We study the impact of negative interest rate policy (NIRP) on banks’ interest rate margins. An important addition to previous studies is our breakdown of banks’ interest rate margin into a funding component, a lending component and maturity transformation. We present three main findings. First, because banks are reluctant to reduce deposit rates below zero, funding margins of banks more reliant on deposit funding have declined significantly compared to that of other banks. Second, these banks have not compensated the loss of funding margins by boosting their lending margins. Hence, banks passed on the declining interest rates to borrowers, which is positive from a monetary transmission perspective. At the same time, it implies a significant erosion of overall interest rate margins. Third, changes in the policy rate affect margins gradually and the full impact may be reached only after 2-3 years.

In the past years, several central banks, including the ECB, have reduced their policy rates below zero. Since then, an intense debate has emerged on the transmission and effectiveness of NIRP. In particular, monetary transmission may be hindered by a zero lower bound on deposit rates, as banks are reluctant to charge negative rates on (retail) deposits. As a result, banks’ interest rate margin is squeezed, which could undermine their profitability and lending capacity. Brunnermeier and Koby (2018) formalized this idea and introduced the so-called “reversal interest rate”, below which further rate cuts have a contractionary impact on the economy.1

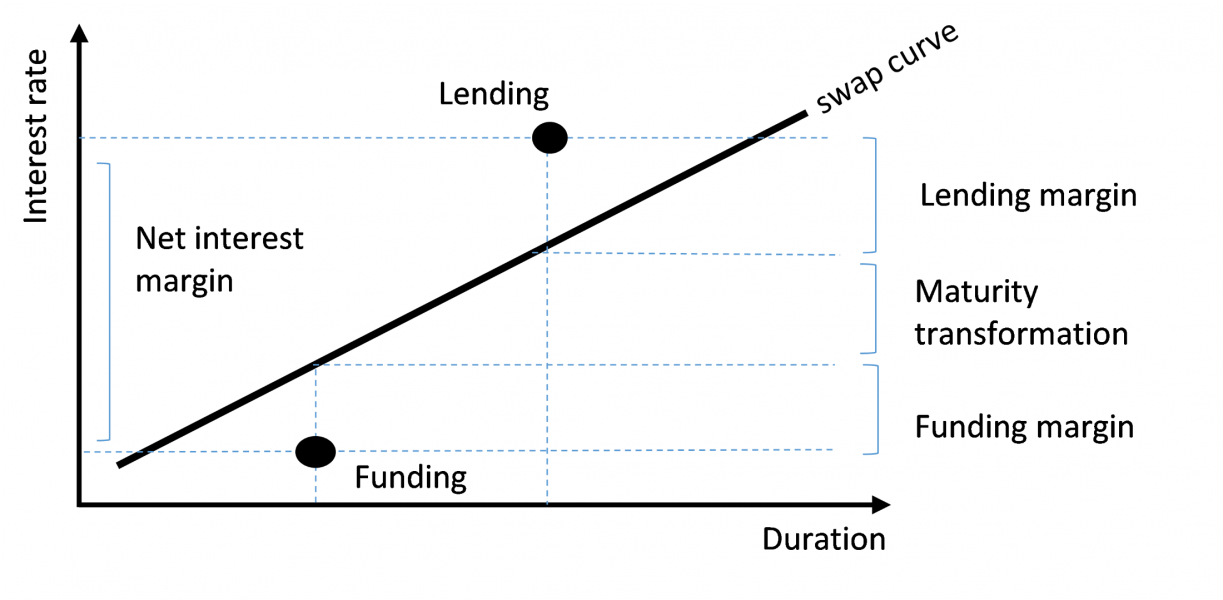

We contribute to this debate by analyzing the impact of NIRP on banks’ net interest rate margin (NIM), which we break down into three components (Figure 1):

Figure 1: Decomposition net interest margin in a non-negative interest rate environment

The decomposition of the interest rate margin provides value-added to most existing reversal rate studies, which typically only consider broader performance measures such as the total NIM or total profitability. Focusing on the different components of the margin is important to better understand the different channels through which NIRP affects banks’ profitability and to distinguish the implications for banks’ lending portfolios and their funding exposures. Moreover, it allows us to take into account the (interest rate risk) hedging behaviour of banks.

The funding margin is most relevant for our analysis. Because of the lower bound on retail deposit rates, the funding margin is likely to be squeezed when market rates turn sufficiently low (or negative). The impact on the lending margin is less obvious, as it is more likely to remain in positive territory and not prone to zero lower bound frictions. The two margin components may also be related, as banks may try to boost their lending margin to compensate the loss of funding margin – which would however only be possible with limited competition.

