Following the Global Financial Crisis, the concept of Finance-Neutral Output Gaps (FNOG) has gained widespread attention among policymakers. This concept is a substitute to the conventional concept of inflation-neutral output gap given the possibility that the economy overheats even if price inflation is low, if financial or external imbalances are building up. Introducing financial variables into the output gap estimations may yield to complementary tools for policymakers to avoid diagnosis errors associated with financial booms. We therefore developed for the euro area a suite of estimates of output gaps incorporating financial variables in several unobserved components model frameworks. The results show that exploiting the information content of financial variables, which co-move strongly with the output cycle, can somewhat improve the real-time estimates of the output gap and help understand the role of financial factors in shaping the business cycle, through the Total Factor Productivity (TFP) channel.

Although the concept of potential output is pivotal in various economic policy areas (fiscal, monetary, financial stability or structural policies), no full consensus has emerged on its definition and on the most suitable method for estimating it. The ECB Monthly Bulletin 20131 defined potential output as “an indication of the level or rate of activity that could be achieved in the economy in the medium to long term [and] is often thought of as the level or rate of activity that can be sustained by means of the available factors of production without creating pressure on prices.” However, this definition neglects the significance of financial factors in assessing potential output, and the financial system’s role in shaping the business cycle. Financial factors have long been considered a driving force of business cycle fluctuations, at least since the seminal contribution of Fisher (1933). More recent general equilibrium approaches also emphasize the role of financial frictions in output fluctuations (see Iacoviello, 2005). According to this strand of the literature, the financial system is not neutral with respect to the business cycle and can either act as an amplifier of shocks or be the source of shocks that trigger business cycle fluctuations. Indeed, the state of the balance sheet of households, firms and banks can give rise to various pro-cyclical mechanisms (such as the financial accelerator). In addition, changes in collateral values (such as residential or commercial property) and the real value of nominally fixed debt can amplify demand shocks. Furthermore, not only financial variables have the property to co-move strongly with the business cycle, but they are also leading indicators of business activity, as illustrated by the predictive power of real M1 for real economic activity (see Musso, 2019). In the same way that financing conditions affect the business cycle, they are also likely to affect potential output. Departing from the principle of monetary neutrality, which assumes that central banks do not affect real variables in the long run, some recent endogenous growth models show that determinants of potential output may exhibit positive/negative hysteresis (See: Jordà et al., 2021 and Elfsbacka Schmöller and Spitzer, 2022).

In a recent paper (Guillochon and Le Roux, 2023), we developed a series of models to estimate potential output and the output gap encompassing financial variables. In a first step, we use a small Unobserved Components Model (UCM) in the line of Melolinna and Tóth (2019) building on Borio et al., 2013 and 2014, where a set of key variables (GDP, the unemployment rate and core inflation) are decomposed into cyclical and trend components. In addition to these macroeconomic variables, we introduce a financial indicator, whose changes influence directly the evolution of the output gap. In a second step, we build on Tóth (2021) who proposes to estimate the euro area output gap and potential output using an unobserved components model which features a production function. We, then, link directly financing conditions to capital efficiency, assuming that the labour and capital productivities are different. This modelling choice is motivated by findings of a strand of the literature (see e.g. Aghion et al., 2010, Garcia-Macia, 2017, Caggese, 2019, or Midrigan and Xu 2014) that shows that an increase in credit availability (like in credit booms) leads to positive effects on total factor productivity including capital productivity.

In this sort of exercise, the selection of financial indicators is always contentious. Real residential property prices and credit to the non-financial private sector are legitimate candidates (Borio et al., 2013) that we use in a first step. However, in light of the mechanisms at work in the financial markets and in the context of modelling their transmission to the business cycle, the choice of these two variables might be overly restrictive. We, then, choose to complement these variables with other asset price variables (stock market) and volume variables (monetary aggregates) by constructing a compound Financial Condition Index (FCI), using a dynamic factor model (Geweke (1976) and Sargent and Sims (1977)). This allows us to avoid the arbitrariness of choosing one single financial indicator to underpin the financial cycle, while remaining relatively agnostic about the exact sources of the financial shocks affecting the economy.

