This policy brief is based on Norges Bank Working Paper 2/2025. The views expressed are those of the authors and do not necessarily reflect those of Norges Bank.

Abstract

Buy Now, Pay Later (BNPL) services are transforming consumer finance by offering lightly regulated short-term credit. This policy brief explores how BNPL data can be leveraged to improve credit risk assessments and enhance financial inclusion. Drawing on proprietary data from a Nordic bank, our research highlights how BNPL lending and the associated repayment histories can increase loan approval probabilities, lower interest costs for low-risk consumers, and promote better borrowing behavior. The findings suggest that integrating BNPL data into mainstream credit evaluations could improve lending practices, particularly for underserved populations. This brief also provides policy recommendations that can contribute to BNPL remaining a beneficial financial tool while safeguarding consumers from potential risks.

Buy Now, Pay Later (BNPL) is a rapidly growing form of lightly regulated credit, particularly popular in developed countries (Cornelli et al., 2023; Svahn, 2023). Unlike traditional credit options such as credit cards, BNPL offers quicker and easier access without direct contact with banks, involving lighter credit checks, interest-free loans, and minimal reporting to credit bureaus. This accessibility allows consumers, including those who might not qualify for conventional credit, to finance purchases, while banks gain contact with a broader customer base.

BNPL users tend to be riskier and less well-served in traditional credit markets (Aidala et al., 2023), however, and concerns about hidden fees, late payment penalties, and over-indebtedness have prompted regulatory responses, such as the recent EU Consumer Credit Directive (CMS, 2023), which aims to enhance consumer protections. Given BNPL’s rapid growth, accessibility, and regulatory developments, understanding its impact on credit markets and financial well-being is increasingly important.

This policy brief outlines how, in the context of a Nordic bank, BNPL transaction data can strengthen credit risk assessments, benefit consumers through better terms, and improve credit access.

The bank that provided data for our study (Laudenbach et al, 2025) uses BNPL information for its internal credit assessments if applicants have a recent and sufficiently frequent history of BNPL transactions. This makes it possible to divide loan applicants into three groups: a first group we label ”internal” BNPL customers, another we call ”external” BNPL customers – those with fewer or older BNPL transactions – and lastly ”all external” customers. External BNPL customers serve as an especially useful comparison group because they have similar BNPL experiences as internal customers while the bank does not incorporate their BNPL data into its loan decisions.

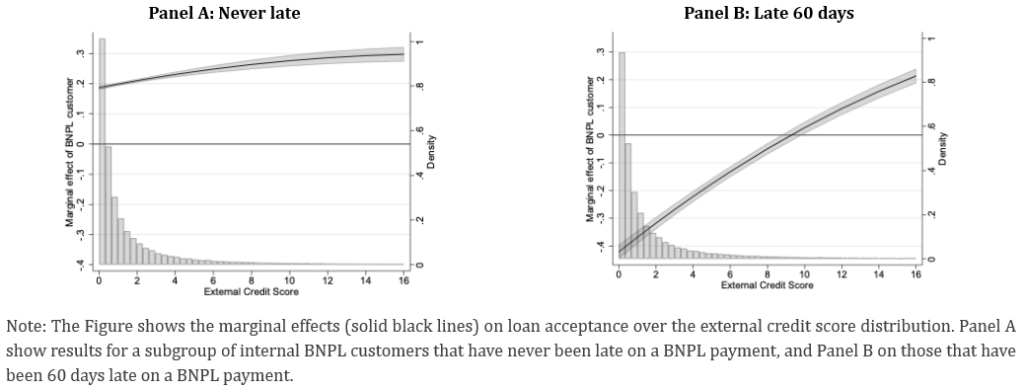

The internal score model, incorporating pre-application payment data, allows the bank to differentiate between customers with identical external scores. This is illustrated in Figure 1, which shows the acceptance rates for customers across different internal and external credit scores.

Figure 1. Acceptance Rate by External and Internal Credit Scores

Internal BNPL loan applicants – those whose BNPL data is included in the bank’s risk assessments – have an internal credit score that is approximately 8-10 points lower than for comparable external applicants. Consequently, customers with a recent BNPL repayment history are significantly more likely to receive bank loans and have approval rates that are nearly 30 percentage points higher.

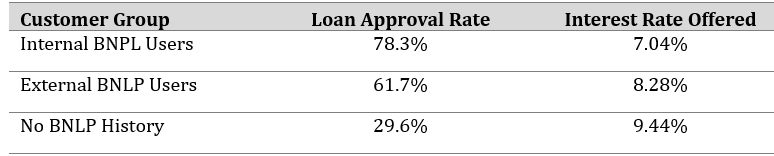

The precise impact of BNPL data varies by repayment history. Customers with strong BNPL repayment records benefit from higher acceptance rates, while those with delinquencies in their histories are less likely to be approved. Particularly the BNPL users who had the very best external credit scores face a reduction in their likelihood of obtaining a bank loan when they are late in their repayment of BNPL credit. On the other hand, applicants with higher, i.e., worse external credit scores see the greatest benefit from favorable internal assessments. This is illustrated in Figure 2, showing the marginal effect on loan acceptance over external credit scores for internal BNPL customers that have never been late on a BNPL payment (Panel A), and those that have been 60 days late on a BNPL payment (Panel B).

