The policy brief is based on ECB Working Paper Series, No 2950.

Abstract

We assess the implications of banks’ exposure to interest rate risk on the monetary policy transmission to bank lending supply in the euro area and find that banks with a higher exposure to interest rate risk, i.e., with a larger duration gap after accounting for hedging, curtailed corporate lending more than their peers when interest rates increase. We then proceed to dissect banks’ credit allocation and find that banks with higher net duration reshuffled their loan portfolio away from long-term and fixed-rate loans in an attempt to limit the increase in interest rate risk and targeted their lending contraction to small and micro firms. Firms exposed to banks with a larger exposure to interest rate risk were unable to fully rebalance their borrowing needs with other lenders, thus experiencing a relatively larger decrease in total borrowing during the monetary tightening episode.

Banks’ engagement in maturity transformation, by borrowing “short” and lending “long”, allows them to earn the spread between the interest rates charged on longer-term assets and the interest rate paid on the shorter-term liabilities. However, this intrinsic feature of their business model exposes them to interest rate risk. Indeed, rapid and unexpected increases in interest rates can adversely impact banks’ economic value of equity due to changes in the present value and timing of future cash flows. Conventional wisdom holds that, on aggregate, increases in interest rates lead to a decline in banks’ net worth as the value of assets declines more than the value of liabilities. This effect is most pronounced for banks that exhibit a large positive mismatch between the duration of their assets and liabilities, i.e., banks with a large duration gap.

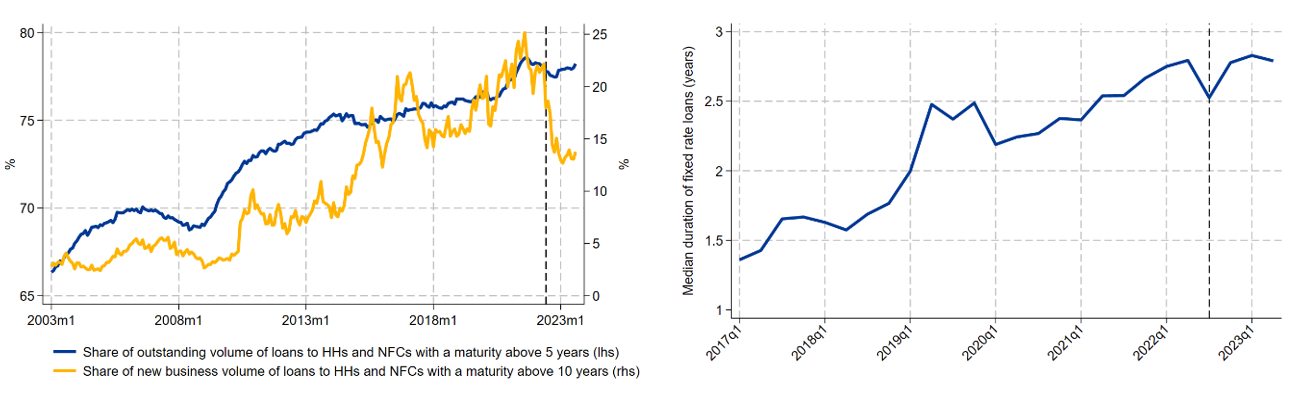

During the low for long interest rate environment, banks had an incentive to earn the higher term premium associated with longer maturities in order to partially offset margin compression and the related drop in profitability due to the low interest rates. The left panel of Figure 1 shows that the share of outstanding volumes of loans to the non-financial private sector with a maturity above 5 years increased by 10 percentage points (p.p.) since the peak of the GFC, pushed by a 20 p.p. surge in the share of new business volume of loans with a maturity above 10 years. This evolution led to an increase in the duration of banks’ asset side (Figure 1, right panel).

Figure 1. Evolution of duration of banks’ asset side

Note: Left panel: evolution of the share of loans to the non-financial private sector with a maturity above 5 and 10 years over total loans. Right panel: evolution of the median behavioural duration of fixed rate loans across a balanced sample of 74 significant institutions. The dashed line shows the start of the hiking cycle.

Source(s): ECB Balance Sheet Items, ECB MFI Interest Rate Statistics, and ECB Supervisory data.

