The views expressed in this paper do not necessarily reflect the position of the European Central Bank (ECB) or the Swiss National Bank (SNB). This research is independently conducted by the authors and not directly connected to the Eurosystem’s digital euro project. It should not be interpreted as reflecting the ECB’s position on the design of the digital euro.

This policy brief reviews how macroeconomics has approached the possible introduction of retail central bank digital currencies (CBDC). A review of the literature reveals that macroeconomic models of CBDC often rely on CBDC design features and narratives which are no longer in line with the one of central banks actually working on CBDC. For example, the literature typically assumes remunerated CBDC or that CBDC is of considerable volume, and derive macroeconomic effects from that. Possible ways forward to understand the impact of CBDC are proposed.

The digitalization of large parts of everyday life and of the economy also extends to payment transactions. In the euro area, for example, the share of cash payments at the point-of-sale (i.e. in physical shops) declined from 79% to 59% between 2016 and 2022, mainly for the benefit of card payments.1 If this trend continues or even accelerates, the role of cash and thus central bank money would decrease significantly for the benefit of private payment service providers. This also raises concerns about insufficient competition, inclusiveness, privacy protection as well as strategic autonomy of sovereign states.

Against this backdrop, a growing number of central banks started to prepare for the issuance of CBDC (for example the People’s Bank of China in 2014, the Riksbank in 2016, India in 2017, and the ECB in 2019). The envisaged design features of retail2 CBDCs that consistently emerged across these CBDC projects include non-remuneration and limitation of holdings. By issuing CBDC, central banks want to preserve the benefits for citizens of the co-existence of central bank money next to commercial bank money (more choice for citizens and merchants, preventing abuse of market power by few dominant private firms since payments have strong network effects, preserving the anchoring of all forms of private money in an effective convertibility promise into usable central bank money) and modernizing central bank money available to citizens by allowing the advantages of electronic payments (integration into mobile phone; overcoming the need to warehouse cash in a separate wallet; reducing risk of theft; overcoming costs associated to cash including higher environmental footprint) to also benefit central bank money and not only commercial bank money.

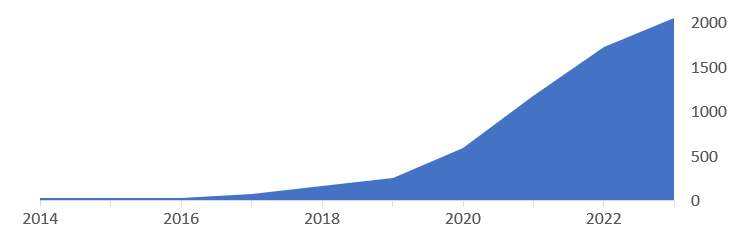

In parallel to the actual work of central bank payment experts, a heated academic debate about CBDC began in 2016. Due to the growing number of papers that present macro-economic models examining CBDC (figure 1) and, on the other hand, quite detailed plans by central banks to issue CBDC, our new paper (Bindseil and Senner, 2024) examines to what extent the assumptions and scenarios contained in these macroeconomic models of CBDC correspond to the objectives and emerging design choices communicated by central banks and related to this, how applicable the papers’ predictions of macroeconomic effects are to the CBDCs outlined or announced by central banks. The choices to be made with regards to the issuance and design of CBDC are of high importance for society, and central bankers and legislators want to understand what is at stake. It is therefore logical that both also turn to academic literature on CBDC with the assumption to find relevant predictions regarding macro-economic effects, and that both also consider basing their choices on the conclusions of this literature.

Figure 1. Number of new papers with CBDC models (annual, 2014-2023, source: Google scholar)

In principle, a variety of CBDC designs could be compatible with the motivation of central banks to preserve the role of central bank money in payments, including the introduction of potentially unlimited, large-scale or remunerated CBDC. When CBDCs first started being discussed in 2015/2016 by central bank researchers (such as Barrdear and Kumhof, 2016/2021), uncertainty about these design features was high and central bank payment departments had not yet worked on the actual specifications of CBDCs. As payment experts progressed in their work and central banks started unveiling their actual plans, however, this uncertainty gradually dissipated. In this sense, it is natural that early academic research work on the topic features some hypothesized characteristics of CBDCs that do not coincide with the designs that were worked out by payment experts and endorsed by the central bank decision makers. When considering the issuance of CBDC, central banks have been particularly careful with regards to unintended consequences of CBDC, while they showed little appreciation for the positive economic effects that research papers considered possible through remuneration or via some quantity effects if CBDC holdings would be large. Central banks essentially approached the design of CBDC in a way to preserve, and not to expand the relative role of central bank money in the economy. Therefore, they also opted against using CBDC for extending their footprint on the economy at the expense of banks and thereby went against those who favored the idea to use the issuance of CBDC to move towards a “sovereign” monetary system.

All central banks working on CBDC have announced that CBDC would not be remunerated, that holdings would be limited, and that CBDC issuance would aim to preserve the roles of central bank money in retail payments in a digitalized world. Another set of key features announced for CBDCs are those that allow to somewhat decouple the store of value from the means of payments function of CBDC and that facilitate the preservation of a single pool of money for citizens. For example, the ECB announced a so-called “reverse waterfall” so that users would not have to prefund a digital euro account before making payments because the digital euro account can be linked to a commercial bank account. Last but not least, central banks have announced access restrictions for CBDC. For example, the ECB plans to only allow natural persons who are permanent residents of the euro area (or possibly of the EU), and temporary residents (e.g. travelers) to be able to hold digital euro within the limits.

