The Eurosystem purchased a large amount of corporate bonds during the Corporate Sector Purchase Programme (CSPP) from June 2016 to December 2018. In this policy review, we address the question whether these purchases have caused unintended consequences in the form of deteriorating liquidity conditions in the corporate bond market. To this objective, we combine the Bundesbank’s detailed CSPP purchase records with a range of liquidity indicators and assess both the short-term (“flow”) and long-term (“stock”) effects of the purchases. We find that while the flow of purchases supported secondary market liquidity, liquidity conditions deteriorated in the long run as the Bundesbank reduced the stock of corporate bonds available for trading in the secondary market.

Besides their intended impact on economic activity, central bank asset purchases are likely to also affect market functioning through different channels. First, by providing a predictable source of demand for bonds, dealers are more willing to hold larger inventories to facilitate market-making (’back-stop’ buyer effect). In addition, asset purchases can stimulate trading activity as dealers are likely to purchase another bond after selling one to the Eurosystem. On the other hand, asset purchases can also lead to a deterioration of market liquidity in particular if the purchase programme is relatively large. If a large proportion of corporate bonds is held by the Eurosystem, sourcing a particular bond can become more costly for dealers (Ferdinandusse, Freier, and Ristiniemi (2017)).

Related empirical literature mostly focuses on the impact of central bank asset purchases of sovereign bonds on secondary market liquidity (e.g. Eser and Schwaab (2011), Han and Seneviratne (2018), Schlepper, Hofer, Riordan, and Schrimpf (2020), Pelizzon, Subrahmanyam, Tobe, and Uno (2018)). Previous work on central bank corporate bond purchases is scarce and focus on the announcement effect of the programme (e.g. Todorov (2018)). Boneva, Elliott, Kaminska, Linton, McLaren, and Morley (2018) and Boneva, Islami and Schlepper (2021) are the only studies so far using granular data from central bank corporate bond purchase operations to analyse the impact of these programmes on liquidity.

In this policy brief, we summarize recent research (Boneva, Islami and Schlepper (2021)) that studies the impact of CSPP purchases on market liquidity in the market for German corporate bonds using Bundesbank’s individual CSPP purchases. The focus is on potential unintended consequences of the programme, in form of deteriorating liquidity conditions in the short-term (“flow effect”) and the long-term (“stock effect”). Finally, we assess whether the evidence depends on the bond characteristics or market conditions.

Identifying the impact of purchases on liquidity or prices is a difficult task because of reverse causality: when the CB decides about purchasing a bond, they may take into account current liquidity conditions. The dealer selling the bond to the CB may also base his or her decision to sell on liquidity conditions, e.g. rather sell an illiquid bond to the central bank that is more difficult and costly to sell on the secondary market.

To reduce this reverse causality issues, the authors create specific indicators derived from Bundesbank’s purchase data that take into account the design features of the purchase programme similar to Boneva, Elliott, Kaminska, Linton, McLaren, and Morley (2018).

The variables obtained from the purchase process such as the number of requests sent to the dealers, the corresponding volumes and the number of trades taking place are observed factors that are correlated with both liquidity and the purchase decision. Controlling for these factors reduces the reverse causality problem.

