We study a large Italian program of public investment subsidies showing it had sizable employment and investment effects. The rule allocating public funds ranked applicant firms on a score reflecting both objective criteria and local political preferences. Contrasting the performance of comparable subsidized and non-subsidized firms we characterize the heterogeneity of treatment effects and cost-per-new-job across all applicants. While responding with larger employment growth, small firms, southern regions and firms preferred by local politicians generated jobs at a higher cost. Estimating the cost effectiveness of subsidies under counterfactual allocation rules shows that relying only on objective criteria would reduce the cost-per-job by 11%, while relying only on political discretion would increase it by 47%. The cost-of-new-investment would vary by similar magnitudes.

Public subsidies to private activity are an important component of public expenditure. Their rationale is to compensate for the existence of failures in some markets, which tend to induce suboptimal level of private investment. Entrepreneurs would invest too little if, for example, their effort generates positive external effects (“spillovers”) that are difficult fully appropriate (as in the case of knowledge investments). If the returns to investment depend on inputs that have the nature of public goods (e.g. infrastructure), which will tend to be underprovided by the private sector. Or when there are large differences between the information available to them vs. potential investors, which would limit the amount of available external resources.

To the extent that they are localized, market failures can contribute to generate wide and persistent territorial disparities, which are a feature − and a policy concern − even among the wealthiest countries. In those cases, spatially targeted government intervention (the so-called “place based” policies) has the potential to favour convergence in the level of development across areas (Kline and Moretti, 2020).

In fact, place based policies absorb a significant amount of public resources in developed countries. Before the Covid-19 pandemic, the total budget of place-based policies in the United States was $61 billion per year, 80% of which was cash grants and tax credits to firms (Bartik 2020). During the same period (2014-2020), the European Union’s Regional Development Fund (ERDF) promoted the economic development of poorer European regions with funding of €279 billion (€46.5 billion per year), to which one should add the resources invested by individual member states. The pandemic recovery budgets are bound to substantially increase financial support to firms in specific areas. In some countries, including Italy, a significant fraction of the EU funded Recovery and Resilience Plan has been earmarked for disadvantaged regions.

Are these measures effective? Because firms are unlikely to be equally affected by market failures, the main challenges when implementing such policies is to reach firms that guarantee the highest “bang for the buck”. Yet, there is uncertainty about the marginal effects of subsidies across different types of beneficiaries. For example, many believe that small (or infant) firms generate the highest returns to public capital, which helps them to overcome their liquidity constraints (see e.g. Chodorow-Reich 2014, Schmalz et al. 2017, Criscuolo et al. 2019, Siemer 2019), but market frictions may also force larger, more mature producers to forego investment opportunities (see e.g. Hsieh & Olken 2014, Akcigit et al. 2020).

In light of this uncertainty, discretion by bureaucrats and politicians may improve on rigid policy rules by allowing subsidy allocation to incorporate additional information about the quality of firms and projects. However it is vulnerable to abuse, and may be used for private benefits rather than for the public interest, as in the case of political connections (see, e.g. Fisman 2001). This “rules vs. discretion” trade-off is a classical theme in macroeconomic policy (Persson & Tabellini 2002), but carries through to other areas of government intervention, including industrial policy (Laffont 1996).

In a recent paper, we investigate the relevance of firm characteristics and allocation criteria – notably, the rules vs. political discretion trade-off – for the effectiveness of public subsidies to private firms (Cingano et al. 2022). We focus on the case of Law 488/92 (L488 henceforth), the largest program of investment subsidies ever implemented in Italy, and one of the largest in Europe (Giavazzi et al. 2012). Between 1996 and 2007, L488 financed 77,000 investment projects over 35 open calls, with a total budget of nearly €26 billion (at constant 2010 prices), partly supplied through the ERDF. In our research, we estimate the impact of these funds on firm investment, job creation, and productivity.

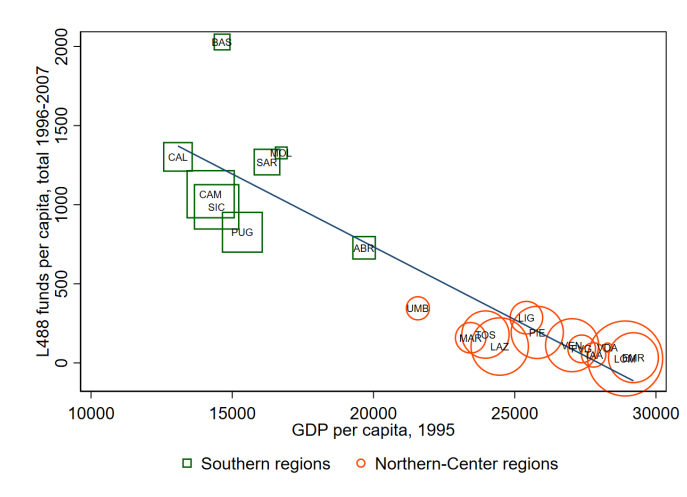

Figure 1: L488 funds and GDP per capita across regions

Notes: per capita amount of L488 subsidies in 1997-2007 (vertical axis) vs. per capita GDP in 1995 (horizontal axis) across Italian regions. Variables in euros at constant 2010 prices. The size of markers is proportional to region population.

