This policy brief is based on ESM Working Papers Series, No 68, 2025. The views expressed in this policy brief are those of the authors and do not necessarily reflect those of the European Stability Mechanism (ESM).

Abstract

Survey-based economic data series can provide a timely signal to gauge where the economy is heading. This makes them a valuable source of information to track the business cycle and developments in specific parts of the economy, including the household, corporate, and financial sectors. Beyond monitoring the state of the economy, survey-based series can also be used for risk assessments. We use more than 100 survey-based economic data series for the euro area to compute a measure capturing the economy-wide perceived balance of downside and upside risks. We show that this measure can help forecast risks to economic activity and how suddenly shifting risk perceptions can negatively affect the economy and financial markets.

Accurate and timely information is key for policymakers to respond swiftly to a changing economic environment and emerging risks. However, economic policy institutions’ assessments of the macroeconomic outlook and risks are often hampered by the fact that economic data is usually released with a sizeable delay.1 This poses a challenge, especially for short-term assessments, which is why quickly released survey-based ‘soft’ indicators are often used to complement actual ‘hard’ economic data. Such survey indicators enjoy great popularity in both the public and private sectors. In a new paper (Boni et al., 2025), we compile a large set of survey-based economic data series for the euro area and show how these can inform macroeconomic risk assessments. Specifically, we extract a factor that summarises asymmetries in the expected distributions of the individual series. We interpret this expected skewness factor as the economy-wide perceived balance of risks and highlight its potential benefits for forecasting risks to economic activity and analysing business cycle dynamics.2

Since risks can emerge in different parts of the economy, we design a measure that provides a signal of economy-wide shifts in risk perceptions and that is available in a timely manner. We compile a large monthly dataset of survey-based indicators for the euro area, covering the period from 2003 to 2023 and measuring the economic sentiment of consumers and sectors such as industry, construction, retail, and services, as well as the assessment of financial market participants and the financial sector. The largest subsets of the more than 100 series are the European Commission’s Business and Consumer Surveys and the Purchasing Managers’ Index series produced by S&P/HCOB, complemented by the ECB’s Bank Lending Survey (interpolated to monthly frequency), and surveys among financial experts and investors conducted by Sentix and ZEW.

Having compiled this dataset, we use a relatively simple two-step approach developed in previous work (Iseringhausen et al., 2023) to compute the expected skewness factor. Specifically, the methodology relies on first obtaining series-specific balance of risk measures based on quantile regressions (Engle and Manganelli, 2004) before summarising these with the help of principal component analysis.

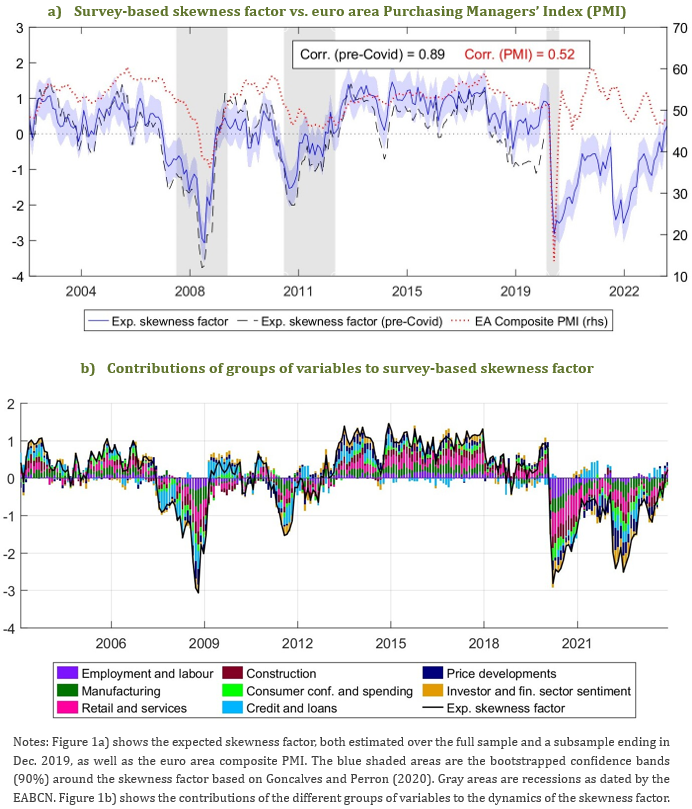

The perceived balance of risks varies over time and changes sharply during crises, with risk perceptions shifting to the downside (Figure 1).3 Survey-based expected skewness moved meaningfully during the Global Financial Crisis (GFC, 2007–09) and at the onset of the Covid-19 period (early-2020), but also during the European sovereign debt crisis (2010–12) and around Russia’s invasion of Ukraine (early-2022). Second, shifts in the perceived balance of risks in some cases lead economic downturns as measured by the euro area PMI (Figure 1a). Third, the skewness factor remains largely unchanged when the (post-)pandemic period is included in the estimation (see also Iseringhausen et al., 2023).

