References

Ash, E., Gauthier, G., & Widmer, P. (2021). Text Semantics Capture Political and Economic Narratives. Available at SSRN 3970603.

Barra. (1998). Global Equity Model (GEM) Handbook. BarraOne.

Bemanke, B., & Harold, J. (1991). The Gold Standard, Deflation, and Financial Crisis in the Great Depression: An International Comparison. NBER Chapters, pp. 33–68.

Bernanke, B. S. (2004). The Great Moderation. Washington, DC.

Bernanke, B. S. (2015). Why are Interest Rates so Low, Part 2: Secular Stagnation. Available at The Brookings Institution Blog.

Blanqué, P. (2010). Money, Memory and Asset Prices. Economica.

Bollen, J., Mao, H., & Zeng, X. (2011). Twitter Mood Predicts the Stock Market. Journal of Computational Science, 2(1), pp. 1–8.

Caldara, D., & Iacoviello, M. (2018). Measuring Geopolitical Risk. FRB International Finance Discussion Paper, (1222).

Campbell, J. Y., & Shiller, R. J. (1998). Valuation Ratios and the Long-run Stock Market Outlook. Journal of Portfolio Management, 24(2), pp. 11–26.

Chen, N.-F., Roll, R., & Ross, S. A. (1986). Economic Forces and the Stock Market. Journal of Business, 59(3), pp. 383–403.

Clarida, R. H. (2021). Federal Reserve Independence: Foundations and Responsibilities: a Speech at the Federal Reserve Bank of Cleveland, Cleveland, Ohio, November 30, 2021 (tech. rep.).

Coibion, O., & Gorodnichenko, Y. (2011). Monetary Policy, Trend Inflation, and the Great Moderation: an Alternative Interpretation. American Economic Review, 101(1), pp. 341–370.

Consoli, S., Pezzoli, L. T., & Tosetti, E. (2021). Emotions in Macroeconomic News and their Impact on the European Bond Market. Journal of International Money and Finance, 118, pp. 102472.

Denev, A., & Amen, S. (2020). The Book of Alternative Data. Standards Information Network.

Eichengreen, B. (2010). Lessons from the Marshall Plan.

Eichengreen, B., & Mitchener, K. J. (2004). The Great Depression as a Credit Boom Gone Wrong. Research in economic history. Emerald Group Publishing Limited.

Fama, E. F. (1984). The Information in the Term Structure. Journal of Financial Economics, 13(4), pp. 509–528.

Fisher, I. (1933). The Debt-Deflation Theory of Great Depressions. Econometrica, pp. 337–357.

Fortes, R., & Le Guenedal, T. (2020). Tracking ECB’s Communication: Perspectives and Implications for Financial Markets. Available at SSRN 3791244.

Friedman, M., & Schwartz, A. J. (1963). A Monetary History of the United States, 1867–1960. NBER Books.

Giraud, Y. (2021). Review of “Narrative Economics: How Stories Go Viral & Drive Major Economic Events” by Robert J. Shiller.

Gordon, R. J., & Stock, J. H. (1998). Foundations of the Goldilocks Economy: Supply Shocks and the Time-varying NAIRU. Brookings papers on economic activity, 1998(2), pp. 297–346.

Hansen, A. H. (1939). Economic Progress and Declining Population Growth. American Economic Review, 29(1), pp. 1–15.

Joyce, M., Miles, D., Scott, A., & Vayanos, D. (2012). Quantitative Easing and Unconventional Monetary Policy – an Introduction. The Economic Journal, 122(564), pp. F271–F288.

Kahneman, D. (2011). Thinking, Fast and Slow. Macmillan.

Klement, J. (2021). Geo-Economics: The Interplay between Geopolitics, Economics, and Investments. CFA Institute Research Foundation.

Knot, K. (2015). The Role of Central Banks; the Netherlands Bank and Sustainable Finance. Opening speech by Mr Klaas Knot, President of the Netherlands Bank, at the Sustainable Finance Seminar, organized by the United Nations Environmental Program and the Sustainable Finance Lab, and hosted by the Netherlands Bank, Amsterdam, 27 November 2015.

Leetaru, K., & Schrodt, P. A. (2013). Gdelt: Global Data on Events, Location, and Tone, 1979–2012. ISA Annual Convention, 2(4), pp. 1–49.

Lepetit, F., Le Guenedal, T., Ben Slimane, M., Cherief, A., Mortier, V., Sekine, T., & Stagnol, L. (2021). The Recent Performance of ESG Investing, the Covid-19 Catalyst and the Biden Effect. Available at SSRN 3946483.

Lopez, D. A. (2012). The Great Inflation: a Historical Overview and Lessons Learned. Page One Economics Newsletter, (Oct), pp. 1–4.

Lundberg, S. M., & Lee, S.-I. (2017). A Unified Approach to Interpreting Model Predictions. Advances in Neural Information Processing Systems 30 (NIPS 2017), pp. 4768–4777.

Nassirtoussi, A. K., Aghabozorgi, S., Wah, T. Y., & Ngo, D. C. L. (2014). Text Mining for Market Prediction: A Systematic Review. Expert Systems with Applications, 41(16), pp. 7653–7670.

Olteanu, A., Castillo, C., Diaz, F., & Vieweg, S. (2014). Crisislex: A Lexicon for Collecting and Filtering Microblogged Communications in Crises. Eighth international AAAI conference on weblogs and social media.

