Europe suffers from a ‘promotional gap’ in the implementation of climate-related financial and monetary policies: European authorities, contrary to authorities in other jurisdictions, pursue their sustainable finance objectives using only a limited set of informational policy instruments (e.g. disclosure requirements), avoiding more proactive incentive- or quantity-based financial policies. We identify the main determinants of this gap in (i) the limited public control on financial capital allocation; and (ii) the strong independence and expanding powers of delegated financial authorities, in particular central banks. The current European institutional balance allows only the implementation of policies on which political and delegated authorities concur, restricting the set of available policy options to informational instruments. We argue that this setting is ultimately unsustainable due to pressing environmental constraints, and explore the implications of different institutional scenarios. We conclude by stressing the need for close cooperation between political and delegated authorities. This policy brief summarises the main contributions of Baer et al. (2021).

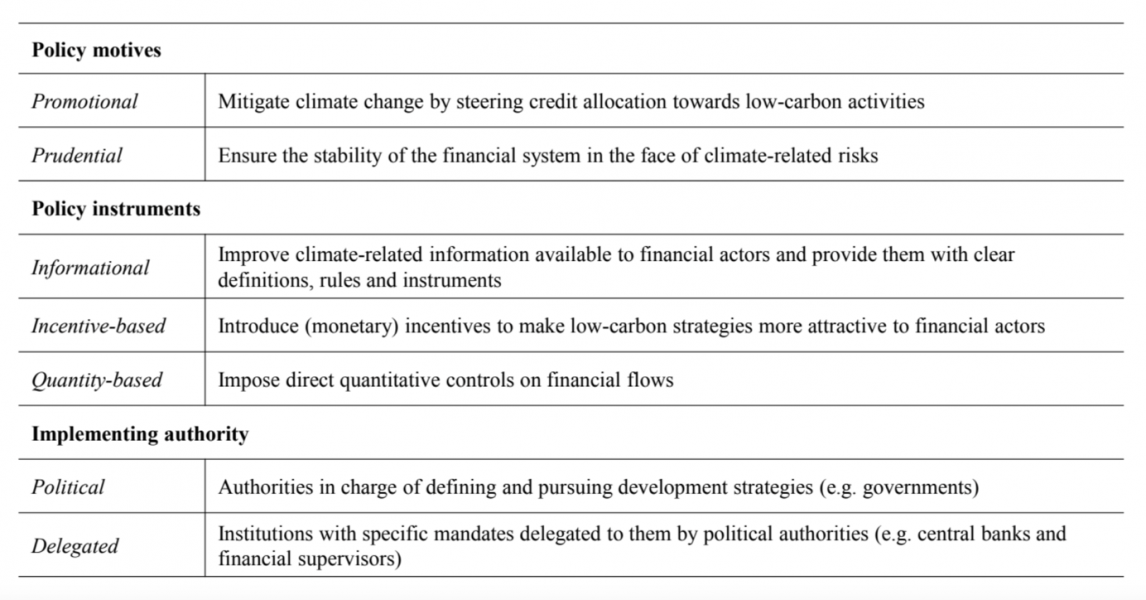

To carry out a precise and consistent analysis of climate-related financial policies1 (CRFPs), we first propose an original classification that allows us to clearly distinguish several key dimensions (see Table 1).

First, one can distinguish CRFPs based on why they are implemented. For instance, public intervention could be motivated by a desire to address climate change by influencing the allocation of financial capital. This is what we define as the promotional motive. Indeed, one of the key goals of the Paris Agreement is to ‘make financial flows consistent with a pathway to low greenhouse gas emissions and climate-resilient development’. On the other hand, policies could be motivated by the desire to ensure the stability of the financial system in the face of climate-related challenges. This is what we define as the prudential motive. As the former Governor of the Bank of England Mark Carney argues in his well-known ‘Tragedy of the Horizon’ speech, several climate-related risks (CRRs), such as physical or transition risks, could threaten the soundness and stability of the financial system.

Table 1: A taxonomy of climate-related financial policies

Second, we focus on how CRFPs are implemented. Public authorities have a wide range of tools at their disposal to influence the allocation of capital. First, they can improve the quantity and quality of climate-related information available to financial market players and provide them with a clear shared set of definitions, rules, and instruments. We call these informational policies, as their goal is to bridge the market failures stemming from imperfect and asymmetric information. Second, regulators could modify the structure of incentives (e.g. the relative prices) that financial actors face when making investment decisions. We refer to these as incentive-based policies, as the allocation of capital remains a market prerogative and investors are free to invest in high-carbon or risky assets, although at a cost. Third, public institutions can intervene directly on the quantity of financial resources allocated to specific productive activities. We call these quantity-based policies, as these policies impose direct quantitative controls on financial flows.

