We study the 2012 Italian reform that introduced minibonds, a financial instrument specifically designed for SMEs, to check whether increased access to market-based finance promotes investment in intangibles. We run diff-in-diff estimates over 1,454 matched samples obtained through a propensity score matching procedure to reduce the selection bias and face model dependence. Minibond-issuing firms increase investments in intangible assets, a component difficult to finance via bank credit, more than other firms and more than investments in tangibles. Two mechanisms are at work: minibonds relax financial constraints (financial effect) and, above all, signal an improvement in business practices (reputational effect). These effects are more intense for smaller, more opaque, and bank-dependent firms.

Advanced economies are transitioning from a traditional production system to a knowledge economy, a system relying on intellectual capabilities more than physical capital (Powell and Snellman, 2004). Correspondly, a growing literature has recognized the importance of intangible over tangible assets as a factor of economic growth. Since the 1970s, the expansion of R&D, customer relationships, managerial organization, logistic structure, employee training, human capital, and trademarks has been crucial for economic performance at the country and the firm levels (Corrado et al., 2009; Corrado and Hulten, 2010). Investments in intangibles spur productivity (Brynjolfsson et al., 2021), profitability, and broadly speaking, economic growth (Corrado et al., 2013).

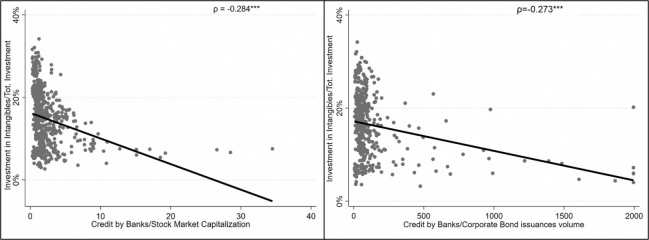

As asymmetric information tends to be more relevant for intangible assets than tangible ones, banks are typically reluctant to finance intangible investments because such activities are challenging to evaluate and re-sell in case of default and because they serve poorly as collateral (Cecchetti and Schoenholtz, 2018; Dell’Ariccia et al., 2021). To relax the financial constraint on intangible investments, firms have recurred to alternative sources of financing such as internal liquidity, equity issuance, tangible assets sales, and liquidity injected by acquirers. Figure 1 shows the negative correlation at the country level between bank reliance (as measured by bank credit on stock market capitalization or scaled by corporate bond issuances) and the ratio of intangible over total investments among OECD countries.

Figure 1: Intangible investments and bank dependence: correlation among OECD countries in 1995-2017. Bank credit is scaled by stock market capitalization (left) and corporate bond issuance volume (right).

Notes: Source: OECD and World Bank. Data are available only for investment in intellectual property products included in national accounts. Intangible assets such as human capital, consumer relationships, and distribution systems are not covered in national accounts. We removed outliers (1st and 99th percentiles) for graphical representation reasons.

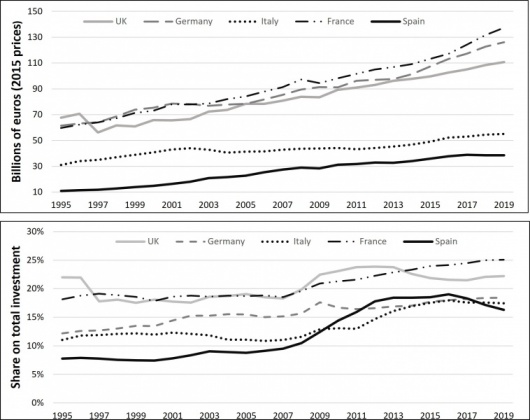

Credit issues are more severe in well-known bank-based countries such as Italy. Traditionally, Italian firms have limited access to capital markets, and banks detain about 70% of domestic financial assets (Bugamelli et al., 2018). It has caused investment stagnation and low economic performance. In particular, Italy has lagged behind in intangible investments compared with the other large European economies. Moreover, the gap with the United Kingdom, France, and Germany has continuously widened since the late 1990s (Figure 1, top graph). Results are similar in relative terms: rather tangible-oriented investments have led Italy to the second-lowest share of intangible over total investments after Spain (Figure 1, bottom graph). The reduced investments in R&D, patents, and workforce training are among the leading factors responsible for the weak economic performance and low labor productivity in Italy.

In a recent paper, we exploit the 2012 Italian reform that introduced a financial instrument called minibond and designed to help firms to collect funds on capital markets as a quasi-natural experiment to analyze the effect of access to market-based finance on intangible investment (Beccari, Marchionne, and Pisicoli, 2022). Our results show that minibonds effectively relax the financial constraint of Italian firms and promote investments in intangible assets. These investments increase less than proportionally with the number of minibond issuances, thus suggesting a relevant reputational effect at work. Furthermore, we find a more intense impact for smaller, unlisted and bank-dependent firms.

Figure 2: Intangible investments: Italy vs. selected European countries, 1995-2019.

Source: Eurostat. Notes: Data are available only for investment in intellectual property products included in national accounts. Intangible assets such as human capital, consumer relationships, and distribution systems are not included.

