Given the recent geopolitical developments, the vulnerability of the euro area to import disruptions in energy resources has gathered large interest given its high import dependence. To assess the aggregate impacts of a sudden import disruption, we provide an empirical macroeconomic assessment of oil and natural gas supply shocks in the euro area. An impulse response analysis based on a small-scale vector autoregressive (VAR) model reveals that economic responses to an unanticipated price increase are qualitatively similar for both energy resources, but the magnitude differs substantially. Moreover, gas price shocks show a less persistent pattern but carry a significantly larger uncertainty compared to oil price hikes. In response to both types of shocks euro area industrial production declines substantially, core inflation increases on impact but declines after a few months. The unemployment rate increases and the EONIA declines on impact. Overall, the unemployment reaction to a gas price hike is larger and mean reversion sets in after about a year. Our results and the uncertainty around our estimates support the important role of gas as crucial input in euro area production processes.

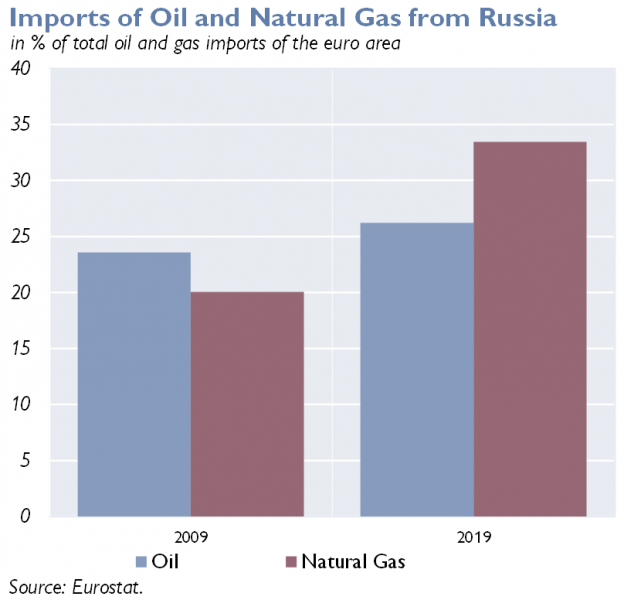

After the Russian invasion in Ukraine and the resulting sanctions from the West, energy disruptions accompanied by substantial price increases of oil and gas became a matter of lively debate worldwide but particularly in Europe. Especially European countries suffer from severe dependence of fossil energy imports, mainly from Russia. Figure 1 shows the relative oil and gas imports from Russia in percent of total oil and gas imports of the euro area. While the dependence on Russian oil has declined slightly in the recent decade, the dependence on natural gas has increased markedly.

Figure 1: Stronger import dependency of gas from Russia compared to oil

Notes: Euro area oil and natural gas imports from Russia, relative to total imports of oil and natural gas.

Although we observe different degrees of dependence on Russian energy products across European countries, a sudden stop of energy imports may have significant effects on the aggregate economy even if some countries might cope well. However, the realized impact will also depend on the possibility to substitute natural gas in production processes and on how quickly existing supply can be shifted within Europe.

From a macroeconomic perspective, three aspects mark the current situation. First, with the onset of the pandemic, energy markets experienced a substantial degree of volatility. Specifically, restrictions such as lockdowns quickly decreased the demand for energy while supply was not adjusted. Second, after production adjustments, the restrictions to counter the fallout of the pandemic were slowly eased. Consequently, the demand for energy surged again but could not fully be met by oil producers. Hence, not only during the pandemic but also in the aftermath a substantial oil supply-demand mismatch persisted. Moreover, global crude oil production still lies significantly below the March 2020 production. Finally, this situation was exacerbated by a variety of sanctions in response to Russia’s aggressions towards Ukraine and affects commodity markets worldwide.

