This policy brief is based on EIB Working Paper 2025/02 “How do macroprudential policies affect corporate investment? Insights from EIBIS data”. This brief is the exclusive responsibility of its authors and does not necessarily reflect the official views of the EIB.

Abstract

In the aftermath of the Global Financial Crisis, macroprudential policies (MaPs) have gained prominence globally. Although extensive literature examines the impact of these tools on financial stability and the macroeconomy, few studies explore their effect on corporate investments. Analyzing firm-bank-level microdata from 29 countries, including 27 EU members, we find that MaP tightening reduces tangible investments while leaving intangible investments unaffected. Our results suggest that this transmission mechanism operates through the influence of MaPs on bank lending standards. Moreover, both bank and firm characteristics affect the transmission of MaPs on corporate investment. The decline in investment is more pronounced among financially weaker firms, those more dependent on external finance, those with fewer tangible assets, or those borrowing from less capitalized banks.

In the aftermath of the Global Financial Crisis (GFC), policies aimed at enhancing financial stability have become more prevalent worldwide. This includes the formalization of macroprudential policy frameworks aimed at reducing systemic risks by utilizing novel tools to contain the adverse effects of excessive credit growth on financial and macroeconomic stability.

Reflecting its growing importance to policymakers, a vast literature has emerged on macroprudential policies. This literature includes assessments of the effectiveness of MaPs in promoting financial stability, their impact on various systemic risk indicators, and their unintended effects on other macroeconomic variables, such as output.

One area that has received less attention in the literature is the impact of MaPs on corporate investments, a key driver of economic growth in the short-run and long-run. However, it stands to reason that non-financial firms’ investment behaviour can be significantly affected by MaPs, especially in economies where the banking system plays a crucial role in financing businesses.

We believe that in an environment where discussions on financial regulation and deregulation remain prominent in policy circles, and corporate investment dynamics continue to be a topic of interest globally, the impact of MaPs on corporate investments and their transmission mechanisms deserves further research. In this brief, we summarize our recent paper investigating this very topic (Alper et al. 2025).

In a nutshell, our paper utilizes a granular micro dataset that combines and links hard and soft data to delve into the following topics:

The dataset, which is instrumental in the novelty of our contributions and in overcoming typical identification challenges inherent in these investigations, is a linked micro-macro dataset covering 29 countries (the EU, the US, and the UK) over the 2015-2022 period. Firm-level data are sourced from the EIBIS database, which provides detailed survey-based information on corporate investments, financing sources, and firm expectations. The EIBIS documents annual firm-level investment and financing behaviour for a representative sample of 12,000 firms across 29 countries (EU27, UK, and the US) from 2015 to 2022. The sampling frame for all countries in this database is based on the BvD ORBIS dataset and includes both SMEs and large corporations in NACE categories C to J.

The EIBIS asks firms to report their main banks. We use the BvD BankFocus dataset to obtain balance sheet and income statement data for all banks cited by firms in the survey and link this data with the respective firms.

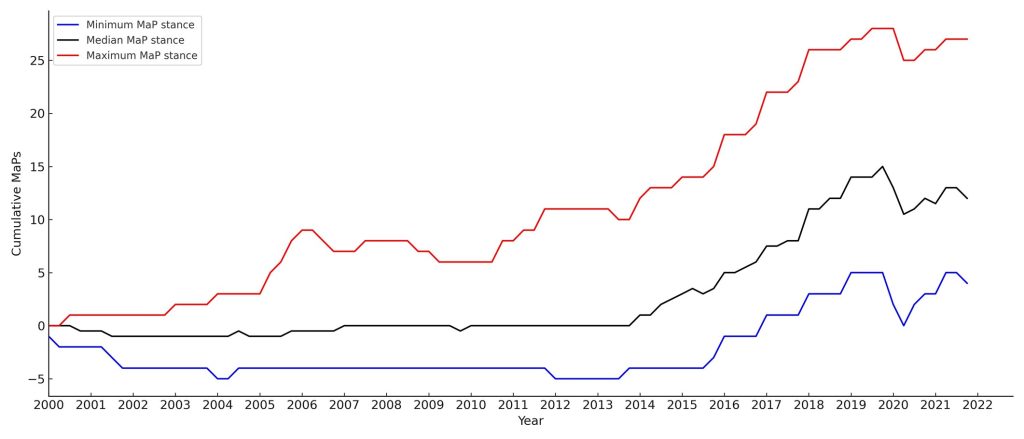

Country-level MaPs data are sourced from the International Monetary Fund’s integrated Macroprudential Policy (iMaPP) database, which provides dummy-type indicators (1 for tightening actions, 0 for no change, and -1 for loosening actions) for policy action indices covering 17 macroprudential tools at the country level.1 In addition to the general MaP index, we constructed two subindices: supply-side and demand-side MaPs. Supply-side or lender-based MaPs target financial institutions through measures such as capital and liquidity requirements. Demand-side or borrower-based MaPs target borrowers by setting thresholds on ratios such as the loan-to-income ratio and the debt service-to-income ratio. Figure 1. illustrates the evolution of the macroprudential (MaP) policy stance from 2008 to 2022, displaying the minimum, median, and maximum values across the countries in our sample.