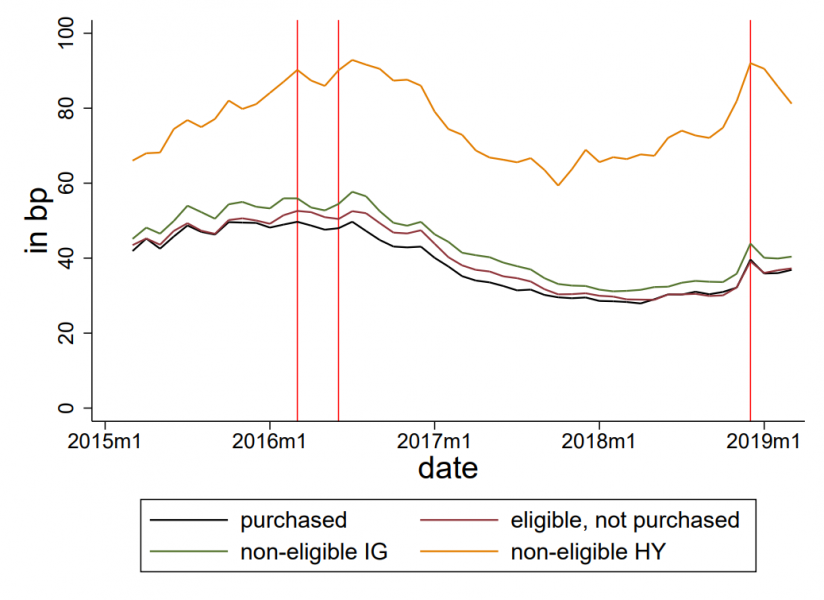

In our estimation of the flow effect, different liquidity indicators are regressed in a difference-in-difference setup on the actual purchase amount, which is the main variable of interest. The previously created purchase variables enter as control variables. Figure 1 shows the evolution of the bid-ask spread over time for bonds purchased under the CSPP, for the control groups eligible but not puchased bonds, and non-eligible investment grade and high yield bonds, respectively.

Figure 1: Evolution of bid-ask spread by bond groups

Notes: The vertical red lines point to the announcement of the CSPP on 10 March 2016, the start of the CSPP on 8 June 2018, and to the end of the net purchases on 31 December 2018, respectively.

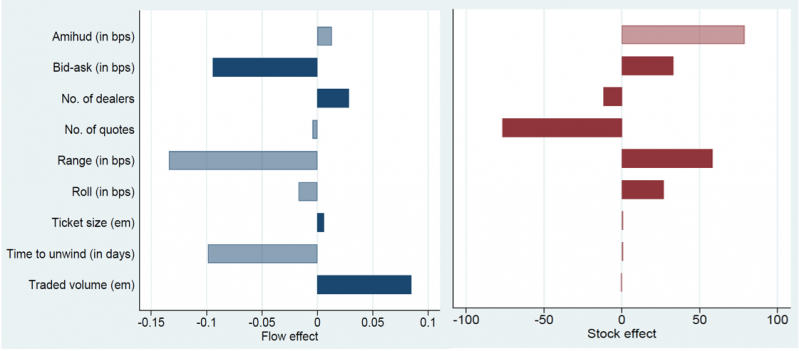

We find that initially, the Bundesbank’s corporate bond purchases improved contemporaneous liquidity conditions in the market for German corporate bonds (flow effect) albeit the estimated effects are relatively small (see Figure 2 a). For an average purchase size of e7m, bid-ask spreads of purchased bonds tightened by 0.7bps on the day of the purchase compared to an average bid-ask spread of 35bps and trading volume increased by e0.6m compared to an average of 2.5 for purchased bonds.

Next to short-term flow effects it is interesting to assess the impact of the Bundesbank’s corporate bond purchases on liquidity in the long run. These so-called stock effects assess the cumulative impact of the purchases on market functioning by comparing liquidity conditions before the announcement of the purchases with those prevailing in the market after the purchases ended. The empirical approach to quantify the stock effects of the Bundesbank’s CSPP purchases is to relate the difference in market liquidity from after the end to before the start of the CSPP to the cumulative amount purchased, controlling for different bond characteristics. The findings suggest that liquidity conditions deteriorated as the Bundesbank reduced the stock of corporate bonds available for trading in the secondary market. This is particularly true for the resilience measures studied (see Figure 2b). For the average volume purchased by bond over the lifetime of the CSPP (e29m), we find that the number of quotes received for a purchased bond compared to a not purchased bond fell by around 2.2 and the number of dealers quoting the bond fell by around 0.3,compared to their averages of 137 and 12, respectively. These findings are consistent with the predictions of the theoretical model by Ferdinandusse, Freier, and Ristiniemi (2017).

| Figure 2: Results flow effect (a) | stock effect (b) |

Notes: The blue bars in Figure (a) on the LHS represent the magnitude of the flow effect found in the regression analysis of our paper. Dark-blue bars show significant, light-blue bars insignificant results. The red bars in Figure (b) on the RHS represent the magnitude of the stock effect. Dark-red bars show significant, light-red bars insignificant results.

As a consequence of the broad eligibility criteria specified by the ECB for CSPP purchases, the characteristics of the bonds included in our analysis vary significantly. One reason for this broad approach is the concept of market neutrality underlying the CSPP implementation aiming at minimizing potential unintended side effects on market functioning. In addition, our sample period (2016-2018) was marked by both calm periods and periods of increased financial market stress such as the UK vote to leave the EU or the US-Chinese trade war. To assess whether the estimated effects differ across time and bond characteristics, we add an interaction term to our baseline specification in both the flow and the stock analysis: this term is a combination of the purchase amount and bond characteristics, e.g. age, issue size. For the flow effect, we also study how the impact varies across market conditions, captured by e.g. maturity or volatility.