Powell. (2021). Powell Says Economy Making Real Progress, But Not for Everyone. https://www.bloomberg.com/news/articles/2021-05-03/powell-says-economy-making-real-progress-but-disparities-weigh

Rogoff, K. (2003). Globalization and Global Disinflation. Economic Review-Federal Reserve Bank of Kansas City, 88(4), pp. 45–80.

Romer, C. D. (1992). What Ended the Great Depression? The Journal of Economic History, 52(4), pp. 757–784.

Roos, M., & Reccius, M. (2021). Narratives in Economics. Available at arXiv: 2109.02331.

Rosenberg, B. (1974). Extra-market Components of Covariance in Security Returns. Journal of Financial and Quantitative Analysis, 9(2), pp. 263–274.

Schnabel, I. (2021). Keynote Speech by Isabel Schnabel, Member of the Executive Board of the ECB. VIII. New Paradigm Workshop, organised by the Forum New Economy.

Schwartz, H. M. (2021). Global Secular Stagnation and the Rise of Intellectual Property Monopoly. Review of International Political Economy, pp. 1–26.

Semet, R., Roncalli, T., & Stagnol, L. (2021). ESG and Sovereign Risk: What is Priced in by the Bond Market and Credit Rating Agencies? Available at SSRN 3940945.

Shapley, L. (1953). The Value of N-Person Games. Annals of Mathematical Studies, 28, pp. 307–317.

Shiller, R. J. (2000). Irrational Exuberance. Philosophy and Public Policy Quarterly, 20(1), pp. 18–23.

Shiller, R. J. (2017). Narrative Economics. American Economic Review, 107(4), pp. 967–1004.

Shiller, R. J. (2020a). Narrative Economics: How Stories Go Viral and Drive Major Economic Events. Princeton University Press.

Shiller, R. J. (2020b). Popular Economic Narratives Advancing the Longest U.S. Expansion 2009–2019 [SI: Growth and Trade in the United States and Europe]. Journal of Policy Modeling, 42(4), pp. 791–798.

Smart, G. (1999). Storytelling in a Central Bank: The Role of Narrative in the Creation and Use of Specialized Economic Knowledge. Journal of Business and Technical Communication, 13(3), pp. 249–273.

Summers, L. H. (2015). Have we Entered an Age of Secular Stagnation? IMF Fourteenth Annual Research Conference in Honor of Stanley Fischer, Washington, DC. IMF Economic Review, 63(1), pp. 277–280.

Temnikova, I. P., Castillo, C., & Vieweg, S. (2015). EMTerms 1.0: A Terminological Resource for Crisis Tweets. Proceedings of the 12th International Conference on Information Systems for Crisis Response and Management (ISCRAM).

Tilly, S., Ebner, M., & Livan, G. (2021). Macroeconomic Forecasting Through News, Emotions and Narrative. Expert Systems with Applications, 175, pp. 114760.

World Economic Forum. (2022). Global Risk Report 2022.

Yellen, J. L. (2015). Inflation Dynamics and Monetary Policy. Speech at the Philip Gamble Memorial Lecture, University of Massachusetts, Amherst Available at FED website.

Zacks, J. M., & Tversky, B. (2001). Event Structure in Perception and Conception. Psychological Bulletin, 127(1), pp. 3–21.

