This policy brief was written by Luc Laeven (Director General, Directorate General Research, European Central Bank), Angela Maddaloni (Head of Section, Directorate General Research, European Central Bank) and Caterina Mendicino (Adviser, Directorate Monetary Policy, European Central Bank). This article summarises some of the key analytical findings and policy implications that have emerged from research by ECB staff conducted as part of the ECB Research Task Force (RTF) on monetary policy, macroprudential policy and financial stability. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank and the Eurosystem.

The main goal of this policy brief is to provide a research-based overview on monetary policy, macroprudential policy and financial stability. We focus on two sets of questions addressed by recent research carried out within the ECB’s Research Task Force on monetary policy, macroprudential policy and financial stability.1 First, we analyse what the potential trade-offs are that monetary and macroprudential policies face. Second, we explore the spillovers among these policies and how do they interact.

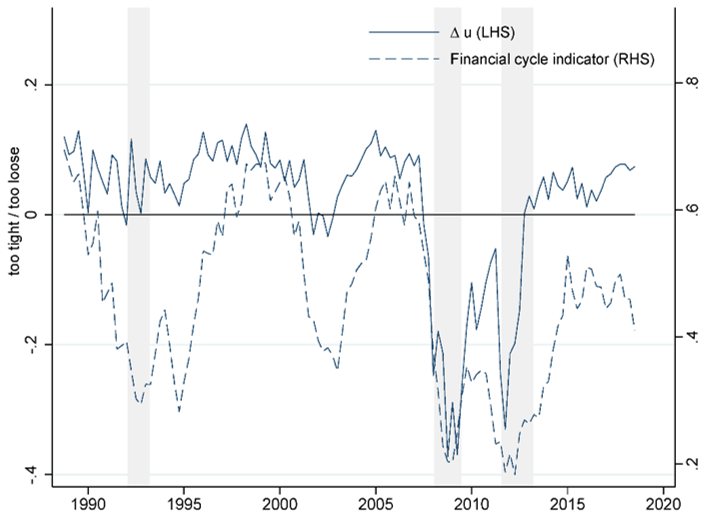

The solid line in Figure 1 plots the results of a counterfactual exercise which at each specific point in time measures the gains of tightening macroprudential tools to build-up buffers which are then released once the crisis starts. The fact that it is almost always in positive territory means that the net benefits of tightening macroprudential tools have been positive most of the time in the euro area.

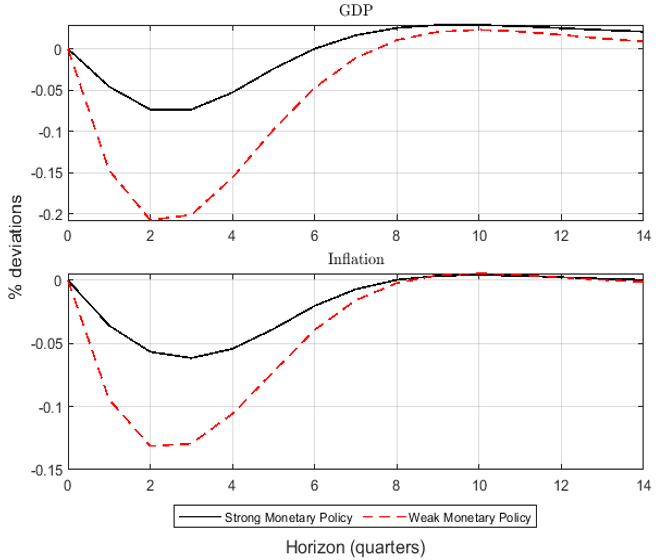

Central bank asset purchases can also have important consequences for bank vulnerability. Karadi and Nakov (2021) argue that in the presence of binding financial constraints, asset purchases are effective in offsetting the negative impact of a financial shock. Output and lending spreads are perfectly stabilized, as well as inflation. In addition, asset purchases also mitigate the initial drop in bank equity caused by the financial shock. However, by avoiding an increase in lending spreads, central bank asset purchases may reduce bank profitability over time and slow down the recapitalization of the banking sector.

From an empirical point of view it is, however, quite difficult to assess how these two policies interact because they operate through common transmission channels. To provide an empirical assessment of the interaction of policies, Altavilla, Laeven and Peydró (2021) use granular credit register data for euro area countries and they show that monetary and macroprudential reinforce each other, and that this effect depends on the amount of bank capital. It follows from this analysis that the complementary effects of accommodative macroprudential and monetary policies are state dependent, being stronger when bank capital is low.

Heider, F. and Leonello, A. (2021), “Monetary policy in a low-rate environment: Reversal rate and risk taking”, Working Paper Series, No 2593, ECB.

See Laeven, Maddaloni and Mendicino (2022) for a detailed review of the key analytical findings and policy implications that have emerged from ECB staff’s research developed under the ECB Research Task Force on monetary Policy, macroprudential policy and financial stability.

The counterfactual exercise simulate forward the GDP growth rate yt+h and the growth shortfall GSt,t+h at any time t+h with h=1,…12. Hence the objective function for each of the two scenarios (active vs passive macroprudential policy) is defined as follows ut(scenario)=yt+1:t+12(scenario)+0.50 GSt,t+1:t+12(scenario). See eq. (17) in Chavleishvili el al. (2021).