Especially natural gas has raised attention for four reasons. First, unlike oil, gas is traded on local markets such that gas supply disruptions do not affect the “global” price for gas proportionally. As a quick comparison reveals, while the US reference price (i.e., Henry Hub sort) has remained fairly stable in the past years, European reference prices have been strongly elevated since the economic recovery after the pandemic in general and after the Russian invasion in particular. Second, due to heavy reliance on infrastructure, such as pipeline networks and infrastructure to handle liquified natural gas (LNG), gas cannot simply be rerouted like most of crude oil and suffers from limited terminal capacities. While plans to expand the necessary infrastructure to switch towards LNG exist, currently there is insufficient capacity to fully substitute Russian natural gas. Hence, it is rather difficult to switch gas suppliers in the short term. Third, while there are still oil reserves that are potentially subject to extraction (i.e., oil producing capacity can be still increased), gas is close to its extraction capacity and has little room for increases left in most production areas. Finally, gas does not only serve as energy input to production processes but also as a direct input into chemical production. These characteristics shed uncertainty on the general substitutability and thus the elasticity of substitution of natural gas. Hence, compared to input-output analyses, where the substitution elasticity is a crucial assumption, an aggregate view may offer insights from a different angle.

Due to the strong trade linkages of euro area economies and different exposure to energy price shocks, microeconomic analyses and input-output considerations may yield country- and firm-specific results. Our empirical approach thus answers the question of aggregate reactions to a sudden shortfall of energy. We investigate the effects of unanticipated changes in oil and gas prices in a five variable hierarchical Bayesian vector autoregression (BVAR) in the fashion of Giannone, Lenza & Primiceri (2015) for the euro area aggregate. We estimate the model twice, with an identical set of variables only differing in the energy resource price series. Both BVAR models are estimated using 12 lags and monthly data spanning from January 1997 to December 2019, intentionally excluding the pandemic period with pronounced volatility in almost all aggregate variables.

The Brent crude oil as well as the natural gas price proxy the relevant aggregate prices and their dynamics for Europe. To gain a picture of the euro area economy, we include an index for industrial production, the euro area unemployment rate, core inflation and the EONIA rate.2 For identification of a price shock, we employ sign restrictions on the response impact (Uhlig, 2005). The sign restrictions in both models are set identically and are in line with a commodity-specific supply shortfall, as we interpret the current situation. More specifically, we assume a negative impact reaction of industrial production and a positive impact reaction of core inflation and unemployment while we leave the response of the EONIA rate unrestricted on impact. This setup coincides with an oil/gas-specific supply shock in contrast to demand-specific shocks (aggregate and commodity-specific demand). The latter would result in a rather muted response of output and delayed inflationary effects, as noted by Kilian (2008).

