many countries.

Figure 5 also shows that the arts and leisure sectors have held up very well in Sweden. This puts Sweden in a unique position, and it is very plausible that this is directly linked to the less strict anti-coronavirus policy. On the other hand, it is noteworthy that the trade, transport and hospitality sectors (taken together) have suffered somewhat more in Sweden than in Germany, Finland and Norway despite the milder lockdown.

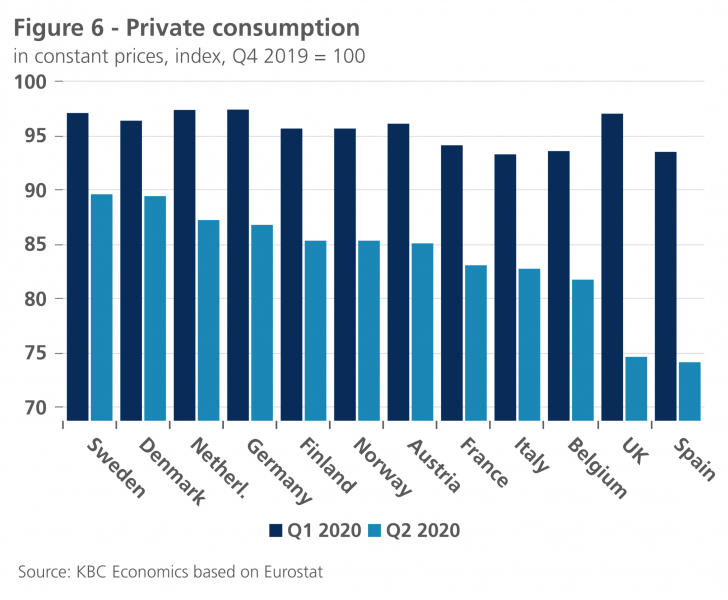

The economic downturn in the service sectors is, of course, closely linked to domestic demand. It held up better in Sweden than in most other European countries. In particular, private consumption held up relatively well. Of all the countries shown in Figure 6, the fall was smallest in Sweden, although the contraction was scarcely more limited than in Denmark and the damage to private consumption in the Netherlands and Germany also remained somewhat limited. Moreover, a contraction in consumption of more than 10% (compared to the fourth quarter of 2019) in Sweden is by no means negligible.

This suggests that it is not only preventive measures against the spread of the coronavirus that have an economic impact, but first and foremost the direct response of consumers in particular to the virus, regardless of the preventive measures taken. For fear of infection, people voluntarily restrict their mobility and, consequently, their purchasing behaviour when the virus flares up. Research in this area mainly concerns non-European countries.

In the US, two thirds of the decline in mobility can be explained by localised flare-ups of the virus and only one third by lockdown measures (W. Maloney and T. Taskin, 2020). For Sweden, the researchers establish a similar link. Other research estimates the impact of formal measures to be even smaller in the US: only 7 percentage points of a 60% drop in consumption (A. Goolsbee and D. Syverson, 2020).

Such a reduction in mobility has a negative impact on non-essential consumption, with the ensuing economic consequences. Comparative research into the impact of coronavirus infections on employment in South Korea (where no formal lockdowns were implemented), the US and the UK suggest that only about half of the job losses are explained by formal lockdowns (S. Aum, e.a., 2020). The other half is the direct result of the spread of the virus itself. The types of jobs lost are similar with or without lockdowns.

Research based on payment data in 214 Chinese cities during lockdown also indicated a changing consumption pattern due to fluctuations in the severity of the pandemic, without changes in lockdown measures (H. Chen, 2020).

It is too early today for a definitive economic assessment of Sweden’s ’soft’ anti-coronavirus strategy. There are indications that the milder lockdown spared the domestic economy somewhat, but at the same time, countries with a more severe lockdown were also able to limit the damage. In any case, internationally interconnected economies are not immune to the impact from abroad. In addition, there will be long-term economic impacts. Second-round effects of bankruptcies and unemployment will undoubtedly change the picture even further. The figures currently available on activity and added value in the various sectors do not necessarily say anything about their profitability.