L488 subsidies were allocated to projects through open calls. First, budgets were allocated to the 20 Italian regions, giving preference to economically under-developed regions in the South (Figure 1). Then, bids within each call-region were ranked according to a numerical score of project quality, and financed on a first-ranked, first-served basis until the funds were fully allocated. Importantly, the selection criteria weighted both objective indicators (“rules”) and subjective priorities indicated by local politicians (“discretion”). This allocation mechanism is an ideal RD design allowing estimating the casual impact of the incentive comparing the outcomes of firms just above and just below the cutoff.

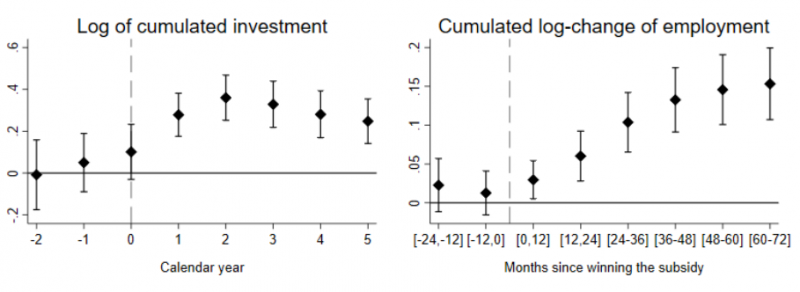

The policy considerably strengthened the scale of production of subsidized firms relative to non-subsidized firms (Figure 2). Investment increased by almost 40 percent over the three-year funding period, before gradually returning to baseline. This transitory shock to investment generated, on average, a 10 percent increase in employment during the same period, which increased to 17 percent over the following three years (i.e., six years after being awarded the subsidy). Before the treatment, firms in the two groups were fairly similar along a number of dimensions, confirming that these quantities measure additional employment (and investment) induced by the policy. Moreover, we show that subsidized firms do not expand at the expense of other non-subsidized firms, so our estimated effects capture a net increase in local employment.

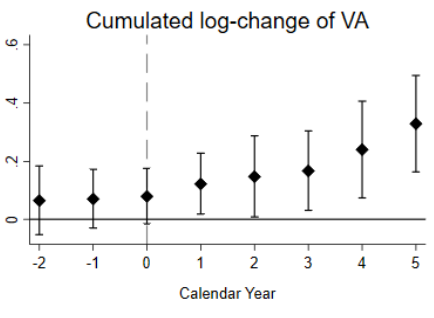

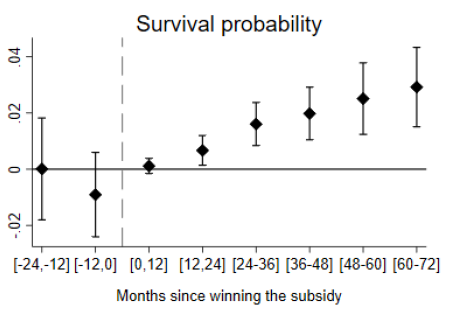

Revenues and value added increased by a similar amount, implying that firm productivity remained approximately constant. Firm survival increased by 3 percentage points (+6% over the baseline).

Figure 2: Dynamic effects of the L488 subsidy on several firm outcomes

|

|

|

|

Notes: These graphs show the estimated effects of the subsidy on several outcomes of interest at different time horizons, indicated on the horizontal axis, and associated confidence intervals (at the 90% significance level).

We exploited recent advances in the econometric literature (Angrist & Rokkanen, 2015) to extend the analysis to firms away from the cutoff. The approach allows characterizing the heterogeneity of treatment effects induced by the policy across different types of applicants, estimating the amount extra employment and extra investment for both treated and non-treated firms. It therefore allows computing total policy effects and their average cost under the actual allocation criteria and under hypothetical counterfactual rules.

We estimate that the cost per new job generated six years after the auction is just below €180,000, or €54,000 per job-year (because many new jobs will survive beyond the sixth year, the actual cost of the policy is plausibly lower). These figures are larger than comparable results obtained in previous evaluations of the same policy1, but not too different from those estimated in the case of similar programs in other countries2. There is, however, a stark divide between Northern and Southern regions, which generate a new job at €68,000 and €241,000, respectively.

