The views expressed here are those of the authors and do not necessarily reflect the position of the BIS or ECB. Comments by Darrell Duffie and Ernest Gnan are gratefully acknowledged.

Two years after the US Treasury market turmoil in March 2020, the purpose of this policy brief is to discuss the resilience of liquidity in core bond markets. This vital segment of the global financial system has steadily become more important due to sharply increasing issuance on the back of fiscal expansion, but in recent years it has also faced episodes of liquidity dry-ups and impaired market functioning. In this Brief we provide a high-level description of the evolution of market structure and liquidity conditions based on publicly available information and the main themes of a SUERF webinar earlier this year.1 We also discuss how bond market functioning has fared more recently amid the heightened volatility following Russia’s invasion into Ukraine and briefly describe policy initiatives underway to address the vulnerabilities that had come to the fore during the crisis.

Government bonds plays a key role in the financial system as they provide the funding for sovereigns and constitute the core safe asset in the economy. Bond yields define a term structure of risk-free rates which in turn serves as the reference from which many other financial asset prices are determined. Government bonds contribute to the transmission of monetary policy and serve as highly liquid collateral instruments in repo transactions or to post margin. The associated derivatives, in particular bond futures and interest rate swaps, are widely used for risk management purposes but also trading strategies (e.g. by levered players).

The smooth functioning of core bond markets depends on the availability of robust market liquidity (cf. Scheicher, 2022). Market liquidity is usually understood as the ease with which a trader can buy or sell a financial instrument at a price close to the observed market price prior to the current transaction.2 Key factors influencing market liquidity are the direct transaction costs (e.g. the bid-ask spread), the market depth (e.g. volume of orders in an order book) and the price impact (reaction of prices to reasonably sized orders).

In the next three sections, we focus on three main themes identified during the SUERF webinar: (1) rising importance of bond intermediation, (2) the changing structure of bond intermediation due to the reduced heft of dealers balance sheets after the Global Financial Crisis (GFC) and the simultaneous shift towards non-banks financial intermediation (NBFI), and (3) greater incidence of imbalances in liquidity supply and demand, with a greater potential to trigger outright liquidity crises as highlighted by the current volatility episode, which we also discuss in detail. We conclude by briefly discussing policies to foster the resilience of market liquidity.

Government debt has increased substantially in the last 15 years across the Western Hemisphere. In the US, outstanding federal government debt grew from about $7.5 trillion in 2005 to $20 trillion in 2020. In the euro area, over the same period, government debt picked up from EUR5.8tn to EUR11tn.3 Since the Covid outbreak in early 2020, this trend has accelerated due to fiscal expansion, with issuance in the US and Europe increasing particularly rapidly.

In parallel to a growing bond supply, we are also in the midst of major shifts in the marginal buyers of bonds. Earlier this year, the Federal Reserve, Bank of England and ECB have announced steps towards a normalisation of monetary policy. The Federal Reserve and the Eurosystem ended their net bond purchases in early March and late June respectively. This widespread reduction in central bank purchase programs, while at the same time issuance remains ample, indicates that the market needs to absorb more volume in the immediate future. This renders the provision of liquidity, notably that of bank dealers, a challenging task. The jury is still out to what extent more opportunistic liquidity supply by non-banks such as hedge funds (engaging in relative value trades, eg between cash bonds and futures) or foreign investors (who typically would also factor in factor in FX hedging costs) will facilitate the smooth absorption of these large flows.

The decentralised trading of bonds “over-the-counter” (OTC)4 puts a large onus on the functioning of intermediation to effectively match buyers and sellers. While bank Dealers still in many ways remain crucial, their role has been increasingly complemented by non-bank financial institutions. The non-bank financial intermediation (NBFI) landscape is vast and varied, covering a diverse set of players with different business models and subject to different regulatory regimes (see Aramonte et al. (2021) for an in-depth treatment of the financial stability implications of the rise in NBFI). At the same time, the market has seen an increasing “electronification” of trading in many segments (cf. CGFS, 2016).5