A. Complementary Materials

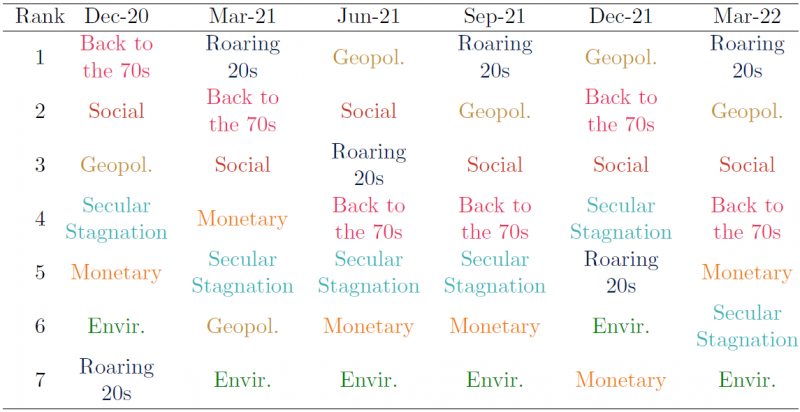

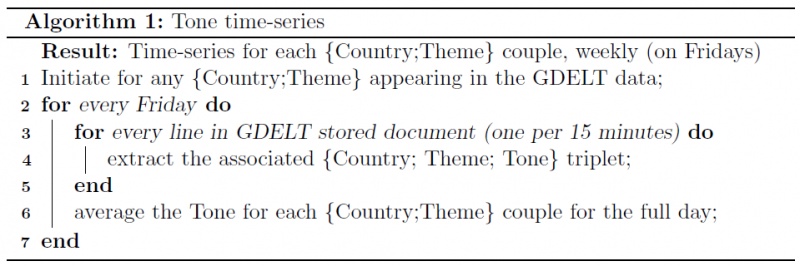

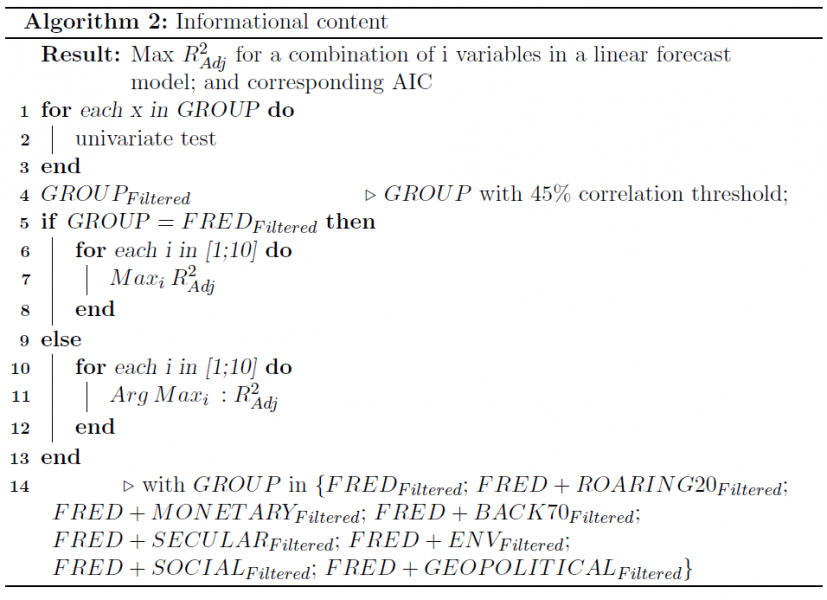

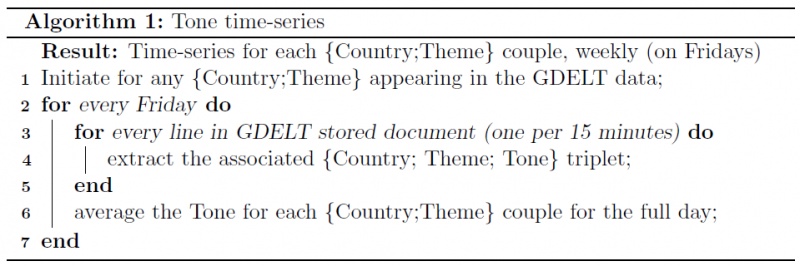

A.1 Algorithms and Informational Content

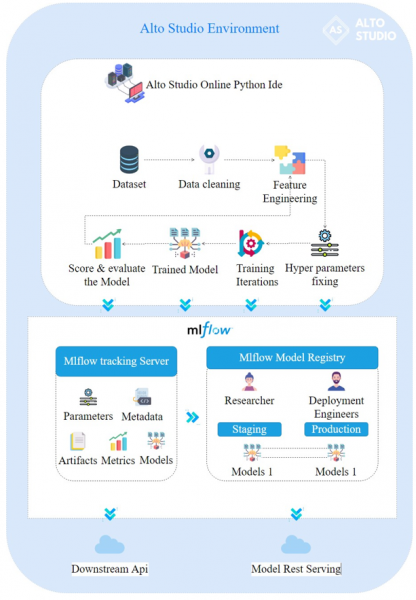

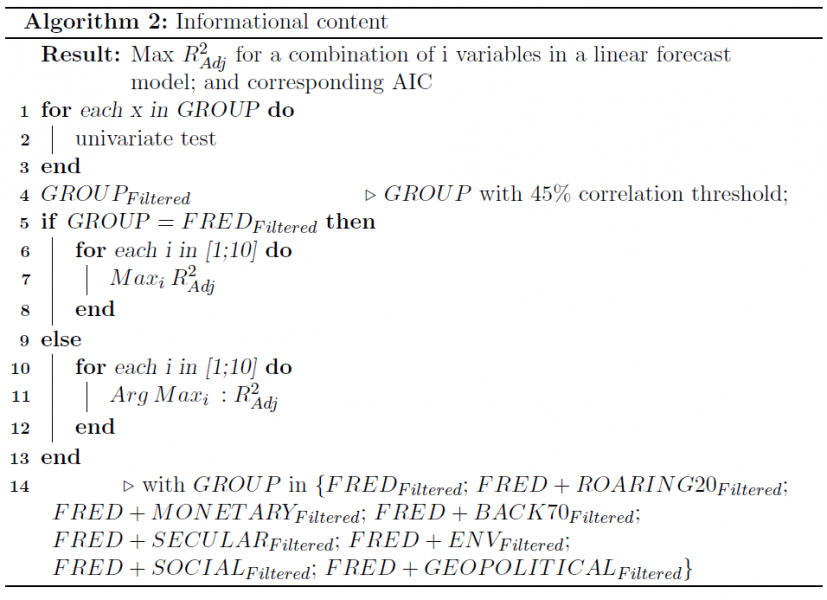

Figure 14: Machine Learning Process

Source: Amundi Institute.

