The debate on currency arrangements and monetary policy frameworks in Iceland has been motivated by developments in Iceland and internationally in recent decades. Historically, Icelanders’ colonial experience and struggle to retain control of vital natural resources made them hesitant participants in the European integration process. While sidestepping direct participation in the process leading to EU and EMU membership, they joined EFTA, the EEA and Schengen. Economic growth and development have been rapid, but the modernisation and liberalisation of the economy have been attended by significant volatility in nominal and real variables. At the same time, the European integration process has continued with its own set of challenges. It is in this context that a vibrant debate has taken place on the choice of currency and associated policies. The main emphasis has been on whether to adopt the euro (through EU membership) or retain the Icelandic króna with the most efficacious monetary policy framework possible. This article offers a review of salient contributions to the debate and the main lessons drawn from it. The key themes of the debate involve the impact currency choice would have on economic growth and resilience to shocks. While the early debate was mostly concerned with trade-theoretic issues, institutional factors have become increasingly important. A new theory concerning a heretofore overlooked policy variable, the evolution of inequality as measured by the wage-productivity gap, is discussed. It is shown to be potentially important for economic and financial outcomes, with implications for the debate.

The debate in Iceland about currency and associated monetary policy arrangements can be said to centre on choices ranging between fixed and floating exchange rate regimes, including intermediate arrangements. Broadly, fixed exchange rates are seen to be associated with more stable growth in output and employment while floating exchange rates are linked to speedier adjustment of output and employment to shocks. In the case of common currencies with internally fixed exchange rates, the output level may rise following membership, as Rose and Frankel (2002) show. Conversely, the outcome in the floating rate case is influenced by the degree of variability in the exchange rate.

In Iceland, the debate on alternative currency choices and related monetary policy arrangements has been motivated by the country’s pronounced output and inflation volatility, whereas European integration, as Wijkman (1994) points out, has been motivated more by the role of increased economic interdependence in fostering peaceful relations among countries previously ravaged by war.

At a lecture given on September 1982 at the University of Iceland, when asked how Iceland should rein in its high inflation, James M. Buchanan suggested that the country should adopt either a strict money growth rule or a strong international currency, such as the US dollar. After the breakdown of the Bretton-Woods system, smaller countries increasingly sought stable inflation by using exchange rates as a nominal anchor. An example is the description by Thygesen (1979) of the “strong currency option.” Thorgeirsson (1988) examined the managed float exchange rate policy in Iceland from the 1970s, finding that the real exchange rate tended to rise due to higher wage and price inflation, resulting in nominal devaluations aimed at restoring profitability in the export sector, in turn creating “a vicious cycle of major devaluations and inflationary surges”. Krugman (1991) wrote an influential paper recommending a floating exchange rate in Iceland as a means to achieve balanced development. His main argument was that Iceland’s export-led business cycle was insufficiently correlated with its trading partner business cycles, and required an independent means of adjustment.2 Seðlabanki Íslands (1997) emphasised the importance of this point in relation to potential participation in the EMU.

Inflation targeting and floating exchange rates (IT) were increasingly adopted in many countries with independent currencies in the 1990s. Based on another influential paper by Gudmundsson et al. (2000), Iceland adopted a 2,5 percent IT with +/-1,5 percent “tolerance” bands in 2001. Despite its early promise, the new framework proved increasingly ineffective in keeping inflation on target as cross-border capital flows, asset bubbles and exchange rate volatility became more pronounced in the run up to the financial crisis. There was some scope to tighten fiscal policy, but this would likely have been insufficient, given the magnitude of private sector imbalances, to keep inflation on target. An effective restraint on bank lending was the critical missing element. Hunt (2006) suggested that Iceland was inherently vulnerable to breaching the narrow deviation bands, and the way around this was to communicate more clearly that such breaches were a reflection of underlying economic volatility and did not reflect a lack of resolve on the part of the Central Bank to bring inflation back to target. In late 2008, at the peak of the twin banking and balance of payments crises, capital controls were adopted to prevent a further drop in the exchange rate.

A major report, Seðlabanki Íslands (2012), on Iceland’s currency and monetary policy choices, highlighted the fact that the pre-crisis currency and monetary policy arrangements proved sub-optimal. An earlier report, Seðlabanki Íslands (2010), had identified reforms supporting the IT framework, including capital flow regulations and macro-prudential policy, which could enhance its efficacy. After the resolution of the failed banks was completed in late 2016, where creditors paid ‘stability contributions’ to the Treasury in order to underpin exchange rate stability, the capital controls were lifted in early 2017. Seðlabanki Íslands (2017) documents the increased efficacy of Iceland’s IT monetary policy following the financial crisis. Inflation and inflation expectations were steadily brought down, resulting in reduced volatility of real interest rates. Capital controls and exchange rate management likely contributed to the benign outcome.

The interest in fixed exchange rates has focused on four distinct frameworks.