Intensifying investments in intangibles is crucial for recovering from the Covid-19 economic turmoil and addressing the digital and ecological transitions that challenge the global economy. In this context, a more diversified financial system better supports the economy. Our findings suggest that encouraging firms’ access to market-based finance can be helpful for their growth and innovation capacity.

Our empirical strategy consists of three steps. First, we apply a Propensity Score Matching (PSM, henceforth) to deal with the selection bias of the firms issuing minibonds and remove endogeneity. The procedure regresses a minibond issuance dummy on observable firm characteristics, assigns a score indicating the probability of issuing minibonds to each firm, and matches each treated firm to the most similar untreated one. We also require exact matching at year, sector, and macro-area levels. We run several PSM regressions to avoid model dependence and discretion (King and Nielsen, 2019). In detail, we obtain 1,454 pruned samples of treated and ex-ante similar control firms by combining the determinants of minibond-issuing firms used in the economic literature and the criteria adopted in the public calls for minibond issuance proposal. The latter unveil the data generating process of issuances and improves the performance of our matching algorithm.

In the second step, for each sample generated by the PSM, we run diff-in-diff estimates to test (i) whether issuing minibonds has facilitated the financing of intangible investments (financial hypothesis), (ii) what the effect of multiple issuances and the long-run effect of one issuance are (reputational hypothesis), and (iii) whether this relationship is affected by other factors (heterogeneity hypothesis). Our panel diff-in-diff approach relies on the estimation of different growth models of intangible and tangible assets.

In the last step, we apply a meta-analysis random-effect model to summarize the results obtained from the 1,454 different samples. This approach is usually applied to the empirical results obtained from various datasets about the same topic. We use it for the pruned samples.

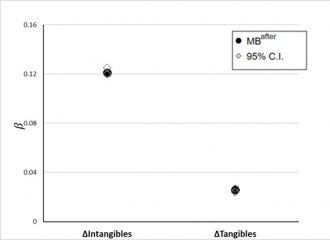

Each of our samples consists of treated units (minibond-issuing firms) matched with their closest untreated firms that (i) are similar based on balance sheet information of the year of the issuance, (ii) operate in the same sector, and (iii) are located in the same macro-area (North, Centre, and Mezzogiorno). Meta-analysis results indicate that minibond-firms experience an increased investment capacity in intangible assets with respect to the control group. We also find that tangible investments increase more for such firms, but the estimated coefficient is smaller than that associated with intangible investments (see Figure 3). Hence, minibonds support the investment capacity of issuing firms, especially in intangibles, the component more difficult to finance via the traditional banking channel.

Figure 3: Impact of minibond issuance on investment in intangibles and tangibles. Meta-analysis results on 1,454 pruned samples obtained through propensity score matching.

Minibonds produce two effects. First, as they are more suited to finance intangible investments than traditional instruments, issuing firms more easily finance R&D, patents, and similar projects, than other firms. In other words, diversification through financing sources increases flexibility, reduces risks, and relaxes financial constraints on intangible investments (financial hypothesis). Second, issuing an innovative instrument represents a structural break for the firm because acquaintance with capital markets provides better financing opportunities. In this case, using a new instrument signals financial maturity to the market and attracts investors less reluctant to finance innovative projects (reputational hypothesis). The legal requirements of issuances also facilitate this process. Indeed, by law, firms need an asset management company or a bank as a sponsor to issue minibonds. The sponsor must retain at least 5% of the overall value if the minibond issuance is smaller than 5 million euros, at least 3% if it is between 5 and 10 million euros, or at least 2% for issuances larger than 10 million euros. Furthermore, the sponsor assigns a credit score to the issuer. Finally, regional administrations select firms that can issue minibonds based on a public call. The presence of the sponsor and the public monitoring mitigates moral hazard and improves the reputation of the issuing firm.

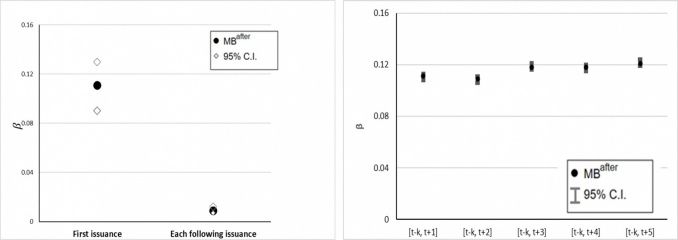

Our empirical analysis distinguishes single and multiple issuances to disentangle the financial and reputational hypotheses. If minibonds only represent a source of fresh liquidity for firms, multiple issuances should proportionally relax financial constraints and promote intangible investments also after the first issuance. On the other hand, a reputation boost occurs only initially. So, the first issuance should impact intangible investments more than the following issuances. Our results indicate that a reputational effect prevails (Figure 4, left panel).

Figure 4: Impact of single and multiple minibond issuances (left) on investment in intangibles. Impact of minibond issuances on investment in intangibles, right truncated samples (right). Meta-analysis results.