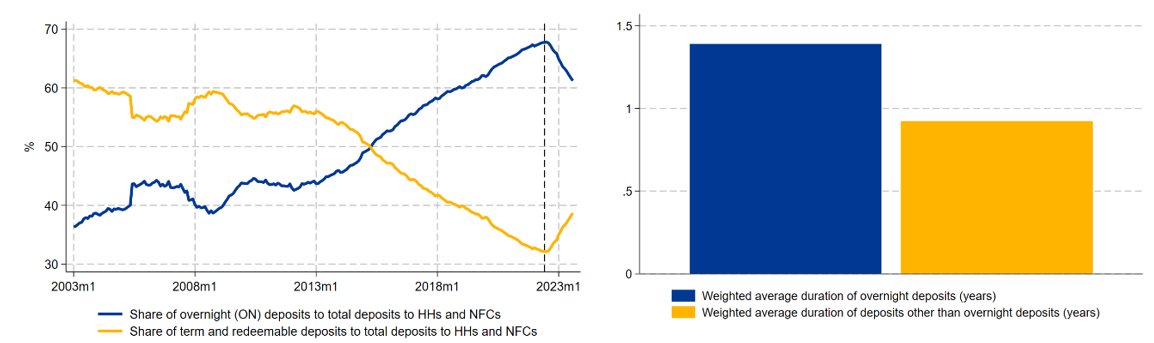

Interest rate risk, however, remained mostly muted during this period because of the large inflow of sticky overnight deposits which behaviourally have a relatively long duration (Figure 2, left panel). In principle, this may appear contradictory as overnight deposits are floating-rate liabilities which contractually have zero duration. However, this happens in practice because banks employ internal models to estimate the duration of overnight deposits based on historical customers’ behaviours (BCBS, 2016, Hoffman et al., 2018). In particular, during the low and negative interest rate environment, banks modelled these overnight deposits to be very sticky, reflecting the impact that the economic environment had on customers’ behaviour which further increased their assumed duration. As shown in the right panel of Figure 2, banks assumed a higher duration of overnight deposits relative to term deposits in the last quarters prior to the monetary policy tightening.

Figure 2. Evolution of duration of banks’ liability side

Note: Left panel: evolution of the share of overnight, terms, and redeemable deposits to the non-financial private sector over total deposits. Right panel: average behavioural duration for deposits in the period before the start of the tightening (2021Q1-2022Q2) across a balanced sample of 73 significant institutions. The dashed line shows the start of the hiking cycle.

Source(s): ECB Balance Sheet Items and ECB Supervisory data.

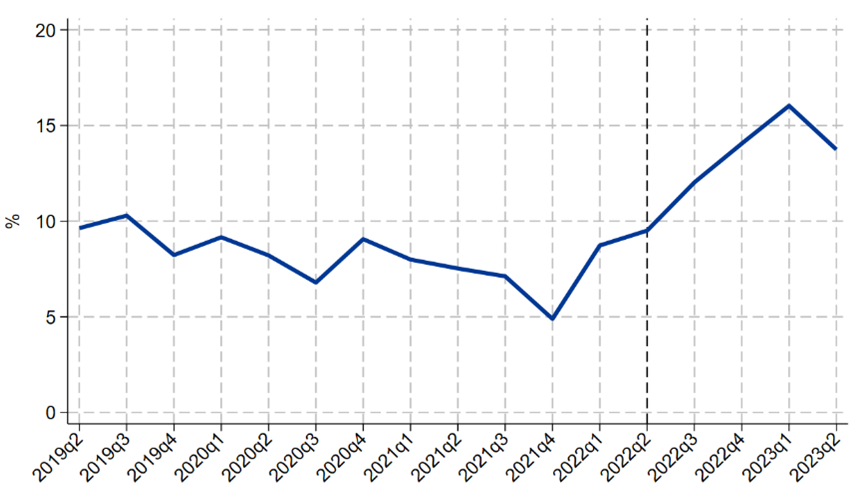

Since the ECB started raising interest rates in July 2022 (as reflected by the dotted vertical line in the left panel of Figure 2), there has been a sudden and large shift from sticky overnight towards more rate-sensitive term deposits. Since these deposits have a lower modelled behavioural duration, this shift led to an increase in the duration gap, causing a materialisation of interest rate risk as shown by the steep increase in Figure 3.

Figure 3. Evolution of banks’ duration gap (net of hedging)

Note: Average based on a sample of 64 significant institutions.

Source(s): ECB Supervisory data.

Against this background, in Coulier, Pancaro, & Reghezza (2024), we use extensive and granular euro area supervisory and credit register data to analyse whether banks’ exposure to interest rate risk affects the transmission of monetary policy to bank lending supply in a rising interest rate environment. Importantly, since we have information on banks’ derivative positions, we are able to measure a bank’s exposure to interest rate risk net of hedging1. Our sample covers the period from 2021Q1 to 2023Q2 for 73 euro area significant institutions. Our bank-firm-level setting allows us to control for credit demand (Khwaja & Mian, 2008) and multiple bank-level characteristics that could impact bank lending supply.

Our main findings show that, when interest rates increase, banks with a larger duration gap after accounting for hedging contract lending more and are less likely to issue new loans to firms compared to banks with a lower exposure to interest rate risk. More specifically, our findings suggest that if interest rates increase by 100 bps, a bank at the 75th percentile of the duration gap distribution reduces lending by 91-94 bps more than a bank at the 25th percentile.

This occurs because banks generally tend to match the duration of their assets and liabilities to maintain a stable duration gap and minimise their exposure to interest rate risk. An unexpected and rapid shortening of the duration of liabilities, as experienced since July 2022, forces banks to adjust the duration of their asset side via a stronger lending contraction. If banks do not react to reduce the widening of the duration gap, they will experience a decline in their economic value of equity. On the one hand, this could lead to closer supervisory scrutiny and potential capital surcharges in the short term in the form of Pillar 2 requirements and Pillar 2 guidance. On the other hand, ceteris paribus, a lower economic value of equity signals lower expected profitability and capital accumulation in the medium to long term, additionally motivating banks to return their duration gap to a stable level. In line with this, we find that banks with a larger duration gap reallocate their loan portfolios away from loans with a longer duration and fixed rates as doing this will most effectively reduce their duration gap.

