This SUERF Policy Brief is based on Elfsbacka Schmoller and Spitzer (2022). The views expressed are those of the authors and do not necessarily represent those of the Bank of Finland or the European Central Bank.

We study the performance of monetary policy strategies under endogenous long-run growth. We show that under endogenous growth the gains from make-up strategies over inflation targeting are amplified as they can alleviate hysteresis effects in total factor productivity (TFP) and related permanent scars to the long-run trend. This result is strengthened under low r* as tight monetary policy space raises the frequency of zero lower bound (ZLB) episodes in which long-run trend effects are particularly adverse. Under endogenous growth, make-up strategies are subject to additional implementation challenges related to communication, measurement, and credibility. Finally, we argue that under endogenous growth inflationary supply shocks generate a trade-off between inflation stabilization and the stabilization of output over both the short and the long run which can be mitigated by confining make-up elements to ZLB episodes.

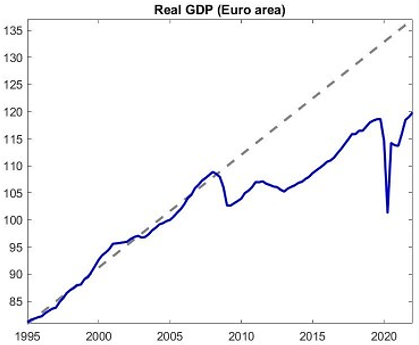

Recessions can cause severe scarring effects on the productive potential of the economy, causing it to remain permanently below its pre-crisis trend path, as illustrated in Figure 1 for the case of the euro area post-2008.1

Figure 1: Euro area real GDP and long-run trend shift

We study monetary policy strategies under endogenous trend growth through technology-enhancing R&D and technology adoption.2 In this environment hysteresis effects which generate long-run scars to aggregate output can occur endogenously. Consistent with the previous literature, our results demonstrate that make-up strategies, i.e. monetary policy strategies which make up for past deviations from target by means of subsequent overshooting or undershooting3, can lead to improvements in the stabilization of inflation and the output gap, especially when r* is low and monetary policy space is tight. We show that this result extends to the long run as make-up strategies can alleviate long-term scars of recessions, above all in proximity to the ZLB.

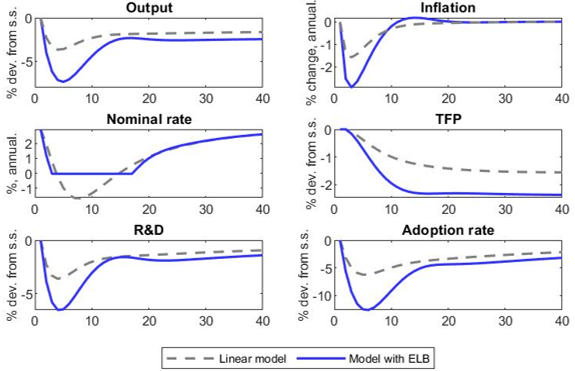

Figure 2 shows the model response to a liquidity demand shock and demonstrates the channels of hysteresis effects in TFP. In this model, and in contrast to standard macroeconomic workhorse models with exogenous technology, recessions induce a decrease in productivity-enhancing investment in R&D and technology adoption, resulting in permanent scars to aggregate output through hysteresis effects in total factor productivity (gray line). Monetary policy is non-neutral over the long run in this environment as it can to some extent influence investment in research and development and in the adoption of new technologies. Thus, constraints to monetary policy in economic stabilization are particularly adverse as they intensify the recession-induced shortfall in productivity-improving investment, amplifying the adverse effects of ZLB episodes (blue line).

Figure 2: Long-run costs of recessions and ZLB episodes

Since make-up strategies imply a commitment of holding interest rates lower for longer at the ZLB, they can alleviate the drop in technology-enhancing investment and the associated long-run trend loss accumulated during ZLB episodes. Consequently, the choice of monetary policy strategy matters also for the long-run aggregate output trajectory and can over time help to reduce permanent output losses.

