The views and conclusions stated are the responsibility of the individual authors, and do not necessarily reflect the views of Danmarks Nationalbank.

We estimate how monetary policy shocks originating from the European Central Bank (ECB) transmit to the Danish economy, which maintains a fixed exchange rate vis-á-vis the euro. Leveraging high-frequency changes in asset prices around policy announcements, we disentangle pure monetary policy shocks from adjustments driven by the ECB’s reaction to economic circumstances. Our analysis reveals that contractionary monetary policy measures adopted by the ECB reduces economic activity and prices in Denmark, in line with standard theoretical models of the transmission of monetary policy in small open economies. To gauge the driving forces behind the response of Danish consumer prices, we furthermore show that the appreciation of the Danish krone against non-euro currencies plays a pivotal role by reducing the price of imported goods.

Central banks recently tightened monetary policy to combat the extraordinary inflation surge in the aftermath of the Covid-19 pandemic. Key to the success of this endeavour is understanding how monetary policy transmission works and at what strength it delivers its goals. Despite a wealth of empirical studies available to policymakers, the bulk of research predominantly centers on major economies like the Unites States and the euro area, leaving, if any, scant evidence specific to smaller economies.

In a recent paper, we empirically investigate the transmission of ECB monetary policy shocks to Denmark (Larsen and Weissert, 2024). Denmark presents a compelling case study due to its fixed exchange rate policy vis-á-vis the euro, which implies a tight correlation between Danish and ECB monetary policy rates. According to standard economic models, an increase in ECB monetary policy rates should lead to a dampening effect on economic activity and prices in Denmark. Our analysis corroborates these theoretical expectations and provides empirical evidence of the alignment between data and theory. In result, our findings affirm that monetary policy is an effective tool for combating inflation, also via a fixed exchange rate regime conducted by a small economy like Denmark.

Any empirical analysis of the transmission of monetary policy faces a significant challenge: separating exogenous monetary policy changes from those driven by economic conditions. This is a complex task as central banks typically craft monetary policy in reaction to prevailing economic circumstances. In consequence, naïve correlations from data are contaminated by reverse causality biases. To address this issue, we isolate exogenous shocks to the ECB’s conventional monetary policy by leveraging high-frequency changes in asset prices around monetary policy announcements (see e.g. Jarocínski and Karadi, 2020).

To estimate the effects of ECB monetary policy shocks on Danish macroeconomic variables, we employ Bayesian Local Projections (Ferreira, Miranda-Aggripino and Ricco, forthcoming). This allows for a data-driven approach to optimally balance the trade-off between bias and variance inherent in two models commonly used to estimate impulse-response functions: vector autoregressions and local projections.

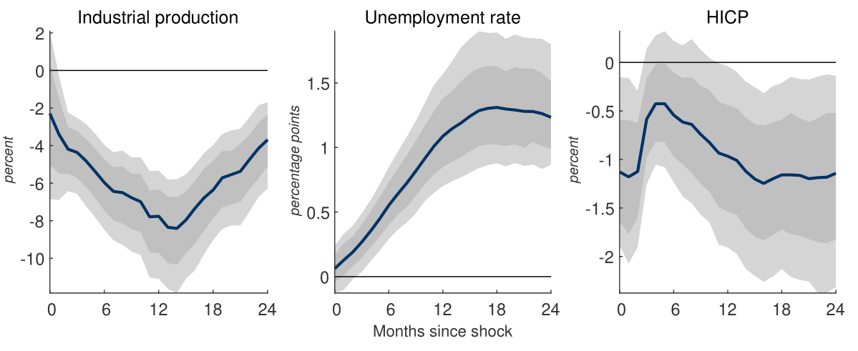

Our main finding is that ECB monetary policy strongly transmits to the Danish economy. Contractionary monetary policy by the ECB leads to a decline in activity, as measured by industrial production, an increase in the unemployment rate, as well as a decline in prices (Figure 1). Furthermore, our findings show that the effects of monetary policy manifest both at long and short lags: while the complete effect materializes after one year, the Danish economy also responds significantly upon impact. Our results on the short lags of monetary policy transmission in Denmark adds to a strand of recent research that has similarly identified this phenomenon in the US, the euro area, and the UK (Jarocínski and Karadi, 2020; Miranda-Aggripino and Ricco, 2021; Bauer and Swanson, 2023; Cesa-Bianchi, Thwaites and Vicondoa, 2020).

Figure 1: Response of industrial production, unemployment rate and HICP to monetary policy shocks

Note: Solid lines show the median impulse-response functions, which are normalized to have a 1 percentage point effect on 3-month money market rates on impact. Light (dark) shaded areas correspond to 90% (68%) posterior coverage bands.