In addition, different groups of survey indicators contribute to movements in the economy-wide balance of risks at different points in time (Figure 1b). Risk signals stemming from credit-related series (i.e., the ECB’s Bank Lending Survey) seem to matter more during the GFC and the sovereign debt crisis. In the (post-)Covid-19 period, shifting risks related to survey series about labour market developments, retail and services, but also price developments and financial market/sector perceptions seem to have gained importance.

Figure 1. Survey-based factor of asymmetric macroeconomic risk (Apr. 2003–Dec. 2023)

The survey-based skewness factor holds potential value for various types of analyses, which we highlight through two applications. First, we aim to understand whether perceived risks, as measured by our survey-based skewness factor, can be helpful in forecasting risks to actual economic outcomes. Since our risk factor is available at the monthly frequency, we focus on forecasting risks to monthly measures of economic activity, namely industrial production and retail sales. We split our dataset into an in-sample and out-of-sample period and predict risks to both variables over the next three months using quantile regression. To assess the accuracy of our forecasts for the out-of-sample period,

we then compare these with the realised outcomes. The results show that our survey-based risk measure can be helpful in predicting downside risk to economic activity (see Table 3 in Boni et al., 2025). When including the (post-)pandemic period, which saw various shocks to the economy, the survey-based skewness factor is more helpful in forecasting downside risks compared to more standard survey-based indicators.

Second, we study the role of risk perceptions for macroeconomic dynamics in the euro area. Specifically, we analyse the importance of shifts in the perceived balance of risks unrelated to changes in the “average assessment” and the “overall level of risk” as reflected in the survey data. The idea is to understand to what extent our skewness factor contains information not already embedded in the baseline assessment and overall volatility. To this end, we estimate a vector autoregression (VAR) with ten variables: industrial production, retail sales, the unemployment rate, the interest (policy) rate, inflation, stock market returns, an indicator of systemic financial market stress (CISS, see Hollo et al., 2012), as well as three survey-based factors capturing co-movement in the actual data (“average assessment”), expected volatility (“overall level of risk”), and expected skewness (“balance of risks”). Focussing on the latter, the Cholesky decomposition of the VAR residual covariance matrix is used to identify unexpected changes in survey-based skewness. We interpret such changes as sudden shifts in how economic agents view the risk landscape.

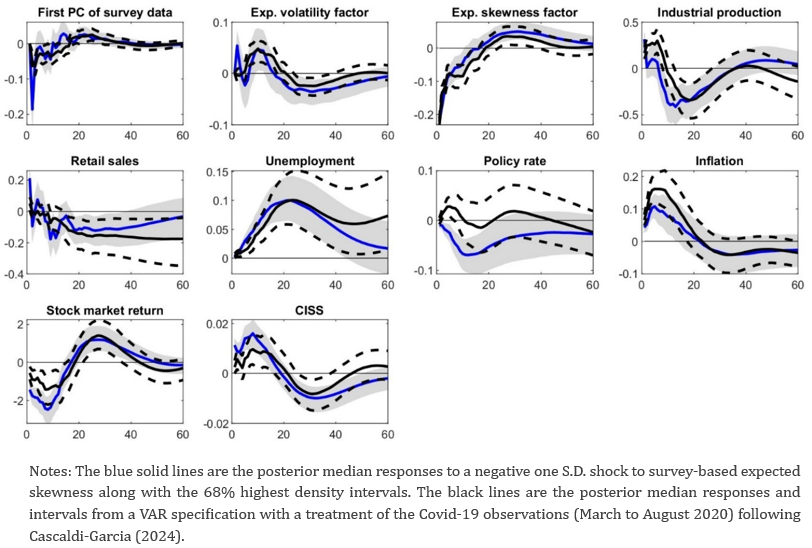

Figure 2. Responses to a downward shift in the perceived balance of risks (skewness)

A sudden deterioration in the perceived balance of risks goes along with financial market stress and a temporary slowdown of the economy (Figure 2): economic activity (industrial production and retail sales) falls, unemployment rises, inflation increases, equity prices fall, and financial market stress increases.4 Moreover, the effects are not exclusively driven by the turbulent pandemic period. These results are striking as they highlight the relevance of changes in the economy-wide perceived balance of risks for business cycle dynamics over and above changes in the baseline assessment and economy-wide perceived volatility.5

The medium-term economic outlook for the euro area is one of subdued growth and surrounded by elevated uncertainty and prevailing downside risk. Amid these circumstances, economic policy institutions strive to gauge in a timely manner where the economy is heading. For this purpose, survey-based indicators have enjoyed popularity both in the public and the private sectors. While they are regularly used to track the business cycle, our work presents a new approach to explicitly using such indicators to assess perceived economic risks.

