The decline in interest rates over the last decades has been associated in many countries with a rise in household debt. How sensitive are the borrowing decisions of households to changes in interest rates? Using a stylized model of household borrowing with credit constraints, we first show that less constrained households with more pre-existing housing wealth increase their borrowing most when interest rates fall. We then use data from the Belgian household credit registry to show that middle-aged borrowers who already own a house accounted for the bulk of the growth in household debt in the last decades. To identify the role of the interest rate, we use regulatory data on the foreign exposures of banks together with branch location data. We find that a 1 percentage point fall in the interest rate is associated with a 15% growth in household debt.

As interest rates fell in the last decades, the price of housing and the level of household debt increased substantially in many countries. In the Euro Area and in the United-States, household debt to GDP ratios are now close to their all-time high. In smaller countries like Sweden, Canada or Switzerland, the growth in household debt-to-GDP has been mostly uninterrupted over the last decades. High household debt can endanger financial stability and increase the procyclicality of the business cycle (Mian and Sufi, 2014). The rise in household indebtedness has also raised distributional concerns. If lenders impose minimum down-payment constraints, less wealthy households may be unable to borrow (Svensson 2020). Understanding how low interest rates affect the distribution of household debt within the population can therefore help understand whether low rates restrict the access to property for some households. One challenge to study this question, however, is that it requires granular data on borrowing for the full population.

In recent work (Emiris and Koulischer, 2021), we use data from the household credit registry of the National Bank of Belgium to study (1) how changes in interest rates affect borrowing by households and (2) how the sensitivity to interest rates varies across credit constrained and unconstrained borrowers. Our data includes the universe of household borrowing and is thus an ideal laboratory to study the increase in household debt and their relation to interest rates.

Our main finding is that existing homeowners in the middle of the age distribution have accounted for the bulk of the increase in credit since 2006. While first time borrowers are more sensitive to changes in interest rates, the debt increase of non-first-time borrowers is larger at the aggregate level when interest rates fall. To identify the role of the interest rate, we use regulatory data on the foreign exposures of Belgian banks. We combine this data with information on the location of bank branches to construct a foreign credit supply shock. Our empirical findings are in line with a stylized model of household borrowing under credit constraints, where younger households with less accumulated wealth remain credit constrained while older households can increase borrowing most.

When buying a house, borrowers are generally required to make a minimum down payment. In this case, the amount borrowed depends on two characteristics of the borrower. The first one is the future income of the household. If households expect to earn substantial income going forward, they will want to shift more resources to the current period. The second determinant is the wealth of the household that can be used as a down payment for the mortgage.

A decline in interest rates will affect both of these determinants. First, it will reduce the cost of borrowing and generally increase the present value of future income. Second, lower rates will increase the value of the accumulated wealth invested in e.g. bonds or housing. While the first channel benefits poorer or younger households whose main resources are future income, the second channel increases the resources of richer, older households who have already accumulated wealth. One question that has been discussed in the literature is whether the “income channel” dominates the “wealth channel”, i.e. whether low rates benefit the wealthier or the working population. We show in the context of our model that, in the absence of credit constraints, the two effects cancel each other out so that the distribution of resources between present wealth or future income is irrelevant as the increase in asset prices is similar to the increase in the present value of future labour income.

This irrelevance result however does not hold when households must make a minimum down payment in order to borrow. In this case, households fall in two categories: they are either credit constrained or unconstrained. The unconstrained households have substantial wealth relative to their future income and they are able to borrow as much as needed. If households have less wealth relative to future income, they are constrained and borrow the maximum amount possible given the down-payment constraint. The transmission of lower interest rates to higher household borrowing thus differs substantially depending on whether households are credit constrained or not. If households are unconstrained, the increase in borrowing will be driven by the higher future income. If households are credit constrained, the increase in borrowing will be determined by the increase in asset values and the down-payment required by the lender.