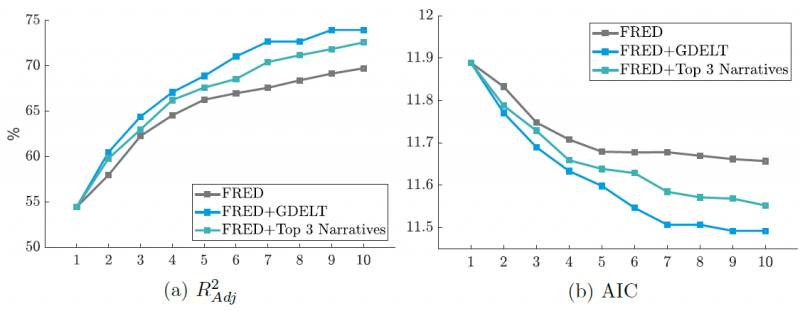

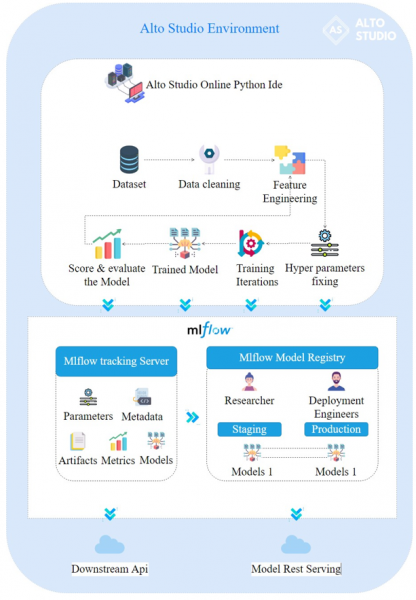

Figure 15: Informational Content Associated with Top 3 Narratives

Source: Amundi Institute. Authors’ calculations

A.2 Definition of Narratives

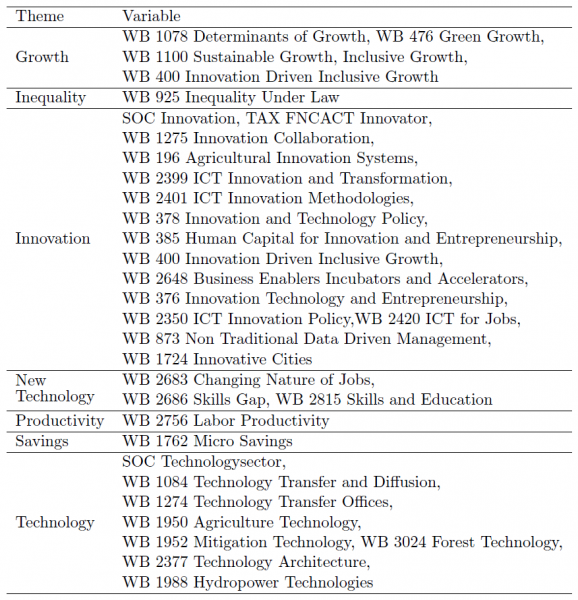

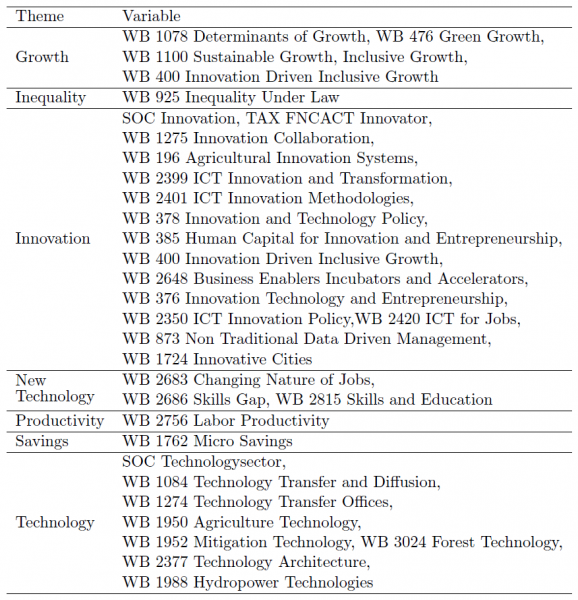

Table 6: Roaring 20s – GDELT Selected Identifiers with United-States Filter

