Brexit has created significant challenges for policymakers in the European Union (EU), particularly in the financial sector, as the UK is now outside its regulatory framework. The EU-UK Trade and Cooperation Agreement includes a very thin financial sector chapter and thus a limited basis for regulatory cooperation. This policy brief discusses recent trends in financial sector regulation in the UK, divergence between the EU and the UK, and the threats posed by this divergence for financial stability in the EU, based on a report for the ECON Committee of the European Parliament. In the medium to long term, the UK is expected to diverge actively from the EU regulatory framework, with a focus on flexibility, common law principles-based approach, competitiveness, growth, and innovation. Such divergence could deepen regulatory fragmentation and undermine financial stability. The brief also elaborates on ways to deepen regulatory cooperation.

Brexit poses unique challenges for financial sector policymakers in the European Union (EU) as the most important financial centre in Europe is now outside its regulatory framework (Beck and others, 2022). At the same time, the United Kingdom (UK) regards its financial sector as a potential growth engine and has been embarking on regulatory reforms to further strengthen the status of the UK as a global financial centre (Edinburgh Reforms, 2022 and TIGRR Report, 2021). In a recent report for the European Parliament, we summarise and discuss recent trends in financial sector legislation and regulation in the UK, divergence between the EU and the UK and threats from this divergence for financial stability in the EU (Petit and Beck, 2023). Critically, we assess the equivalence policy and strategy of the EU towards the UK and options to deepen regulatory cooperation while ensuring financial stability, market integrity and competitiveness.

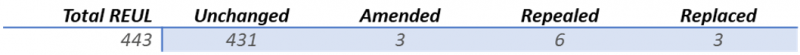

The UK’s approach to regulation will lead to the transfer of most rules from statutory level to the regulators’ rulebook, reinforcing the UK tradition of common law and principles-based approach to regulation. Greater responsibility for regulators is one important objective of the recently introduced Financial Services and Markets Bill that intends to amend, repeal or replace specific retained EU law that impacts financial services and insurance activities. This bespoke regulatory overhaul is led in parallel to the Retained EU Law (Revocation & Reform) Bill, a politically controversial bill, which might also raise implementation challenges considering the breadth of the thousands of acts to amend, repeal or replace. In addition, secondary objectives would be added for regulators to ‘facilitate, subject to aligning with relevant international standards, the international competitiveness of the UK economy (including in particular the financial services sector) and its growth in the medium to long term’ (Hunt, 2022). The secondary objectives of growth and international competitiveness would then differentiate the UK regulators’ mandate from its EU counterparts that have a mandate for financial stability, market integrity and investor protection, while protecting the level playing field in the EU Single Market.

While there has been thus limited divergence so far, we can expect substantial divergence across different segments of the financial sector during the next five to ten years.

While an extensive Trade and Cooperation Agreement (TCA) was agreed in December 2020 between the UK and the EU, it includes a very thin financial sector chapter, with eight out of 783 articles directly covering this sector. Deeper cooperation in the financial sector has so far been held back by the stand-off over the Northern Ireland Protocol. The resolution of this conflict through the Windsor Framework might allow for closer cooperation between the UK and the EU in several policy sectors, but there are a number of impediments. While a Memorandum of Understanding that allows for regulatory cooperation on Financial Services, including the establishment of a Joint UK-EU Regulatory Forum (UK Government, March 2021), is now likely to finally go ahead, the European Commission has made it clear that it sees any action that allows access to the EU’s financial market by third country providers as a unilateral decision, not subject to negotiation, as we will discuss in the following.

