References

Afonso, G, L Logan, A Martin, W Riordan and P Zobel (2022): “How the Fed’s overnight reverse repo facility works”, Liberty Street Economics, January.

Aldasoro, I, T Ehlers and E Eren (2022): “Global banks, dollar funding, and regulation”, Journal of International Economics, no 137, 103609.

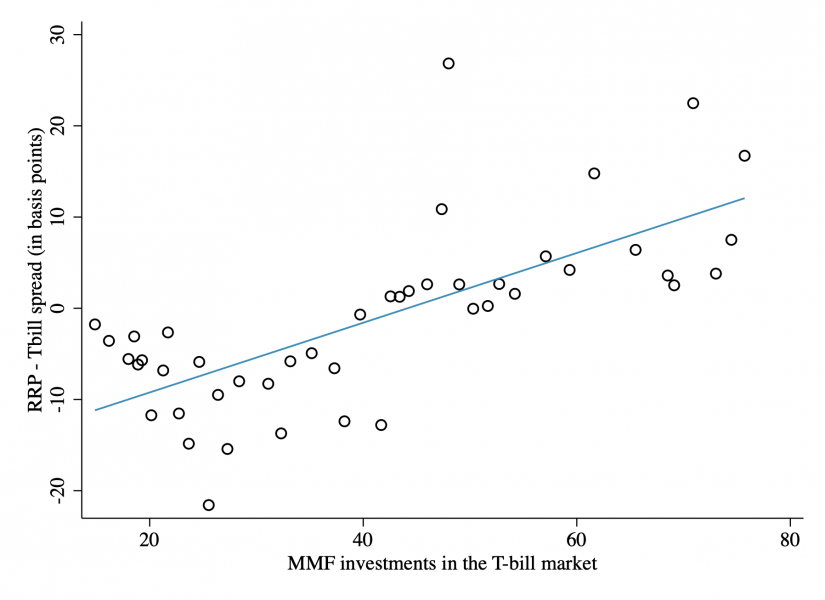

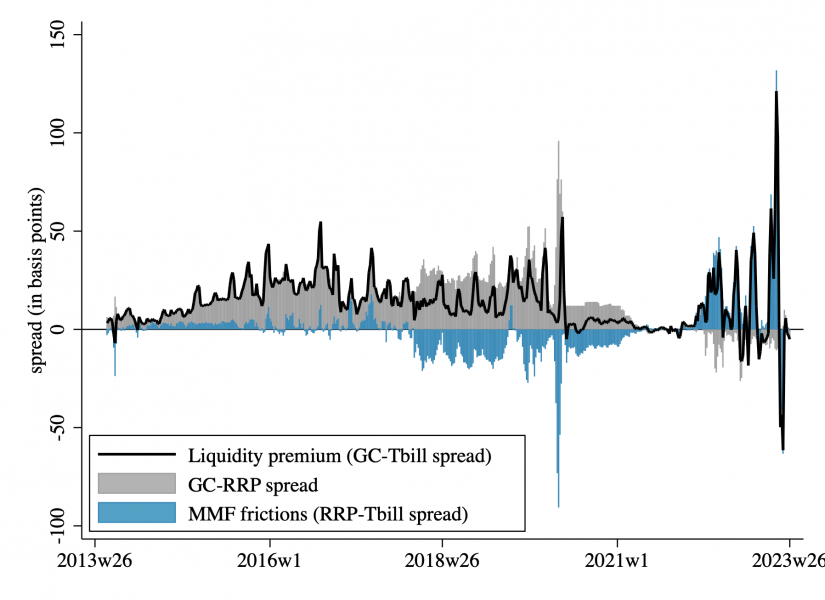

Doerr, S, E Eren and S Malamud (2023): “Money market funds and the pricing of near-money assets”, BIS Working Paper, no 1096.

Drechsler, I, A Savov and P Schnabl (2017): “The deposits channel of monetary policy”, The Quarterly Journal of Economics, vol 132, no 4, pp 1819–76.

Greenwood, R, S G Hanson and J C Stein (2014): “A comparative-advantage approach to government debt maturity”, The Journal of Finance, no 70 (4), pp 1683–1722.

Krishnamurthy, A and A Vissing-Jorgensen (2012): “The aggregate demand for treasury debt”, Journal of Political Economy, no 120 (2), pp 233–267.

Nagel, S (2016): “The liquidity premium of near-money assets”, The Quarterly Journal of Economics, no 131 (4), pp 1927–1971.

Xiao, K (2020): “Monetary transmission through shadow banks”, The Review of Financial Studies, vol 33, no 6, pp 2379–420.