References

Althouse, J. and Svartzman, R. 2022. Bringing subordinated financialisation down to earth: the political ecology of finance-dominated capitalism. Cambridge Journal of Economics. 46(4), pp.679–702.

Armstrong McKay, D.I., Staal, A., Abrams, J.F., Winkelmann, R., Sakschewski, B., Loriani, S., Fetzer, I., Cornell, S.E., Rockström, J. and Lenton, T.M. 2022. Exceeding 1.5°C global warming could trigger multiple climate tipping points. Science. 377(6611), p.eabn7950.

Casey, A.J. 2014. The New Corporate Web: Tailored Entity Partitions and Creditors Selective Enforcement. Yale Law Journal. 124(8), pp.2680–2745.

Chenet, H., Ryan-Collins, J. and van Lerven, F. 2021. Finance, climate-change and radical uncertainty: Towards a precautionary approach to financial policy. Ecological Economics. 183, p.106957.

Clapp, J. 2019. The rise of financial investment and common ownership in global agrifood firms. Review of International Political Economy. 26(4), pp.604–629.

Cohen, G.J., Dice, J., Friedrichs, M., Gupta, K., Hayes, W., Kitschelt, I., Lee, S.J., Marsh, W.B., Mislang, N., Shaton, M., Sicilian, M. and Webster, C. 2021. The U.S. syndicated loan market: Matching data. Journal of Financial Research. 44(4), pp.695–723.

Davidson, W. 2020. Ratio Analysis: The Effect Ratios In: Financial Statement Analysis [Online]. [Accessed 23 July 2024]. Available from: https://learning.oreilly.com/library/view/financial-statement-analysis/9781119742326/c02.xhtml.

Folke, C., Österblom, H., Jouffray, J.-B., Lambin, E.F., Adger, W.N., Scheffer, M., Crona, B.I., Nyström, M., Levin, S.A., Carpenter, S.R., Anderies, J.M., Chapin, S., Crépin, A.-S., Dauriach, A., Galaz, V., Gordon, L.J., Kautsky, N., Walker, B.H., Watson, J.R., Wilen, J. and de Zeeuw, A. 2019. Transnational corporations and the challenge of biosphere stewardship. Nature Ecology & Evolution. 3(10), pp.1396–1403.

Galaz, V., Crona, B., Dauriach, A., Jouffray, J.-B., Österblom, H. and Fichtner, J. 2018. Tax havens and global environmental degradation. Nature ecology & evolution. 2(9), pp.1352–1357.

Galaz, V., Crona, B., Dauriach, A., Scholtens, B. and Steffen, W. 2018. Finance and the Earth system – Exploring the links between financial actors and non-linear changes in the climate system. Global Environmental Change. 53, pp.296–302.

Grabs, J., Carodenuto, S., Jespersen, K., Adams, M.A., Camacho, M.A., Celi, G., Chandra, A., Dufour, J., zu Ermgassen, E.K.H.J.,Garrett, R.D., Lyons-White, J., McLeish, M., Niehues, I., Silverman, S. and Stone, E. 2024. The role of midstream actors in advancing the sustainability of agri-food supply chains. Nature Sustainability. 7(5), pp.527–535.

Haddad, E.A., Araújo, I.F., Feltran-Barbieri, R., Perobelli, F.S., Rocha, A., Sass, K.S. and Nobre, C.A. 2024. Economic drivers of deforestation in the Brazilian Legal Amazon. Nature Sustainability., pp.1–8.

Haselmann, R. and Wachtel, P. 2011. Foreign banks in syndicated loan markets. Journal of Banking & Finance. 35(10), pp.2679–2689.

IPBES 2019. Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services [Online]. Available from: https://doi.org/10.5281/zenodo.3831673.

Kedward, K., Ryan-Collins, J. and Chenet, H. 2022. Biodiversity loss and climate change interactions: financial stability implications for central banks and financial supervisors. Climate Policy. 23(6), pp.763–781.

Lagarde, C. 2024. Central banks in a changing world: the role of the ECB in the face of climate and environmental risks. [Accessed 14 August 2024]. Available from: https://www.ecb.europa.eu/press/key/date/2024/html/ecb.sp240607_1~faecc95713.en.html.

Lenton, T.M., Armstrong McKay, D.I., Loriani, S., Abrams, J.F., Lade, S.J., Donges, J.F., Milkoreit, M., Powell, T., Smith, S.R., Zimm, C., Buxton, J.E., Bailey, E., Laybourn, L., Ghadiali, A. and Dyke, J.G. 2023. The Global Tipping Points Report 2023 [Online]. Exeter, UK:University of Exeter. Available from: https://global-tipping-points.org/.