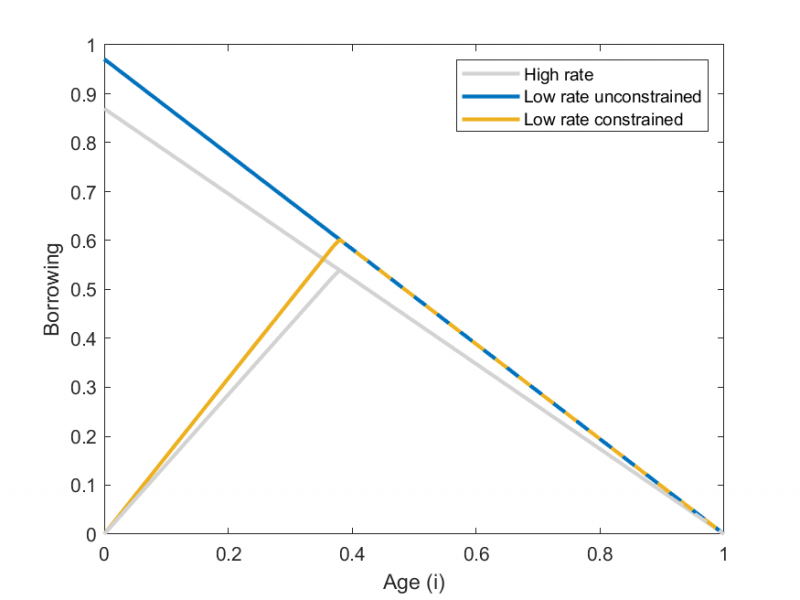

Figure 1: Impact of a decline in interest rates on household borrowing

If we assume that younger households have less assets but more future income and that older households have less future income but more assets, a decline in interest rates will increase borrowing most for middle aged households. Figure 1 illustrates this. The blue line shows how much households would borrow without down-payment constraints. When households must make a down payment, the younger households are up against their borrowing constraint, until an age threshold at which they can borrow the unconstrained amount. The grey line illustrates an initial outcome with a higher interest rates. If rates fall, the bulk of the credit growth arises from middle aged households.

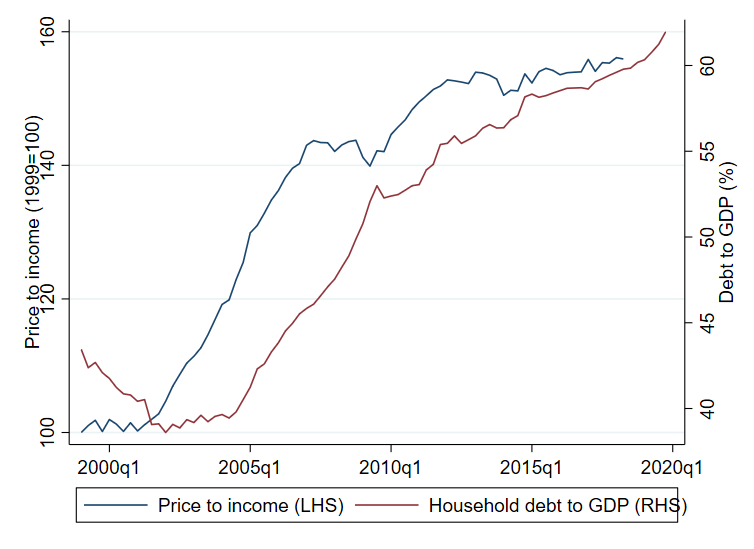

As a small open economy in a large currency union, Belgium provides an interesting setting to explore these predictions. The country was relatively less affected by the sovereign debt crisis. As shown in Figure 2, household indebtedness has increased by 50% over the last 15 years, rising from 40% of GDP in 2004 to 60% of GDP in 2018. Over the same period, house prices also increased strongly as reflected by the increase in price-to-income ratio.

Figure 2: Household debt and house prices in Belgium

This figure shows the ratio of household debt to GDP in Belgium (Source: ECB Quarterly Sector Accounts and Main Aggregates statistics) and the ratio of house prices to disposable income in Belgium (Source: OECD Housing Prices). The price-to-income is normalized to 100 in 1999.