Our approach allows us to monitor the economy-wide perceived balance of risks in the euro area, with risk signals extracted from more than 100 survey-based economic data series. We show how this risk factor can help improve forecasts of (downside) risk to actual economic outcomes, i.e. industrial production and retail sales. Moreover, using a VAR analysis, we highlight that changes in the perceived balance of risks can negatively affect the macroeconomy and financial markets.

Adrian, T., Boyarchenko, N. and Gianonne, D. (2019), “Vulnerably Growth”, American Economic Review 109(4), 1263-89.

Bachmann, R., Elstner, S., and Sims, E. R. (2013), “Uncertainty and Economic Activity: Evidence from Business Survey Data”, American Economic Journal: Macroeconomics, 5(2):217–249.

Bloom, N. (2009), “The Impact of Uncertainty Shocks”, Econometrica, 77(3):623–685.

Boni, S., Iseringhausen, M., Petrella, I. and Theodoridis, K. (2025), “A survey-based measure of asymmetric macroeconomic risk in the euro area”, ESM Working Papers, No. 68, European Stability Mechanism.

Cascaldi-Garcia, D. (2024), “Pandemic Priors”, Mimeo.

Castelnuovo, E. and Mori, L. (2024), “Uncertainty, Skewness, and the Business Cycle Through the MIDAS Lens,” Journal of Applied Econometrics, forthcoming.

Delle Monache, D., De Polis, A., and Petrella, I. (2024), « Modeling and forecasting macroeconomic downside risk”, Journal of Business & Economic Statistics, 42(3):1010–1025.

Dew-Becker, I. (2024), “Real-time forward-looking skewness over the business cycle”, Review of Economic Dynamics, 54:101233.

Engle, R. F. and Manganelli, S. (2004), “CAViaR: Conditional Autoregressive Value at Risk by Regression Quantiles”, Journal of Business & Economic Statistics 22(4), 367-381.

Ferreira, T. R. (2024), “Cross-sectional financial conditions, business cycles and the lending channel”, Journal of Monetary Economics, 147:103597.

Giglio, S., Kelly, B. and Pruitt, S. (2016), “Systemic risk and the macroeconomic: An empirical evaluation”, Journal of Financial Economics, 119(3), 457-471.

Gilchrist, S., Schoenle, R., Sim, J. and Zakrajsek, E. (2017), “Inflation Dynamics during the Financial Crisis”, American Economic Review, 107(3):785–823.

Goncalves, S. and Perron, B. (2020), “Bootstrapping factor models with cross sectional dependence”, Journal of Econometrics, 218(2), 476–495.

Hollo, D., Kremer, M., and Lo Duca, M. (2012), “CISS – A Composite Indicator of Systemic Stress in the Financial System. ECB Working Paper Series, 1426.

Iseringhausen, M., Petrella, I. and Theodoridis, K. (2023), “Aggregate Skewness and the Business Cycle”, Review of Economics and Statistics, forthcoming.

Jensen, H., Petrella, I., Ravn, S. H., and Santoro, E. (2020), “Leverage and Deepening Business-Cycle Skewness”, American Economic Journal: Macroeconomics, 12(1):245–81.

Montes-Galdon, C. and Ortega, E. (2022), “Skewed SVARS: Tracking the Structural Sources of Macroeconomic Tail Risks”, In Essays in Honour of Fabio Canova (Advances in Econometrics, Vol. 44A), pages 177–210. Emerald Publishing Limited.

Salgado, S., Guvenen, F. and Bloom, N. (2023), “Skewed Business Cycles”, Mimeo.

For example, data releases for the euro area usually happen around 2 months after the reference quarter for GDP (leaving aside so-called flash estimates), and 1-1.5 months after the reference month for unemployment and industrial production.

There is a large literature studying asymmetries in the conditional distributions of macroeconomic outcomes, in particular economic activity (see, for example, Giglio et al., 2016 and Adrian et al., 2019). Moreover, several papers have analysed the role of skewness at both firm and macro level (see, for example, Jensen et al., 2020; Montes-Galdon and Ortega, 2022; Iseringhausen et al., 2023; Salgado et al., 2023; Castelnuovo and Mori, 2024; Delle Monache et al., 2024; Dew-Becker, 2024; Ferreira, 2024).

Analysing skewness can be seen as a natural progression from the concept of (symmetric) uncertainty, which has been studied extensively (see, for example, Bloom, 2009 and Bachmann et al., 2013).

The increase in inflation is consistent with the idea that firms may increase prices in the face of financial frictions and deteriorating demand to maintain liquidity (Gilchrist et al., 2017).

Salgado et al. (2023) demonstrate the importance of skewness in the case of productivity shocks using a macroeconomic model. While analysing a different question and using a different approach, their reported impact on GDP is surprisingly similar, both in terms of magnitude and timing, to our results for industrial production.