The major post-GFC regulatory overhaul (cf. Borio et al, 2020) and the market entry of non-bank trading firms have affected the viability of the dealer business model. More stringent capital and liquidity requirements (and in the US the Volcker rule) have reduced incentives for bank Dealers to profitably run large inventory positions (and act as a principal in transaction with clients). By contrast many dealers have favored more balance-sheet light approaches, such as risk-less principal trades, where dealers only engage in a client transaction when they have lined up opposing trading interest by another client. At the same time, liquidity provision has been increasingly “outsourced” to non-banks that complement the role of bank Dealers (Aramonte et al., 2021 or Eren and Wooldridge, 2021). Two types of entities stand out: (i) principal trading firms (PTFs), who facilitate the redistribution of risk by buying and selling securities (while keeping minimal overnight inventories), and (ii) certain types of hedge funds focused on relative-value strategies in fixed income markets, who effectively warehouse risks.6 The overall impact of these changes is that liquidity is now provided in a Bank – light and technology-heavy intermediation mechanism.

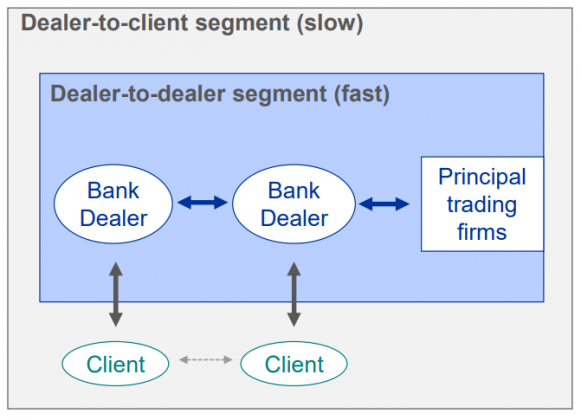

The current structure of government bond trading is summarised in Chart 1 based on the US Treasury market. The cash segment typically contains an ‘interdealer’ and a “dealer to client” market. While intermediation in the dealer-to-client market, both in Europe and the US, largely remains the domain of bank dealers, there are notable differences between the US and Europe. Whereas bank dealers provide the bulk of liquidity in inter-dealer cash markets, in the US PTFs play a much more pronounced role on traditional inter-dealer brokerage platforms such as BrokerTec, intermediating more than half of the benchmark US Treasury transactions.7

Chart 1: The structure of government bond trading

Arguably, the structural changes post-GFC noted above have led to a more fragile provision of liquidity with more frequent dry-ups. Indeed, even though in normal times bond market liquidity seems ample, bond markets have faced a series of liquidity shocks over the last decade. Some of these have been akin to “flash events” and characterised by sharp price movements in a very short period followed by a reversal, but without a longer-lasting impact on market functioning. The most prominent of these events occurred on October 15, 2014, when U.S. Treasuries experienced an unusually high level of volatility8 and a spike in transaction costs (cf. Joint Staff Report, 2015). Although trading volumes spiked and the market continued to function, liquidity conditions became significantly strained. In Europe a “Bund tantrum” took place on 3 June 2015, when benchmark Bund yields jumped by 15 basis points within an hour without a fundamental reason.9

In March 2020, the financial system had to cope with large shifts in the demand and supply for market and funding liquidity as a reaction to the exogenous shock of the pandemic outbreak (cf. FSB, 2020). Stress in the “world’s safe asset” arose because many forced sellers (Treasuries were among the few assets which could be sold quickly) met few traders willing to buy in a highly imbalanced market characterised by extreme uncertainty.10 While dealers did step up their intermediation – due to various balance sheet constraints, such as binding internal risk limits – this rise was insufficient to accommodate the large rise in the demand for immediacy. Off-the run Treasury trading was the epicentre of the impact of the Covid-shock and saw a particularly sharp deterioration in trading conditions (see Chart 1 below, right hand side).

The Federal Reserve reacted to in the turmoil in US Treasury trading by starting a massive purchase of various fixed income instruments, in particular off-the-run Treasuries. Purchases came from bank Dealers whose balance sheets had been clogged due to heavy client selling amid the “dash for cash”. This intervention of a truly unprecedented scale exceeded the activities during the GFC and showed the Fed (and other central banks) acting as “Dealer of last resort” (cf. Hauser, 2021).

