The views expressed in this column are the responsibility of the authors and do not necessarily reflect the position of the Bank of Greece and the National Bank of Greece.

Abstract

This study examines the impact of monetary policy shocks on the macroeconomic performance of 20-euro area countries. In doing so, it assesses how variations in the characteristics of the banking system affect the transmission of monetary policy. The main results show that a contractionary monetary policy shock reduces both inflation and retail sales while increasing the unemployment rate. In contrast, an expansionary monetary policy shock has positive but much milder effects on the economy. Monetary policy has a stronger effect in economies with banking systems that have higher profitability, risk exposure, and lower assets to GDP ratios. The main results hold when we consider alternative definitions of monetary policy shocks.

Monetary policy has played a decisive role in recent years in stabilizing the economy and reducing inflation both in Europe and in other countries of the world. According to Mishkin (1995), monetary policy changes can be transmitted to the economy through several channels. The asset price channel works by influencing the value of assets, which affects household wealth and spending. The interest rate channel operates by altering borrowing costs and savings incentives, impacting on consumption and investment. The exchange rate channel affects the value of a country’s currency, influencing trade competitiveness and economic activity. Lastly, the credit channel changes the availability of loans, affecting businesses’ and consumers’ ability to spend and invest. Furthermore, parts of the literature have identified the cost channel as a key factor contributing to the price puzzle, where increased borrowing costs are passed on to final product prices, leading to short-term inflationary pressures even during monetary tightening (Christiano et al., 1997). Moreover, the risk-taking channel suggests that during periods of expansionary monetary policy, banks tend to take on greater risks in an effort to boost profitability (Abbate and Thaler, 2023).

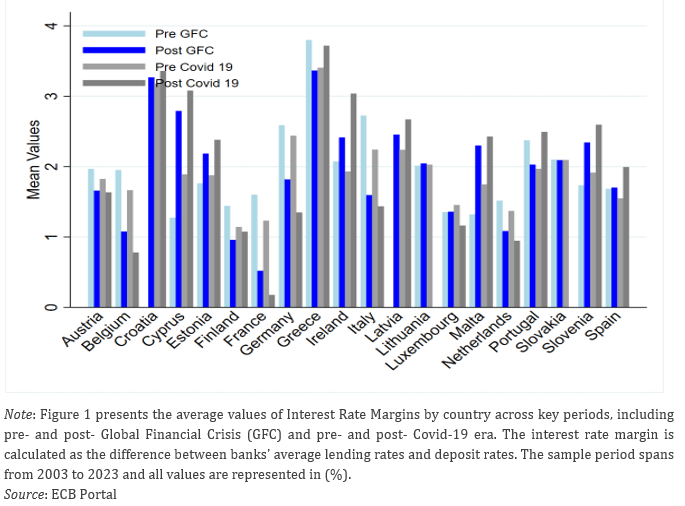

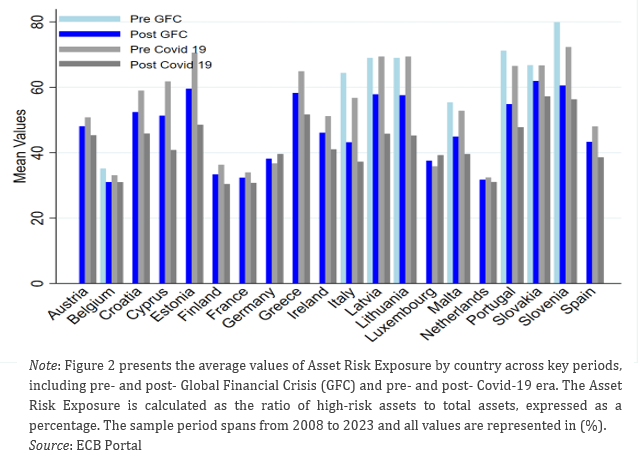

Motivated by recent developments, this column investigates the effects of expansionary and contractionary monetary policy shocks, obtained from Altavilla et al (2019), on inflation, retail sales, and unemployment across 20-euro area countries, from January 2000 to October 2023. Moreover, we also explore how the effects of monetary policy shocks vary depending on specific banking characteristics, including profitability, size, funding costs, and risk exposure. The starting point for examining the impact of specific banking characteristics on the monetary policy transmission mechanism stems from the significant heterogeneity that exists between banking systems in euro area countries. For example, as shown in Figures 1 and 2, there are significant differences between euro area banking systems in terms of interest rate margins and asset risk exposure. These differences, which are also observed in other banking characteristics, may affect the monetary policy transmission mechanism (see e.g., Altavilla et al., 2024; Choi et al.,2022).

