This policy brief is based on ECB Working Paper, Series No 2931. The views expressed in this article belong to the authors and do not necessarily reflect those of the European Central Bank.

Abstract

US mutual fund managers actively rebalance their sovereign portfolios towards safe government bonds that offer relatively higher returns, in particular euro-denominated securities. The size of the effect is large, leading to a change in portfolio share by around one percentage point on average in response to a change by one percentage point in the currency-specific excess return, without hedging currency risk. However, hedging currency risk may alter relative returns for US based investors. Interestingly, US mutual funds shift towards currencies, such as the Japanese yen, that display large deviations in the covered interest parity and offer higher returns than US Treasuries on a currency-hedged basis. Deviations from international arbitrage conditions can then impact the incentives of investors to allocate their portfolios across currencies and in turn trigger substantial capital flows.

After the global financial crisis in 2008, a scarcity of safe assets emerged, generating a growing interest in the characteristics of these securities that command a premium for their safety and liquidity (Krishnamurthy & Vissing-Jorgensen, 2012), are information insensitive (Gorton, 2017) and whose demand is inelastic compared to riskier assets (Nenova, 2024). Understanding the drivers of demand for safe assets becomes even more important as geopolitical risk is on the rise following the war in Ukraine, sanctions on Russia by advanced economies and tensions in the Middle East, which might have long-term implications for the international monetary system. In a recent study (Graziano & Habib, 2024), we investigate the demand of safe government bonds by US mutual funds, a large and increasingly important sector investing in sovereign debt markets (Fang et al., 2023). We find that cross-currency yield differentials in the sovereign bond market of highly-rated issuers do affect the relative appeal of currencies for US mutual funds, shaping the overall demand for global safe assets. Therefore, even though safe assets may have a lower demand elasticity to yields compared to riskier assets, relative returns do matter within a portfolio of major issuers of safe government debt.

Importantly, we show that there are significant differences in the reaction to excess returns if currency risk is not hedged or it is hedged through derivatives. To a very large extent, government debt of major advanced economies is issued in domestic currency, so that the US dollar return of the portfolio of US mutual funds will be influenced by exchange rate movements of these currencies against the US dollar. Portfolio managers may decide to accept the currency risk or hedge it. We investigate the reaction of the portfolio shares of sovereign safe assets to both currency unhedged excess returns – i.e. the total return differential between US dollar debt and that issued in another currency – and currency hedged excess returns, relevant whenever asset managers use derivatives to neutralise the impact of fluctuations in the exchange rate of the US dollar against other currencies in the portfolio. Indeed, around 90% of US fixed income funds with an international focus use currency forwards to manage their foreign exchange exposure (Sialm & Zhu, 2022).

In theory, the Covered Interest Parity (CIP) condition should ensure that interest rate differentials match the forward premium or discount, i.e. the difference between the spot exchange rate and the forward one, which represents the cost of currency hedging operations. This way, the dollar return equals the return from investing in another currency that is hedged into dollars. In practice, the central role of the dollar in the international monetary system leads to sizeable deviations from CIP, due to the special safety and liquidity features of US Treasuries (Krishnamurthy & Vissing-Jorgensen, 2012) and to excess demand for dollar hedging in foreign exchange markets subject to frictions (Gabaix & Maggiori, 2015, Borio et al., 2016).

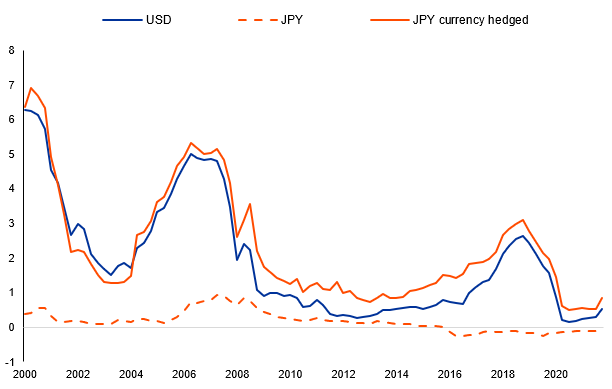

US-based investors may exploit CIP deviations to earn extra returns. Figure 1 shows a concrete example: on an unhedged basis, US Treasuries (solid blue line) yield higher returns than Japanese government bonds (dashed orange line) so that an investment in Japanese yen offers a lower return unless the investor expects that the yen will appreciate over the investment horizon. Under CIP, the return from an investment in US Treasuries and one in Japanese debt, currency hedged (solid orange line) should coincide. Instead, while the two lines tend to co-move, there are large discrepancies. On average, the returns are more than 50 basis points higher for an investment into Japanese debt, currency hedged, and display peaks up to 100 basis points. Most importantly, since the global financial crisis in 2008, the sign of this deviation is consistently positive, so that this risk-free excess return is predictable.

