References

Batten, S., Sowerbutts, R., Tanaka, M., 2016. Let’s talk about the weather: the impact of climate change on central banks. Technical report, Bank of England.

Bolton, P., Després, M., da Silva, L.A.P., Samama, F., Svartzman, R., 2020. The green swan. BIS Books.

Carney, M., 2015. Breaking the tragedy of the horizon – climate change and financial stability (speech). Bank of England, Speech.

Coeuré, B., 2018. Monetary policy and climate change, speech by b. coeur ́e, member of the executive board of the ecb, at a conference on “scaling up green finance: The role of central banks”. European Central Bank.

Dikau, S., Ryan-Collins, J., 2017. Green central banking in emerging market an developing country economies. NEF working paper.

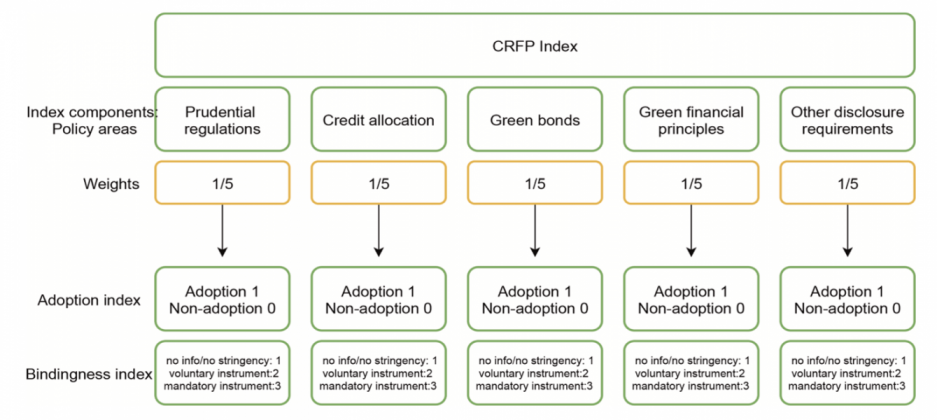

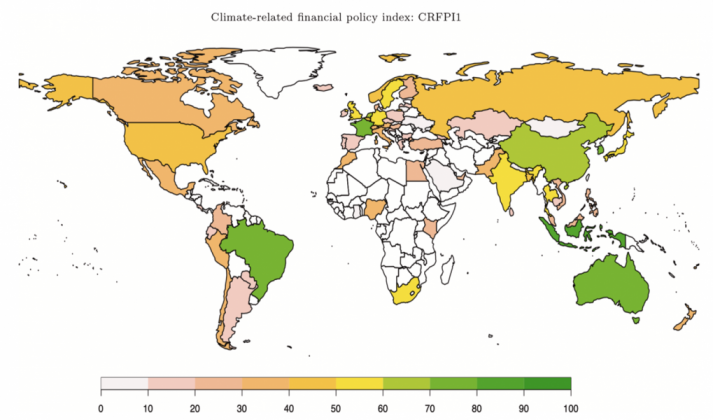

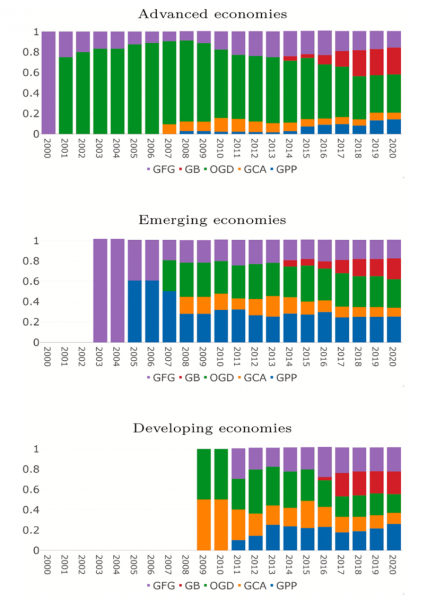

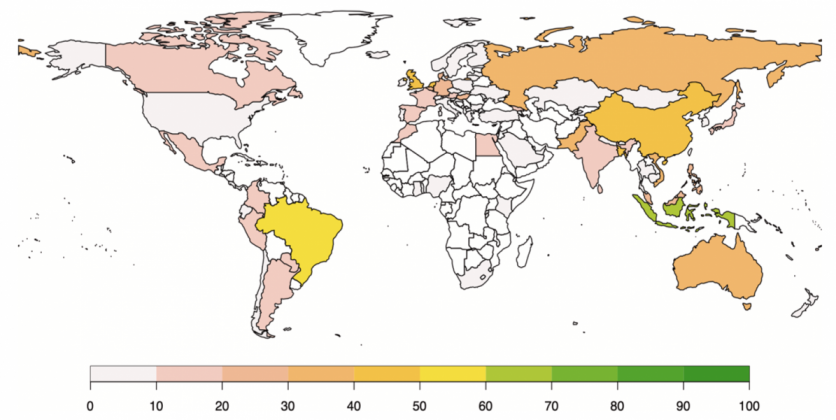

D’Orazio, P., & Thole, S. (2022). Climate-related financial policy index: a composite index to compare the engagement in green financial policymaking at the global level. Ecological Indicators, 141, 109065. DOI: https://doi.org/10.1016/j.ecolind.2022.109065

D’Orazio, P. (2022). Mapping the emergence and diffusion of climate-related financial policies: evidence from a cluster analysis on G20 countries, International Economics, 169, 135-147. DOI: https://doi.org/10.1016/j.inteco.2021.11.005

D’Orazio, P., & Dirks, M. W. (2022). Exploring the effects of climate-related financial policies on carbon emissions in G20 countries: a panel quantile regression approach. Environmental Science and Pollution Research, 29(5), 7678-7702.

D’Orazio, P., (2021) Towards a post-pandemic policy framework to manage climate-related financial risks and resilience, Climate Policy, 21, no. 10 (2021): 1368-1382. DOI: https://doi.org/10.1080/14693062.2021.1975623

D’Orazio, P., Popoyan, L., 2019. Fostering green investments and tackling climate-related financial risks: Which role for macroprudential policies? Ecological Economics. 160, 25–37.

Krogstrup, S., Oman, W., 2019. Macroeconomic and Financial Policies for Climate Change Mitigation: A Review of the Literature. International Monetary Fund.

OECD, 2008. Handbook on constructing composite indicators: methodology and user guide. Joint Research Centre, European Commission and others – OECD publishing.

Schnabel, I., 2020. When markets fail – the need for collective action in tackling climate change speech by Isabel Schnabel, member of the executive board of the ECB at the European sustainable finance summit, Frankfurt am Main, 28 september 2020. European Central Bank.