This policy brief is based on OECD Economics Department Working Paper No. 1791. OECD Working Papers should not be reported as representing the official views of the OECD or of its member countries. The opinions expressed and arguments employed are those of the author(s).

Despite ambitious carbon reduction targets set by policymakers worldwide, current investments fall well short of the net-zero emissions scenario. Investigating barriers to firms’ green investment, this Policy Brief shows that: i) both financing constraints and a lack of green managerial capacity reduce firms’ probability of investing in green technologies; ii) well-designed environmental policies can mitigate these impacts; iii) green investment is more elastic to financing conditions than other types of investment; iv) investment in integrated technologies is more sensitive to these barriers compared to end-of-pipe solutions.

Many OECD countries have set ambitious targets to become carbon neutral by 2050, requiring substantial investment. The European Commission estimates that relevant investment will need to be raised from an average of €683 billion per year to around €1,040 billion per year until 2030 (Lenaerts et al., 2021). According to the International Energy Agency, this investment will have to be shouldered mainly by the private sector, responding to market signals and policies set by governments (IEA, 2021).

Green investment efforts to date however fall well short of the zero-emission scenario (ECB, 2023), due to specific barriers affecting this type of investment. Particularly, financing investment in such technologies may be more difficult to obtain compared to other, more established, technologies, due to specific characteristics like high fixed costs and risk, or information asymmetries (De Haas and Popov, 2023). Investments in newer and riskier green technologies may also be deferred due to a lack of knowledge among firms regarding this specific type of investment and how to manage it effectively (De Haas et al., 2022).

Against this backdrop, our new paper (Costa et al., 2024) delves into the factors holding back corporate green investment. The study places specific emphasis on the role of firm capacity, examining both financing constraints and weak green management practices, and their interaction with environmental policies. Our cross-country analysis focuses on the response to a survey of over 6.500 large, listed companies, across 33 countries between 2004 and 2020. This is complemented by a case study analysis based on disaggregated and comprehensive data available for Portuguese firms between 2010 and 2020. Our research aims to contribute valuable insights to boost green investment toward meeting the ambitious targets set for 2050.

Cross-country information on firms’ green investment is self-reported, collected from the ESG module of Refinitiv. We use firms’ answer to the question “Does the company report on making proactive environmental investments or expenditures to reduce future risks or increase future opportunities?” as a measure of whether the firm made green investments or not. In Portugal, a similar question is asked by the enterprise survey on environmental management and protection that covers firms’ behaviour with respect to the environment, where in addition firms report on the amounts spent by type of technology they invested in.

