We provide preliminary evidence of potential risk reduction benefits from banks’ loan portfolio diversification cross-border within the euro area. Using aggregate data on banking sector corporate loan losses for each euro area member-state, our estimates suggest that the static diversification benefit could be substantial. The minimum capital needed to withstand the maximum annual loss from a hypothetical fully diversified euro area bank loan portfolio over the period 2001-2017 would have been only 40 % of the total capital needed to withstand the maximum losses on a country by country basis. We also calibrate the country-specific loan loss distributions and the euro area portfolio’s loss distribution to the Vasicek (2002) model, which underlies the Basel framework’s Internal Ratings Based Approach. We find that the implied asset correlation parameter of a median country portfolio is about twice as large as that of the fully diversified euro area portfolio. These results suggest that there is substantial potential for risk reduction through further cross-border diversification in euro area loan portfolios. To encourage further banking integration, this potential might be recognized in bank capital requirements.

An integrated European banking market can be seen as an ultimate goal of the Europe’s banking union project. This would help ease the dependency of credit supply in a certain country from the state of public finances and the overall economy of that country. For example, the initiative to reduce single-country biases in banks’ sovereign debt exposures with the help of capital requirements aims to support these goals. By a similar logic, one might argue that bank lending to the real sector could also be steered towards more cross-border diversification within the banking union. This could happen both by reducing obstacles to cross-border diversification as well as by strengthening incentives to cross-border diversification of corporate and retail lending.

In this paper we provide preliminary evidence of potential risk reduction benefits of banks’ loan portfolio diversification cross-border within the euro area, using aggregate data on banking sector loan losses per euro area member-state. Our preliminary results suggest that the “stressed” capital need of a fully diversified euro area bank loan portfolio over the period 2001-2017 would have been substantially less than the sum of stressed capital needs of the current country portfolios.

Second, we discuss the possibility to recognize the risk reduction benefits from cross-border loan portfolio diversification (or, alternatively, the risks from concentrations of loans in single countries) in bank capital requirements and thereby to use capital requirements to provide incentives to further cross-border lending diversification.2 We also provide an illustrative calibration of the asset correlation parameter in the Basel framework’s Internal Ratings Based Approach model for capital requirements, taking into account the further diversification potential in the euro area.

The paper is structured as follows. In section 2 we discuss the rationale for deeper banking integration in the euro area. Section 3 discusses how bank capital requirements might be used to spur further integration. Finally, in section 4 we present preliminary evidence of potential risk reduction benefits from further cross-border loan portfolio diversification within the euro area. Section 5 concludes.

The pillars of the European banking union – common banking supervision, common bank recovery and resolution framework, and common deposit insurance, the first two of which have already been implemented – facilitate the development towards a truly integrated European banking market. Together they can be expected to increase competition and efficiency in the financial market and enhance the financial stability of the area.

An integrated banking market entails well diversified cross-border banking services. This would improve financial stability because the supply of bank credit in a certain country would no longer crucially depend on the state of public finances nor the state of the economy of that country (cf. e.g. Draghi 2018).

The monetary union of the United States provides an example: although single states have occasionally experienced economic or financial distress the supply of credit in these states can be maintained thanks to regionally diversified banking institutions and federally organized public institutions overseeing and stabilizing commercial banking. Evidence from the United States indicates that integration of bank ownership across states has led to diminished and synchronized state business cycles (Morgan et al 2004).

Therefore banking integration can be a forceful way to tackle the so called bank-sovereign loop that threatened financial stability during the sovereign debt crisis in Europe. So far, cross-border lending of banks within euro area has remained at a moderate level and seems to have gone in reverse after the financial crises (see e.g. Hoffmann et al 2018).3 Using calibrated macro models both Hoffmann et al (2018) and Martinez et al (2019) demonstrate macroeconomic benefits from further private sector risk-sharing in euro area.

The initiative to reduce home bias in European banks’ sovereign debt exposures aims to support these goals (Véron 2017). It would work via higher capital requirements on banks with high sovereign debt concentrations.

By a similar logic, bank lending to corporates and households could be steered towards more cross-border diversification within the banking union. This could be encouraged within the current system of banks’ capital requirements.

In technical terms, the most obvious way would be to use the so called asset correlation parameter embedded in the Internal Ratings Based Approach (IRBA) of the Basel framework. IRBA is the system that mainly large banks use, subject to supervisory approval, to determine their capital requirements. A more diversified cross-border loan portfolio could entitle a bank to apply a lower asset correlation parameter and hence have a lower capital requirement, assuming other risk elements stay constant.