The public cost of new investment (i.e. the inverse investment multiplier) shows a similar gradient. New investment in the south just matches the amount of the public subsidy, while each € of public subsidy generates nearly three additional euros of investment in center-northern regions.

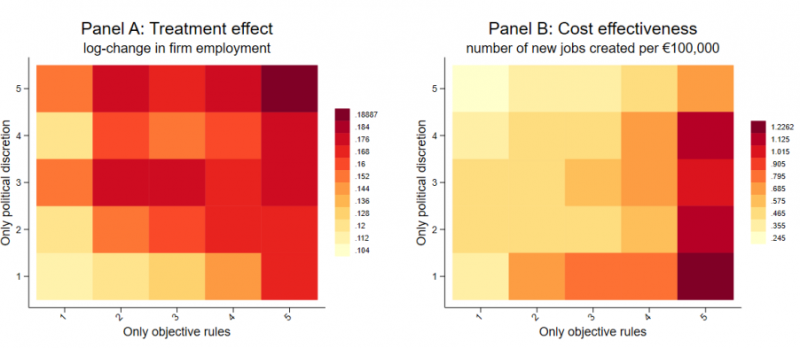

Turning to heterogeneity, we find that firms ranking high on objective indicators and firms preferred by local politicians both generate larger treatment effects than other firms, on average, but the firms preferred by politicians do so at a higher cost-per-job (Figure 3). It takes just over €80,000 for high-on-rules, low-on-discretion applicant firms to create a new job, while the cost is five times as large for low-on-rules, high-on-discretion applicant firms. There is also stark cost-size gradient: a subsidized job costs about €325,000 among small (10-) firms, and around €75,000 in the case of large (250+) firms.

Figure 3: Treatment effect and average cost per new job, rules vs. discretion

Notes: This figure shows the heterogeneity in treatment effects on firm employment growth (Panel A) and the cost effectiveness of subsidies (Panel B), by quintiles of the score sub-components relating to political discretion and objective rules.

To isolate the role of political discretion, we estimate employment effects under two alternative, hypothetical criteria for distributing the subsidies: the first criterion completely ignores the subjective preferences of local politicians, thus eliminating them from the score used to rank applicants; the second criterion relies exclusively on such preferences. In each case, we re-rank applicants under the new rule and re-distribute the funds pre-allocated to each ranking until exhaustion. As a result, some of the actual winners and losers will switch status. Integrating the treatment effects over the set of firms that would be funded under the counterfactual ranking, as obtained applying the above-mentioned methodology, allows inferring the relative efficiency of rules vs discretion.3

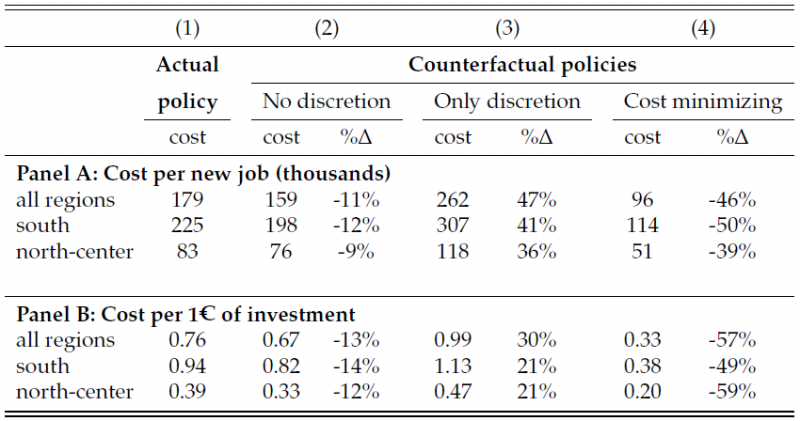

We find that political discretion unambiguously weakens the efficacy of the subsidy (Table 1). Adopting a “rules-only” criterion, the cost per new job and the cost of new investment decrease by 11% and 13%, respectively, compared to the actual policy. Relying exclusively on political discretion increases the cost of job creation and additional investment by 47% and 30%. Under both counterfactual policies, political discretion is particularly detrimental in economically disadvantaged Southern regions, which received more funds and had a higher cost-per-job under the actual policy. In principle the higher costs may reflect efforts by local politicians to target areas facing tighter frictions (e.g. in financial markets) or severe under development. In practice, comparing the distribution funds across provinces we do not find that allowing for political discretion shifts subsidies towards provinces facing tighter credit constraints or higher unemployment relative to a “rules-only” criterion.