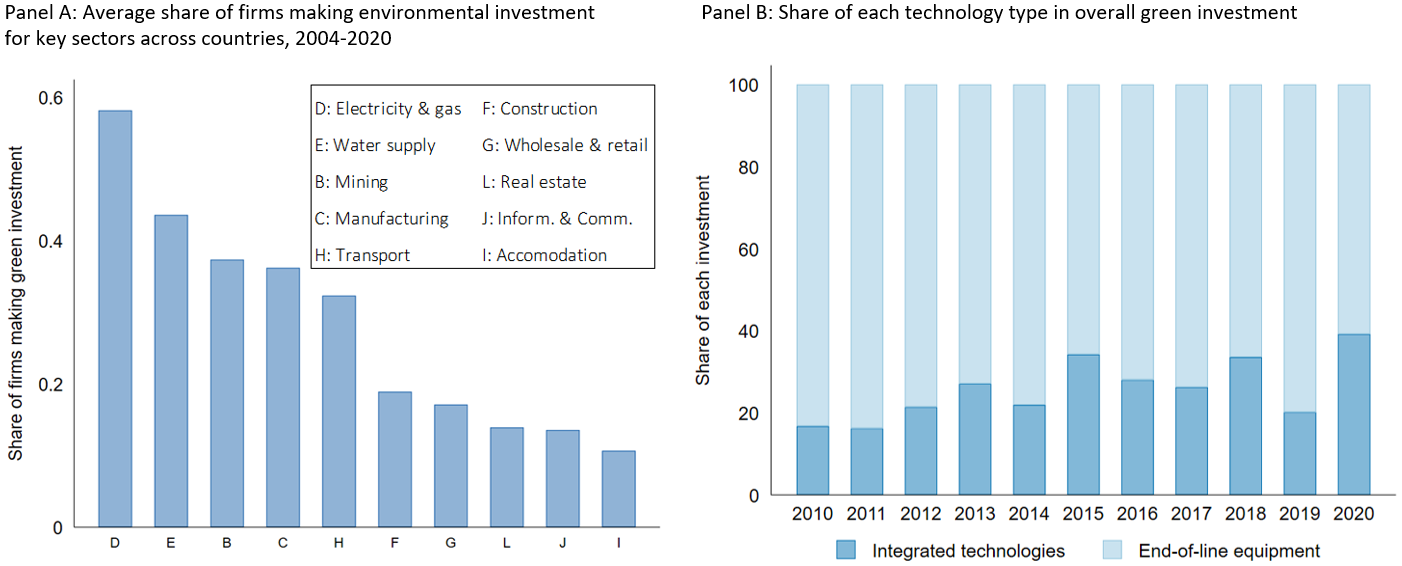

The data show that, across countries, the share of firms investing in green technologies varied throughout time and sectors during the period of analysis, with larger investment shares in emission intensive sectors like manufacturing and electricity (Figure 1, A). Our case study shows that the amount of green investment also varied markedly by type, with investment in end-of-line equipment being generally larger than investment in integrated technologies (Figure 1, B).

Figure 1: Green investment across sectors and by type

Note: Panel A: Average share of green investment indicator by single-digit NACE Rev. 2. Panel B: End-of-line equipment concerns treatment or filtration prior to discharging pollution into the environment, while integrated technologies change the process giving rise to pollution.

Source: OECD calculations based on Refinitiv ESG data matched to Orbis 2004-2020 (Panel A) and on data from the Portuguese Statistics Institute and the Portuguese Ministry for Education (Panel B).

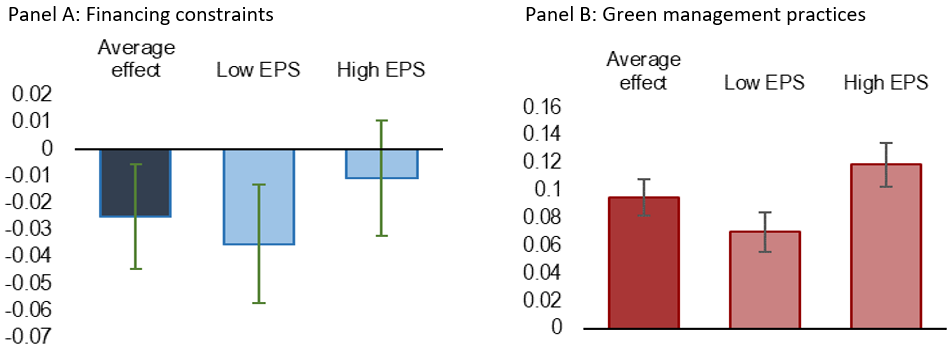

Our cross-country analysis shows that in OECD countries both financing constraints and lack of green managerial capacity reduce firms’ probability of investing in green technologies, leading to higher emission intensity. Specifically, becoming financially constrained decreases a firm’s probability to invest by 2.5 percentage points, around 8% of the average probability (Figure 2, Panel A, first column). In turn, introducing a green management practice, for example by creating a team with green functions, is associated with an increase in the probability to invest (Figure 2, Panel B, first column).

The estimated impacts are toned down in the presence of well-designed environmental policies. Specifically, stringent market-based environmental policies countervail the negative effects of financing barriers on green investment (Figure 2, Panel A). This is possibly because such policies may incentivise firms to prioritise green investments which would otherwise not be undertaken due to financing constraints. In addition, the positive effect of green management practices is larger the more stringent non-market environmental policies are and the more generous public support is (Figure 2, Panel B). This indicates that green management capacity may help firms to deal with the complexity of non-market-based regulations and government support.

Figure 2: Firm capacity and environmental policy jointly affect green investment

Note: The bars represent the estimated coefficients and the green whiskers the 90% confidence intervals. Panel A: Financial constraints are firms within the highest quartile of the SAFE indicator at NACE2 rev.2 – year. Panel B: The indicator of green management practices is equal to 0-1-2 for firms adopting respectively 0, 1 or 2 green management practices (having a dedicated green team or providing green training to staff). See Equation 1 in Costa et al. (2024) for more details.

Source: OECD calculations based on Refinitiv ESG data matched to Orbis 2004-2020.