Our modelling framework allows us to compare the ECB monetary policy transmission in Denmark to that in the euro area. In related work, we estimate that the transmission in Denmark closely mirrors that in the euro area, both in terms of magnitude and timing (Danmarks Nationalbank, 2024). This finding implies that a monetary policy rate change by the ECB does not necessitate a Danish fiscal policy response. Indeed, there is considerable co-movement between the economies of Denmark and the euro area (Spange, 2022).

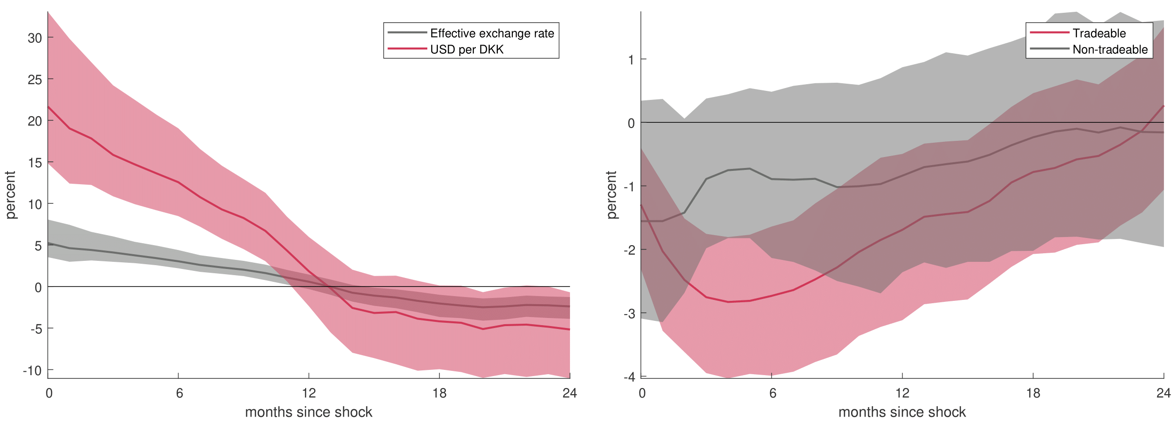

Contractionary monetary policy by the ECB also leads to an immediate appreciation of the Danish krone against non-euro currencies through an appreciation of the euro (Figure 2, left). Given that Denmark is a small and very open economy, exchange rate movements and their impact on import prices could be an important channel through which ECB monetary policy affects overall consumer prices in Denmark, especially at short lags. We investigate this by exploiting input-output tables to split subcategories of the Danish harmonized consumer price index into goods and services with high non-euro area import shares, i.e. tradables, and low non-euro area import shares, i.e. non-tradables. Our analysis reveals that the price response of tradables is statistically significant and large, while the response of non-tradables is insignificant (Figure 2, right).

Figure 2: Response of exchange rates and prices of tradables/non-tradables to monetary policy shocks

Note: Solid lines show the median impulse-response functions, which are normalized to have a 1 percentage point effect on 3-month money market rates on impact. Shaded areas correspond to 90% posterior coverage bands. The effective exchange rate refers to a trade-weighted average of currencies (left figure). Tradeable refers to the harmonized consumer price index for products with above-median extra-euro area import share, while non-tradeable refers to the price index for products with below-median extra-euro area import share (right figure).

Bauer, M.D., and Swanson, E.T. (2023). A Reassessment of Monetary Policy Surprises and High-Frequency Identification. NBER Macroeconomics Annual, vol. 37.

Ferreira, L. N., S. Miranda-Agrippino and G. Ricco (forthcoming). Bayesian Local Projections. The Review of Economics and Statistics.

Cesa-Bianchi, A., Thwaites, G., and Vicondoa, A. (2020). Monetary policy transmission in the United Kingdom: A high frequency identification approach. European Economic Review, vol. 123.

Danmarks Nationalbank (2024). Effects of increases in monetary policy rates. Danmarks Nationalbank Analysis, no. 5.

Jarocinski, Marek and Peter Karadi (2020). Deconstructing Monetary Policy Surprises—The Role of Information Shocks. American Economic Journal: Macroeconomics, vol. 12(2).

Larsen, Rasmus B. and Christoffer J. Weissert (2024). Monetary policy transmission in Denmark. Danmarks Nationalbank Working Paper, no. 198.

Miranda-Aggripino, S. and Ricco G. (2021). The transmission of monetary policy shocks. American Economic Journal: Macroeconomics, vol. 13(3).

Spange, Morten (2022). Monetary and fiscal policy in Denmark. Danmarks Nationalbank Analysis, no. 12.