Table 1: Cost of new jobs and investment under different counterfactual policies

Notes: This table shows the cost per new job (Panel A) and the cost of new investment (Panel B) under the actual policy (column 1) and under different counterfactual policies. Column 2 eliminates the subcomponent of the application score left to politicians’ discretion; column 3 ranks firms only based on political discretion; column 4 gives priority to applicants with lower cost of generating jobs. All amounts are expressed in euros at constant 2010 prices.

Finally, we consider a counterfactual policy assigning priority to firms generating new jobs at the lowest cost. Adopting this alternative criterion would reduce the cost of creating new jobs and investment would decrease by 46 and 57 percent. Once again, the largest benefits would accrue to southern regions.

Akcigit, U., Akgunduz, Y. E., Cilasun, S. M., Ozcan-Tok, E. & Yilmaz, F. (2020), ‘Facts on business dynamism in turkey’, European Economic Review 128, 103490.

Angrist, J. D. & Rokkanen, M. (2015), ‘Wanna get away? regression discontinuity estimation of exam school effects away from the cutoff’, Journal of the American Statistical Association 110 (512), 1331–1344.

Bartik, T. J. (2020), ‘Using place-based jobs policies to help distressed communities’, Journal of Economic Perspectives 34(3), 99–127.

Cerqua, A. & Pellegrini, G. (2014), ‘Do subsidies to private capital boost firms’ growth? a multiple regression discontinuity design approach’, Journal of Public Economics 109, 114–126.

Chodorow-Reich, G. (2014), ‘The employment effects of credit market disruptions: Firm-level evidence from the 2008-09 financial crisis’, Quarterly Journal of Economics 129(1), 1–59.

Chodorow-Reich, G. (2019), ‘Geographic cross-sectional fiscal spending multipliers: What have we learned?’, American Economic Journal: Economic Policy 11(2), 1–34.

Cingano, F., F. Palomba, P. Pinotti, and E. Rettore (2022), Making subsidies work: rules vs. discretion, Bank of Italy working papers n. 1364.

Criscuolo, C., Martin, R., Overman, H. G. & Van Reenen, J. (2019), ‘Some causal effects of an industrial policy’, American Economic Review 109(1), 48–85.

Fisman, R. (2001), ‘Estimating the value of political connections’, American Economic Review 91(4), 1095–1102.

Giavazzi, F., D’Alberti, M., Moliterni, A., Polo, A. & Schivardi, F. (2012), ‘Analisi e raccomandazioni sui contributi pubblici alle imprese’, Rapporto alla Presidenza del Consiglio 23.

Kline, P. & Moretti, E. (2014), ‘People, places, and public policy: Some simple welfare economics of local economic development programs’, Annu. Rev. Econ. 6(1), 629–662.

Laffont, J.-J. (1996), ‘Industrial policy and politics’, International Journal of Industrial Organization 14(1), 1–27.

Persson, T. & Tabellini, G. (2002), Political economics: explaining economic policy, MIT press.

Siemer, M. (2019), ‘Employment Effects of Financial Constraints during the Great Recession’, The Review of Economics and Statistics 101(1), 16–29.

Slattery, C. & Zidar, O. (2020), ‘Evaluating state and local business incentives’, Journal of Economic Perspectives 34(2), 90–118.

See Cerqua & Pellegrini (2014), who estimate each new job cost €60,000-€100,000. Restricting the analysis to marginal firms close to the cutoff, as they do, closes part of the gap; the remaining part reflects differences in data coverage, research design, and estimation methodology. For instance, our administrative data cover almost all applicants, including very small firms.

Bartik (2020) finds that the typical drawn-out incentive package generates a job at a discounted cost of $180,000 dollars. The figure factors in a local multiplier effect of 1.5, hence the cost per job at subsidized firms amounts to $270,000, which should be compared with our average estimate in discounted US$ of $236,000. Slattery & Zidar (2020) find a lower average figure ($96,000), which nonetheless varies substantially across states, reaching $310,000 in disadvantaged areas – an estimate comparable to ours for disadvantaged, Southern Italian regions ($320,000). Chodorow-Reich (2019) reviewed estimates of local effects of the American Recovery and Investment Act (ARIA), in terms of cost per job-year. The estimates vary between $25,000-$125,000, depending on the components of the program and the estimation approach. The preferred figure is about $50,000 per job-year, which we compare to $71,000 in our case (after conversion to US$).

This exercise maintains that firms’ decisions to apply for L488 funds are invariant to the criteria used to award the subsidies. While admittedly strong, this assumption is supported by evidence that applicants’ observable characteristics remain very similar between the first two calls for projects, for which political discretion was not part of the selection criteria, and the two calls for projects issued immediately after the introduction of political discretion.