We study the performance of various make-up strategies by means of model simulations against the benchmark case of inflation targeting, modeled as a standard Taylor rule under which the central bank targets inflation and a conventional output gap measure. Specifically, we analyze price level targeting (PLT), average inflation targeting (AIT) with different averaging horizons, temporary price level targeting (TPLT) and a hysteresis rule under which the central bank directly targets the long-run trend and aims at completely offsetting hysteresis effects in total factor productivity. We study the relative performance of these strategies with respect to the stabilization of inflation and output over both the short and – novel to the literature – over the long run.

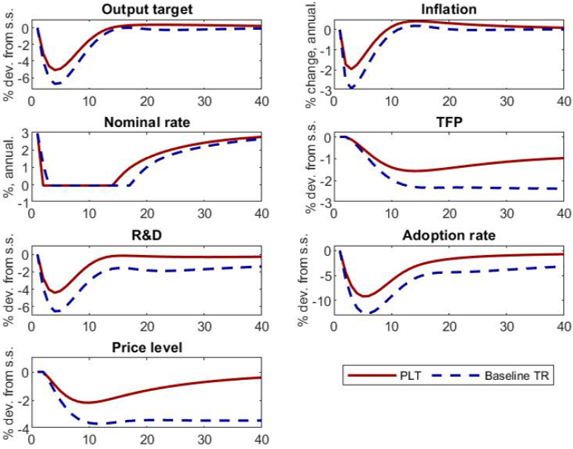

Our results demonstrate that while inflation targeting performs relatively well when monetary policy space is sufficient, its ability to stabilize inflation, the output gap and trend growth is impaired in a situation when the long-run natural rate of interest r* is low and monetary policy space is tight. Consistent with the literature, we find that make-up strategies generally improve the stabilization of inflation on the one side and output – over both the short and the long run – on the other side. Under the hysteresis rule4 the central bank fully stabilizes the long-run trend and thus fully offsets hysteresis effects which is, however, associated with mean inflation above target. Inflation-based make-up strategies (PLT, AIT, TPLT) generally perform well in offsetting the downward bias in inflation. Moreover, even without directly targeting the long-run trend, they also lead to a pronounced alleviation of hysteresis effects and the long-run aggregate output path. Figure 3 demonstrates these findings by comparing the model responses to a liquidity demand shock under the PLT rule (red line) with the responses under inflation targeting modeled by means of a Taylor rule (blue line). Differently to the Taylor rule, which takes bygones in terms of past under- or overshooting of inflation as bygones, PLT aims at making up for past deviations of inflation from target and thus results in a subsequent overshooting in inflation and output, returning the price level to its initial, targeted path, as conventionally the case in the literature. Importantly, while the price level targeting strategy does not fully close the technology gap, i.e. the shortfall on the technology margin, the long-run output losses are considerably reduced compared with the baseline Taylor rule.

Figure 3: Dynamics after a deflationary liquidity demand shock at the ZLB under inflation targeting (blue line) and price level targeting (red line)

Inflationary episodes which are demand-driven do not pose a direct trade-off for monetary policy as inflation and output move in the same direction. Leaning against the expansion to contain inflation has under endogenous trend growth, however, also implications for the long-run trajectory of aggregate output due to the contractionary effect on technology-enhancing investment. We show that the asymmetric strategy of TPLT performs well in this environment since it does not feature a make-up element outside the ZLB and hence permits for more procyclical improvements in TFP and thus higher permanent output. PLT, AIT and the hysteresis rule, in turn, entail a symmetric response to both disinflationary and inflationary shocks and may thus be subject to credibility challenges as the central bank foregoes permanent output increases in the context of the expansion.

