A long period of low and stable inflation and highly accommodative monetary policy ended in 2021. Macroprudential policy (MPP) was increasingly used during this period to counter the gradual increase in systemic risks in the banking sector. However, the recent increase in inflation and the tightening of monetary policy significantly transformed the macrofinancial environment for MPP, raising new questions about how to conduct this policy appropriately. Given the considerable uncertainties facing the materialisation of macrofinancial vulnerabilities and the macroeconomic outlook, there appears to be no general advice. The key question to ask before deploying capital-based measures is about the current state and outlook of banking sector resilience. Against that background, it appears to be too early to release MPP capital buffers, and in some countries, an increase in macroprudential space might even be advisable. The situation regarding borrower-based measures must be seen in a more nuanced manner, given that the mortgage and real estate cycle in European countries is clearly turning. There is, however, no prior cross-national situation demonstrating that loosening BBMs is the most appropriate course of action at this stage because while looser lending standards might smooth over any cyclical correction, they may also generate challenges to financial stability in the medium term. Overall, it appears clear that the focus of MPP at this stage should be on preserving the resilience of the financial system. In contrast, the need to ‘tame the cycle’ and to prevent dynamic shocks to the financial cycle has clearly receded.

A long period of low and stable inflation in the euro area ended in 2021. A combination of external shocks, including supply chain disruptions from the COVID-19 pandemic and a steep increase in energy prices due to the Russian war against Ukraine, increased consumer price inflation significantly. In the euro area, year-on-year HICP inflation peaked from -0.3% in December 2020 at 10.6% in October 2022 and reached still high values of 7% in April 2023. The European Central Bank reacted to this with a series of interest rate hikes, which, in turn, were transmitted to market interest rates for consumers as well as nonfinancial corporations.

The importance of macroprudential policy (MPP) increased significantly during the low interest rate period. Highly accommodative monetary policy resulted in a gradual increase in systemic risks in the banking sector, which macroprudential policy has been designed to counter.1 Its objective, as formulated by the ESRB (European Systemic Risk Board, 2014), is to contribute to safeguarding the stability of the financial system. MPP first cushions the increase in systemic risks (‘taming the cycle’) and second, strengthens the resilience of the banking system. It is thus not surprising that the use of MPP increased significantly during the last decade (Eller, et al., 2020). These developments were complemented and reinforced by institutional changes such as the creation of the ESRB in 2011, the strengthening of MPP decision-making bodies in many European countries, and the new MPP function for the European Central Bank as of 2014.

There is substantial evidence that MPP can cushion the negative side effects to financial stability of accommodative monetary policy (Lo Duca, et al., 2023). The monetary policy strategy review completed by the ECB in 2021 also concluded that monetary policy and macroprudential policy are interrelated and should be looked at in combination. In fact, MPP should be seen as the first line of defence against building financial vulnerabilities, including the possible side effects of monetary policy on financial stability. To put it differently, in a low interest rate/low inflation environment, macroprudential tightening allows monetary policy to remain accommodative for longer. The relationship between monetary policy and MPP in a high inflation/high interest rate environment is, however, less clear.