Liu, T., Chen, Dean, Yang, L., Meng, J., Wang, Z., Ludescher, J., Fan, J., Yang, S., Chen, Deliang, Kurths, J., Chen, X., Havlin, S. and Schellnhuber, H.J. 2023. Teleconnections among tipping elements in the Earth system. Nature Climate Change. 13(1), pp.67–74.

LSEG 2024. Deals Business Intelligence Data. Available from: https://www.lseg.com/en/data-analytics/financial-data/deals-data/deals-business-intelligence-data.

Maio, C.D., Dimitropoulou, M., Farkas, Z.L., Houben, S., Lialiouti, G., Plavec, K., Poignet, R. and Maria, E.E. 2023. An Examination of Net-Zero Commitments by the World’s Largest Banks.

Marques, A., Martins, I.S., Kastner, T., Plutzar, C., Theurl, M.C., Eisenmenger, N., Huijbregts, M.A.J., Wood, R., Stadler, K., Bruckner, M., Canelas, J., Hilbers, J.P., Tukker, A., Erb, K. and Pereira, H.M. 2019. Increasing impacts of land use on biodiversity and carbon sequestration driven by population and economic growth. Nature Ecology & Evolution. 3(4), pp.628–637.

Marsden, L., Ryan-Collins, J., Abrams, J.F. and Lenton, T.M. 2024a. Ecosystem tipping points: Understanding risks to the economyand financial system. University College London. Available at: https://www.ucl.ac.uk/bartlett/public-purpose/publications/2024/apr/ecosystem-tipping-points-understanding-risks-economy-and-financial-system

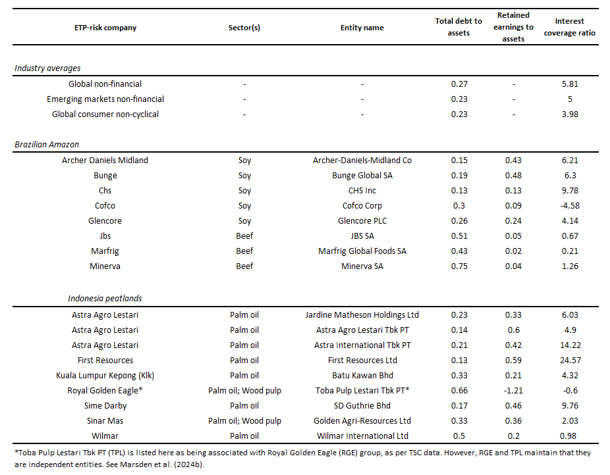

Marsden, L., Ryan-Collins, J., Abrams, J., and Lenton, T. (2024). Financial interactions with ecosystem tipping points: evidencefrom the Brazilian Amazon and Indonesian peatlands. UCL Institute for Innovation and Public Purpose, Working Paper Series (IIPP WP 2024-11). Available at: https://www.ucl.ac.uk/bartlett/public-purpose/publications/WP-2024-11

Meyfroidt, P. 2016. Approaches and terminology for causal analysis in land systems science. Journal of Land Use Science. 11(5), pp.501–522.

NGFS 2024. Nature-related Financial Risks: a Conceptual Framework to guide Action by Central Banks and Supervisors [Online]. Network for Greening the Financial System. [Accessed 14 August 2024]. Available from: https://www.ngfs.net/sites/default/files/medias/documents/ngfs-conceptual-framework-nature-risks.pdf.

Ouma, S. 2020. Numbers: What We Know (and Do Not Know) About Finance-Gone-Farming In: Farming as Financial Asset [Online]. Global Finance and the Making of Institutional Landscapes. Agenda Publishing, pp.45–68. [Accessed 6 February 2024]. Available from: https://www.jstor.org/stable/j.ctv13840b0.9.

Page, S., Mishra, S., Agus, F., Anshari, G., Dargie, G., Evers, S., Jauhiainen, J., Jaya, A., Jovani-Sancho, A.J. and Laurén, A.2022. Anthropogenic impacts on lowland tropical peatland biogeochemistry. Nature Reviews Earth & Environment. 3(7), pp.426–443.