Finally, CRFPs can be distinguished based on who implements them. We distinguish two main types of public institutions that can be involved in the design and implementation of CRFPs. First, political authorities (PAs) are the public organisms in charge of determining the direction of economic development on behalf of their populations, deciding between competing interests. They include parliaments, governments, ministries, and other public institutions able to contribute to the definition of development strategies, and therefore to the promotional objectives. Second, delegated authorities (DAs) are autonomous or semi-autonomous organisms with specific mandates given to them by the PAs. The main delegated authorities active in the financial governance are central banks and financial supervisors. While delegated authorities are primarily accountable for prudential goals, their mandate may also encompass promotional objectives such as achieving low employment or steering capital flows to certain sectors for development purposes.

Using this framework, we analyse European policy efforts in the field of sustainable finance (see for instance the EU sustainable finance initiatives) and find that both prudentially- and promotionally-motivated policies in Europe rely solely on informational instruments. These include disclosure guidelines, a sustainability taxonomy, standards for green bonds, climate benchmarks and climate stress tests. Incentive- and quantity-based instruments are not used to redirect financial resources towards more sustainable activities. The implicit assumption of this policy approach is that the main barrier to sustainable investment is imperfect and asymmetric information. By providing reliable and harmonized information to market actors, policymakers expect market discipline to perform its function of adequately pricing financial assets. However, these measures may not be sufficient to redirect financial flows towards low-carbon activities in the required amounts (Ameli et al., 2020). In other jurisdictions, public authorities complement informational measures with incentive-based policies, such as differentiated bank requirements or favourable central bank refinancing conditions for banks to lend to environmentally sustainable firms, or quantity-based policies such as credit quotas. We find examples of these policies especially in emerging regions (Campiglio et al., 2018).

We thus define the European ’promotional gap’ as the limited use of policy instruments at the potential disposal of European policymakers to achieve their promotional objectives in the field of sustainable finance.

What explains the European promotional gap and the diversity of CRFPs across jurisdictions? We argue that the answer can be found by looking at historical dynamics and institutional characteristics. Over the past fifty years, European policymakers have progressively limited their control over financial dynamics and capital allocation. In the post-war period, most European countries relied on a wide range of instruments to direct capital to certain activities following national priorities and development objectives (Bezemer et al., 2018). Subsequently, especially during the ‘80s and ‘90s and together with the European integration process, many jurisdictions have moved from being ‘interventionist’ (or ‘market-shaping’) to ‘regulatory’ (or ‘market-fixing’) states (Majone, 1997; Ryan-Collins, 2019). Capital control instruments were phased out across Europe, as they were increasingly seen as distorting the proper allocation of resources (Monnet, 2018). Since delegated authorities’ actions were having gradually less distributive implications, they started being considered as ‘technical’ agencies, and progressively gained independence from political authorities. In exchange for this independence and elevated influence, their actions would be limited to a precise set of functions.

This evolution was particularly prominent in high-income countries, and most notably in Europe. Indeed, the ECB can be considered as one of the most independent central banks in the world. It has a single primary objective of price stability, which is pursued through monetary policy implemented with a ‘market neutrality’ operational principle. This means that the ECB strives not to influence the distribution of the market in any way, trying to be as transparent as possible. Selectivity, once a key part of monetary policy decisions, is now seen as something to be avoided. Having lost its promotional nature, its mandate was instead supplemented with additional prudential aims after the global financial crisis. With new instruments (such as quantitative easing or macroprudential policy) and a reinforced independence, European delegated authorities’ powers on financial governance increased even further.

These strong and independent institutions are able to rebuff governments’ attempts to use the policy functions under their control for purposes that do not fit within their mandate. For instance, the idea of implementing a promotional ‘green supporting factor’ (lowering the amount of capital requirements for banks that lend to sustainable activities), explicitly pushed and supported by European political authorities, encountered clear opposition by the European financial supervisors (e.g. the European Banking Authority), on the behalf of its prudential implications. In the same vein, the numerous pushes for ECB to amend its monetary policy to solve its strong carbon-bias (e.g. Matikainen et al., 2017) encountered opposition by European central bankers. The President of the Deutsche Bundesbank Jens Weidmann epitomises such view, arguing that ‘it is not the task of the Eurosystem to penalise or subsidise certain industries. Correcting market distortions often has intricate distributional implications. Such decisions need strong democratic legitimacy and are a matter for governments and parliaments.’