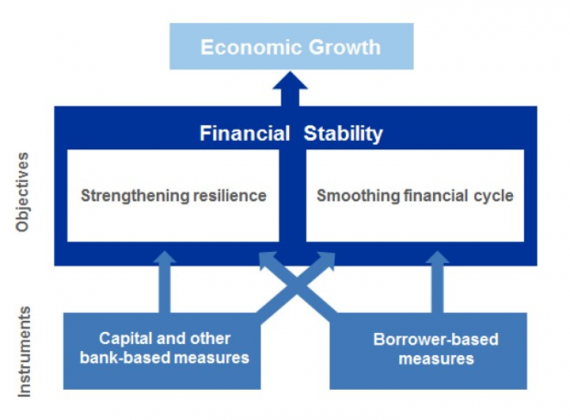

The impact of MPP on bank resilience is particularly important to ensure financial stability. This resilience can be increased directly via capital-based measures or indirectly, by decreasing the riskiness of bank portfolios using borrower-based measures (Figure 1). Higher resilience has a countercyclical impact during phases when risk materialises. The impact of MPP on the financial cycle during an upswing, while also important, tends to be more indirect, and its effectiveness is less certain. It will depend on different factors, e.g., the level of competition in the banking system. If there is high demand for credit, banks have strong incentives to meet this demand despite possible higher funding costs due to the additional capital requirements. Even for borrower-based MPP measures, there is some evidence that banks try to minimise the volume of credit lost (Cesnak, et al., 2021).

Figure 1: Transmission of macroprudential policies to economic growth

Source: Ampudia, et. al. (2021)

The increase in inflation and the end of a period of highly accommodative monetary policy significantly transformed the macrofinancial environment for MPP. Higher interest rates have a range of implications for banking sector resilience, the financial cycle and therefore systemic risk. Moreover, some of these effects operate in opposite directions, complicating the rationale for the use of MPP. First, monetary policy normalisation is likely to slow the further accumulation of systemic risks or even reduce them (Detken et al., 2018, Lang et al., 2019). At the same time, monetary policy normalisation may be a trigger for the materialisation of accumulated systemic risks, having negative direct and indirect effects on bank balance sheets, testing the resilience of the financial system as a whole.

The aggregate impact of high inflation and tighter monetary policy on financial stability is not easy to assess. First, increasing interest rates result in a more positive development of net interest income. However, increasing interest rates also lead to increasing debt-service burden for firms and households. In addition, they will face higher input costs and a decrease in real income, respectively, possibly necessitating further new loans. Second, adverse macroeconomic developments may increase unemployment and bankruptcy rates, resulting in declining asset quality and possibly an increase in nonperforming loans. The increase in policy rates will also trigger losses in banks’ bond portfolios, negatively affecting bank capital positions.2 Emerging market economies face even higher macrofinancial risks, given that they may experience capital outflows and the realisation of foreign currency risks.

The effect of monetary tightening on real estate markets, a key area of attention for MPP decision-makers, is multifaceted, but a significant negative impact cannot be excluded. While monetary policy, mortgage supply, housing preference and income shocks jointly drove real estate price growth during the low-inflation and low-income period, we already see a marked decrease in real estate price growth throughout the eurozone. In some European countries, real estate price growth has already turned negative. Going forwards, assuming that inflation will remain elevated for some time, coupled with tightening monetary policy and increasing interest rates, we expect residential real estate prices to be under pressure across the eurozone, although with high uncertainty regarding their medium-term evolution.

Policy decisions from the COVID-19 pandemic can provide some tentative guidance for macroprudential policy decisions in the current macrofinancial environment. COVID-19 was the first instance since MPP became widely used in Europe that banks faced negative economic developments. When the crisis started, it was widely expected that the lockdowns would have very severe negative economic effects. In response to these expectations, MPP authorities across Europe were quick to release MPP measures when the crisis started (Lagaria, 2021). It turned out, however, that government actions such as loan payment moratoria, state guarantees and furlough schemes rather effectively helped nonfinancial companies and households withstand any short-lived financial distress. Even after the expiration of loan moratorium schemes in the euro area, there was only a limited increase in credit losses (European Central Bank, 2021).

The pandemic revealed, however, two important issues regarding the impact of the release of MPP capital buffers (Adrian, 2021).

Given the uncertainties regarding the materialisation of macrofinancial vulnerabilities and the macroeconomic outlook, there appears to be no general advice on how MPP should be used at the current juncture. That said, one can identify some of the key considerations for MPP decision-making at this stage. Moreover, these considerations, and the overall approach, differ somewhat between capital and borrower-based MPP measures.