We estimate panel data regressions using microdata for 170 euro area banks over the period 2007-2019, i.e. excluding the COVID crisis. The margin components are dependent variables in our regression; the explanatory variables are a NIRP dummy, bank characteristics and macro controls. Our main bank-specific variable is the proportion of deposit funding. Presumably, if shrinking margins are positively related to banks’ reliance on (retail) deposits, this would corroborate the relevance of a zero bound.

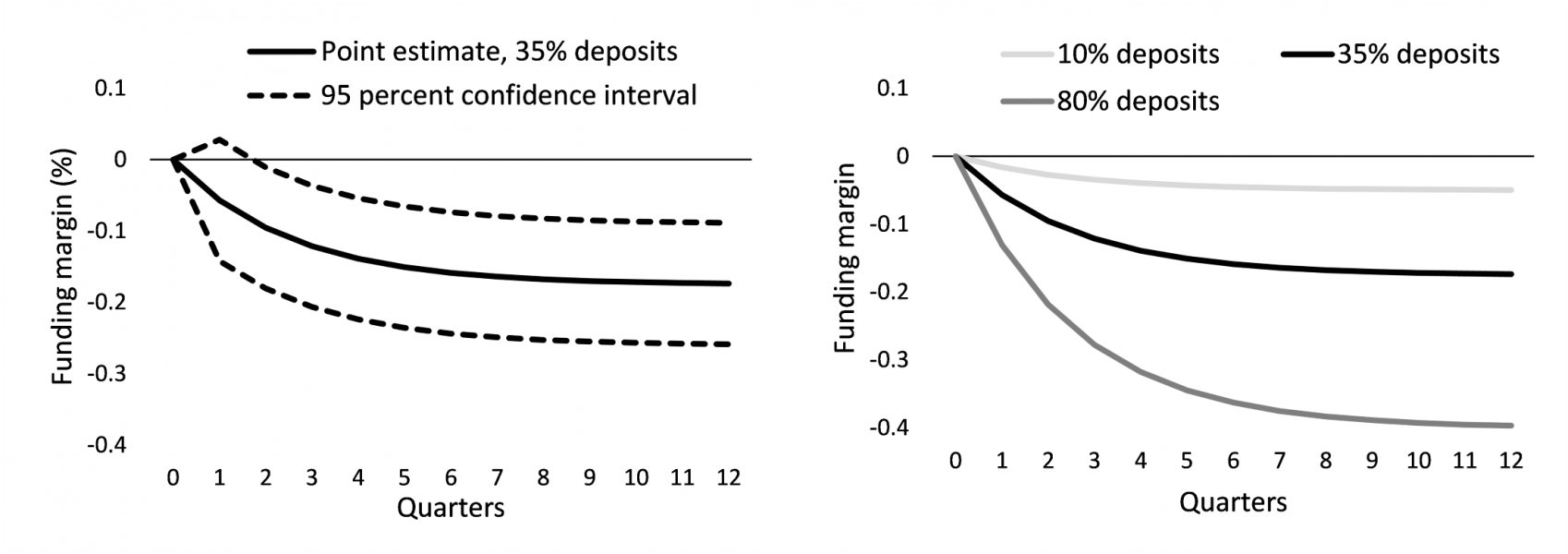

First of all, we find clear evidence that NIRP is associated with a negative impact on banks’ funding margin. This is in line with previous studies and what we would expect. The impact is material (Figure 2, left). For the average bank in our sample, with 35 percent deposit funding, the long-term negative impact of NIRP on the funding margin is estimated at 18 basis points relative to banks without deposit funding. This is about half of banks’ average funding margin in the years prior to 2014, when NIRP was implemented, or about one third of the average bank’s return on equity. Moreover, the size of the impact is larger the more banks rely on deposit funding (Figure 2, right), which provides further evidence that the impact of NIRP is indeed caused by the zero lower bound on retail deposits.

Figure 2: Dynamic impact of NIRP on banks’ funding margin

Source: Freriks and Kakes (2021)

Second, the impact of low rates on the funding margin evolves gradually, taking more than two years before it has been fully transmitted. This may be due to the fact that we measure NIRP with a dummy while interest rates were reduced in several steps from -10 basis points in 2014 to -50 basis points in September 2019. The impact on bank profitability is even more gradual than suggested by Figure 2, as the funding margin we investigated is based on new production. In other words: because it takes time before outstanding liabilities mature and are replaced by new funding, it takes even longer before the total impact on outstanding amounts has materialized.