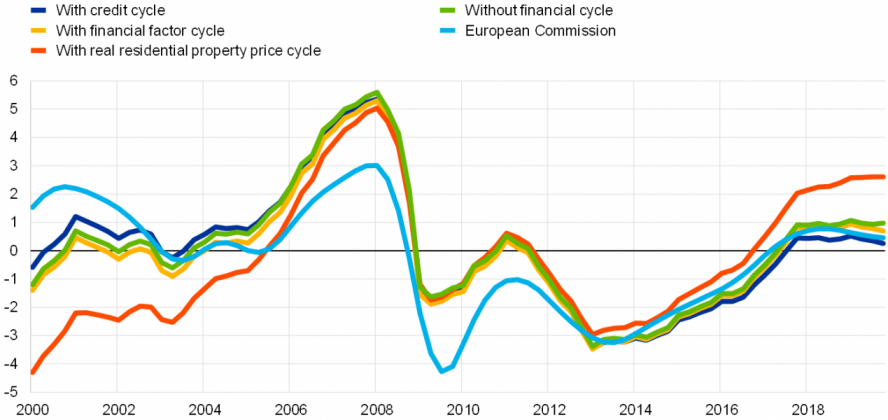

The results are manifold (chart 1). First, the choice of financial series used for the analysis matter: the output gap which includes real house prices differ significantly from the alternative estimations, confirming the literature that shows how FNOGs may differ from traditional output gaps. Furthermore, the output gap estimates including the FCI is similar to that obtained when including solely the credit to non-financial firms. Hence, in our framework, the value added of deriving a synthetic indicator of the financial cycle vis-à-vis considering separately financial indicators is not significant. In addition, the various estimates of output gaps which include the financial cycle depart from those of the European Commission. However, as the methodology used differ, we cannot infer that the difference is due to the inclusion of the financial indicators. Our estimates are meant to complement those existing and provide additional estimates aligned with the finance-neutral output gap literature.

Our study confirms that including financial cycle information improves the real-time reliability of the output gap estimates and, hence, increases its usefulness for policymakers. However, these improvements are small in magnitude and mainly visible during the Global Financial Crisis and sovereign debt crisis. In this regard, our results are different from those reported for other countries, especially that for the UK, for which the increase in the real time performance is larger.

Chart 1: Output gaps across small Unobserved Components Models.

Note: The output gap is the difference between the natural logarithm of GDP and that of potential output. The credit cycle represents credits to non-financial corporations. The financial factor cycle accounts for the Financial Condition Index. Source: own calculations, European Commission Autumn 2022 Forecast.

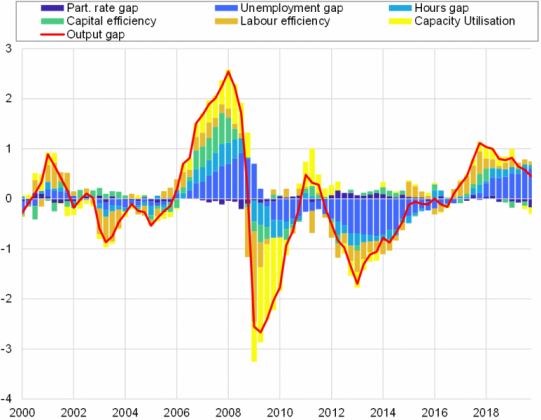

In a second step, the production function approach allows to break down the output gap in different labour and TFP contributions. Chart 2 shows the results after accounting for the financial cycle with the inclusion of the FCI as a determinant of capital productivity. In accordance with our prior, the productivity of capital is cyclical as financial conditions influence the access to the capital and, thus, the quality of the available capital, which in turn affects its efficiency and productivity. In line with the previous findings using the smaller UCM (chart 1), the contribution to the output gap of financial factors, through the capital efficiency channel, is limited. Moreover, the credit boom of the 2006-2007 period is associated with a somewhat large positive contribution of the capital efficiency. On the contrary, in the subsequent downturn, capital efficiency contributes negatively but mildly to the output gap. This is supported and aligned with the findings that credit booms (busts) are associated with higher (lower) capital productivity. Finally, as a result of the accommodative monetary policy pursued in the euro area from the mid-2010s onwards with facilitated access to credit, the capital efficiency provided a positive, albeit reduced contribution to the closure of the output gap.