Figure 1. Interest Rate Margins by Country

Figure 2. Asset Risk Exposure by Country

We expect that a more concentrated banking system will be associated with higher market power, which will manifest itself in higher profit margins (Corvoisier et al.,2002). Banking concentration can increase financing obstacles and makes financing more expensive, as banks charge higher interest rates (Beck et al.,2004; Gödl-Hanisch 2022), negatively affecting economic activity. In this context, a monetary policy shock will be transmitted more easily to retail interest rates, thus leading to larger reductions in inflation and economic activity.

Moreover, banks facing higher asset-risk exposure could respond more aggressively to policy shifts to manage their risk profiles. When a contractionary monetary policy is implemented, banks that have higher risk on their assets begin to face higher potential losses and volatility. This may lead them to tighten their lending standards and raise loan rates to mitigate risk (Altunbas et al., 2009). As a result, inflation, output and employment will be affected the most.

Our baseline specification1 reveals that contractionary monetary policy shocks have a stronger impact on the economy than expansionary monetary policy shocks. Furthermore, we show that there is significant heterogeneity in the transmission of monetary policy, which is associated with various characteristics of the banking sector. More specifically, we show that the effects of monetary policy are more pronounced in countries with banking systems that exhibit higher profitability, have fewer bank assets, increased funding costs, and greater asset-risk exposure.

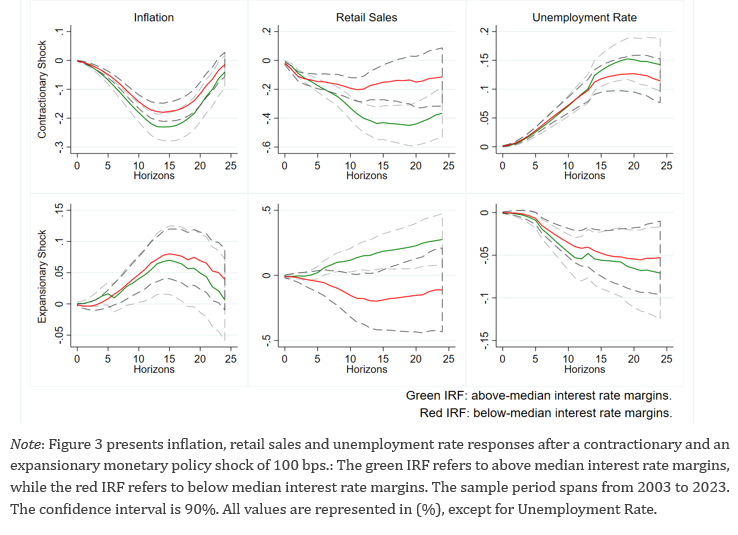

As shown in Figure 3, a contractionary monetary policy shock has a much stronger negative impact on inflation and retail sales and a positive impact on unemployment in high interest rate margin banking systems (green lines) than in low interest rate margin banking systems (red lines). When an expansionary shock occurs, retail sales increase much more strongly in high interest rate margin banking systems (green lines) than in low interest rate margin banking systems, while the response of inflation and unemployment is almost identical regardless of the interest rate margin (see Figure 3).