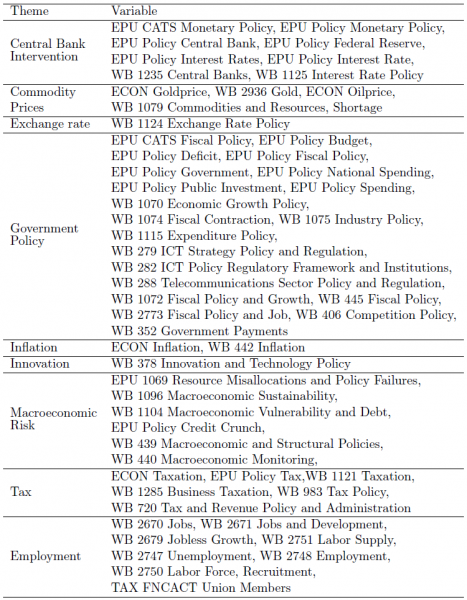

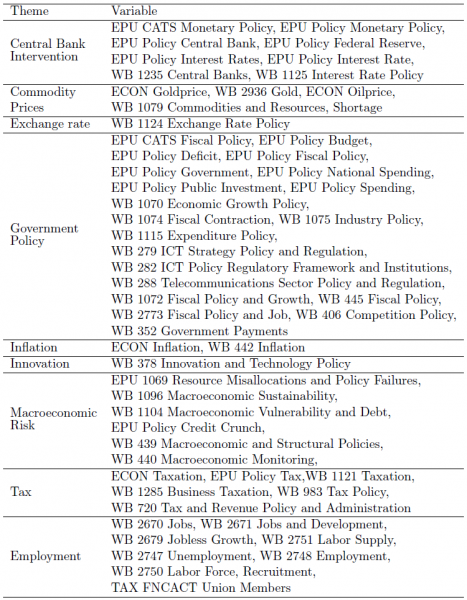

Table 7: Back to the 70s – GDELT Selected Identifiers with United-States Filter

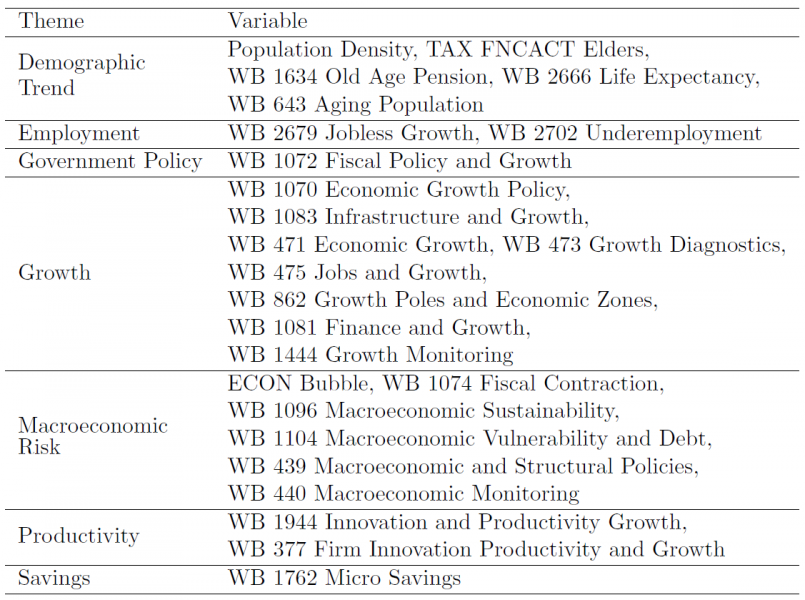

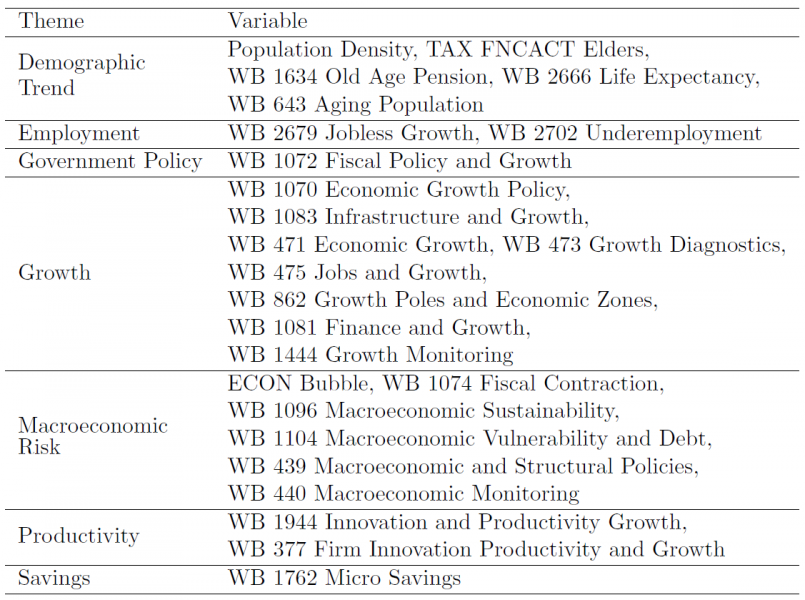

Table 8: Secular Stagnation – GDELT Selected Identifiers with United-States Filter