Figure 1. Returns for a US-based investor from USD and JPY government bonds (percent)

Notes: the blue line (USD) depicts average yields on US Treasuries in dollars. The dashed orange line (JPY unhedged) depicts the average yield of Japanese government bonds in yen. The solid orange line (JPY currency hedged) depicts the average yield of Japanese government bonds hedged into dollars. All yields are averaged over the 3 months, 1 year, 2 years, and 5 years maturities. Hedged returns are calculated based on forward contracts of the same maturity as the corresponding government bond. Source: Refinitiv Eikon and authors’ calculations.

Since the sign, size and predictability of CIP deviations against the dollar vary across major reserve currencies, the picture that emerges is one of significant heterogeneity in the incentives for US-based mutual funds investors to allocate their investment in a portfolio of safe sovereign bonds. Indeed, we find that US-based fund managers react differently to excess returns on an unhedged and hedged basis for different currencies.

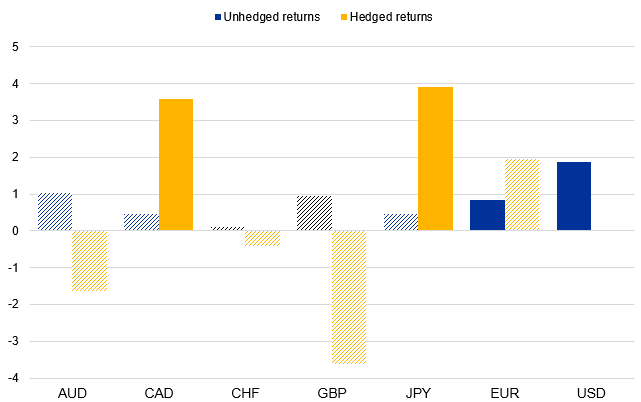

Figure 2 shows that a change by one percentage point in unhedged excess return leads to a change in portfolio shares by around one percentage point, on average in a sample of around 190 funds, across several currencies. This portfolio adjustment also has important implications for capital flows. For instance, an increase in the excess return of euro area government debt securities by one percentage point would trigger capital flows from the United States towards the euro area economies issuing highly-rated debt securities in the order of magnitude of $300 million, amounting to around 2 percent of total quarterly foreign flows into highly-rated euro area government debt securities, according to balance of payments data.

At the same time, currencies such as the Japanese yen, that offer lower returns on an unhedged basis, may still attract US-based institutional investors by offering relatively higher returns on a currency hedged basis. The reaction is particularly strong for the Japanese yen, with a one percentage point excess return on a hedged basis resulting in an increase in the portfolio share of Japanese sovereign bonds by almost four percentage points. These results reveal that US mutual funds do exploit the advantage conferred by their role of liquidity providers in the market for forward dollars. We also provide insights on the role of financial and monetary conditions for the sovereign portfolio shares of US mutual funds and for their sensitivity to excess returns. When global risk is on the rise, US mutual fund managers repatriate their investments towards US government debt securities, mainly at the expenses of euro-denominated ones. On the other hand, when US monetary policy rates are low, US fund managers respond more strongly to the excess returns of euro-denominated securities.

Figure 2. Impact of excess returns, unhedged or currency hedged, on the portfolio share of major currencies

Notes: the chart reports the coefficients associated with excess returns in a model of the currency share in the portfolio of highly-rated government debt securities. Shaded areas indicate that coefficients were not statistically significant, at least at the 5 percent level. See Graziano and Habib (2024) for further details.

Our results imply that capital flows between the United States and other major currency areas not only respond to push factors, as shown in the search for yield literature (Ammer et al., 2019), but also to pull factors like excess returns, even in the context of safe assets which are less sensitive to changes in yields compared to riskier assets. Furthermore, our findings suggest that, intriguingly, institutional investors actively exploit failures in arbitrage conditions once hedging currency risk, in turn affecting capital flows.

Ammer, J., Claessens, S., Tabova, A., & Wroblewski, C. (2019). Home country interest rates and international investment in U.S. bonds. Journal of International Money and Finance, 95(C), 212–227.

Borio, C., McCauley, R., McGuire, P., & Sushko, V. (2016). Covered interest parity lost: Understanding the cross-currency basis. BIS Quarterly Review.

Fang, X., Hardy, B., & Lewis, K. K. (2023). Who Holds Sovereign Debt and Why It Matters. BIS Working Papers, 1099.

Gabaix, X., & Maggiori, M. (2015). International Liquidity and Exchange Rate Dynamics. The Quarterly Journal of Economics, 130(3), 1369–1420.

Gorton, G. (2017). The history and economics of safe assets. Annual Review of Economics 9 (1), 547–586.

Graziano, M., & Habib, M. M. (2024). Mutual Funds and Safe Government Bonds: Do Returns Matter? ECB Working Paper No. 2024/2931.

Krishnamurthy, A., & Vissing-Jorgensen, A. (2012). The Aggregate Demand for Treasury Debt. Journal of Political Economy, 120(2), 233–267.

Nenova, T. (2024). Global or Regional Safe Assets: Evidence from Bond Substitution Patterns). Available at SSRN: https://ssrn.com/abstract=4736704.

Sialm, C., & Zhu, Q. (2022). Currency management by international fixed income mutual funds.pdf. Nanyang Business School Research Papers