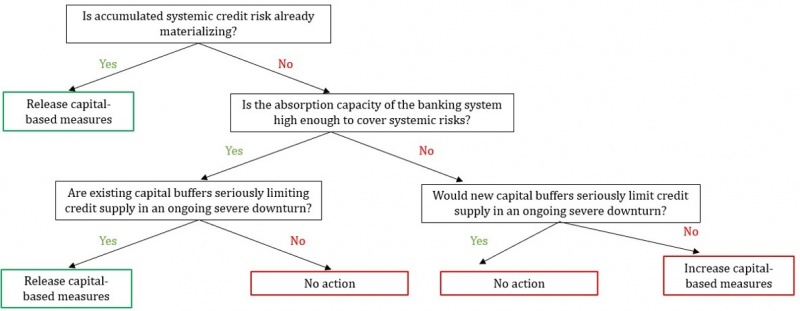

Regarding capital-based measures, the key question to ask is about the current state and future outlook of banking sector resilience. This includes (1) the outlook for credit losses and the extent to which they are already provisioned for. A closely related question is (2) the current level of absorption capacity in the system, including Pillar 2, MPP and ‘management’ capital buffers. Moreover, MPP authorities should take a dynamic perspective when looking at absorption capacity, including the outlook for bank capital formation. What are the prospects for bank profits and their retention? Finally, and importantly, (3) is there a need to release capital buffers? Is there unmet credit demand in the economy that is more likely to be met if MPP capital buffers are released? The recent experience with MPP buffer releases during COVID-19 can be particularly useful here when designing possible release measures. Releases expected to be lasting are, for example, more likely to be effective for lending to constrained banks than capital relief measures with uncertain or overly short time horizons (Couaillier, et al., 2022). At this stage, it seems generally too early for buffer releases. In some countries, even an increase in macroprudential space might be advisable before losses materialise. This is justified because as long as credit losses are generally kept from materialising, the risk that profits will be distributed to shareholders instead of being kept in the bank to increase absorption capacity is high. At the same time, the likelihood that buffer increases would turn out to be procyclical is relatively low, at least in countries where banks that voluntarily maintain capital buffers above regulatory requirements are substantial and bank profitability is strong. With respect to the decision tree depicted in Figure 2, euro area and CESEE-11 countries are—depending on the specific country—likely to be in one of the three red boxes.

Figure 2: Relaxation of Macroprudential Capital Requirement – scheme

Borrower-based measures must be seen in a more nuanced manner, given the rather clear evidence that the mortgage and real estate cycle in European countries is turning. A further tightening of borrower-based measures appears clearly less likely than for capital-based measures, but there is no prior cross-country model to determine whether waiting or loosening is the most appropriate course of action going forwards. An important argument for loosening would be, for example, a significant mechanical tightening of borrower-based measures such as the debt-service-to-income ratio cap following a strong increase in mortgage rates. Demand for new housing loans would be significantly curtailed if a large share of new borrowers would suddenly find such a cap binding. Moreover, the macroeconomic repercussions of a possible sharp contraction of the real estate sector should be kept in mind. A strong contraction in demand could possibly best be avoided by raising the share of allowed exemptions, if necessary, instead of loosening lending standards in general. Without excessive procyclicality in new lending and in the absence of severe spillover to overall economic development, it seems prudent to keep borrower-based measures constant through the cycle. This approach prevents lending standards from deteriorating in critical times, thus preventing the accumulation of systemic risks in bank loan portfolios.

Overall, in the short- to medium-term, MPP is likely to be quite heterogeneous across countries, with the current MPP ‘stance’, the stock of vulnerabilities and the transmission of inflation and monetary policy effects to the financial sector as key determinants. The challenging environment and the possible heterogeneity in policy across different jurisdictions are also recognised by other international authorities, to a large extent, with the view presented above (Valderama, 2023). Moreover, MPP should be seen as part of the overall ‘policy puzzle’, which includes more than MPP and monetary policy. While large-scale government support was unavoidable in the pandemic to help households and firms, across-the-board fiscal support is not the most efficient solution for times of high and persistent inflation. Governments should continue to prioritise the most vulnerable households or firms. In many advanced and emerging economies, fiscal restraint can lower inflation while reducing debt (Adrian & Gaspar, 2022).