As regards the market turbulences after the Russian invasion of Ukraine in February 2022, the epicentre is in the energy and commodity market. That said, some of the mechanisms in force parallel the “dash for cash” in March 2020. A key driver has again been sharp unexcepected increases in CCPs’ margin requirements, where the largest daily variation margin calls in UK CCPs amounted to GBP 34 billion.11 Against the backdrop of massive spikes in commodity prices, non-bank market participants such as utilities or commodities traders have found liquidity pressures to meet margin calls (which in turn puts pressure on their holdings of liquid assets).

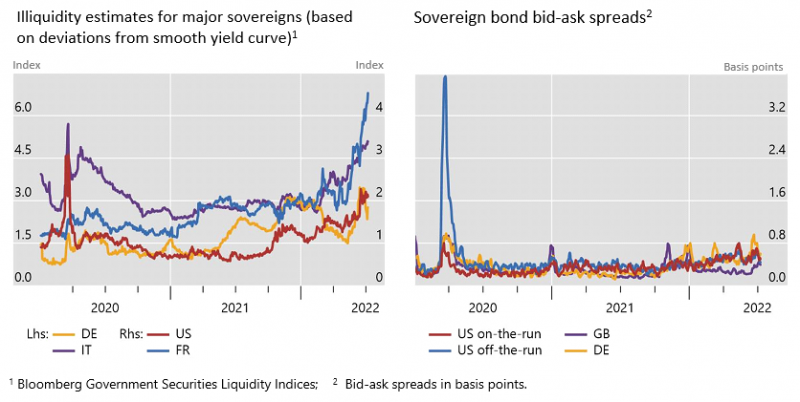

Chart 2: Fragile market liquidity in major government bond markets since 2020

Sources: Bloomberg, BIS calculations.

At the time of writing, liquidity in core bond markets continues to be strained, as one would also expect in a volatile market environment when a lot of news needs to be digested (which also includes important monetary policy news given the hawkish pivot of many central banks in the face of persistent inflationary pressures). However, one cannot describe what we have seen as market dysfunction. As the chart above (left hand side) shows, a yield-curve based measure of illiquidity – capturing deviations from relative-value relationships – has deteriorated in the last few weeks across major segments, although the extent varies across bond markets. Bid-ask spreads have also picked up to some degree. While these indicators clearly point to a worsening of liquidity conditions, the deterioration is of a different scale compared to that seen in March 2020. As there is considerable heterogeneity across time and across countries, the chart also highlights the importance of using a broad set of indicators to measure liquidity conditions rather than focusing on bid-ask spreads alone.

The US Treasury dislocation and similar events in other bond markets have triggered a wide range of policy initiatives. At the global level, coordinated by the FSB, various initiatives have been launched to mitigate the spikes in liquidity demand stemming from the NBFI sector, e.g. due to leverage, liquidity mismatches and run behaviour in certain mutual funds. Some workstreams focus on mitigating the pro-cyclicality of CCPs’ margining practices (BCBS, CPMI and IOSCO, 2020), thereby seeking to reduce system-wide externalities from spikes in margins. All the while, central banks’ “dealer of last resort” function has been debated, focusing on possible changes to the toolkit to make it fit for purpose in a world with a greater footprint of NBFIs, while at the same time avoiding that incentives for private self-insurance against liquidity risks be jeopardised (Markets Committee, 2022). This trade-off puts particular emphasis on the design of liquidity support interventions so that they can overcome potential side-effects arising from moral hazard.

