This policy brief studies the trading behaviour of U.S. actively managed equity mutual funds during the COVID-19 market crash. It finds that Environmental, Social, and Governance (ESG) oriented funds helped to stabilize the market, but non-ESG funds also provided support for ESG stocks. All funds experiencing inflows increased their net purchases, but this behaviour was stronger for ESG funds. Non-ESG funds experiencing outflows increased their net sales, but this was limited to their holdings of non-ESG stocks.

Covid-19 pandemic resulted in a sudden stock market crash, unrelated to underlying economic conditions. Stock prices declined on average by close to 30 percent during the crash, but performance varied significantly across firms. Stocks with high Environmental, Social, and Governance (ESG) ratings performed better in February and March, 2020, with higher returns and lower volatility, relative to non-ESG stocks (Albuquerque, Koskinen, Yang, and Zhang 2020a, 2020b; Ding, Levine, Lin, and Xie 2020; Garel and Petit-Romec 2021). In addition, ESG-oriented actively managed mutual funds experienced fund inflows during the crisis period whereas other funds manifested increases in fund outflows (Pastor and Vorsatz 2020).

In Albuquerque, Koskinen and Santioni (2021), we connect these two streams of evidence by asking if the trading behaviour actively managed equity mutual funds contributed to the observed resiliency of ESG stocks during the crash. Recent evidence suggests that ESG fund investors are more loyal than other investors as they demonstrate less sensitivity to fund performance (Bollen 2007; Renneboog, Ter Horst, and Zhang 2008). Ergo, we postulate that this behaviour facilitates ESG-oriented fund managers to weather storms by avoiding fire sales and displaying loyalty towards their portfolio stocks.

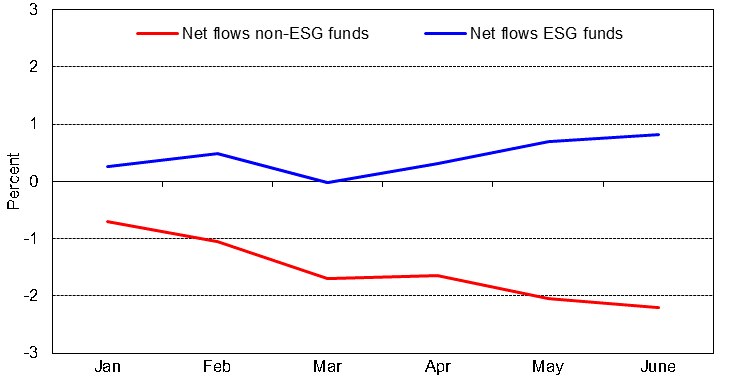

To test this hypothesis, we use the heterogeneity in fund flows into ESG and non-ESG actively managed U.S. equity mutual funds during the stock market crash of 2020. ESG funds generally experienced an increase in net flows during this period (Figure 1), except in March. In contrast, non-ESG funds experienced a pronounced decline in net flows through the whole period, especially starting in March. The exogenous crash that occurred in February and March 2020 is an ideal event where we can test for the loyalty of ESG and non-ESG mutual funds to ESG stocks and to non-ESG stocks.

Figure 1. Fund flows and sustainability rating

(as a percentage of Total Net Asset)

Notes: Morningstar Direct. This figure plots aggregate cumulative net fund flows from January 1 to June 30, 2020, using monthly fund flows, for two fund categories, those that receive by Morningstar 4 or 5 Globes (ESG funds) and those with less than 4 Globes (non-ESG funds).

In carrying out the analysis, we use a similar empirical model to that of Cella, Ellul, and Giannetti (2013) to study the trading behaviour of U.S. actively managed equity mutual funds during the first six months in 2020, paying special attention to the market crash months of February and March. Our main data source is a proprietary granular data set from Morningstar with portfolio holdings collected at the monthly frequency, instead of the commonly used, and publicly available quarterly data. The use of monthly data allows us to identify February and March of 2020 as the stock market crash months, as opposed to the first quarter, which would be the case if we were limited to using quarterly data.