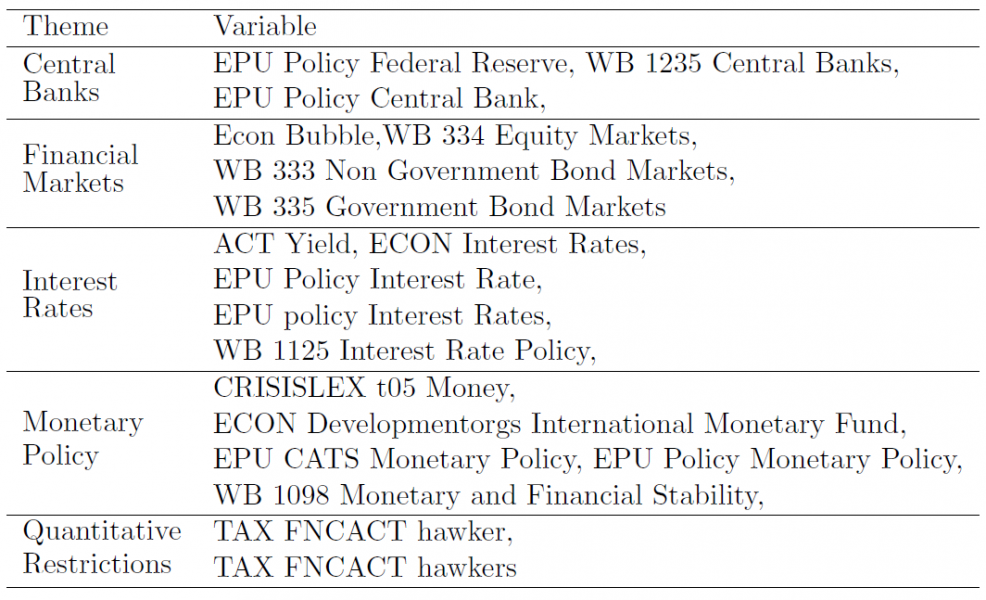

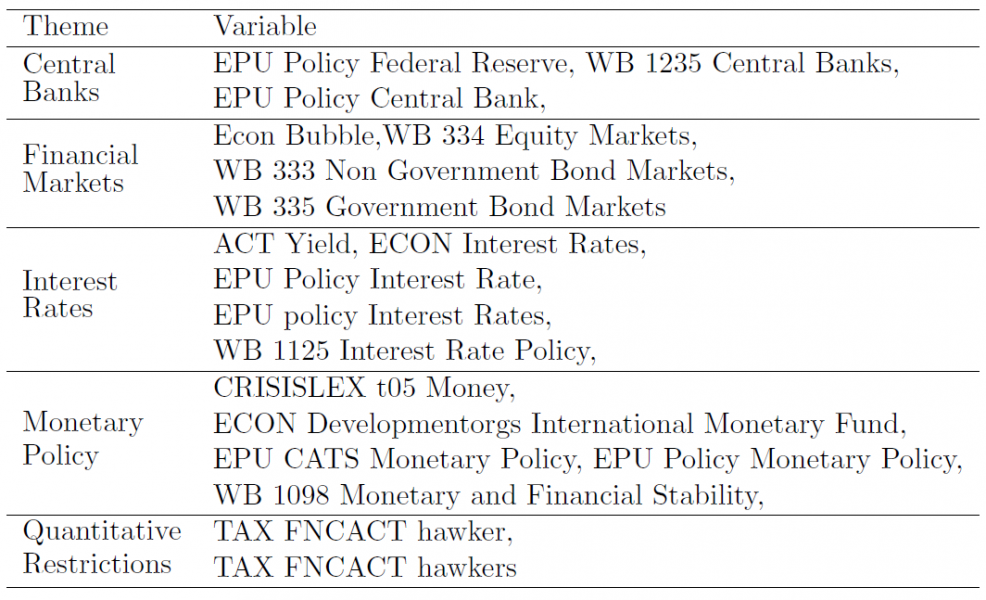

Table 9: Monetary – GDELT Selected Identifiers with United-States filter

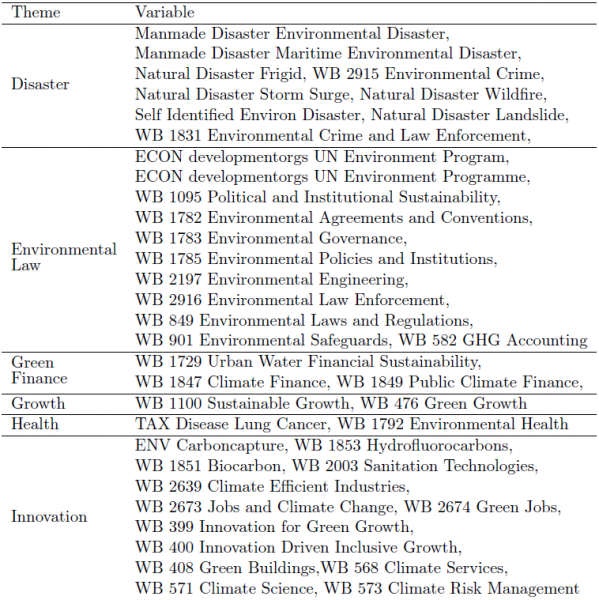

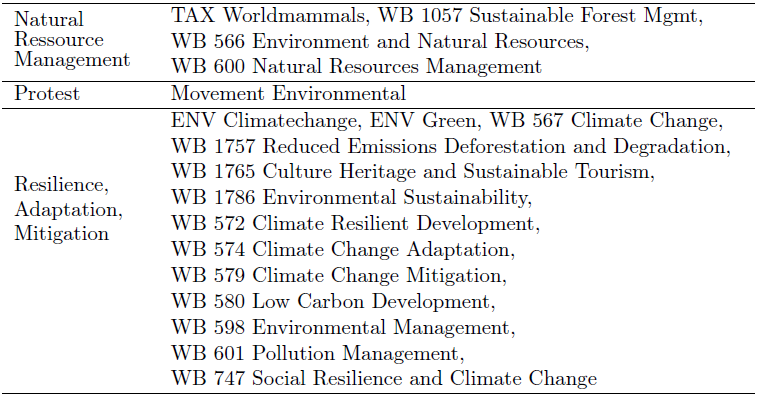

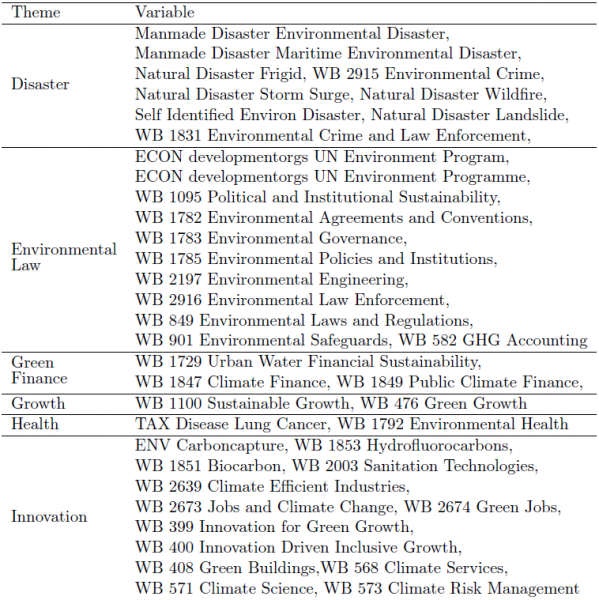

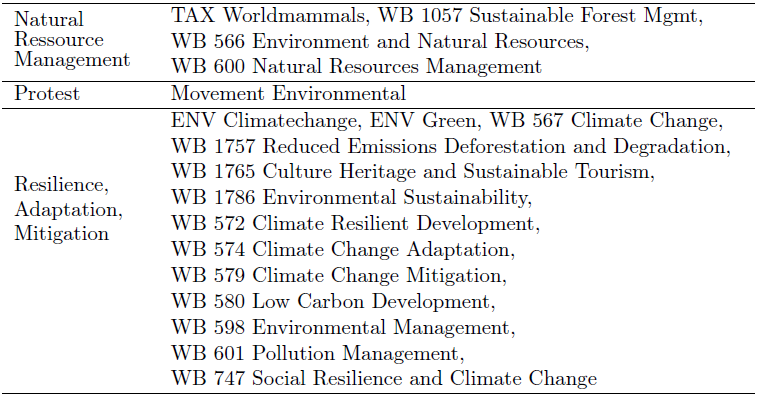

Table 10: Environment – GDELT Selected Identifiers with United-States filter

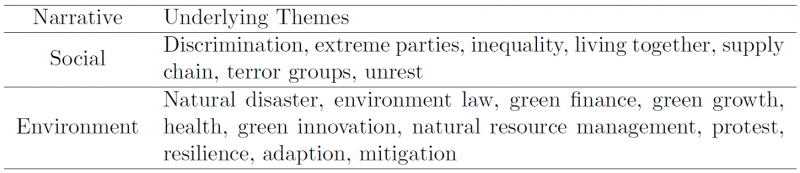

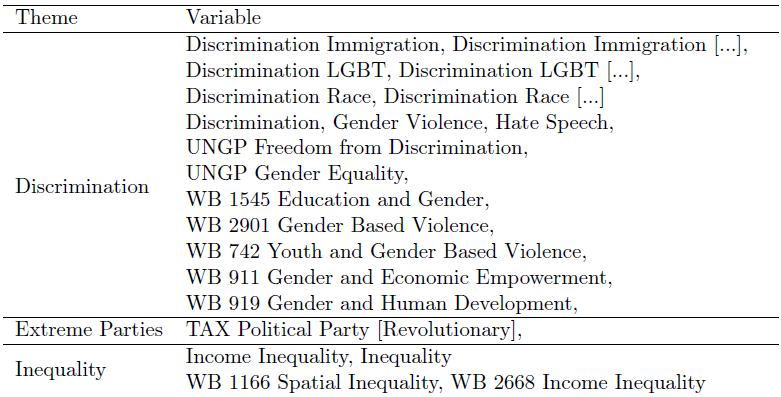

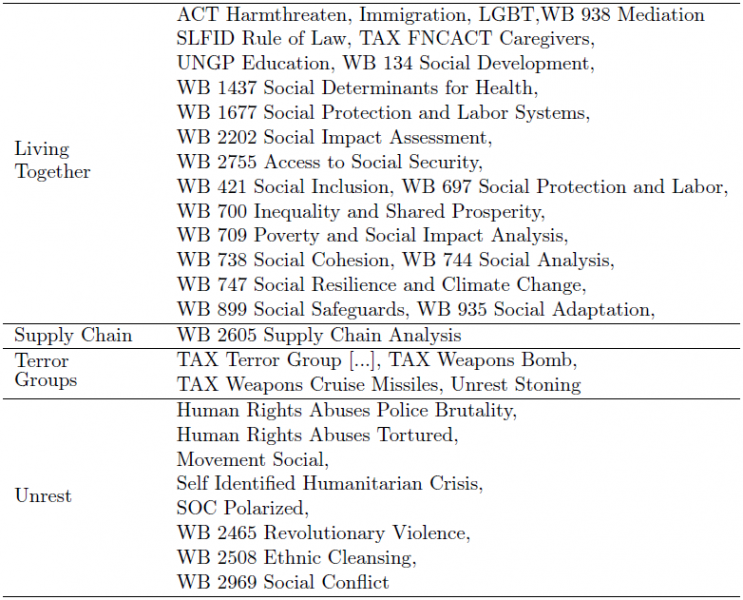

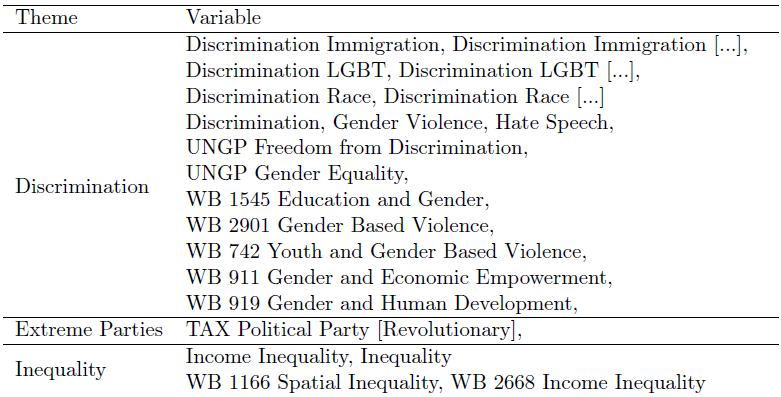