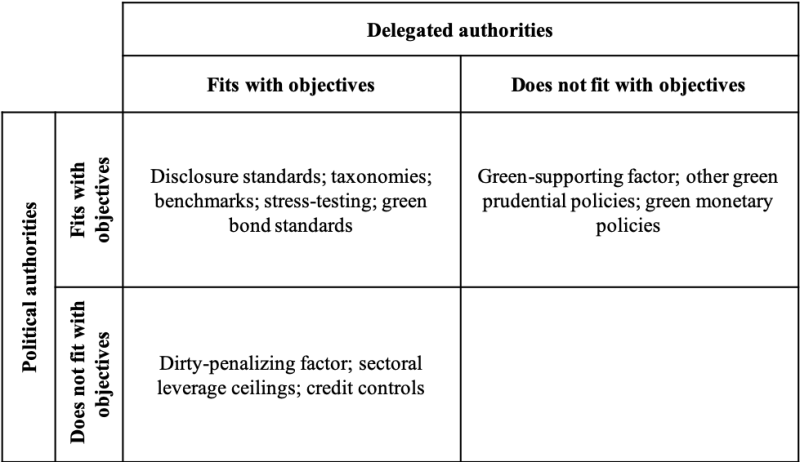

The outcome of this situation is an institutional deadlock. Political authorities that benefit from the democratic legitimacy to implement far-reaching promotional policies cannot or prefer not to employ financial governance instruments. The delegated authorities that inherited them are bound by restricted technical mandates that prevent them from doing so. As a result, only a limited subset of CRFPs can be implemented in Europe: the consensual policies that fit within the objectives and remits of both political and delegated authorities (see Table 2).

Table 2. Climate-related financial policy space in Europe

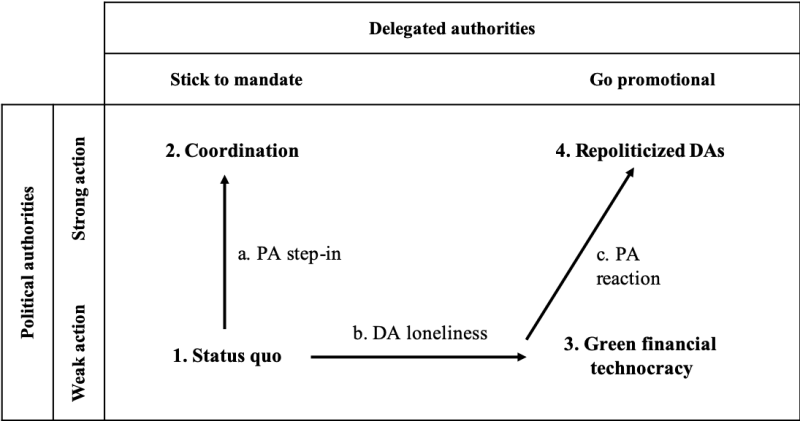

The last objective of this Policy Brief is to discuss the possible evolutions stemming from the current promotional gap and institutional lock-in. We assume political authorities to have two main strategies: i) take a strong action to mitigate climate change (e.g. implement a carbon pricing policy in line with climate stabilization objectives); and ii) take no or limited climate action. Delegated authorities also have two main strategies: i) continue adhering to market neutrality and prudential motives; and ii) adopt more interventionist policies with promotional aims. These strategies represent stylised extremes of a continuum of possible behaviours by both PAs and DAs. We identify four main scenarios (1. to 4.) and three main dynamics (a. to c.) that are represented in Table 3.

Table 3. Stylised institutional scenarios

The status-quo scenario represents the current institutional blockage: delegated authorities limit themselves to the achievement of the objectives stated in their mandate, without overstepping. Political authorities are implementing mitigation policies in the fiscal sphere, but so far not enough to achieve their climate goals. We argue this equilibrium to be ultimately unstable due to the increasing environmental constraints.

The first way to break out of the deadlock would be for political authorities to significantly step up their promotional efforts to mitigate climate change. This PA step-in would be relieving DAs from the necessity to go beyond their prudential objectives. Although this coordination scenario would be the most suited given the current institutional framework and division of responsibilities, it might be unlikely. First, it is uncertain that sole fiscal action would be enough to tackle climate change. Second, if fiscal action were to represent all climate action, it would have to be far-reaching, having strong economic and political costs in the short term. We could be witnessing a change in pace with the EU Green Deal initiatives, but (i) it is still too soon to tell; and (ii) despite possibly having impacts also on financial actors, they are not primarily aimed at them.

The second possible dynamics out of the institutional impasse would be for delegated authorities to adopt climate-related promotional policies. Indeed, some DAs might consider climate change likely to jeopardise their primary objectives: besides endangering financial stability with increased physical risks, climate change would disturb monetary policy transmission channels and limit the European central banks’ ability to achieve their objective of price stability in the future (Andersson et al., 2020). In a context characterized by political authorities’ inaction, this might force DAs to intervene to compensate for the lack of promotional effort in the face of an unfolding climate crisis. If brought to its extreme, these dynamics of DA loneliness could lead to a green financial technocracy scenario, i.e. a situation characterized by independent technical agencies with the power of defining the features of economic and societal development with no or little political control and without an appropriate adjustment of their mandates. As argued by the economist John Cochrane, among others, this might ultimately put at risk the credibility of these institutions and affect their ability to reach their primary goals.