Third, we do not find significant effects of NIRP on banks’ lending margin – the evidence is at best mixed for mortgages and absent for lending to non-financial firms. This result suggests that euro area banks have continued to transmit the cuts in the policy rate to lending rates. We have not further investigated banks’ reluctance to increase lending margins. Possibly, competitive pressure (both from other banks as well as from non-banks) plays a role. Another possible explanation is that most of the NIRP period coincides with economic recovery and declining credit risk in the euro area, which – if not fully captured by our controls – may counteract upward pressure on lending rates.

Our overall conclusion is that NIRP gradually squeezes funding margins, while lending margins remain intact, which implies that the total interest margin is shrinking.

Our findings support a key element of the reversal rate literature, which states that low and negative interest rates gradually erode bank margins. Does this mean that negative interest rates hurt bank profitability and, through its impact on bank capital and intermediation capacity, reduce the effectiveness of monetary policy? To fully answer this question, we need to take into account other factors as well, which are beyond the scope of our study.

First, a decline in interest rates also affects profitability through other channels. For example, lower interest rates improve banks’ financial position through capital gains on their fixed-income portfolios. Moreover, by improving the economic outlook and increasing the value of collateral, lower rates increase borrower creditworthiness, lowering loan loss provisions. Demand for loans is also expected to increase due to lower rates. Altavilla et al. (2018) argue that these channels may explain why thus far they find no negative impact on bank overall profitability, despite the reduction in margins. Some of these channels may prove not to be sustainable in a less favourable environment, however, such as the one created by the Covid-19 virus in 2020-2021. This is an important area for future research.

Second, the ECB has introduced other policies that mitigate the impact of negative interest rates on bank profitability (Schnabel, 2020). Noteworthy is the introduction of a two-tier system in 2019, which increases the average remuneration banks receive on their excess liquidity holdings.

Finally, banks may try to compensate for the reduction in interest margins by boosting profitability in other ways. For example, banks could try to increase non-interest income or reduce operating expenses. In addition, banks could rebalance their portfolios towards assets with a higher interest rate margin, potentially increasing the risk profile of their assets. The latter could bring new challenges from a prudential point of view and therefore warrants close monitoring.

Altavilla, C., M. Boucinha and Peydro, J. (2018). “Monetary policy and bank profitability in a low interest rate environment”. Economic Policy, Volume 33, Issue 96, pp. 531– 586.

Ampudia M. and S. Van den Heuvel (2018). “Monetary policy and bank equity values in a time of low interest rates”, ECB Working Paper No 2199.586.

Brunnermeier, M.K. and Y. Koby (2018). “The reversal interest rate”. NBER Working Paper No. 25406.

Bats, J., M. Giuliodori, and Houben, A. (2020). “Monetary Policy Effects in Times of Negative Interest Rates: What do Bank Stock Prices Tell Us?”, DNB Working Paper, No. 694.

Chaudron, R. (2018), “Bank’s interest rate risk and profitability in a prolonged environment of low interest rates”, Journal of Banking & Finance, 89(C), pp. 94-104.

Demiralp, S., J. Eisenschmidt, Vlassopoulos, T. (2021). “Negative interest rates, excess liquidity and retail deposits: banks’ reaction to unconventional monetary policy in the euro area”, European Economic Review, Vol. 136 (C).

Drechsler, I., A. Savov and P. Schnabl (2021), Banking on deposits: maturity transformation without interest rate risk, Journal of Finance, 76(3), pp. 1091-1143.

Freriks, J. and J. Kakes (2021), Bank interest rate margins in a negative interest rate environment, DNB Working Paper, No. 721.

Heider, F., F. Saidi and Schepens, G. (2019). “Life below zero: Bank lending under negative policy rates”, The Review of Financial Studies, 32(10), pp. 3728-3761.

Hoffmann, P., Langfield, S., Pierobon, F., & Vuillemey, G. (2019). Who bears interest rate risk?. The Review of Financial Studies, 32(8), pp. 2921-2954.

Schnabel, I. (2020), “Going negative: the ECB’s experience”. ECB Speech.

Several papers have investigated the impact of negative interest rates on banks’ performance (e.g. Altavilla et al. 2018; Heider et al., 2019; Demiralp et al., 2021; Ampudia and Van den Heuvel, 2018; Bats et al., 2020). In addition, studies have analyzed banks’ interest risk in connection to their deposit and lending rates and their hedging behavior (e.g. Hoffmann et al., 2019; Drechsler et al., 2021; Chaudron, 2018).