It is important to bear in mind at least the following aspects when considering bank capital requirements that take into account the degree of bank loan portfolio diversification cross-border.

First, the IRBA is designed to measure only the standalone risk of a bank’s credit portfolio. It does not take into account systemic risk. Systemic risk of a bank may well increase if greater cross-border lending diversification leads to an increase in bank size, e.g. due to cross-border mergers.

Second, diversification of bank loan portfolios cross-border could compromise banks’ knowledge of their customers. This could lead to a deterioration in the average quality of loans. This is a true concern, even if in the age of digitalization securing sufficient customer information may no longer require physical presence such as a branch network.

Third, the IRBA model is a single systematic risk factor model where the risk factor may well be interpreted as the business cycle of a country. Although the business cycle is usually interpreted in terms of output movements it has several other dimensions as well, including movements in asset prices, productivity and competitiveness. Already the assumption of common output growth cycles becomes increasingly problematic in the euro area context which, despite the very aim of economic and hence business cycle convergence within the euro area, is yet hardly driven by a single cycle. As Gordy (2003) shows, there is no simple way for setting approximately portfolio invariant capital requirements in a multi-risk factor case.

More broadly, new incentives via capital requirements could change the whole landscape of banks’ lending operations. There could be implications for the size distribution of banks, the legal and institutional framework of bank lending and risk assessment, as well as the menu of financial products that banks provide. Development of a well-functioning cross-border lending market would probably put pressure on such things as harmonization of bankruptcy laws and production of comparable information of factors which affect banks’ lending risk.4

In this section we discuss the preliminary empirical evidence, presented in Jokivuolle and Virén (2019), of the potential risk reduction effect of banks’ further loan portfolio diversification cross-border within the euro area. Jokivuolle and Virén (2019) use aggregate monthly data on banking sector corporate loan losses from each member-state (henceforth, “country”) and annual data on loan stocks per country. Their loan loss data are from the period 01/2001-03/2018 from most countries and come from the ECB.5 The data are confidential so that individual country results are not reported by name.6

Jokivuolle and Virén (2019) compare loan loss rate distributions of individual countries with that of a hypothetical euro area (EA) portfolio. The loss rate of a portfolio in month t is simply the amount of loan losses from the portfolio in month t divided by the outstanding stock of loans in the beginning of that month. The loan loss rate of the EA portfolio is the weighted-average of the individual countries’ loan loss rates, weighted by the shares of individual country loan stock of the aggregate euro area loan stock.

Jokivuolle and Virén (2019) make two kinds of comparisons. First, they take a “non-parametric approach” by calculating the average loss rate and the maximum loss rate as a simple measure of dispersion for each country portfolio and for the EA portfolio. Using the maximum loss rate is reminiscent of a “stress test” view of loss rates. For this analysis they aggregate the monthly losses to annual level.

Second, Jokivuolle and Virén (2019) calibrate the asset correlation parameter for each country portfolio and the EA portfolio by fitting the Vasicek (2002) model underlying the IRBA model to the respective empirical loss rate distributions. A lower calibrated asset correlation parameter for a given portfolio indicates a higher degree of risk diversification within that portfolio.7 For further details of these two approaches the reader should consult section 4 and the technical appendix in Jokivuolle and Virén (2019).

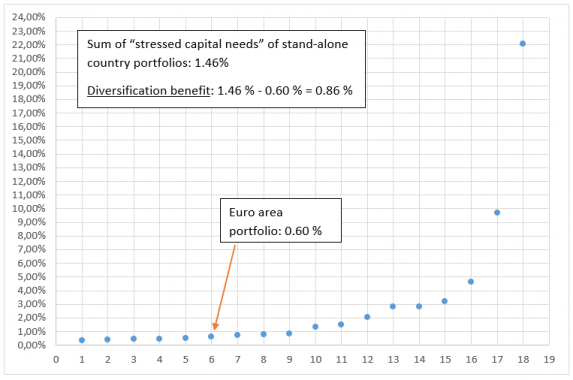

The outcome from the two approaches of Jokivuolle and Virén (2019) are reproduced in Figures 1 and 2. Figure 1 looks at the actual loan loss data per country and the EA portfolio in a very simple manner. It depicts the difference between the maximum annual loss rate observation and the time-series average loss rate over the sample period 2001-2017 for each country and the EA portfolio.

This measure provides the “stressed” minimum capital need of a portfolio as a percentage of the loan stock, net of the expected loss rate (measured by the average loss rate), that it would have taken to withstand the maximum annual loss rate over the sample period. Figure 1 shows that the range of the stressed capital need is very wide across countries, between 0.37 % and 22.08 %. For the EA portfolio the stressed capital need is 0.6 %.