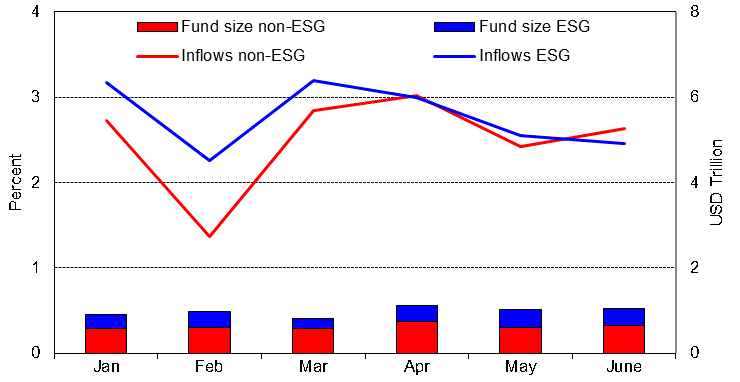

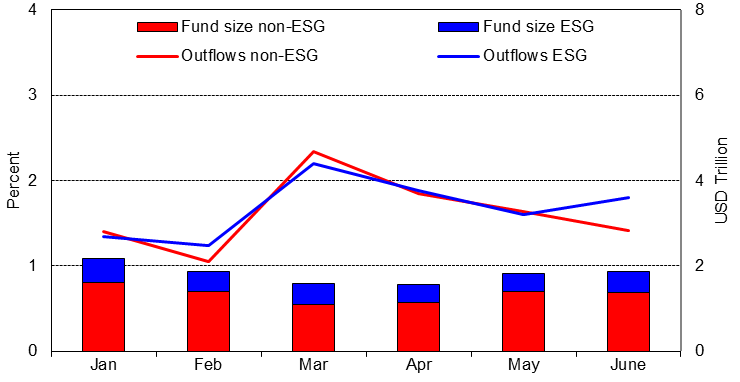

In our econometric analysis, fund-level net sales are a function of funds’ ESG-orientation, flows and fund size, a stock market crash dummy, as well as aggregate stock market returns and volatility. Fund-level ESG orientation is measured by different metrics provided by Morningstar. We denote as ESG funds those that report being ESG funds in their prospectus. In addition, ESG funds are those with 4 or 5 Morningstar Sustainability Globe ratings as of January 2020. As a third definition, ESG funds are those that receive a Low Carbon Designation from Morningstar as of January 2020. The main variables in our panel regressions are fund inflows and outflows obtained by separating funds based on whether they experienced relatively more gross inflows or more gross outflows. Figure 2 shows that ‘Inflows’ took a hit in February for both ESG and non-ESG funds, but especially for non-ESG funds. ‘Inflows’ recovered quickly by March, whereas ‘Outflows’ were slower to respond, plummeting in March. Furthermore, the figure shows that the funds experiencing ‘Outflows’ have double the total net assets compared to funds encountering ‘Inflows’, which is consistent with a declining industry trend. Note also that non-ESG funds are mostly responsible for this phenomenon.

Figure 2. Fund inflows and outflows and sustainability rating

(as a percentage of Total Net Asset)

(a) Inflows

(b) Outflows

Notes: Morningstar Direct. Panel A (Panel B) plots the weighted average of monthly Inflows (Outflows), weighted by lagged fund total net assets, from January 1 to June 30, 2020, for two categories of funds, those that receive by Morningstar 4 or 5 Globes (ESG funds) and those with less than 4 Globes (non-ESG funds). Inflows is equal to fund flow in month t divided by net assets under management in month t–1 if positive, otherwise zero. Outflows is equal to the absolute value of fund flow in month t divided by net assets under management in month t–1 if negative, otherwise zero.

Our first set of estimates show that, not surprisingly, fund flows are major determinants of net sales. Second, ESG funds reduced net sales during the crash. Third, the mitigating effect of inflows on net sales is always in place and it is more pronounced for ESG-funds compared to non-ESG funds, whether in the crash period or not. Overall, ESG funds buy more aggressively in response to inflows. Fourth, there is no difference in behaviour between ESG-oriented and other funds in response to outflows: outflows increased net sales for both ESG-oriented and other funds, whether in the crash period or not.