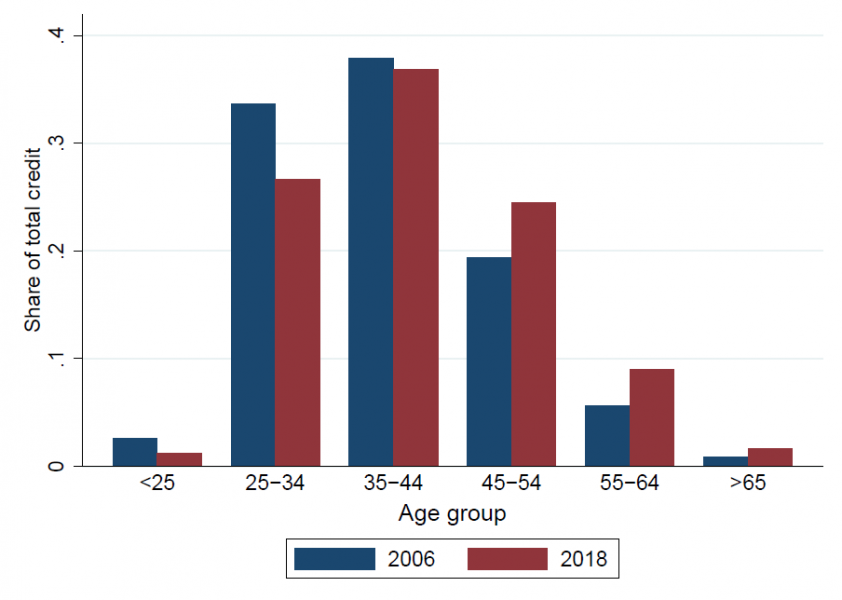

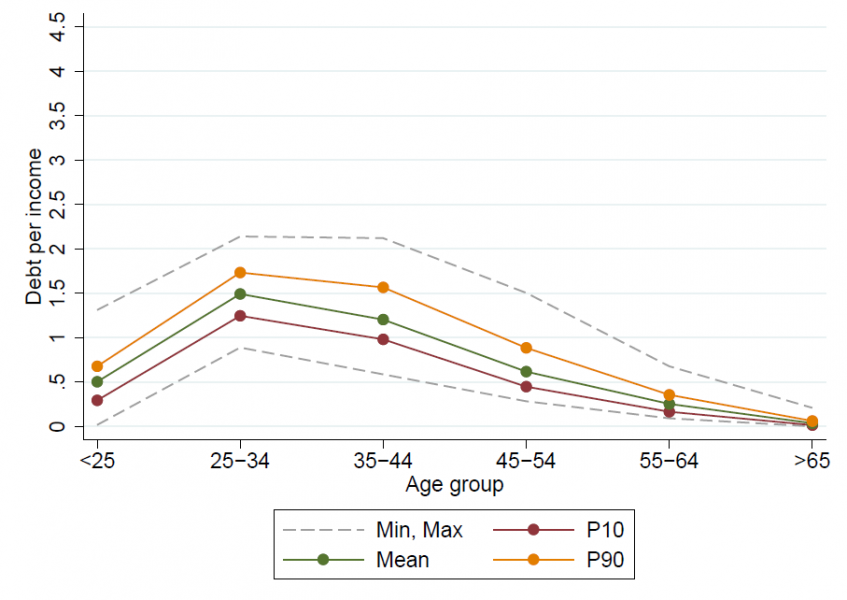

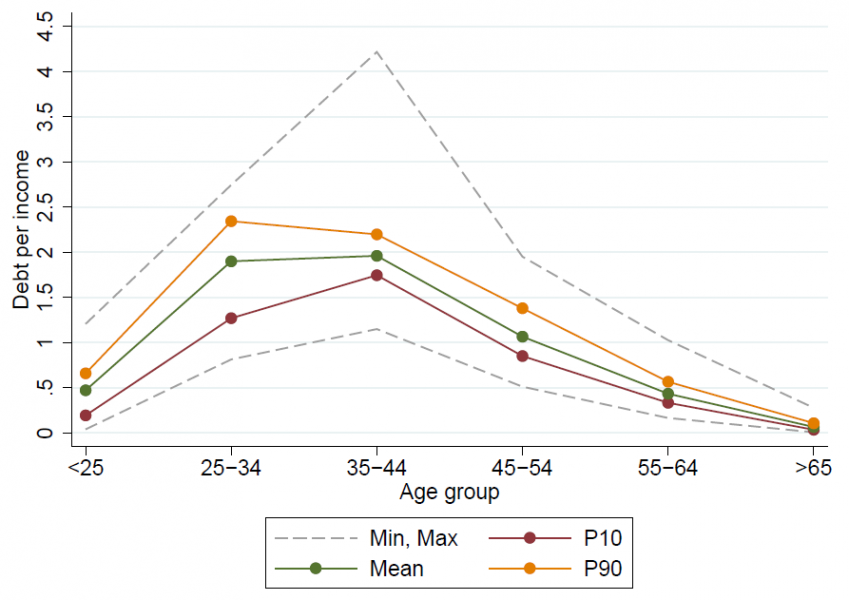

The model predicts that middle-aged households that have both wealth and future income will borrow most. In the data, we find that older households increased their share of total credit in the last decade as interest rates fell. Figure 3 illustrates this point: the share allocated to households between 25 and 35 years of age declined by around 10 p.p. while the share of households above 45 increased by the same amount. While young households aged 25 to 44 years accounted for around 75% of credit in 2006, the distribution is now more evenly distributed across age groups. Figure 4 further documents the shift in borrowing towards older age groups. It shows the distribution of debt to income ratio by age groups in 2006 and 2016. A comparison of the two years is in line with the predictions of Figure 1: all households increased their indebtedness, and households in the middle of the age distribution increased their indebtedness most.

Figure 3: Distribution of credit by age group in 2006 and 2018

This figure shows the share of total mortgage credit outstanding allocated to the different age groups in 2006 and 2018.

An important determinant of household borrowing is the lending standards of banks as many authors have documented how a relaxing of standards by banks led to the subprime credit boom in 2004-2006 in the United-States (see e.g. Keys et al. 2010). In the case of Belgium, the growth in credit from 2006 to 2018 does not seem to be driven by a relaxation of lending standards by banks. While the loan-to- income ratio increased as households became more indebted, other indicators such as the Debt- Service-To-Income (DSTI) or the Loan-To-Value (LTV) ratios remained broadly stable. The average DSTI ratio for newly issued mortgages is around 40% and 23% of borrowers have a DSTI ratio above 50%. These numbers remained broadly unchanged between 2009 and 2017. The average LTV at origination is 64% and the share of mortgages with LTV above 90% remained stable at around 35%.

Figure 4: Ratio of total mortgage debt to annual income across municipalities in Belgium

These figures show the distribution of debt to income across municipalities and age groups in 2006 (LHS) and 2016 (RHS). The figures show the 10th and 90th percentile, the minimum and maximum of debt to income across municipalities for each age group. The mean is the national average. Percentiles are computed across municipalities using population weights.

| 2006 | 2016 |

|

|

The stylized facts thus suggest (1) a shift of borrowing towards older households and (2) that lending standards remained stable. A third feature of the model that is important is the identification of credit constrained households. A particular challenge is that the information on borrowers is limited, as we do not observe their wealth or income. One advantage of our data however is that it allows to identify precisely first-time borrowers. We therefore use first-time borrowers as a proxy for credit constrained borrowers, assuming that households that buy a house for the first time mobilize all their savings and hit their borrowing constraint when buying their first house. Credit to first-time buyers represented around 10% of total credit in 2006. The amount of credit to first time buyers remained broadly stable even as total credit increased, so that the share of first time buyers in total credit declined, from 10% in 2006 to 5% in 2018. Most of the credit growth was thus driven by non-first time borrowers who already had some existing housing wealth and increased their borrowings.

