This policy brief is based on Banque centrale du Luxembourg, Working Paper No 195. The views expressed are those of the authors and should not be attributed to the Board of Governors of the Federal Reserve System, the Banque centrale du Luxembourg or the Eurosystem.

Abstract

Does money growth provide an early warning of risks to medium-term price stability? We take a regime-dependent view of the money growth-inflation link and evaluate the information content of monetary variables as warning signals for shifts across inflation regimes. We show that money growth can be useful to predict inflation in some episodes, such as the recent post-pandemic phase. We conclude that the money growth-inflation relationship is non-linear, with faster money growth signalling a higher probability of entering a “High” inflation regime, thus providing a sharp assessment of the risks to price stability.

Despite the key role that money plays in the economy, its perceived relevance for monetary policy has changed considerably in the last few decades. According to the quantity theory of money (QTM), in the long run there is a one-to-one link between money growth and inflation. However, since World War II there appeared signs of instability in this link, with monetary aggregates becoming particularly controversial as guides to future inflation. For example, the strength of the relationship between money growth and inflation appeared to vary with changes in monetary regimes and their correlation disappeared or weakened substantially during periods of low and stable inflation.

For this reason, by the early 1990s most central banks had abandoned monetary targeting in favour of inflation targeting, with the emergence of New Keynesian models limiting the monetary policy transmission mechanism to the interest rate channel, so that monetary policy was determined without reference to the quantity of money.

In 2021, inflation rates rose rapidly above their target levels, first in the US and then in Europe. The extraordinarily rapid growth in money before this inflation surge1 revived the debate regarding the role of money growth as a predictor for inflation. In Amisano and Colavecchio (2025), we review the link between money growth and inflation in the theoretical and the empirical literature to assess whether money growth can provide an early warning of risks to medium-term price stability.

We take a regime-dependent view of the money growth-inflation link and evaluates the information content of monetary variables as warning signals for shifts across inflation regimes. We show that money growth can be useful to predict inflation in some episodes, such as, in the case of the euro area, the early 1980s and the recent post-pandemic phase. We conclude that the money growth-inflation relationship is non-linear, with faster money growth signalling a higher probability of entering a “High” inflation regime, thus providing a sharper assessment of the risks to price stability.

In the past, monetary aggregates played a key role in monetary policy frameworks in many countries. Monetarism gained importance in the 1970s, as an attempt to respond to the “stagflation” of that decade. Keynesian economic theory, with its focus on the demand side of the economy, was ill equipped to explain these developments and failed to provide an appropriate policy response. Monetarists, on the other hand, argued that the high inflation was due to rapid increases in the money supply and claimed that money supply control would be the most effective monetary policy. The ascent of the monetarist paradigm, which emphasized the implications of the QTM for macroeconomic outcomes, drove many central banks to shift their focus on money and to adopt monetary targeting.

Since the mid-1980s, the monetarist approach was gradually abandoned, as central banks moved away from monetary targets and towards more directly inflation-centered regimes. This tendency was underpinned by the rise of a class of New Keynesian models that were more successful at explaining macroeconomic fluctuations despite the QTM having no role in monetary policy-making. In the 1990s, several industrialized countries adopted inflation targeting. The Deutsche Bundesbank and the European Central Bank in its early years were notable exceptions.

Between 1995 and 2020, advanced economies enjoyed a macroeconomic environment characterized by low and stable inflation. It is widely believed that one reason why inflation stayed so low for so long was the change in monetary policies that took place in the 1990s, when central banks adopted inflation targeting in an effort to commit credibly to a policy strategy aiming at low inflation. This stabilized inflation expectations at levels that provided a solid nominal anchor for economic agents to plan their consumption, saving and investment.

Monetary policy was not the only factor behind this phase of broad macroeconomic stability. Several structural changes occurring during this period – globalization, technological progress, labor market developments –helped to dampen price increases. During the latter part of this phase, which became known as the “Great Moderation”, central banks were particularly concerned about inflation being too low rather than too high. At the same time, policymakers worried that low inflation would permanently move nominal interest rates near their “zero-lower-bound”, constraining their interest rate policies in an undesirable way. As a result, monetary policy in all major countries remained highly expansionary throughout the latter part of this phase (near-zero interest rates became common). The broad consensus remained that inflation targeting provided a sound framework for monetary policy and that monetary aggregates only played a peripheral role.

The Global Financial Crisis of 2007–09 prompted central banks to introduce unconventional policy measures, including quantitative easing (QE) and forward guidance, in an effort to circumvent the effective lower bound on the policy rate, to address impairments in various stages of the policy transmission mechanism and to help deliver the intended monetary policy accommodation. These policies were controversial, with central banks accused of excessively inflating their balance sheets, increasing the money supply and risking a sharp rise in future price levels. However, between 2010 and early 2020, unconventional monetary policy had only moderate effects on broad money growth and did not cause the feared surge in inflation.