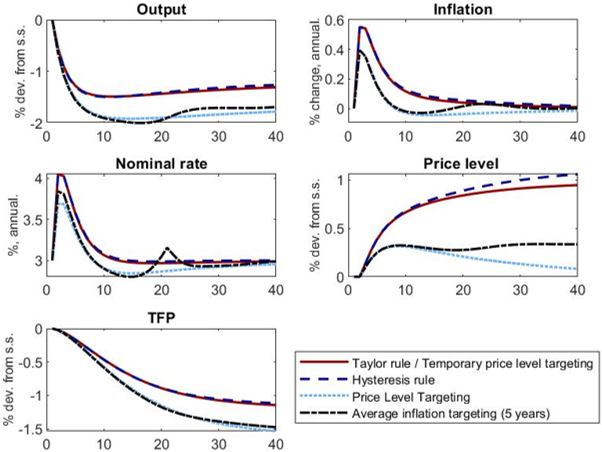

By contrast, an inflationary supply shock raises inflation but depresses output and thus generates a trade-off for the central bank between the stabilization of inflation on the one hand and of output – over both the short and long run, on the other hand. Figure 4 demonstrates that in response to supply shocks the hysteresis rule (TTR) further reinforces the inflationary response as fully offsetting the procyclical drop in TFP requires prolonged monetary stimulus post-shock due to the slow-moving properties of technology-enhancing investment, resulting in a protracted phase of above-target inflation. Inflation-based make-up strategies, such as PLT and AIT, in turn, are more effective in containing inflation. The implied more pronounced tightening, however, further weighs on technology-enhancing investment and thus reinforces the permanent output losses. TPLT, in turn, functions outside the ZLB as a standard Taylor rule, resulting in a to some extent less pronounced increase in inflation compared to the hysteresis rule, but simultaneously reduced long-term output losses relatively to PLT and AIT strategies.

Figure 4: Performance of make-up strategies under inflationary supply shocks

Make-up strategies under endogenous trend growth face increased challenges related to their implementability. A key challenge for make-up strategies is communication, which we show applies particularly to the hysteresis rule as the latter requires understanding of the full transmission mechanism, including the concept of hysteresis effects. Further, the hysteresis rule also intensifies existing well-known issues related to the measurement of potential output as it requires the identification of the cyclical component of TFP to identify the underutilization on the trend margin. This measurement problem may render inflation-based make-up strategies preferable as they perform well in restoring the long-run trend without explicitly targeting it. Lastly, make-up strategies may be subject to increased challenges as to credibility emerging from their implied response outside the ZLB.

Anzoategui, D., D. Comin, M. Gertler and J. Martinez (2019): “Endogenous Technology Adoption and R&D as Sources of Business Cycle Persistence”, American Economic Journal: Macroeconomics, Vol. 11, No. 3, pp. 67-110.

Bianchi, F., H. Kung and G. Morales (2019): “Growth, Slowdowns, and Recoveries”, Journal of Monetary Economics, Vol. 101, pp. 47-63.

Comin, D. and M. Gertler (2006): “Medium-Term Business Cycles”, American Economic Review, Vol. 96(3), pp. 523-551.

Elfsbacka Schmöller, M. and M. Spitzer (2022): “Lower for longer under Endogenous Technology Growth”, ECB Working Paper, No. 2714.

Elfsbacka Schmöller, M. and M. Spitzer (2021): “Deep Recessions, Slowing Productivity and Missing (Dis-)inflation in the euro area, European Economic Review, Vol. 134, May 2021, 103708.

Moran, P. and A. Queralto (2018): “Innovation, Productivity, and Monetary Policy”, Journal of Monetary Economics, Vol. 93, issue C, pp. 24-41.

Smets, F. and R. Wouters (2007): “Shocks and Frictions in US Business Cycles: A Bayesian DSGE Approach”, American Economic Review, Vol. 97(3), pp. 586-606.

The role of hysteresis effects in TFP and their role in macroeconomic dynamics is also well-documented by the previous literature (Moran and Queralto (2018); Anzoategui et al. (2019); Bianchi et al. (2019); Elfsbacka Schmöller and Spitzer (2021)).

Endogenous trend growth is implemented following Comin and Gertler (2006). The main model structure is a quarterly medium-scale DSGE model in the spirit of Smets and Wouters (2007).

We study strategies which entail a symmetric response to both over- and undershooting as well as an asymmetric strategy (temporary price level targeting) which only makes up for past undershooting of inflation at the ZLB but does not feature a make-up element outside ZLB episodes.

The hysteresis rule is an otherwise standard Taylor rule in which the deviation of TFP from its trend path is taken into account. Under the hysteresis rule the central bank thus targets the full trend path, including the underutilization on the trend margin. As a result, this rule will gradually bring back TFP to its initial trend path.