While interest rates declined as household debt increased in the last decades, many other events occurred in the economy over the same period. The challenge to identify the role of the interest rate in household borrowing is that banks set interest rates using a broad range of borrower and local economy characteristics that are unobservable. For example, if the local economy in a municipality is booming, this can increase the demand for loans and lead local banks to increase interest rates. In that case, a higher interest rate would be associated with higher debt levels, but this would not reflect the true impact of the interest rate. We address this challenge in two steps. First, we use data on the location of bank branches to construct a measure of the local interest rate faced by each borrower. This approach relies on evidence from Argyle et al. (2020) that the distance to the closest bank branches is a strong determinant of the credit supply faced by consumers. By using bank branches in 2006 and the interest rates of the bank at the national level, we can therefore construct a measure of interest rates that is less dependent on local economic conditions. The second step is to use regulatory data on the foreign exposures of banks to construct an instrument for credit supply shocks. The idea is that if a bank lends to a firm in a remote country and this country experiences a shock, this will also influence the local credit supply in Belgium through the lending network. If foreign shocks are independent of local economic conditions, we can then use them to construct exogenous changes in credit supply and therefore identify the demand of households.

The regressions confirm that low interest rates are associated with a higher household debt and this result is robust to a number of alternative specifications. In terms of magnitude, we find that a one percentage point reduction in the interest rate is associated with a 15% growth in household debt. If we restrict the analysis to first-time borrowers who are more constrained, we find that the sensitivity to interest rates is up to three times higher. Since first-time borrowers represent only a small fraction of the total population of borrowers, the results suggest that non-first time borrowers account for the bulk of the increase in household debt, in line with the stylized facts.

When comparing these results to the literature, it is interesting to note that many papers had found a positive relationship between interest rates and debt (e.g. Di Maggio et al. 2017; Cloyne et al. 2019). The reason is that their empirical strategy focused on specific adjustable rate mortgage contracts, so that borrowers who received an unexpected income boost from lower interest rates on their existing debt then chose to reduce their indebtedness. Our setting instead allows to study a more general case for the full population of borrowers. Our findings are also consistent with those of Acharya et al. (2020). They study the implementation of macroprudential policy measures in Ireland that limited the ability of banks to lend to borrowers with low down payment. They find that the tighter lending standards did not prevent aggregate credit growth, but that they instead led to a reallocation of credit towards less constrained households. This seems broadly consistent with our study, where banks kept lending standards broadly stable and credit flowed mostly to the older, less constrained households.

To sum up, we find that interest rates are an important determinant of household borrowing and that the credit growth when interest rates fall is mostly driven by unconstrained, non-first-time borrowers. These results are important in an environment of low interest rate and high household debt since credit constraints can limit the ability of some households to become homeowners.

Argyle, B., Nadauld, T. D., & Palmer, C. (2020). Real Effects of Search Frictions in Consumer Credit Markets. NBER Working Paper No. 26645.

Cloyne, J., Huber, K., Ilzetzki, E., & Kleven, H. (2019). The Effect of House Prices on Household Borrowing: A New Approach. American Economic Review, 109(6), 2104–2136.

Di Maggio, M., Kermani, A., Keys, B. J., Piskorski, T., Ramcharan, R., Seru, A., & Yao, V. (2017). Interest Rate Pass-Through: Mortgage Rates, Household Consumption, and Voluntary Deleveraging. American Economic Review, 107(11), 3550–3588.

Emiris, M., & Koulischer, F. (2021). Low Interest Rates and the Distribution of Household Debt. Working Paper, National Bank of Belgium.

Keys, B. J., Mukherjee, T., Seru, A., & Vig, V. (2010). Did Securitization Lead to Lax Screening? Evidence from Subprime Loans. The Quarterly Journal of Economics, 125(1), 307–362.

Mian, A., & Sufi, A. (2014). What Explains the 2007-2009 Drop in Employment? Econometrica, 82(6), 2197–2223.

Svensson, L. E. O. (2019). Amortization requirements, distortions, and household resilience: Problems of macroprudential policy II. Working Paper, Stockholm School of Economics.

marina.emiris@nbb.be; francois.koulischer@uni.lu (Corresponding author)