In the wake of the pandemic, central banks’ experience with QE was very different. In 2021, inflation rates began to exceed central banks’ target levels, first in the US and then in Europe. The post-pandemic surge in inflation, preceded by non-standard monetary policy measures that significantly increased the size of central banks’ balance sheets and money supply, revived the debate regarding the role of money growth for inflation and put the actions of central banks under new scrutiny.

Post-pandemic developments also sparked new interest in the question whether the sharp increase in money growth over 2020-2021 could be viewed as an early warning indicator for risks to medium-term price stability. Our empirical contribution to the debate is summarized in the next section.

Our analysis contributes evidence that money growth can signal risks to price stability. It adopts a regime-dependent view of the money growth-inflation link. Our approach can quantify the information content of monetary variables as warning signals for shifts among inflation regimes. We model inflation as a regime-switching process where the probabilities of moving from one inflation regime to another, the transition probabilities (TP), depend on the rate of money growth (Amisano and Fagan, 2013 and Amisano et al., 2014).

This framework allows money to act as “warning signal” of the risk that inflation may exit the “price stability” regime. A simple way to assess whether money growth helps to predict inflation regimes is to compare the one-step-ahead predicted probabilities2 of a high inflation regime obtained with the model that exploits the information content of money growth with those provided by a model where transitions between regimes are exogenously determined and independent of money growth.

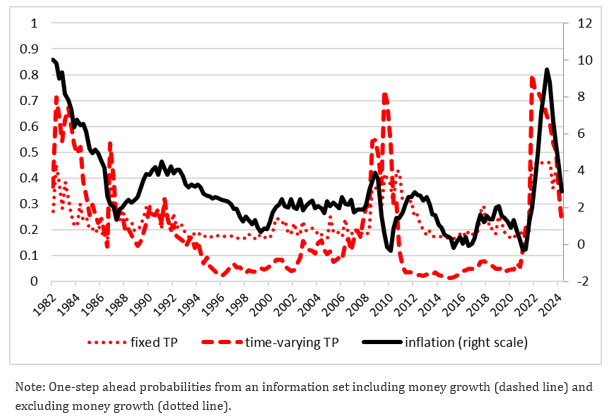

If monetary aggregates can provide useful information to evaluate the risks to price stability, the one-step ahead probabilities obtained using money growth as an early warning indicator should provide a stronger and possibly timelier signal of departure from the price stability regime than those from a model which excludes money growth. Figure 1 shows the results for the euro area, plotting the one-step ahead probabilities of the “High” inflation regime produced by each model, along with year-on-year inflation.

Preceding euro area episodes characterized by volatile and/or high inflation, such as the early 1980s, the Global Financial Crisis and the post-pandemic years (2022-2023)3, the one-step ahead predictive probability of the “High” inflation regime differed substantially across models. In particular, the model including money growth provides a much stronger signal for the risk of entering a “High” inflation regime than the model excluding money growth.

Figure 1. Euro area – One-step ahead probabilities of “High” inflation regime

The main purpose of our money-augmented regime-switching model is to identify increases in the probability of entering the “High” inflation regime, so this must be the criterion to assess its usefulness. Figure 1 suggests that the model with time-varying TPs has been able to identify the episodes of “High” inflation regime more clearly than the model with fixed TPs. For example, in 2021Q2, shortly before the post-pandemic inflation surge in the euro area, the model with time-varying TP signals an 80% probability of entering the “High” inflation regime, almost twice as high as the probability implied by the model with fixed TP.

We show that money growth provides a signal that is, in some, but not all circumstances, useful to predict inflation. Our model shows, in fact, that the strength of this signal has not been uniform, as would be implied by a simple linear relationship between money growth and inflation, but is relevant in those episodes, such the early 1980s and the recent post-pandemic phase, when the risk of high inflation has been clearly anticipated by rapid money growth. Our results also explain why during the period starting with the 1990s and ending just before the pandemic, money growth had apparently ceased to provide any useful signal to predict inflation. In other words, the money growth- inflation relationship is non-linear, with faster money growth signaling a higher probability of entering a “High” inflation regime, in this way providing a sharper assessment of the risks to price stability.

Amisano G. and Colavecchio R. (2025), “Monetary aggregates and inflation: A new view on an old relationship”, BCL working papers 195, Central Bank of Luxembourg.

Amisano G., R. Colavecchio and G. Fagan (2014), “A money-based indicator for deflation risk”, Hamburg University, Department Wirtschaft und Politik Macroeconomics and Finance Series Discussion Paper 3/2014.

Amisano, G. and Fagan G. (2013), “Money growth and inflation: A regime switching approach”, Journal of International Money and Finance, 33, 118-145.

In the US, money supply (M2) grew at record year-on-year rates from February 2020 through 2022 but has declined at record rates since late 2022.

Our analysis uses quarterly data and therefore “one-step ahead” refers to the next quarter.

These were periods in which the level and/or the volatility and of inflation were particularly high, as Figure 1 shows. The model assigns these periods to the third regime, labelled “High” inflation regime.