Chart 2: Euro area output gap decomposition (% of potential output and percentage points) – UCM augmented with financial conditions.

Source: own calculations.

Finally, in a central banking context, the forecasting ability of output gap estimates are key. Consequently, we perform a pseudo-real time performance estimate exercise of the different output gaps to assess inflation in a reduced form Phillips curve (PC) for the aforementioned models. The different output gaps constructed in this exercise are relatively good predictors of inflation, in comparison with an AR(2). However, their predictive capacity falls significantly in the absence of a Philips curve in the model that we use, or when certain financial variables (eg. property prices) are used. This reflects the often very different shape of FNOGs compared with conventional output gaps.

Philippe Aghion, George-Marios Angeletos, Abhijit Banerjee, and Kalina Manova. Volatility and growth: Credit constraints and the composition of investment. Journal of Monetary Economics, 57(3):246–265, 2010.

Katalin Bodnár, Julien Le Roux, Paloma Lopez-Garcia, and Béla Szörfi. The impact of COVID-19 on potential output in the euro area. Economic Bulletin Articles, 7, November 2020.

Claudio Borio, Frank Piti Disyatat, and Mikael Juselius. Rethinking potential output: Embedding information about the financial cycle. BIS Working Papers 404, Bank for International Settlements, February 2013.

Claudio Borio, Piti Disyatat, and Mikael Juselius. A parsimonious approach to incorporating economic information in measures of potential output. BIS Working Papers 442, Bank for International Settlements, February 2014.

Andrea Caggese. Financing constraints, radical versus incremental innovation, and aggregate productivity. American Economic Journal: Macroeconomics, 11(2):275–309, April 2019.

ECB. Potential output, economic slack and the link to nominal. Economic Bulletin Boxes, 11, November 2013.

Justine Guillochon and Julien Le Roux. Unobserved components model(s): output gaps and financial cycles. Working Paper Series 2832, European Central Bank, July 2023.

Michaela Elfsbacka Schmöller and Martin Spitzer. Lower for longer under endogenous technology growth. Bank of Finland Research Discussion Papers 6/2022, Bank of Finland, June 2022.

Irving Fisher. The debt-deflation theory of great depressions. Econometrica, 1(4):337–357, 1933.

Daniel Garcia-Macia. The Financing of Ideas and the Great Deviation. IMF Working Papers 2017/176, International Monetary Fund, July 2017.

John Geweke. The Dynamic Factor Analysis of Economic Time Series Models. Workshop series / Social Systems Research Institute, University of Wisconsin. University of Wisconsin, 1976.

Matteo Iacoviello. House prices, borrowing constraints, and monetary policy in the business cycle. American Economic Review, 95(3):739–764, June 2005.

Òscar Jordà, Sanjay Singh, and Alan Taylor. Longer-run economic consequences of pandemics. The Review of Economics and Statistics, 104:1–29, 03 2021.

Marko Melolinna and Máté Tóth. Output gaps, inflation and financial cycles in the UK. Empirical Economics, 56(3):1039–1070, March 2019.

Virgiliu Midrigan and Yi Xu. Finance and misallocation: Evidence from plant-level data. American Economic Review, 104(2):422–58, 2014.

Alberto Musso. The predictive power of real M1 for real economic activity in the euro area. Economic Bulletin Boxes, 3, 2019.

Thomas Sargent and Christopher Sims. Business cycle modelling without pretending to have too much a priori economic theory. Working Papers 55, Federal Reserve Bank of Minneapolis, 1977.

Máté Tóth. A multivariate unobserved components model to estimate potential output in the euro area: a production function based approach. Working Paper Series 2523, European Central Bank, February 2021.

See “Potential output, economic slack and the link to nominal”, Monthly Economic Bulletin, ECB, November 2013 (ECB, 2013), or “The impact of COVID-19 on potential output in the euro area”, Economic Bulletin, Issue 7, ECB, 2020, (Bodnár et al., 2020).