Figure 1. Macroprudential Policy Stance

Before conducting the core econometric analysis, we address potential endogeneity issues related to the implementation of MaPs. Although changes in MaPs are not driven by individual firms’ investments, economic conditions can influence both corporate investment and macroprudential policy decisions. Therefore, to estimate the causal effect of MaPs on corporate investment, we identify MaP shocks—changes in MaPs that are orthogonal to credit and GDP growth—using the approach developed by Auerbach and Gorodnichenko (2012) for identifying fiscal policy shocks, which was recently applied to macroprudential policies by Altavilla et al. (2020).

Firstly, we find that corporate investment declines following MaP tightening. Among the MaPs, supply-based measures such as capital requirements, dynamic provisioning, and leverage limits have a stronger impact on corporate investment compared to demand-based measures like loan-to-value and debt-to-income limits.

Secondly, using bank-level balance sheet data, we examine the reaction of bank loans and financials to MaPs. We document that a tightening in MaPs results in a decline in lending activity and an increase in the capitalization ratio but no significant effect on bank profitability.

We turn to soft data from EIBIS to assess the effect of MaPs on access to finance from firms’ perspectives. The data indicate a strong association between the tightening of MaPs and an increase in reliance on internal sources. Then, we investigate the effect of MaPs on firms’ loan application outcomes and their satisfaction levels regarding loan terms and conditions. Our results show that MaPs increase the likelihood of loan application rejections and worsen firms’ satisfaction with loan terms, particularly regarding the loan amounts obtained.

These results imply that the effect of MaPs on corporate investment operates through their impact on banks’ lending behaviour, which affects firms’ access to credit. We find that both bank and firm characteristics significantly contribute to the effect of MaPs on corporate investment. Firms that are financially weaker, heavily reliant on external finance, or have credit relationships with less capitalized banks experience stronger investment declines.

Another noteworthy result regarding the role of firm characteristics in MaP transmission is the importance of firm size. We find that small and medium-sized firms are more exposed to the adverse effects of MaPs, while investments by micro firms and large firms remain unaffected.

Lastly, MaP tightening affects tangible and intangible investments differently. Tangible investments, such as machinery, equipment, and infrastructure, decline significantly, whereas intangible investments, including R&D and employee training, remain unaffected. We attribute this to two factors: (1) firms cannot pledge intangible capital as collateral; and (2) firms primarily finance tangible capital investments with external sources and intangible capital investments with internal sources (partly because of the first factor). Therefore, intangible capital investment is less dependent on the traditional bank lending channel.2

Our analysis implies that macroprudential policies, particularly supply-side measures, affect corporate investments through bank lending channel. The impact of MaPs is more pronounced for financially weaker firms and those working with financially weaker banks. The results regarding the impact of MaPs on bank lending broadly align with previous literature, which documents that MaPs serve their intended purpose: credit growth is tamed, primarily through reductions in lending by risky lenders and to risky borrowers.

Considering the composition of corporate investments, analyses consistently suggest that intangible investments, which are the main drivers of productivity gains at the firm or country level, are not significantly affected by MaPs. This is consistent with studies documenting that intangible investments are almost exclusively financed by equity or internal sources.

On the other hand, the fact that corporate investments, particularly by small and medium-sized firms, are significantly affected by MaPs warrants some attention. While MaPs should improve financial conditions from a long-term perspective by preempting boom-bust cycles, it is still worth reflecting on whether the short-term costs in terms of reduced corporate investments are justifiable or unavoidable. In other words, in evaluating and designing these tools, we believe that our results highlight the need to better understand the unintended implications of MaPs on investments and to take these into account when calibrating and designing MaP tools.

Ahnert, T., Forbes, K., Friedrich, C., and Reinhardt, D. (2021). Macroprudential FX regulations: shifting the snowbanks of FX vulnerability? Journal of Financial Economics, 140(1):145–174.

Alam, Z., Alter, A., Eiseman, J., Gelos, G., Kang, H., Narita, M., Nier, E., and Wang, N. (2024). Digging deeper—evidence on the effects of macroprudential policies from a new database. Journal of Money, Credit and Banking, No.13130.

Alper, K., Baskaya, S., & Shi, S. (2025). How do macroprudential policies affect corporate investment? Insights from EIBIS data (No. 2025/02). EIB Working Papers.

Altavilla, C., Laeven, L., and Peydró, J.-L. (2020). Monetary and macroprudential policy complementarities: evidence from European credit registers. Working Paper Series 2504, European Central Bank.

Döttling, R. and Ratnovski, L. (2023). Monetary policy and intangible investment. Journal of Monetary Economics, 134:53–72.

Forbes, K. J. (2021). The international aspects of macroprudential policy. Annual Review of Economics, 13:203–228.

As Forbes (2021) states, it is difficult to measure the intensity of MaPs, including the intensity of the same tool implemented in different countries. and that of different tools adopted in the same country. However, the discrete information may help us to capture average effects.

Döttling and Ratnovski (2023)) find similiar results for the effect of monetary policy.