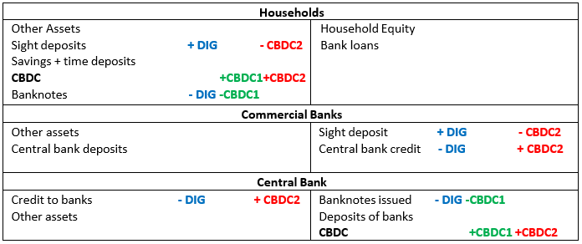

The approach taken in macro-economic models to introduce CBDC as an exogeneous policy shock can be traced back to CMPI-MC (2018, 25) and Bindseil (2020, 10). Flow of funds were presented there as in figure 2, starting from the assumption that banknotes are given and that when CBDC is introduced, the key question is to what extent it either substitutes banknotes (CBDC1) or deposits of banks (CBDC2). The former is neutral from a macro-economic point of view (starting from the fact that financial accounts remain unchanged), while the second requires banks to substitute one relatively cheap and stable funding source, household deposits, with alternatives which are at least likely to be more expensive. At the same time, CBDC2 allows the central bank balance sheet to grow, potentially increasing seigniorage income and thus profits disbursed to governments, etc. This approach is also visible in a speech by Bank of England’s Broadbent (2016, 2), where, without showing flow of funds explicitly, it is discussed to what extend the introduction of CBDC would substitute deposits or cash away, implying that CBDC would affect an otherwise static situation.

If we however consider the Scandinavian countries or other countries in which digitalization of payments has gone very far, we observe that before any issuance of CBDC, the circulation of banknotes significantly decreased for the benefit of household deposits with banks, and it is this effect that triggers analysis of central banks to possibly issue CBDC, to address the effects of digitalization on payments and preserve a role for central bank money. For example, in Sweden the nominal amount of cash in circulation declined in nominal terms by 50% since 2006 (according to the 2022 payments report of the Sveriges Riksbank). We add this initial effect which is the trigger of all other effects as “DIG” for DIGitalization effect. DIG may well exceed CBDC2 and it may even exceed CBDC1+CBDC2 – this would certainly be the case if a CBDC is designed in a way to strongly discourage the store of value function.

Figure 2. Financial accounts impact of CBDC as in CPMI-MC (2018) and Bindseil (2020)

The features that central banks have announced are important for any macroeconomic consequences of CBDC. However, we review 14 papers predicting macro-economic consequences of CBDC and find that the macro-economic literature often provides answers to key policy questions which rely on early CBDC narratives and design assumptions, and less on the explanations and plans outlined by central banks. Moreover, the papers often use models that do not appear suited to study CBDC, independent of the design. See Bindseil and Senner (2024) for a detailed review of these papers’ predictions on CBDC.

We identify in particular the following aspects which future research on the macroeconomics of CBDC could consider including:

Under the assumption of ever-progressing digitalization of society, the macro-economic effects of issuing CBDC should be identified starting from the counterfactual. If retail payments are exclusively left to the private sector and central bank money would be marginalized, then the amount of central bank money in circulation will significantly shrink, the length of central bank balance sheets would decline and the banks would benefit from deposit inflows, payment costs will increase (due to increasing market power of the successful firms in a market with strong network externalities), monetary and financial stability will be weakened (as the unifying convertibility test of all private moneys, i.e. to be exchangeable at sight against central bank money, will have become remote or inexistant), and strategic autonomy will be undermined with negative consequences under scenarios of a further geopolitical deterioration. In this sense, the issuance of CBDC aims at preserving economic efficiency and stability by preserving the current role of central bank money (a genuine public good).

Barrdear, J., and Kumhof, M. (2016/2021) “The Macroeconomics of Central Bank Issued Digital Currencies,” Journal of Economic Dynamics & Control, 142:1-24. (Initially published as Bank of England Working Paper No. 605 in 2016).

Bindseil, Ulrich (2020), “Tiered CBDC and the financial system”, ECB working paper No. 2351.

Bindseil, Ulrich, and Richard Senner (2024). “Macroeconomic Modelling of CBDC: A Critical Review.” ECB Working Paper No. 2024/2978, available here.

BIS CPMI (2018), “Central bank digital currencies”, Committee on Payments and Market Infrastructures, Markets Committee, March 2018.

Broadbent, B. (2016), “Central Banks and Digital Currencies.” Speech by Ben Broadbent, former Deputy Governor for Monetary Policy of the Bank of England, at the London School of Economics, London, March 2, 2016.

ECB (2020), “Report on digital euro”, October 2020.

ECB (2023), “OPINION OF THE EUROPEAN CENTRAL BANK of 31 October 2023 on the digital euro”, (CON/2023/34).

ECB (2023a), “A stocktake on the digital euro”, Summary report on the investigation phase and outlook on the next phase, 18 October 2023.

People’s Bank of China (2021), “Progress of Research & Development of e-CNY in China”, Working Group on Research & Development of e-CNY of the People’s Bank of China, June 2021.

Riksbank (2017), “The Riksbank’s e-krona project – Report 1”, September 2017.

See ECB SPACE publication here.

We use the term “CBDC” for “retail CBDC” i.e. electronic central bank money available for citizens for retail payments. The BIS has also proposed the term “wholesale CBDC” but we consider this use as confusing since electronic central bank money has been accessible for banks for a long time in the form of RTGS balances. The term “retail payments” is actually used in the literature and by practitioners in various ways: some use it as referring only to payments involving natural persons, such as “POI” payments (“P2B” – person to business, essentially in physical shops and e e-commerce) and P2P (person to person) payments, while others would use it for all payments which are not interbank payments, i.e. including B2B (business to business) payments. For example, the digital euro is a CBDC for retail purposes in a narrow sense, excluding B2B payments.