Figure 3. Responses to a 100 bps contractionary vs expansionary monetary policy shock, depending on banks’ interest rate margin

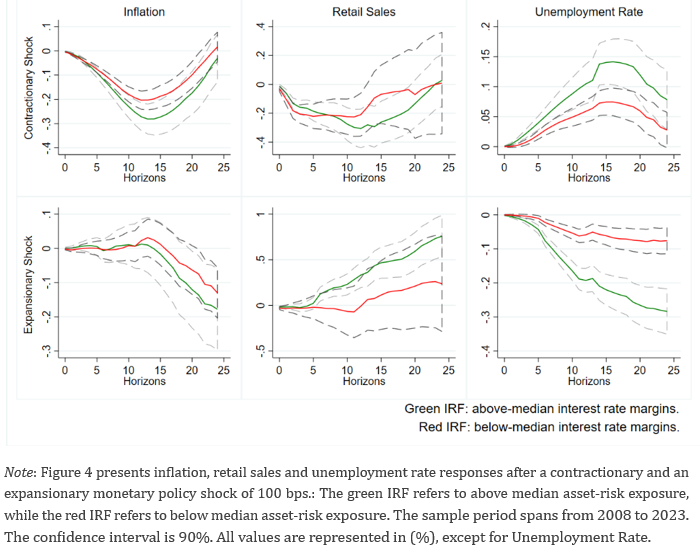

As shown in Figure 4, after a contractionary monetary policy shock, inflation and retail sales fall more and unemployment rise more sharply in banking systems with high asset-risk exposure (green line) than in banking systems with low asset-risk exposure (red lines). In the case of an expansionary monetary policy shock, inflation and retail sales rise more in the medium term, while unemployment falls much more sharply in banking systems with higher asset-risk exposure (green line).

Figure 4. Responses to a 100 bps contractionary vs expansionary monetary policy shock, depending on banks’ asset risk exposure

The findings of the study (for more details see Mermelas and Tagkalakis, 2024) highlight the importance of the banking sector in the transmission of monetary policy. Economies with banking systems characterized by higher profitability, greater bargaining power, elevated funding costs, increased asset-risk exposure, and lower amount of total assets to GDP exhibit more pronounced responses to monetary policy shocks. This supports the notion that the structure and health of the banking sector play a critical role in amplifying or dampening the effects of monetary policy interventions. These differences in the transmission of monetary policy are mitigated by the common supervision of significant banks under the Single Supervisory Mechanism (SSM). However, they remain a source of risk and divergence in the monetary policy transmission mechanism as long as the Banking Union remains incomplete, particularly due to the absence of a common deposit insurance scheme and other crucial components.

Abbate, A., & Thaler, D. (2023). Optimal monetary policy with the risk-taking channel. European Economic Review, 152, 104333.

Altavilla, C., Brugnolini, L., Gürkaynak, R. S., Motto, R., & Ragusa, G. (2019). Measuring euro area monetary policy. Journal of Monetary Economics, 108, 162-179.

Altavilla, C., Gürkaynak, R. S., & Quaedvlieg, R. (2024). Macro and micro of external finance premium and monetary policy transmission. ECB Working Paper Series, No 2934.

Altunbas, Y., Gambacorta, L., & Marques-Ibanez, D. (2009). Securitisation and the bank lending channel. European Economic Review, 53(8), 996-1009.

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2004). Bank competition and access to finance: International evidence. Journal of Money, Credit and Banking, 36(3), 627-648.

Choi, S., Willems, T., & Yoo, S. Y. (2024). Revisiting the monetary transmission mech anism through an industry-level differential approach. Journal of Monetary Economics, 103556.

Christiano, L. J., Eichenbaum, M., & Evans, C. L. (1997). Sticky price and limited partic ipation models of money: A comparison. European Economic Review, 41(6), 1201-1249.

Corvoisier, S., & Gropp, R. (2002). Bank concentration and retail interest rates. Journal of Banking & Finance, 26(11), 2155-2189.

Gödl-Hanisch, I. (2022). Bank concentration and monetary policy pass-through. FDIC Center for Financial Research Paper, (2022-06).

Mermelas G., and A. Tagkalakis, (2024) Monetary policy transmission: the role of banking sector characteristics in the Euro area, Bank of Greece, Working Paper No 332, November.

Mishkin, F. S. (1995). Symposium on the monetary transmission mechanism. Journal of Economic Perspectives, 9(4), 3-10.

See Mermelas and Tagkalakis (2024) for the full set of results.