However, we argue this extreme scenario is also ultimately unlikely, as the increasing disconnection between the de jure institutional arrangement and the de facto distribution of financial governance powers will force a reaction from political authorities. PA reaction could take several shapes. First, in an extreme scenario, it could lead PAs to disavow DAs promotional pushes and prevent further agency drift by retaking political control of DAs, bringing back monetary policy and financial regulations under their control. This setting would see Re-politicized DAs aligning their actions to PAs development objectives, even if they might have negative prudential implications. Second, political authorities could grant DAs with new input legitimacy to implement promotional policies, giving them both clearer grounding and boundaries to clarify democratically the ‘authorization gaps’ of their mandates (de Boer & van’t Klooster, 2020). This is what happened in the UK, the BoE having received an updated remit to align regulatory monetary policies consistent with the government’s economic strategy to reach net-zero. While a mandate change would be difficult for ECB, ordinary legislative procedures (e.g. clarifying the ranking of the objectives or the statutes of the ECB) could prove sufficient to grant DAs adequate input legitimacy. Alternative, ex-post validation could provide institutional clarity and backing to green promotional central banking (similar to what happened to ‘unconventional’ monetary policy interventions after the global financial crisis).

In a 2018 speech meaningfully titled ‘Let’s dance’, the chair of the NGFS Frank Elderson outlined the contributions that central banks and supervisors could make in the societal effort to address climate change. We argue that central banks cannot and should not dance alone. Either through strong action in the fiscal sphere and/or through new clear delegations of climate missions to independent authorities, political authorities will have to step in at some point. It will take two to dance: only through cooperation from early stages will it be possible to simultaneously achieve effective climate action and continued strong institutional legitimacy.

Ameli, N., Drummond, P., Bisaro, A., Grubb, M., & Chenet, H. (2020). Climate finance and disclosure for institutional investors: Why transparency is not enough. Climatic Change, 160(4), 565‑589. https://doi.org/10.1007/s10584-019-02542-2

Andersson, M., Baccianti, C., & Morgan, J. (2020). Climate change and the macro economy. ECB Occasional Paper Series, 243. https://data.europa.eu/doi/10.2866/83282

Bezemer, D., Ryan-Collins, J., van Lerven, F., & Zhang, L. (2018). Credit where it’s due: A historical, theoretical and empirical review of credit guidance policies in the 20th century. UCL Institute for Innovation and Public Purpose. https://www.ucl.ac.uk/bartlett/public-purpose/publications/2018/nov/credit-where-its-due

Campiglio, E., Dafermos, Y., Monnin, P., Ryan-Collins, J., Schotten, G., & Tanaka, M. (2018). Climate change challenges for central banks and financial regulators. Nature Climate Change, 8(6), 462‑468. https://doi.org/10.1038/s41558-018-0175-0

de Boer, N., & van’t Klooster, J. (2020). The ECB, the Courts and the Issue of Democratic Legitimacy After Weiss (SSRN Scholarly Paper ID 3712579). Social Science Research Network. https://papers.ssrn.com/abstract=3712579

Majone, G. (1997). From the Positive to the Regulatory State: Causes and Consequences of Changes in the Mode of Governance. Journal of Public Policy, 17(2), 139‑167.

Matikainen, S., Campiglio, E., & Zenghelis, D. (2017). The climate impact of quantitative easing [Policy paper]. Grantham Research Institute on Climate Change and the Environment.

Monnet, E. (2018). Controlling Credit: Central Banking and the Planned Economy in Postwar France, 1948–1973. Cambridge University Press.

Ryan-Collins, J. (2019). Beyond voluntary disclosure : Why a ‘market-shaping’ approach to financial regulation is needed to meet the challenge of climate change, SUERF Policy Note, Issue No 61. SUERF – The European Money and Finance Forum. Beyond voluntary disclosure

van’t Klooster, J. (2021). The ECB’s conundrum and 21st century monetary policy : How European monetary policy can be green, social and democratic [Preprint]. SocArXiv. https://doi.org/10.31235/osf.io/f25td

By financial policies, we here mean policies that modify the conditions in which private investment or lending decisions are taken. This broad definition includes both central bank policies (e.g. monetary policy) and banking/financial regulation. Climate-related financial policies refer to a subset of such policies linked to either climate change or the transition to a carbon-free society.