A key concern is that OLS estimates may be biased if firms that invested previously and want to continue to invest in green technologies are more likely to access financing due to better growth prospects (upward bias in financing constraints estimates) or are more likely to adopt environmental management practices and hire staff with more environmental knowledge and awareness precisely to harness the benefits of these investments (upward bias in estimates on the role of management practices). To tackle endogeneity issues, we proceed as follows:

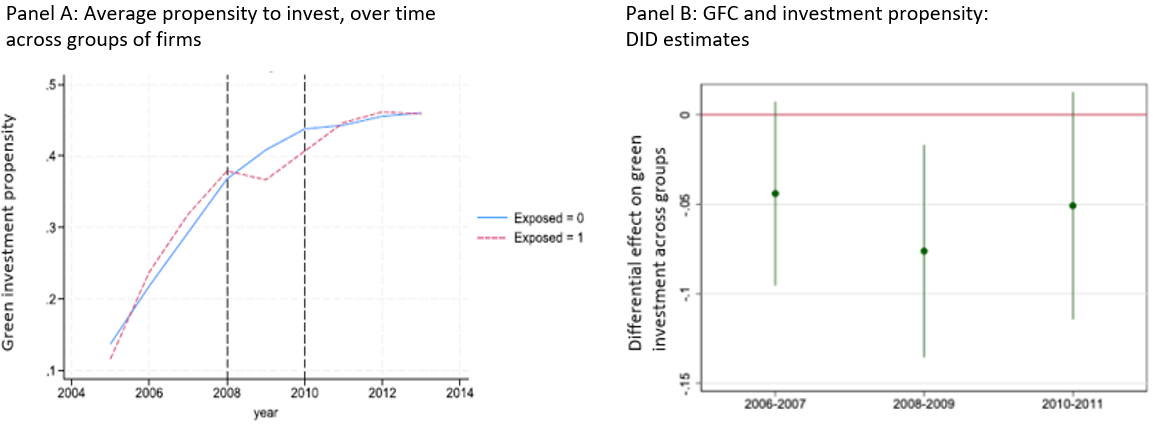

Figure 3: Dealing with endogeneity: green investment over the global financial crisis

Note: Panel A shows the average green investment profile for both groups of firms: those more exposed (those within the highest quartile of short-term to long-term debt at NACE2 rev.2 sector level at the onset of the crisis) and those less exposed (all others) over time, testing the parallel trend assumption. Panel B plots the coefficients (circles) and related confidence intervals (vertical lines) of the interaction between firms’ exposure status and time-period dummies on green investment; the regression also includes a set of controls and country by sector by period fixed effects. We do not omit any base category, so the coefficients can be interpreted as the total difference between firms more and less affected by the GFC in terms of financial constraints. See Equation 2 in Costa et al. (2024) for more details.

Source: OECD calculations based on Refinitiv ESG data matched to Orbis 2004-2020.

Finally, while it is known from previous research that all investment tends to respond negatively to financing constraints (Kalemli-Özcan et al., 2022), our case study based on Portuguese data shows that green investment is more elastic to financing conditions than other types of investment. Within green investment, we find that investment in integrated technologies is more sensitive to financing conditions than end-of-pipe solutions, possibly because it is performed less often and primarily to comply with regulation and its costs are less easily measured.

These results offer valuable insights for policy makers wishing to progress towards their decarbonization goal by promoting private investment. Upgrading firm financing and managerial capacity is essential to mobilise firms’ investment in green technologies. To this end, our paper discusses a menu of policy options that includes actions i) to ease financing constraints both at the banking and equity market levels; ii) to improve environmental management by defining standards for best practices as well as by encouraging firms to provide training programmes through subsidies and/or tax incentives; iii) to improve monitoring tools such as ESG standards which help investors assess firms’ greenness and exposure to transition risks; and iv) to maintain strong and predictable climate policy, for instance through carbon pricing, which not only serves to increase awareness but also helps to attenuate the effects of limited firm capacity.

Costa, H., Demmou, L., Franco, G., and S. Lamp (2024), “Making the grass greener: the role of firms’ financial and managerial capacity in paving the way to the green transition”, OECD Economics Department Working Papers, No. 1791)

De Haas, R., Martin, R., Muûls, M., and H. Schweiger (2022), “Managerial and Financial Barriers during the Green Transition”, CentER Discussion Paper Nr. 2021-008

De Haas, R. and A. Popov (2023), “Finance and Green Growth”, Economic Journal, Vol. 133/150, pp. 637-668

ECB (2023), “Closing gaps to bend the trend: embedding the flow of finance in the transition”, Speech by Frank Elderson, State of the Union conference organised by the European University Institute, May 2023

IEA (2021), “Net Zero by 2050 – A Roadmap for the Global Energy Sector”, October 2021

Kalemli-Özcan, Ş., Laeven, L., & Moreno, D. (2022), “Debt overhang, rollover risk, and corporate investment: Evidence from the European crisis”, Journal of the European Economic Association, 20(6), 2353-2395

Lenaerts, K., Tagliapietra, S., and G.B. Wolff (2021), “How much investment do we need to reach net zero?”, Bruegel Blog, 25 August