Figure 2. Acceptance of Internal BNPL customers by external credit score

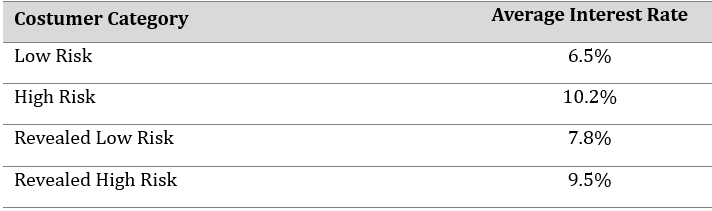

Internal BNPL customers receive more positive credit evaluations, and this results in higher approval rates and improved loan terms; Table 1 shows that their applications are 17 pp more likely to be approved than when equally risky external customers apply, and they obtain an average interest rate discount of approximately 1.4 percentage points – approximately 15% of the market rate corresponding to their external credit profile. In comparison to applicants without any BNPL experience their interest rate advantage is even higher, 2.4 percentage points.

Table 1. Loan Approvals and Interest Rates Offered, by BNPL Usage

While lenders leverage BNPL data to offer competitive rates to low-risk borrowers they appear to maintain profitability through price discrimination. “Revealed low risk” customers—those with strong BNPL histories but weaker external scores—pay lower interest rates than their external risk profiles suggest, though still more than customers with strong internal and external risk profiles. Conversely, “revealed high risk” customers—those with strong external scores but poor BNPL repayment histories—face higher interest rates than low risk customers but lower rates than their internal risk profiles would typically warrant. This asymmetric pricing strategy allows the bank to internalize competitive conditions resulting from information differences between lenders and extract value from their private BNPL data while mitigating risk.

Table 2. Interest Rate Differences by Risk Category

While earlier research has documented that BNPL users tend to be riskier than the general population, our analysis offers a more nuanced image. We find that, for a given external risk profile, BNPL usage is associated with an improvement in repayment behavior on traditional bank loans. Internal BNPL customers are 10 to 12 percentage points less likely to have a 30-day payment delay on their bank loans compared to external customers. Moreover, external customers with BNPL experience are also significantly less likely to have late payments compared to other external customers, despite facing the same interest rates. This suggests that BNPL serves as a learning tool, helping borrowers develop repayment discipline before transitioning to larger credit commitments.

Our analysis does not consider the costs that BNPL users who do not graduate to regular bank credit incur for their BNPL usage. However, our findings illustrate how small loans such as BNPL produce valuable information about customers who likely are relatively underserved in mainstream credit markets. Such information can improve the assessment of loan applications and generates higher acceptance rates as well as lower credit costs.

Policymakers should consider whether sharing BNPL transaction data with credit bureaus is socially desirable. On the one hand, sharing information could lead to improved credit risk assessments, mitigate adverse selection and increase financial inclusion, On the other hand, information sharing could make lending to marginal applicants less attractive because costly data needs to be shared. Although we do not investigate this, mandatory information sharing of BNPL histories can also discourage marginal borrowers from trying out BNPL credit and thereby learn to handle a loan.

While consumer protection is important, overly restrictive BNPL regulations could inadvertently limit access to credit for responsible users because BNPL can act as a steppingstone into traditional credit markets. Regulators therefore face a challenge to balance consumer protection with financial innovation.

BNPL services are reshaping the financial landscape by providing consumers with flexible payment options. More importantly, BNPL data offers valuable insights that can improve credit access, reduce risk for lenders, and offer a way for borrowers to deal with credit. Our findings suggest that integrating BNPL data into mainstream credit evaluations could improve lending practices, particularly for underserved groups.

Aidala, F., Mangrum, D., and Van der Klaauw, W. (2023). Who Uses “Buy Now, Pay Later”? Federal Reserve Bank of New York Liberty Street Economics.

CMS, (2023), Adoption of the New Consumer Credit Directive: Impact for BNPL, (October), Accessed through CMS RegZone at EU: Adoption of the new consumer credit directive: impact for BNPL

Cornelli, G., Gambacorta, L., and Pancotto, L. (2023). BNPL: A Cross-Country Analysis. BIS Quarterly Review.

Svahn, Nanna, (2023), BNPL is a Popular Payment Option in Sweden, Staff Memo, Sveriges Riksbank (September).

Laudenbach, Christine, Molin, Elin, Roszbach, Kasper and Sondershaus, Talina, (2025) Buy Now Pay (Less) Later: Leveraging Private BNPL Data in Consumer Banking, Available at: https://ssrn.com/abstract=5117651