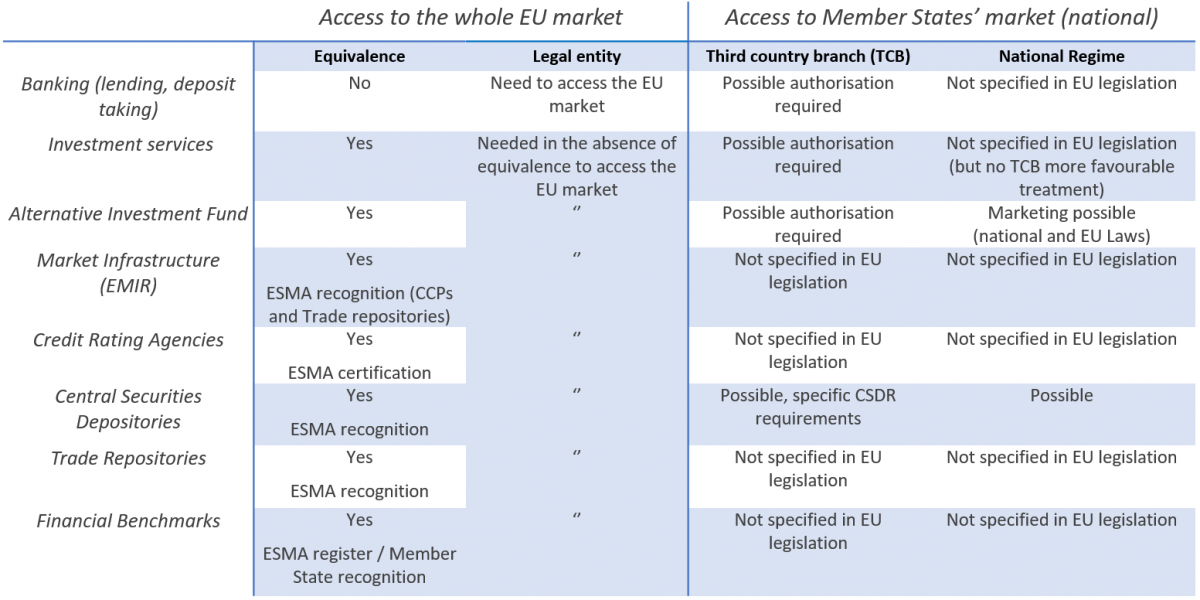

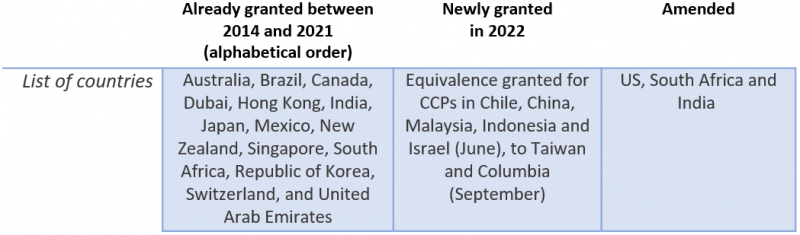

One specific challenge for European authorities is the treatment of CCPs in London. On the one hand, there is the intention to build more clearing capacity with infrastructures within the EU, in particular with the legislative proposals from the European Commission to develop further the EU Capital Markets Union in December 2022 (European Commission, 2022).3 On the other hand, there are financial stability concerns on having a large part of transactions be cleared outside the EU. Supervisory cooperation is therefore critical, but equivalence decisions are not exclusively driven by technical criteria but also by (legal/political) risks stemming from a scenario where such an equivalence would be withdrawn. All in all, equivalence decisions are contingent, limited in scope and require reciprocity. The 2022 legislative proposals from the European Commission show a tightening of equivalence regime in the financial sector.

UK Government, “Retained EU Law Dashboard Updated 30 January 2023,” Tableau Software, 2023, https://public.tableau.com/views/UKGovernment-RetainedEULawDashboard/Guidance?%3Adisplay_static_image=y&%3AbootstrapWhenNotified=true&%3Aembed=true&%3Alanguage=en-US&:embed=y&:showVizHome=n&:apiID=host0#navType=0&navSrc=Parse; together with data from UK Government, ‘Retained EU Law Dashboard – Excel Sheet’ (GOV.UK, 30 January 2023) <https://www.gov.uk/government/publications/retained-eu-law-dashboard> accessed 31 January 2023.

J Deslandes, C Dias and M Magnus, ‘Third Country Equivalence in EU Banking and Financial Regulation’ (2019) PE 614.495 EGOV In-depth analysis.

European Commission, “Communication from the Commission to the European Parliament, the Council, the European Central Bank and the European Economic and Social Committee – A Path Towards a Stronger EU Clearing System,” COM(2022) 696 final § (2022).