Considering the flow effect, CSPP purchases tightened bid-ask spreads for a bond with an average age but widened instead for older bonds. One explanation for this result could be that bonds are traded more frequently when newly issued. As they age, bonds are traded less frequently as a significant portion is purchased by buy-and-hold investors who reduce the free float available for trading by other investors (Mahanti, Nashikkar, Subrahmanyam, Chacko, and Mallik (2008)). Thus, central bank purchases of old bonds may reduce their liquidity further. Moreover, this could imply that the CSPP has mainly improved the liquidity of already more liquid bonds, thereby potentially favouring a “bifurcation” of corporate bond liquidity. Regarding the stock effect, the CSPP impact also seems to depend strongly on age: for bonds older than 2 years, CSPP purchases lead to a worsening of depth over the period of the programme.

The potential unintended consequences of large scale asset programmes on market functioning have been widely discussed by politicians and academics. However, empirical studies, especially on a bond-by-bond level are still relatively sparse (BIS Markets Committee (2019)). Our study has contributed to fill this gap by estimating the short- and log-term effects of the CSPP on liquidity in the German corporate bond market using granular purchase data. Our findings suggest that the contemporaneous (flow) effect of the purchases is positive albeit small. But in the long run, we found some evidence of a deterioration in liquidity conditions as the Bundesbank reduced the stock of corporate bonds available for trading in the secondary market, thus raising concerns about unintended consequences of large-scale asset purchases. These findings add to our understanding of the transmission mechanism of unconventional monetary policies. In particular, liquidity premia are often mentioned as one channel through which corporate bond purchases affect corporate bond yields. Our results provide evidence that central bank purchases of corporate bonds can affect these premia both in the short- and long run. Moreover, our findings on heterogeneity, e.g. that only newly issued bonds encounter an improvement in liquidity, while older bonds’ liquidity worsens through CSPP purchases rising concerns of a “bifurcation of liquidity” offer insights on the design of future purchase programmes. With the newly launched pandemic emergency purchase programme (PEPP) in March 2020, the Eurosystem announced to purchase eligible securities “[…] to foster smooth market functioning”1. Assessing if the PEPP purchases have been successful in this regard remains an open question for future research.

BIS Markets Committee (2019): Large central bank balance sheets and market functioning.

Boneva, L., D. Elliott, I. Kaminska, O. Linton, N. McLaren, and B. Morley (2018): The Impact of QE on Liquidity: Evidence from the UK Corporate Bond Purchase Scheme,” mimeo.

Boneva, L., M. Islami, I, and K. Schlepper (2021): Liquidity in the German corporate bond market: has the CSPP made a difference?,” Bundesbank Discussion Paper No. 08/2021.

Eser, F., and B. Schwaab (2011): Evaluating the impact of unconventional monetary policy measures: Empirical evidence from the ECBs Securities Markets Programme,” Journal of Financial Economics, 119, 147-167.

Ferdinandusse, M., M. Freier, and A. Ristiniemi (2017): Quantitative easing and the price-liquidity trade-of,” Sveriges Riksbank working paper.

Han, F., and D. Seneviratne (2018): Scarcity Effects of Quantitative Easing on Market Liquidity: Evidence from the Japanese Government Bond Market,” IMF Working Papers 18/96, International Monetary Fund.

Mahanti, S., A. Nashikkar, M. Subrahmanyam, G. Chacko, and G. Mallik (2008): Latent liquidity: A new measure of liquidity, with an application to corporate bonds,” Journal of Financial Economics.

Pelizzon, L., M. Subrahmanyam, R. Tobe, and J. Uno (2018): Scarcity and Spotlight Effects on Liquidity and Yield: Quantitative Easing in Japan,” IMES Discussion Paper Series 18-E-14, Institute for Monetary and Economic Studies, Bank of Japan.

Schlepper, K., H. Hofer, R. Riordan, and A. Schrimpf (2020): Market Microstructure of Central Bank Bond Purchases,” Journal of Financial and Quantitative Analysis, 55, 193-221.

Todorov, K. (2018): Quantify the Quantitative Easing: Impact on Bonds and Corporate Debt Issuance,” SSRN working paper.