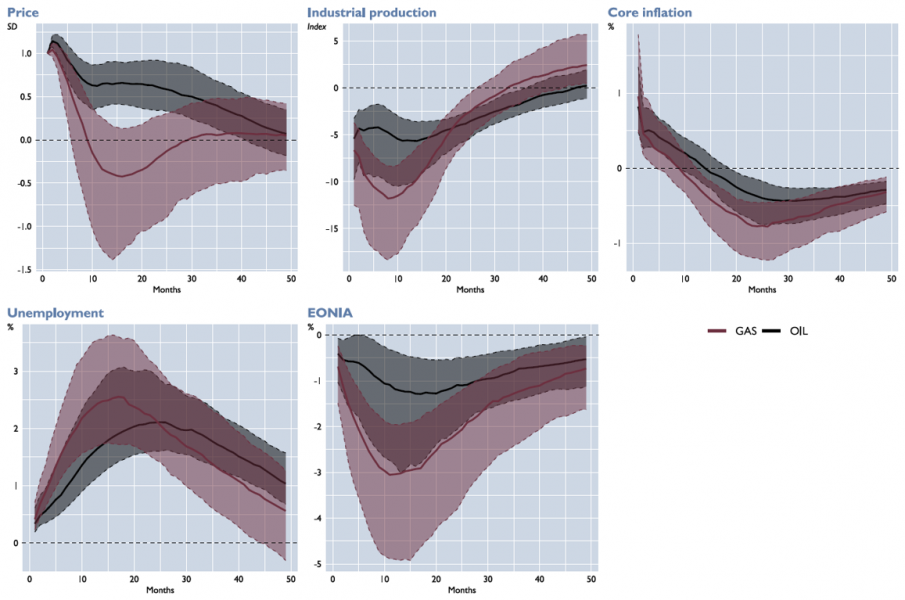

Figure 2 reports the results of our simulation exercise of a one standard deviation unanticipated oil and gas price shock.3 Each subfigure shows the response function of a certain variable in our system to an unexpected increase in oil and gas prices in the euro area. Overall, both shocks impact the European economy in a similar qualitative fashion, however, with more severe economic implications for a gas price hike. In general, while the gas price reaction appears to be much less persistent compared to an oil price shock, it carries a much larger degree of uncertainty.

Figure 2: Gas price hikes are accompanied by stronger uncertainty and induce pronounced reactions of industrial production and unemployment

Notes: The solid lines correspond to the posterior median of a one-standard-deviation gas (red) and oil (black) price shock, while the shaded areas denote the 68% confidence bounds.

The steep decline in industrial production highlights the importance of both gas and oil in the production process. The much stronger reaction of industrial production to a gas price hike further underlines the notion of its poor substitutability as opposed to oil. For both types of shocks, core inflation reacts positively in the first few months, as a direct reaction to increased input costs. The following decline may occur due to overall declining aggregate demand and, in turn, disinflationary pressure arising from a negative output gap. Unemployment rises substantially after both types of shocks, although at a slightly sharper rate for the gas price shock. Moreover, the mean-reverting behavior starts a bit earlier compared to the reaction after an oil price shock. The EONIA rate decreases on impact (while not significant within an 84-credible set), gaining momentum after several months. After about one year, mean reversion sets in. The stronger decline of the EONIA in response to the gas price shock may be a result of much more uncertain credit conditions that investors face. In the case of the oil price shock, investors seem less sensitive to sudden price changes since significant credit effects only arise after the shock persists for a longer horizon.

Overall, we find a much more pronounced uncertainty in our estimates for a gas price shock. On the one hand, this may be caused by structural reasons that make the euro area economy more resilient to oil-specific shocks. At least Kilian (2008) reports that the US economy has become less responsive to energy price shocks due to various structural reasons. On the other hand, it could be the result of both the local market structure for gas (and hence its relatively inflexible pricing) and the comparatively low substitutability. Finally, as mentioned above, we focus on oil/gas-specific supply shocks that may be of a very different nature than demand-specific shocks or expectation-driven shocks leading to precautionary demand increases (see, e.g., Kilian (2008) for a thorough discussion of these issues).

In this note we provide a macro perspective on possible effects of oil and gas price shocks on the aggregate euro area economy. To achieve this, we estimate an empirical VAR model and find similar qualitative dynamics for both types of price shock. However, a gas price shock shows less persistence and significantly larger uncertainty, when compared to an oil price hike. Our results suggest that the euro area economy may be better equipped at dealing with oil price surprises, while natural gas serves as a crucial input factor in the euro area production process. While the limit of our approach lies in the aggregate nature of the model and therefore warrants a cautious interpretation, our results do not suffer from assumptions about the microstructure of the underlying production linkages. Carefully and timely implemented policy measures may attenuate the fallout of a sudden price increase in energy prices and therefore minimize social costs.

Giannone, D., Lenza, M., & Primiceri, G. E. (2015). Prior selection for vector autoregressions. Review of Economics and Statistics, 97(2), 436-451.

Kilian, L. (2008). The economic effects of energy price shocks. Journal of Economic Literature, 46(4), 871-909.

Uhlig, H. (2005). What are the effects of monetary policy on output? Results from an agnostic identification procedure. Journal of Monetary Economics, 52(2), 381-419.

The views expressed in this policy brief are those of the authors and do not necessarily reflect those of the Eurosystem or the Oesterreichische Nationalbank (OeNB).

We retrieved the energy prices from Federal Reserve Economic Database (FRED), while the euro area macro quantities were extracted from the Eurostat database.

One standard deviation is equal to an oil price increase of 31.5 USD/bbl. and a gas price increase of 3.52 USD/mio BTU, respectively.