Parmesan, C., Morecroft, M.D., Trisurat, Y., Adrian, R., Anshari, G.Z., Arneth, A., Gao, Q., Gonzalez, P., Harris, R., Price,J., Stevens, N., Talukdar, G.H., Strutz, S.E., Ackerly, D.D., Anderson, E., Boyd, P., Birkmann, J., Bremerich, V., Brotons, L., Buotte, P., Campbell, D., Castellanos, E., Chen, Y.-Y., Cissé, G., Cooley, S., Cowie, A., Dhimal, M., Domisch, S., Donner, S., Douwes, E., Escobar, L.E., Rivera Ferre, M., Flecker, A., Foden, W., Gallagher, R.V., Gaxiola, A., Gemeda, A., Goulding, M., Grey, K.-A., López Gunn, E., Harrison, S., Hicke, J., Hilmi, N.J.M., Barragan-Jason, G., Keith, D.A., Bezner Kerr, R., Kraemer, B.M., Langhans, S., Lasco, R., Latimer, A., Lempert, R., Lluch-Cota, S.E., Loisel, J., Mackey, J., Martinetto, P., Matthews, R., McPhearson, T., Mauritzen, M., Midgley, G., Mordecai, E., Moreira, F., Mukherji, A., Myers-Smith, I., Nabuurs,G.-J., Neufeldt, H., Pearce-Higgins, J., Pecl, G., Pedace, R., Townsend Peterson, A., Piepenburg, D., Postigo, J.C., Pulhin, J., Racault, M.-F., Rocklöv, J., Rogelj, J., Rost, B., Romanello, M., Gallego-Sala, A., Schmidt, D., Schoeman, D., Seddon, N., Semenza, J.C., Singer, M.C., Singh, P.K., Slingsby, J., Smith, P., Sukumar, R., Tirado, M.C., Trisos, C., Turetsky, M., Turner, B., van Aalst, M. and Young, K. 2022. Terrestrial and FreshwaterEcosystems and Their Services. EPIC3 https://www.ipcc.ch/report/ar6/wg2/, Cambridge University Press, pp. 197-377. [Online], pp.197–377. [Accessed 7 September 2023]. Available from: https://epic.awi.de/id/eprint/57714/.

Pendrill, F., Gardner, T.A., Meyfroidt, P., Persson, U.M., Adams, J., Azevedo, T., Bastos Lima, M.G., Baumann, M., Curtis, P.G.,De Sy, V., Garrett, R., Godar, J., Goldman, E.D., Hansen, M.C., Heilmayr, R., Herold, M., Kuemmerle, T., Lathuillière, M.J., Ribeiro, V., Tyukavina,A., Weisse, M.J. and West, C. 2022. Disentangling the numbers behind agriculture-driven tropical deforestation. Science. 377(6611), p.eabm9267.

Power, S., Dunz, N. and Gavryliuk, O. 2022. An Overview of Nature-Related Risks and Potential Policy Actions for Ministries of Finance: Bending the Curve of Nature Loss [Online]. Coalition of Finance Ministers for Climate Action. [Accessed 25 June 2024]. Available from: https://www.financeministersforclimate.org/sites/cape/files/inline-files/Bending%20the%20Curve%20of%20Nature%20Loss%20-%20Nature-Related%20Risks%20for%20MoFs_2.pdf.

Ripple, W.J., Wolf, C., Lenton, T.M., Gregg, J.W., Natali, S.M., Duffy, P.B., Rockström, J. and Schellnhuber, H.J. 2023. Many risky feedback loops amplify the need for climate action. One Earth. 6(2), pp.86–91.

Taufik, M., Minasny, B., McBratney, A.B., Dam, J.C.V., Jones, P.D. and Lanen, H.A.J.V. 2020. Human-induced changes in Indonesian peatlands increase drought severity. Environmental Research Letters. 15(8), p.084013.

Titley, M. 2024. EU27 countries in the spotlight for deforestation exposure. Trase.

Trase 2024. Trase: Open-data. Available from: https://trase.earth/open-data.

UNEP 2023. State of Finance for Nature 2023. UNEP – UN Environment Programme. [Online]. [Accessed 12 December 2023]. Available from: http://www.unep.org/resources/state-finance-nature-2023.

Wang-Erlandsson, L., Tobian, A., van der Ent, R.J., Fetzer, I., te Wierik, S., Porkka, M., Staal, A., Jaramillo, F., Dahlmann, H., Singh, C., Greve, P., Gerten, D., Keys, P.W., Gleeson, T., Cornell, S.E., Steffen, W., Bai, X. and Rockström, J. 2022. A planetary boundary for green water. Nature Reviews Earth & Environment. 3(6), pp.380–392.

Willcock, S., Cooper, G.S., Addy, J. and Dearing, J.A. 2023. Earlier collapse of Anthropocene ecosystems driven by multiple faster and noisier drivers. Nature Sustainability. 6(11), pp.1331–1342.