Debates in the US have focused on the disconnect between the shrinking commitment of bank-dealers to market making activities at a time when there has been rapid growth of Treasury issuance (cf. G30, 2021; see also G30, 2022 for a status update). To reduce this disconnect, Duffie (2020) for instance advocates that the structure of the US Treasury market be made more resilient, for example by moving towards all to all trading and more extensive central clearing. Such a less centralised market structure where buyers and sellers can trade without the help of an intermediary would reduce the burden on bank dealers as pivotal market makers and cold be achieved via expanded use of certain trading protocols already now in use. Expanded central clearing of cash transactions would improve operational resilience and – through enhanced netting – free up dealer balance sheets for more intermediation.12

Given the complexity of fixed income trading – as well as market idiosyncrasies – it seems unlikely that there is a single silver bullet to achieve comprehensive market resilience. Policies need to be tailored to the respective market structure and context, such as differences between the US and EU environment. Nevertheless, a holistic policy mix outlined above could help mitigate the frequency and magnitude of liquidity imbalances in future stress periods. Here the current turbulences in commodities markets and changes in market conditions due to central banks’ scaling back of purchases will also provide valuable further lessons regarding fixed income market functioning under stress.

www.suerf.org • suerf@oenb.at

Aramonte, S., A. Schrimpf and H. Song Shin, 2021, “Non-bank financial intermediaries and financial stability,” BIS Working Papers, 972.

Bank of England, 2022, “Financial Stability Report”.

Barone, J., A. Chaboud, A. Copeland, C. Kavoussi, F. Keane, and Seth Searls, 2022, “The Global Dash for Cash: Why Sovereign Bond Market Functioning Varied across Jurisdictions in March 2020.” Federal Reserve Bank of New York Staff Reports, no. 1010

BCBS, CPMI, and IOSCO, 2021, “Review of margining practices,” Consultative report, Basel Committee on Banking Supervision, Committee on Payments and Market Infrastructures and Board of the International Organization of Securities Commissions.

Borio, C., M. Farag, and N. Tarashev, 2020, “Post-Crisis International Financial Regulatory Reforms: A Primer,” BIS Working Papers, 859.

CGFS, 2016, “Fixed Income Market Liquidity,” Committee on the Global Financial System Papers, 55.

Duffie, D., 2018, “Post-Crisis Bank Regulations and Financial Market Liquidity.” Baffi lecture.

Duffie, D., 2020, “Still the World’s Safe Haven?,” Hutchins Center Working Paper #62.

Duffie, D., T. Foucault, L. Veldkamp and X. Vives, 2022, “Technology and Finance,” The Future of Banking report.

Eren, E., and P. Wooldridge, 2021, “Non-bank Financial Institutions and the Functioning of Government Bond Markets,” BIS Papers, 119.

FSB, 2020, “Holistic Review of the March Market Turmoil,” Financial Stability Board Reports to the G20, 17 November.

Group of Thirty (2021), “U.S. Treasury Markets: Steps Toward Increased Resilience,” G30 Working Group on Treasury Market Liquidity.

Group of Thirty (2022), “U.S. Treasury Markets: Steps Toward Increased Resilience – status update,” G30 Working Group on Treasury Market Liquidity.

Hauser, A., 2021, “From Lender of Last Resort to Market Maker of Last Resort via the Dash for Cash: Why Central Banks Need New Tools for Dealing with Market Dysfunction,” Speech at Thomson Reuters Newsmaker, London, 7 January.

Joint Staff Report, 2015, “The U.S. Treasury Market on October 15, 2014, ”U.S. Department of the Treasury, Board of Governors of the Federal Reserve System, Federal Reserve Bank, of New York, U.S. Securities and Exchange Commission, and U.S. Commodity Futures Trading Commission.

Markets Committee, 2022, “Market dysfunction and central bank tools.”

Riordan, R. and A. Schrimpf, 2015, “Volatility and evaporating liquidity during the bund tantrum.” BIS Quarterly Review, September 2015, p 10 – 11.

Schrimpf A., Shin H., and Sushko V (2020): Leverage and margin spirals in fixed income markets during the Covid-19 crisis, BIS Bulletin No.2

Scheicher, M. 2022, Intermediation in bond and swap markets: Stylised facts, trends, and the impact of COVID crisis in March 2020. Mimeo.

Vissing-Jorgensen, A., 2021, The Treasury Market in Spring 2020 and the Response of the Federal Reserve. NBER Working Paper No 29128, August 2021.

See CGFS (2016) for an overview.

Sources: BIS and EU Commission