The views expressed in this paper are those of the authors and do not necessarily represent those of the European Central Bank.

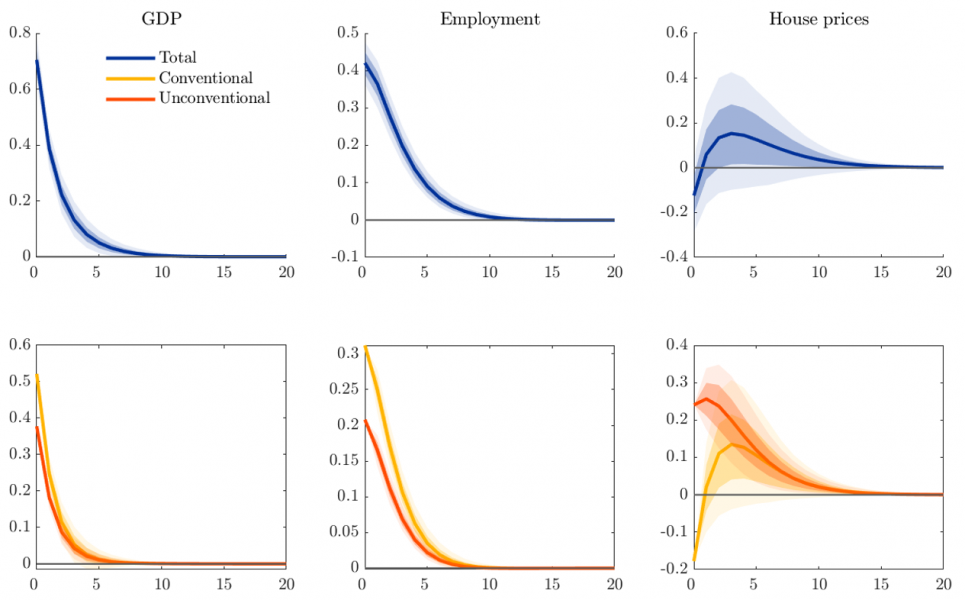

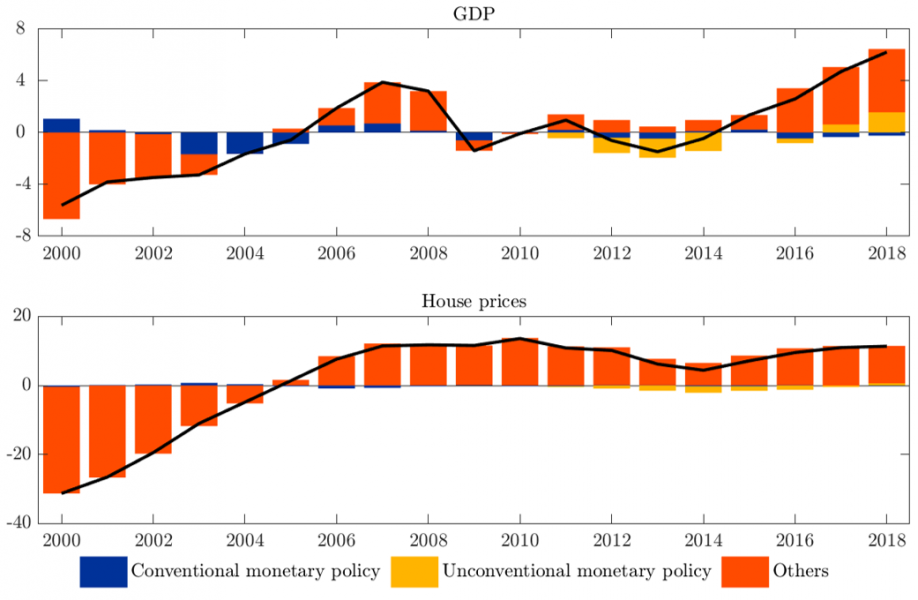

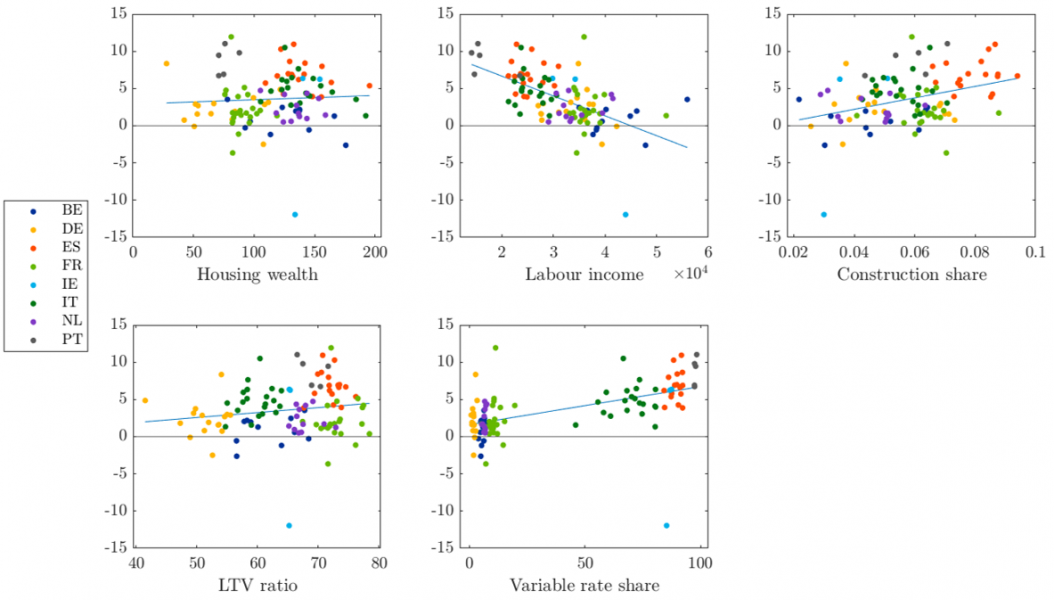

This analysis assesses the role of the housing market in the transmission of conventional and unconventional monetary policy across euro area regions. By exploiting a novel regional dataset, we show that monetary policy propagates effectively to economic activity and house prices, albeit in a heterogeneous fashion across regions. Although the housing channel plays a minor role in the transmission of monetary policy to the economy on average, its importance increases in the case of unconventional monetary policy. In addition, we find that unconventional monetary policy has been a key driver of economic activity and house prices since 2013. We also explore the determinants of the diverse transmission of monetary policy to economic activity across regions, finding a larger impact in areas with lower labour income. An expansionary monetary policy can thus be effective in mitigating regional inequality via its stimulus to the economy.

This analysis is based on Battistini et al. (2022), to which the reader may refer for more details on the data, the methodology and further results.