Our baseline findings have some potential real effects through firms. Shortening loans’ maturity, for example, exposes firms to refinancing risk (Hardford, Klasa, & Maxwell, 2014), which may impair firms’ decisions about long-term projects, leading to sub-optimal investment strategies (Almeida et al., 2012) which can be especially detrimental during an economic recovery (Black & Rosen, 2016). Moreover, if firms are forced to substitute long-term bank funding with bond issuance in a higher interest rate environment, this can lead to greater interest expenses for firms, forgoing the unique benefits of bank loans.

Diving deeper into our results, we find that micro, small, and medium enterprises (MSMEs) are the most affected by the contraction in lending supply. Compared to large corporations, MSMEs do not rely on market-based funding as a substitute to bank credit (Becker & Ivashina, 2014; Becker & Ivashina, 2018) and are subject to greater lender discretion facing a disadvantage to large firms when requesting credit from banks (Chodorow-Reich et al., 2022). The real effects are thus potentially more pronounced for these types of firms.

However, there is in principle no threat to the real economy if firms demand more credit from banks benefiting from higher interest rates. In practice, however, firms exposed to high duration gap banks may struggle to replace existing sources of financing with alternative ones or to establish new credit relationships during turbulent times. This is confirmed in our empirical analysis, where we find that affected firms cannot (fully) substitute the contraction in credit coming from banks with a larger duration gap by borrowing more from banks with a lower duration gap, resulting in an additional reduction in borrowing during a monetary tightening episode for these firms relative to other firms.

Overall, our findings have important policy implications. First, from a monetary policy perspective, we provide evidence that the transmission of monetary policy is heterogeneous across euro area banks, with a stronger effect for banks with a large duration gap. This is an important parameter for monetary policymakers to consider when deciding on (the extent and pace of) monetary policy changes. In terms of financial stability, an excessive contraction in (long-term) lending supply may lead to an economic downturn. Moreover, since MSMEs, who are most affected by this contraction, cannot rely on market-based funding as a substitute to bank credit, the impact might be especially pronounced for these types of firms.

Almeida, H., Campello , M., Laranjeira, B., & Weisbenner, S. (2012). Corporate debt maturity and the real effects of the 2007 credit crisis. Critical Finance Review, 1(1), 3-58.

BCBS. (2016). Interest rate risk in the banking book.

Becker, B., & Ivashina, V. (2014). Cyclicality of credit supply: Firm level evidence. Journal of Monetary Economics, 62, 76-93.

Becker, B., & Ivashina, V. (2018). Financial repression in the European sovereign debt crisis. Review of Finance, 22(1), 83-115.

Black, L., & Rosen, R. (2016). Monetary policy, loan maturity, and credit availability. International Journal of Central Banking, 12(1), 199-230.

Chodorow-Reich, G., Darmouni, O., Luck, S., & Plosser, M. (2022). Bank liquidity provision across the firm size distribution. Journal of Financial Economics, 57(6), 908-932.

Coulier, L., Pancaro, C., & Reghezza, A. (2024). Are low interest firing back? Interest rate risk in the banking book and bank lending in a rising interest rate environment. ECB Working Paper Series, 2950.

Hardford, J., Klasa, S., & Maxwell, W. (2014). Refinancing risk and cash holdings. The Journal of Finance, 69(3), 975-1012.

Hoffman, P., Langfield, S., Pierobon, F., & Vuillemey, G. (2018). Who bears interest rate risk? The Review of Financial Studies, 32(8), 2921–2954.Khwaja, A., & Mian, A. (2008). Tracing the impact of bank liquidity shocks: Evidence from an emerging market. The American Economic Review, 98(4), 1413-1442.

Banks can manage their interest rate risk either by changing the composition of their balance sheets or by actively using derivatives for hedging purposes. The first approach, known as natural hedging, involves aligning the interest rate sensitivity of assets and liabilities. In this way, banks’ cash flows generated from asset exposures offset those stemming from their liabilities along the repricing schedule. Alternatively, banks can use derivatives contracts linked to interest rate fluctuations to reduce the duration gap between assets and liabilities without altering their balance sheet structures. This means that banks actively trade in the interest rate derivatives market to manage their interest rate risk. See the boxes entitled “Interest rate risk exposures and hedging of euro area banks’ banking books”, Financial Stability Review, ECB, May 2022, and “Euro area interest rate swaps market and risk-sharing across sectors”, Financial Stability Review, ECB, November 2022 and Coulier L., Gardó S., Klaus B., Lenoci F., Pancaro C., and Reghezza, A., 2023. “Assessing risks from euro area banks’ maturity transformation,” Financial Stability Review, European Central Bank, vol. 2..