The relative economic ’success’ of the Swedish approach raises further questions when health outcomes are also taken into account. While the number of infections in most European countries started to fall relatively quickly from April 2020, it remained persistently high in Sweden. This was followed by another sharp increase in June, which was only brought under control by the end of July. The summer surge seems to be less pronounced in Sweden than elsewhere in Europe. However, it was not until the end of August that the number of infections per 100 000 inhabitants was brought under control.

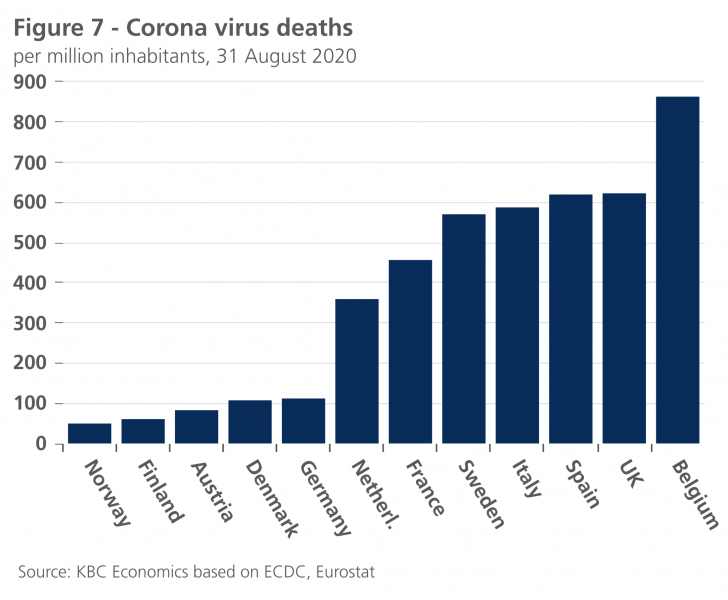

Sweden has more corona deaths than its neighbours in relation to its population (Figure 7). The number of deaths in Sweden is proportionally hardly lower than in Italy or Spain and five to more than ten times higher than in Denmark, Finland and Norway. Research suggests that a formal lockdown between mid-March and mid-May would have halved the number of infections in Sweden and reduced the number of deaths by a third (B. Born, 2020).

The virus has taken a high toll in residential care centres in Sweden, which is similar to the experience in Belgium where the coronavirus mortality rate is even. This is associated recognisable for Belgium with the under provision and large scale of care institutions, their poor connection to the rest of the health system, and a poor response to the pandemic, including a lack of protective equipment (Financial Times, 22 June 2020). Moreover, according to OECD figures, Sweden has the lowest number of acute care hospital beds per inhabitant in Europe.

It is also too early to draw up the final health balance of the Swedish coronavirus approach. As of mid-September 2020, Swedish figures on coronavirus infections are relatively encouraging. However, the virus has not yet been definitively overcome. It remains to be seen, therefore, to what extent Sweden will be spared more than other countries from new, large waves of infection.

The Swedish anti-coronavirus strategy aims to achieve a balance between health, economic and social sustainability objectives. From an epidemiological perspective, it seems quite clear that drastic short-term lockdown measures are most effective in combating the virus.

However, drastic measures clash with the basic principles of a free society. In fact, their constitutional anchoring lies at the heart of the Swedish government’s voluntary coronavirus approach (L. Jonung, 2020).

In the long term, drastic restrictive measures are also unsustainable in social terms. Moreover, they have a high social and economic cost, although the Swedish economic figures do not yet provide overwhelming evidence that a less stringent approach will drastically reduce the economic cost.

There is a good chance that the economic cost of the pandemic will ultimately be determined by the collective ability of the population to continue to exercise an appropriate level of caution.

Fear of infection may diminish through habituation, which will make people less likely to self-enforce rules of social distancing. Moreover, risk perception differs from person to person. There is also a difference between the risk of becoming infected and seriously ill oneself and the risk of infecting others. People can make their voluntary behaviour more dependent on the first risk, without taking sufficient account of the second risk.

The capacity for collective caution is determined by the degree of ’social capital’. This is the degree of commitment, shared values and understanding in society that allows individuals and groups to trust and cooperate with each other (OECD, 2007).

