References

Acharya, V., L. Pedersen, T. Philippe, M. Richardson, 2017, “Measuring Systemic Risk,” Review of Financial Studies, Vol. 30 (January), pp. 2-47.

Alam, Z, A. Alter, J. Eiseman, G. Gelos, H. Kang, M. Narita, E. Nier, and N. Wang, 2019, “Digging Deeper: Evidence on the Effects of Macroprudential Policies from a New Database,” IMF Working Paper, No. 19/66 (Washington D.C.: International Monetary Fund).

Altavilla, C., L. Laeven, and J.-L. Peydró, 2020, “Monetary and Macroprudential Policy Complementarities: Evidence from European Credit Registers,” Working Paper Series, No 2504, ECB.

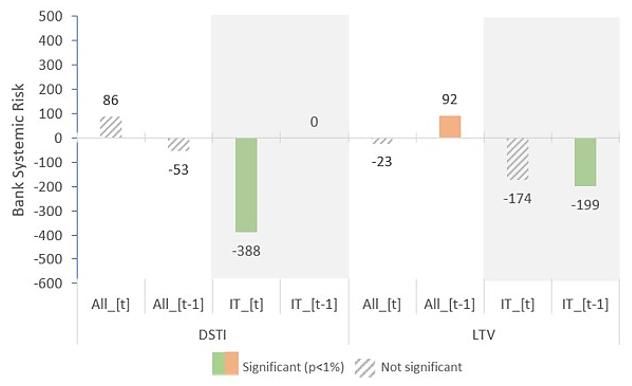

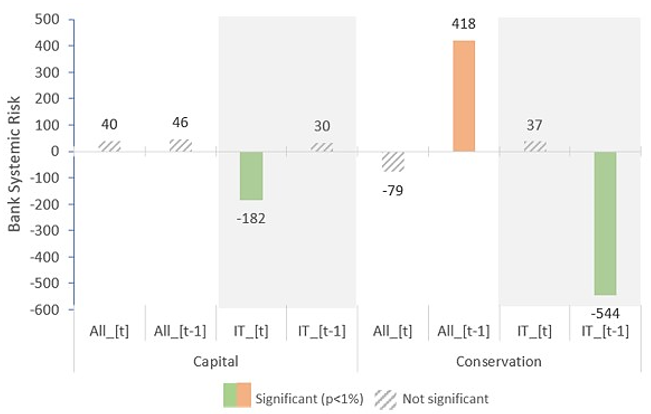

Belkhir, M, S. Ben Naceur, B. Candelon, W. G. Choi, and F. Mugrabi, 2023, “Macroprudential Policy and Bank Systemic Risk: Does Inflation Targeting Matter?” IMF Working Papers 2023/119 (Washington D.C.: International Monetary Fund).

Brownlees, C., and R. F. Engle, 2017, “SRISK: A Conditional Capital Shortfall Measure of Systemic Risk,” Review of Financial Studies, Vol. 30 (January), pp. 48-79.

Choi, W. G., and D. Cook, 2018, “Policy Conflicts and Inflation Targeting: The Role of Credit Markets,” IMF Working Paper, No. 18/72 (Washington D.C.: International Monetary Fund).

Claessens, S., G. Cornelli, L. Gambacorta, F. Manaresi, and Y. Shiina, 2021, “Do Macroprudential Policies Affect Non-Bank Financial Intermediation?” CEPR Discussion Paper No. DP15895 (March).

Cozzi, G., M. Darracq Pariès, P. Karadi, J. Körner, C. Kok, F. Mazelis, K. Nikolov, E. Rancoita, A. Van der Ghote, and J. Weber, 2020, “Macroprudential Policy Measures: Macroeconomic Impact and Interaction with Monetary Policy,” ECB Working Paper Series No. 2376.

Fazio, D. M., T. C. Silva, B. M. Tabak, and D. O. Cajueiro, 2018, “Inflation Targeting and Financial Stability: Does the Quality of Institutions Matter?” Economic Modelling, Vol. 71 (April), pp. 1-15.

Gambacorta, L., and H. S. Shin, 2018, “Why Bank Capital Matters for Monetary Policy,” Journal of Financial Intermediation, Vol. 35 (July), pp. 17-29.

Kim, S., and A. Mehrotra, 2018, “Effects of Monetary and Macroprudential Policies—Evidence from Four Inflation Targeting Economies,” Journal of Money, Credit and Banking, Vol. 50 (August), pp. 967-92.

Kuttner, K., and I. Shim, 2016, “Can Non-interest Rate Policies Stabilize Housing Markets? Evidence from a Panel of 57 Economies,” Journal of Financial Stability, Vol. 26 (October), pp. 31-44.

Louati, S., and Y., Boujelbene, 2020, “Inflation Targeting and Bank Risk: The Interacting Effect of Institutional Quality,” Cogent Business & Management, 7(1): 1847889.

Mendicino, C., K., Nikolov, J. Suarez, and D. Supera, 2020, “Bank Capital in the Short and in the Long Run,” Journal of Monetary Economics, Vol. 115 (November), pp. 64-79.

Papadamou, S., M. Sidiropoulos, and E., Spyromitros, 2015, “Central Bank Transparency and the Interest Rate Channel: Evidence from Emerging Economies,” Economic Modelling, Vol. 48 (August), pp. 167–174.

Rubio, M., and F. Yao, 2020, “Macroprudential Policies in a Low Interest Rate Environment,” Journal of Money, Credit and Banking, Vol. 52 (September), pp. 1565-1591.

Van der Ghote, A., 2020, “Benefits of Macro-prudential Policy in Low Interest Rate Environments,” Working Paper Series, No 2498, ECB.