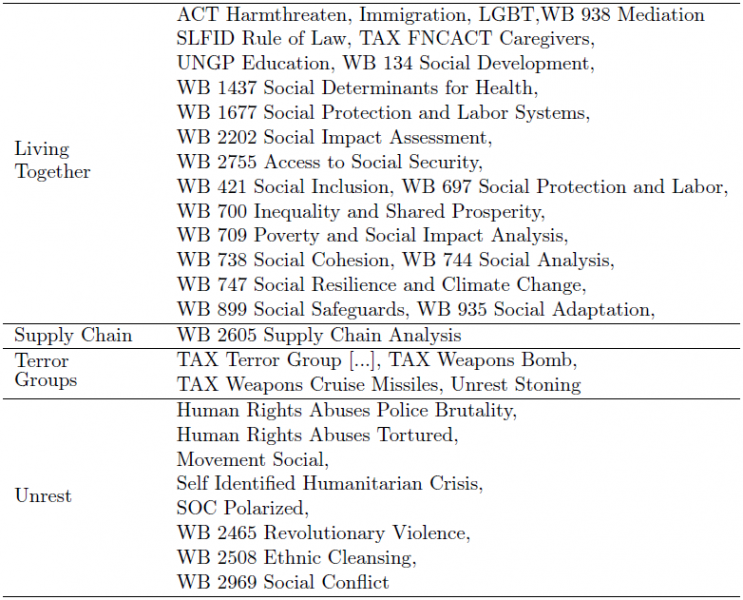

Table 11: Social – GDELT Selected Identifiers with United-States filter

Notes: For variables denoted […] we actually retrieve all the variables with at least one count over the period of analysis that begins with the same prefix. For instance, there are many groups under the prefix Discrimination Immigration, such as Discrimination Immigration Attacks on Immigrants or Discrimination Immigration Xenophobia. For extreme parties, we selected those whose labels contained the term “revolutionary”.