Temporal dynamics can also help to disentangle the two hypotheses. Minibond issuances promptly release financial constraints, but their impact fades when constraints become less binding. On the contrary, the signaling effect starts with the first issuance but takes time to unfold and spread. Hence, intangible investments due to a better reputation consolidate over time. The implication is that only the financial effect is at work immediately after the minibond issuance, whereas the reputational one emerges in the medium run. Both vanish in the long run. To investigate these temporal dynamics, we right-truncate our samples by aligning the years of minibond issuances across firms at time t=0 and progressively cutting observations with t>1, t>2,…, t>5 away. Our financial hypothesis is corroborated if the estimated coefficient in the sample truncated at t+1 is greater than the coefficients truncated at subsequent years because minibonds become quickly ineffective in promoting intangible investments when they merely represent additional liquidity. Conversely, if the effect increases over time, the reputational hypothesis prevails. Figure 4 (right panel) presents our results: the reputational effect prevails over the financial one.

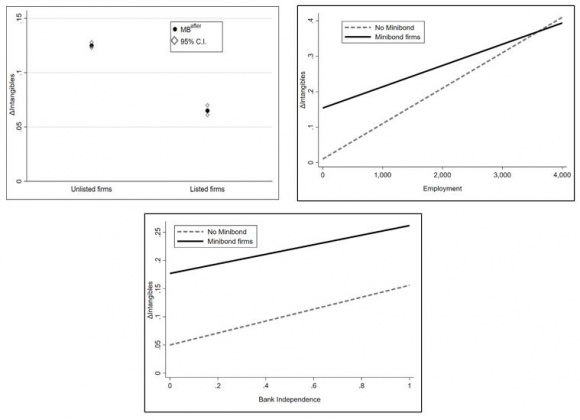

In addition, we investigate a number of potential heterogeneities. We find that minibonds mainly support unlisted, smaller, and bank-dependent firms. Minibonds are more effective in promoting intangibles for unlisted firms because they typically have limited access to capital markets. For similar reasons, smaller firms should also benefit more from a minibond issuance. Finally, bank-dependent firms find minibonds more beneficial than diversified firms because the latter already enjoy a financial structure better suited to finance intangibles (see Figure 5).

Figure 5: Effect of minibond issuances on intangible investments: listed vs unlisted firms (top left); firm size (top right); bank independence (bottom).

Finally, ancillary findings of the paper show that minibond-issuing firms (i) increase their overall financial resources in line with our reputational hypothesis and previous results by Ongena et al. (2021), (ii) experience an increase in productivity and profitability, and (iii) lower investment sensitivity to cash flow.

Investments in intangible assets are crucial in a knowledge economy, particularly during a digital and ecological transition. However, bank credit is ill-suited to finance these investments due to high asymmetric information. Alternative market-based financial instruments can mitigate this issue. Our paper focuses on the 2012 reform that introduced minibonds in Italy. We show that firms issuing minibonds invest more intangible assets than other firms. Investments grow not only in the year after the minibond issuance but also in the following years. Although both financial and reputational effects coexist, the latter is stronger and easily dominates the former. Consistent with our results, policymakers should incentivize the issuance of alternative market-based financial instruments to certify the good conditions of smaller, less transparent, and more bank-dependent firms and spur their profitability and innovation capacity through investments in intangible assets.

Beccari G., Marchionne F., Pisicoli B. (2022). Alternative financing and investment in intangibles: evidence from Italian firms, MoFiR working paper n° 174.

Brynjolfsson, E., Rock, D., & Syverson, C. (2021). The productivity J-curve: How intangibles complement general purpose technologies. American Economic Journal: Macroeconomics, 13(1), 333-72.

Bugamelli, M., Lotti, F., Amici, M., Ciapanna, E., Colonna, F., D’Amuri, F., … & Sette, E. (2018). Productivity growth in Italy: a tale of a slow-motion change. Bank of Italy Occasional Paper, (422).

Cecchetti, S. and Schoenholtz, K. (2018). Financing intangible capital. CEPR Policy Portal VoxEU.

Corrado, C. A., & Hulten, C. R. (2010). How do you measure a” technological revolution”?. American Economic Review, 100(2), 99-104.

Corrado, C., Haskel, J., Jona-Lasinio, C., & Iommi, M. (2013). Innovation and intangible investment in Europe, Japan, and the United States. Oxford Review of Economic Policy, 29(2), 261-286.

Corrado, C., Hulten, C., & Sichel, D. (2009). Intangible capital and US economic growth. Review of income and wealth, 55(3), 661-685.

Dell’Ariccia, G., Kadyrzhanova, D., Minoiu, C., & Ratnovski, L. (2021). Bank lending in the knowledge economy. The Review of Financial Studies, 34(10), 5036-5076.

Ongena, S., Pinoli, S., Rossi, P., & Scopelliti, A. (2021). Bank credit and market-based finance for corporations: the effects of minibond issuances. Bank of Italy Temi di Discussione (Working Paper) No, 1315.