The greater the ’social capital’ in a society, the less coercive measures will be needed to maintain the necessary social distancing and the more normal the economy will continue to function. While a lack of ’social capital’ complicates the enforcement of coercive measures, their effectiveness in controlling the virus thus diminishes, but the economic cost threatens to increase.

Sweden’s soft anti-coronavirus strategy is based on the confidence of policy makers in the rationality and social cohesion of Swedish society. It is part of a tradition of expert-based policy. However, due to the high mortality rates, the approach is also under heavy attack. Doubts are also being raised as to whether social cohesion in Sweden is sufficiently great to keep the epidemic under control with the chosen approach. Only time will tell. In this respect, the ’soft’ coronavirus strategy can also be seen as a test of cohesion in Swedish society.

The final assessment of the impact of the pandemic on public health and the economy can only be made once the pandemic has been brought fully under control and the economy has recovered. An interim assessment already suggests that it is not only the measures that are important in the fight against the coronavirus and its economic impact, but, more importantly, people’s behaviour. As long as there is no adequate medical cure, the stock of ’social capital’ appears to be a critical success factor in controlling the virus and limiting its economic damage. Now that there is a growing awareness that social distancing will still be needed for a long time to come in order to contain the virus, attention to the social sustainability of the measures becomes crucial for their long-term effectiveness.

The differences in impact between the countries suggests that the exchange of experience can help to make the right choice for measures with an optimal balance between effectiveness in the fight against the virus and their socio-economic cost. The analysis also reminds us that small, open economies, like the Belgian ones, are highly dependent on foreign countries. This is an important lesson for the recovery policy. Temporary support to steer the economy through the crisis is useful. However, in order to stimulate economic recovery, fiscal stimulus is not very effective and the focus on competitiveness is all the more important.

Box – The coronavirus crisis in Belgium in a European perspectiveMeasured by the average value of Oxford University’s Stringency Index for government measures to control the spread of the coronavirus, the lockdown in Belgium was among the strictest in Northern and Western Europe. It was similar to those in the UK and Spain. Only France and Italy had stricter lockdowns (Figure 1). With real GDP contracting by 3.5% in the first quarter and 15.2% in the second quarter of 2020 (all compared to the fourth quarter of 2019), the economic damage caused by the coronavirus crisis was perfectly in line with the euro area average (Figure B1). The economic damage remained more limited than in neighbouring France but was significantly greater than in Germany and the Netherlands, whose contraction rates were closer to those of the Nordic countries.

In comparison with neighbouring countries, the decline in value added in the retail and wholesale trade, transport, and hotel and catering sectors in Belgium had a relatively large share in the economic contraction (Figure 5). This indicates a large impact of the lockdown. This may be due to the small scale of Belgium, which means that lockdown measures quickly apply to the whole territory or large parts of it. Larger countries may be able to differentiate measures more geographically, if necessary, depending on the sources of the virus. Professional and public services also made up a large share of the economic decline in Belgium. However, the difference with neighbouring countries is not so great in this respect. The contribution of industry to the economic decline is greater in Belgium than in the Netherlands, but significantly smaller than in Germany. This is because the economic importance of industry in Belgium is much smaller than in Germany (figure 3). Moreover, the share of the car industry and the textile and clothing industry, which fell sharply in the euro area in the first half of the year, is small in Belgium. Compared to the Netherlands, Belgium has a relatively important pharmaceutical industry, which continued to grow during the coronavirus crisis. The decline in the value added of construction in Belgium and France is striking, while in Germany and the Netherlands it is hardly noticeable. Lessons can probably be learned from the way in which these countries have applied social distancing measures in the construction sector. It is also striking that the art, entertainment and leisure sectors in Belgium seem to have experienced a smaller contraction than in most other countries. However, this conclusion may be premature. Indeed, the figures shown contain a residual category under this heading, including activities by international institutions, such as the European institutions. These are, of course, very important in Belgium. |

The article has been previously published by KBC Economics and in BFW digitaal / RBF numerique 2020/8.

Due to the lack of detailed figures for Sweden in the classification used, the pharmaceuticals sector is included in chemicals in Figure 3. For Norway, chemicals also include coke & refined petroleum.