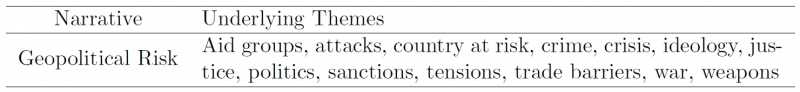

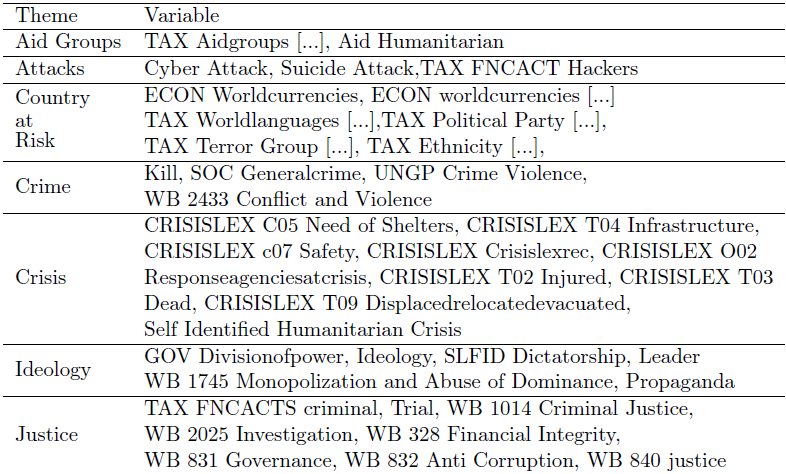

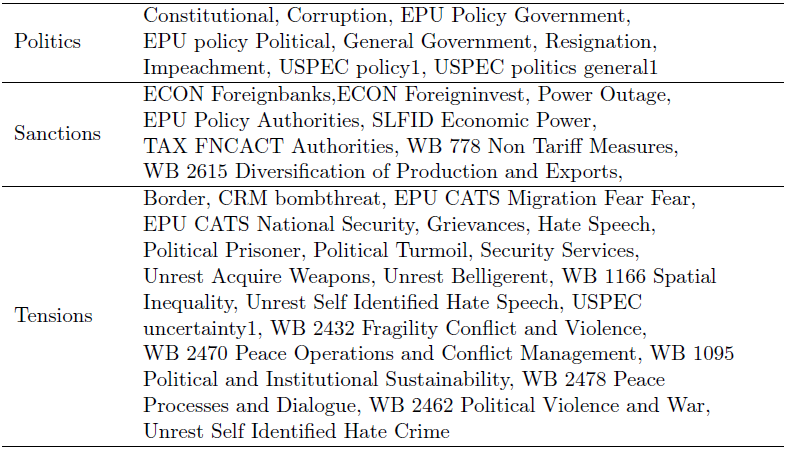

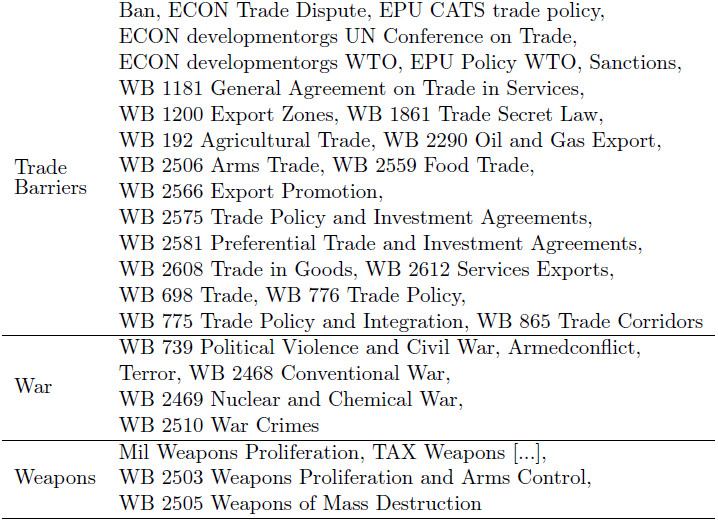

Table 12: Geopolitical Risk – GDELT Selected Identifiers with United-States filter

Notes: For the TAX Aidgroups variables denoted […] we actually retrieve all the metrics with at least one count over the period of analysis that begins with the same prefix. For instance, there are many groups under the prefix TAX Aidgroups, such as TAX Aidgroups Amnesty International or TAX Aidgroups Red Cross. Similarly, for Weapons, we selected all the different types, ranging for instance from TAX Weapons Landmines to TAX Weapons Surface to Air Missile. For the country at risk, we retrieve the top 20 countries that are assimilated to “ennemies” in a survey available at https://today.yougov.com/topics/politics/articles-reports/2017/02/02/americas-friends-and-enemies. For each of these countries, we retrieve metrics related to the national language, political party, terror group, ethnicity and currency when available.