Our initial hypothesis assumes that funds trade their portfolio stocks in a uniform fashion, whether they are ESG or non-ESG funds. However, examining stock level holdings is important since we know that both ESG-oriented and other funds hold both ES and non-ES stocks in their portfolios. Ultimately, we are interested in uncovering the reason for why ES stocks exhibited resiliency during the crash. Fund managers’ portfolio allocation decisions may have contributed to the observed ES stock resiliency, in addition to mutual fund investor behaviour. We therefore study the portfolio stocks that funds chose to trade during the stock market crash by splitting each fund’s portfolio into ES stocks and non-ES stocks. In order to do so, we retrieved firm specific environmental and social scores in 2019 from Thomson Reuters’ Refinitiv, omitting the ‘G’ component as is commonly done in the literature (e.g. Albuquerque, Koskinen, and Zhang 2019).

We have two main findings. First, we find no difference in net sales for ESG and non-ESG funds toward ES versus non-ES stocks in response to fund inflows. Since we know from prior research (Pastor and Vorsatz 2020) that during the crash ESG-oriented funds were the ones that experienced inflows, we conclude that inflows to ESG-funds are a major reason why ES-stocks exhibited resiliency during the crash months of February and March. Second, while there is no difference in behaviour between ESG funds and other funds in response to outflows in terms of their aggregate net sales as indicated above, we find that funds’ behaviour displays significant heterogeneity toward ES and non-ES stocks. In particular, sensitivity of net sales to fund outflows increased during the crash for non-ES stocks for all fund types, but most remarkably, this does not hold for ES stocks. The sensitivity of net sales to outflows for ES stocks remained largely unchanged in the crash period for ESG-oriented and other funds. Recall that non-ESG funds were the ones that mostly experienced outflows. This implies that non-ESG funds contributed significantly to the observed resiliency of ES stocks. In related literature, Glossner, Matos, Ramelli, and Wagner (2021) find that institutional investors favoured stock with low debt and high cash balances during the COVID-19 market crash, but not stocks with better ES performance. This last result contrasts with what we find. The difference, we believe, is due to the more granular monthly holdings data that we have access to, but more research is needed to identify the disparities. Using monthly data in contrast to quarterly data is important given the significant monthly variations in fund flows observed in the first quarter of 2020.

Albuquerque, R., Y. Koskinen, S. Yang, and C. Zhang (2020a). “Love in the time of Covid-19: The resiliency of environmental and social stocks,” CEPR Covid Economics, 11, 35-56.

Albuquerque, R., Y. Koskinen, S. Yang, and C. Zhang (2020b). “Resiliency of environmental and social stocks: An analysis of the exogenous Covid-19 market crash,” Review of Corporate Finance Studies, 9, 593-621.

Albuquerque, R., Y. Koskinen, and R. Santioni (2021). “Mutual fund loyalty and ESG stock resilience during the COVID-19 stock market crash,” European Corporate Governance Institute, Finance Working Paper No. 782/2021, Available at SSRN: https://ssrn.com/abstract=3908464 or http://dx.doi.org/10.2139/ssrn.3908464

Bollen, N. P. B. (2007). “Mutual fund attributes and investor behavior,” Journal of Financial and Quantitative Analysis, 42, 683–708.

Cella, C., A. Ellul, and M. Giannetti (2013). “Investors’ horizons and the amplification of market shocks,” Review of Financial Studies, 26, 1607–1648.

Ding, W., R. Levine, C. Lin, and W. Xie (2020). “Corporate immunity to the COVID-19 pandemic,” Journal of Financial Economics, 141, 802–830.

Garel, A. and A. Petit-Romec (2021). “Investor rewards to environmental responsibility in the COVID-19 crisis,” Journal of Corporate Finance, 68, 101948.

Glossner, S., P. P. Matos, S. Ramelli, and A. F. Wagner (2021). “Do institutional investors stabilize equity markets in crisis periods? Evidence from Covid-19,” CEPR Discussion Paper 15070.

Pastor, L. and M. B. Vorsatz, (2020). “Mutual fund performance and flows during the Covid-19 crisis,” Review of Asset Pricing Studies, 10, 791–833.

Renneboog, L., J. Ter Horst, and C. Zhang (2008). “Socially responsible investments: Institutional aspects, performance, and investor behavior,” Journal of Banking and Finance, 32, 1723–1742.

This policy brief is based on Albuquerque, Koskinen and Santioni (2021). The views expressed in this article are those of the authors and do not necessarily represent the views of the institutions with which they are affiliated.