Clearly, some country banking sectors have less risky aggregate loan portfolios than the aggregated EA portfolio, which is a weighted average of them, but this does not mean that there would not be potential benefits from cross-country loan portfolio diversification for euro area as a whole. In order to demonstrate this, Figure 1 shows the weighted average of the country-specific stressed capital needs, which is 1.46 %.8 In other words, this is the sum of the stand-alone country-specific stressed capital needs in the euro area, as a ratio of the total euro area corporate loan stock. It is almost 2.5 times the stressed capital need of the EA portfolio, 0.6 %. Hence, there are substantial potential benefits in risk reduction for the euro area as a whole from further cross-border loan portfolio diversification within the euro area.9

A future research question would be to study how the potential benefit from further cross-border diversification relates to the size of a member-state banking sector. However, even if the relative benefit might be largest for smaller member-states, individual banks in larger member-states could also benefit greatly from further diversification.

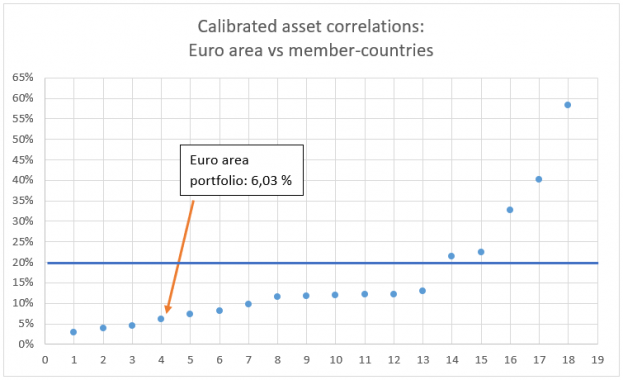

Figure 2 depicts the calibration of asset correlation parameters for various country portfolios and the EA portfolio in ascending order. The EA portfolio, indicated in the figure, has the fourth lowest asset correlation, approximately 6%. It is half of the median asset correlation, ca. 12%, among the country portfolios. This also clearly suggests that most euro area countries’ banking sectors could benefit in terms of risk reduction from euro area wide cross-border diversification of loan portfolios. These results suggest that there would be room to recognize better cross-border diversification in euro area banks’ capital requirements. However, as already pointed out earlier, implementing such adjustments in a theoretically consistent manner in a single risk factor model such as the IRBA model, could be a challenge.

We have studied risk reduction gains from cross-border diversification of banks’ loan portfolios across the euro area and found them to be potentially substantial. Promoting that might be possible and even desirable with carefully designed and implemented regulatory incentives such as bank capital requirements which better recognize the degree of risk concentrations vs risk diversification. This could help realize the objectives of the banking union. An amendment to current bank capital regulations along these lines would be best considered as part of a broader package of reforms which are currently discussed. However, we want to emphasize that recognizing loan risk diversification in capital requirements in a coherent manner in a multi-country and hence multi-business cycle setting is theoretically not straightforward, as shown by earlier literature, so further analysis would be welcome.

***

Figure 1. Stressed capital needs and diversification benefit

The difference between the maximum and the average annual loss rate (“stressed capital need”) during 2001-2017 for the euro area member-state portfolios and the hypothetical euro area portfolio. The annual loss rate of a portfolio equals the annual loan losses over loan stock.

The country portfolios and the euro area portfolio are ordered on the horizontal axis, numbered in ascending order by their stressed capital need. The stressed capital need is measured on the vertical axis. Two euro area countries are excluded from the sample because of insufficient data.

Figure 2. Calibrated Asset Correlations

Asset correlations are calibrated with the Internal Ratings Based Approach (IRBA) model from monthly loan loss rates for euro area member-state portfolios and the hypothetical euro area portfolio.

The country portfolios and the euro area portfolio are ordered on the horizontal axis, numbered in ascending order by their calibrated asset correlation parameter. The asset correlation is measured on the vertical axis in percentages. For example, for the euro area portfolio (indicated by an arrow) the asset correlation is calibrated to be ca. 6%. The 20% asset correlation level that the Basel framework’s IRBA model uses for corporate loan portfolios is highlighted in the chart. Two euro area countries are excluded from the sample because of insufficient data.

Draghi, M. (2018), “Risk-reducing and risk-sharing in our Monetary Union”. Speech by Mario Draghi at the European University Institute, Florence, 11 May 2018.