Macroprudential policy in Europe is facing challenges related to increasing inflation and tightening monetary policy for the first time. This, together with the considerable uncertainty in future macroeconomic developments, creates many questions regarding the best way forwards for MPP at the current juncture.

It appears clear that the focus of MPP at this stage should be on preserving the resilience of the financial system. This includes securing an appropriate loss absorption capacity now in advance of the moment an otherwise systemic event could occur. In contrast, the need to ‘tame the cycle’ and to prevent bubbles and other unexpected growth in the financial cycle has clearly receded. Given that resilience is typically directly addressed with capital-based measures, the case for further tightening of such measures may remain. Depending on country-specific circumstances, especially in cases of recent macroprudential policy tightening, however, a wait-and-see approach may be the best way forwards. For borrower-based measures, the situation is more nuanced, and the balance is tilted towards keeping a steady hand or releasing in very specific circumstances. The most prudent way to do this seems to be to increase exemptions. In any case, the country-specific situation, especially the bindingness of the current stance, is key to any solution. Finally, although other factors were not discussed in detail in this note, MPP is only part of the puzzle, and a joint effort between monetary and fiscal policy is needed to efficiently cope with the negative consequences of current economic development.

Adrian, T., 2021. Macroprudential Responses to the COVID-19 Pandemic and Outlook.

Adrian, T. & Gaspar, V., 2022. How Fiscal Restraint Can Help Fight Inflation. IMF Blog.

Ampudia, M. et al., 2021. On the effectiveness of macroprudential policy. ECB Working Paper No 2559 / May 2021.

Cesnak, M., Klacso, J. & Vasiľ, R., 2021. Analysis of the Impact of Borrower-Based Measures. NBS Occasional paper, Issue 3.

Couaillier, C., Reghezza, A., d’Acri, C. R. & Scopelliti, A., 2022. How to release capital requirements during a pandemic? Evidence from euro area banks. ECB Working Paper No 2720/ September 2022.

Detken, C., Fahr, S. & Lang, J., 2018. Predicting the likelihood and severity of financial crises over the medium term with a cyclical systemic risk indicator, ECB Financial Stability Review, May 2018.

Eller, M., Martin, R., Schubert, H. & Vashold, L., 2020. Macroprudential policies in CESEE – an intensity-adjusted approach. Focus on European Economic Integration, Issue Q2/2020, pp. 75-81.

European Central Bank, 2021. Financial Stability Review November 2021

Europen Systemic Risk Board, 2014. The ESRB handbook on operationalising macroprudential policy in the banking sector.

Lagaria, K., 2021. Macroprudential Policy Measures in Response to the COVID-19 Pandemic Crisis in the EU/EA. Bank of Greece, Financial Stability Review, June 2021 – Part B, Special Feature II.

Lang, J. H., Izzo, C., Fahr, S. & Ruzicka, J., 2019. Anticipating the bust: a new cyclical systemic risk indicator to assess the likelihood and severity of financial crises. ECB Occasional Paper No 2019 / February 2019.

Lo Duca, M. et al., 2023. The more the merrier? Macroprudential instrument interactions and effective policy implementation. ECB Occasional Paper Series No 310/March 2023.

Valderama, L., 2023. Calibrating Macroprudential Policies in Europe: Considerations Amid Rising Housing Market Vulnerability. IMF Working Paper WP/23/75.

Systemic risks increased also in other parts of the financial sector but given that MPP is for now almost exclusively focused on the banking sector, we disregard nonbank financial entities in this policy brief.

The failure of Silicon Valley Bank shows what the consequences of a large unhedged bond portfolio can be in times of swift interest rate increases when combined with a deposit base largely not covered by deposit insurance.