European Commission (2018): Reducing Risk in the Banking Union: Commission presents measures to accelerate the reduction of non-performing loans in the banking sector. Brussels, 14 March 2018.

Gordy, M. (2003), “A risk-factor model foundation for ratings-based bank capital rules”, Journal of Financial Intermediation 12, 199-232.

Hoffmann, M., E. Maslov, B.E. Sørensen, I. Stewen (2018), “Are Banking and Capital Markets Union Complements? Evidence from Channels of Risk Sharing in the Eurozone”, CEPR Discussion Paper No. 13254.

Jokivuolle, E (2018), “Promoting European banking integration with capital requirements?” in VoxEU blog 14 June 2018, https://voxeu.org/content/promoting-european-banking-integration-capital-requirements.

Jokivuolle, E., M. Virén (2019): Cross-border loan portfolio diversification, capital requirements, and the European Banking Union, BoF Economics Review 3/2019.

Morgan, D.P, B. Rime, P.E. Strahan (2004), “Bank Integration and State Business Cycles”, Quarterly Journal of Economics 119:4, 1555–1584.

Repullo, R., J. Suarez (2004), “Loan pricing under Basel capital requirements”, Journal of Financial Intermediation 13, 496-521.

Martinez, J., T. Philippon, M. Sihvonen (2019), ”Does a Currency Union Need a Capital Market Union?”, unpublished working paper.

Vasicek, O.A. (2002), “The distribution of loan portfolio value”, Risk 15(12), 160-162.

Véron, N. (2017), “Sovereign concentration charges: A new regime for banks’ sovereign exposures”, http://bruegel.org/wp-content/uploads/2017/11/IPOL_STU2017602111_EN.pdf

Villeroy de Galhau, F. (2019), “How to develop a “financial Eurosystem” post-Brexit”, Banque de France speeches, 4 May 2019.

We thank Janne Lehto for excellent research assistance and George Pennacchi, Mathias Hoffmann, Juha Kilponen, colleagues at the Bank of Finland and members of the SUERF Policy Notes Editorial Board for valuable comments as well as Juha Tarkka, Paavo Miettinen, Jukka Topi, Nicolas Veron and Jeromin Zettelmeyer for valuable discussions at an earlier stage of the project. A more technical version of this paper has earlier appeared as BoF Economics Review 3/2019. Responsibility for any remaining errors and shortcomings is solely ours. Any views are those of the authors and do not necessarily represent those of the Bank of Finland.

Jokivuolle (2018) has previously discussed this idea. More recently, a similar idea has been presented by Villeroy de Galhau (2019); see also Financial Times, 6 April 2019: “French bank chief seeks capital change to spur cross-border deals”.

Integration of bank ownership, such as through bank holding company structure, is not the only way banking integration may evolve. For instance, banks might use more syndicated loans to achieve better diversification. However, as these mainly concern lending to large corporations, mergers might be a way to benefit from further cross-border diversification into SME loans. At least anecdotal evidence from the US experience with interstate banking proliferation suggests that mergers rather than new branches or subsidiaries have been the more common way to market extension.

See Financial Times 9 May 2019: “Société Générale chief says banking mergers make sense in Europe”.

Preliminary unreported results suggest that correlation between loan losses and non-performing loans in a given country may not always be high, suggesting that loan losses alone may not provide a full picture of bank risks in some countries. European Commission has launched a program to accelerate the reduction of non-performing loans in bank portfolios (see European Commission 2018).

Note that the country-specific banking sector loan losses are generated from the current bank portfolios in each country and hence reflect the current degrees of cross-border diversification in those portfolios. In this regard, it is somewhat misleading to use the term “country portfolios” although for brevity we do that.

Several strong assumptions are needed for the calibration given that only the banking sector loan loss rates are observed for each country but there is no other information of the loan portfolios of any bank in any country. Such information would include loan sizes and maturities, and industry and credit quality distributions of loans. Specifically, Jokivuolle and Virén (2019) assume that each loan obligor in any given country has the same probability of default and that the loss given default rate (LGD) is fixed and the same for all loans. They estimate the common probability of default by the time-series average default rate of the given country. Although the assumptions are seemingly strong, they may not make much difference to the comparative results.

The weight of an individual country is the share of its loan stock of the whole euro area loan stock, using sample time-series averages.

Note that if there already were a full cross-border diversification in bank loan portfolios, each euro area bank would effectively hold a share of a common “loan market” portfolio. As a result, country-specific loan loss rates would be equalized and so the capital need of the EA portfolio would be equal to the total capital need of country-specific banking sectors.