The first three choices were found to be relatively less suitable for Iceland for a variety of reasons, including a potential lack of credibility, liquidity management problems, FX reserve costs, seignorage income loss and financial stability risks. The fourth choice was, and still is considered by some a viable alternative to the present arrangement. However, this choice is not unambiguous.

In debating these two choices, IT and EMU, frequent reference is made to Mundell’s Optimum Currency Area (OCA) theory. OCA theory focuses on the need for adjustment in the economy to an exogenous shock, with the understanding that a floating nominal exchange rate usually results in a smaller loss of output and employment than a fixed exchange rate. As membership in a monetary union fixes exchange rates among its members, several conditions must be in place for an adjustment comparable to that achieved with floating exchange rates. The greater the trade and finance among the countries, the more flexible the domestic labour market and the greater the mobility of labour within the area, the greater the similarity of the economic structure and business cycles, the easier the adjustment to a shock.

Iceland has a high degree of trade integration with the euro area, and a flexible labour market, but its business cycle tends to be asymmetric vis-à-vis the euro area. Agnarsson et al. (1999) studied the flexibility of wage formation in Iceland and concluded that adoption of the single currency could restrict the authorities’ ability to react to a supply shock. However, endogenous adjustment within a currency union could bring added policy credibility and labour market flexibility. Gudmundsson et al. (2000), found that Iceland may not fulfil OCA criteria ex ante but could possibly do so ex post. They also cautioned that “if exchange rates are excessively volatile, an independent currency may in itself have destabilising effects on the economy, in which case a monetary union membership might be welfare improving”. Buiter (2000) judged the case for Icelandic membership of the EU and EMU to be “nearly balanced,” because “the extraneous instability and excess volatility inherent in a market determined exchange rate dominate the shock absorber properties of a flexible exchange rate when financial markets are highly integrated.”

The Seðlabanki Íslands (2012) report further enunciates the limits of OCA theory in terms of the potential for ex post exogenous adjustment in the structure of the economy for a smooth transition to a new currency regime. Indeed, with an increasing share of FX receipts coming from the growing tourism sector, Iceland’s business cycle may be becoming increasingly synchronised with the international business cycle. Einarsson et al. (2016) performed a study of Iceland’s financial cycle, based on components of housing, lending and balance sheets, over the past one hundred and fifty years. They find that “spillover effects” have had the effect of synchronizing Iceland’s financial cycle more closely with the international financial cycle than previously thought. The extent to which such effects amplify the domestic business cycle may present a further challenge to the prevalent view of “relatively weak links between the Icelandic and global business cycle.”

Pétursson (2015) discusses the evidence concerning the optimality of Iceland as a small currency area in terms of several factors: the cost of maintaining a currency area is relatively greater for a small currency area than for a larger one; operating independent monetary policy in a small currency area makes inflation outcomes less certain because of the greater volatility associated with an illiquid FX market; the currency could become an obstacle for small firms’ competitiveness and expansion into international markets; and the greater volatility of a small currency could contribute to volatility of households’ consumer goods imports, complicating the demand management.

Thorgeirsson and van den Noord (2013) find that the adjustment involving floating rates can come with non-trivial asymmetric costs and benefits. While Iceland’s post-crisis recovery was indeed quicker than in many euro-area countries, the significant exchange rate drop in 2008 caused inflation to spike while nominal wages and debts remained unchanged. Many households experienced a sharp drop in real incomes while firms’ profits increased, particularly in the export sector. An accelerating surge in tourism from 2010 onwards helped pave the way for a recovery of employment and incomes, which improved households’ financial position. Even so, given the considerable increase in real household debt, many Icelandic households faced a solvency challenge that was probably more intense than that of their euro area counterparts, apart from Greece, which was a special case.

Gudmundsson and Thorgeirsson (2010) describe how the “EU passport” provided for in the EEA Agreement enabled private Icelandic banks to expand their operations into the single market, but without an adequate lender of last resort in foreign currency. This and the difficult resolution process of the failed banks reveal a binding constraint on the financial sector’s participation in European integration on the basis of the Icelandic króna.

The Seðlabanki Íslands (2012) report concluded that, even if dissimilar, both the IT and EMU frameworks were likely possible currency and monetary policy arrangements for Iceland. The amplitude of business cycles is about the same in countries with fixed and flexible exchange rates. However, inflation and exchange rate changes tend to be greater in the latter group. In sum, if asymmetric shocks to export revenues are no longer the overriding concern, membership of a monetary union would be expected to result in greater exports, lower financing costs, and higher incomes.

There are costs and benefits associated with any currency arrangement, not only due to differences in reaction to external shocks, but also due to the build-up of internal instability, eventually causing internal shocks. In this regard, significant problems became apparent for both IT in Iceland and EMU in its member countries in the prelude to and aftermath of the financial crisis.

In Iceland, from the end of 2008 to early 2017, the IT framework was accompanied by capital inflow restrictions and a more active FX market intervention policy by the Central Bank of Iceland, so as to prevent excessive volatility. A new Financial Stability Council, with a dedicated Systemic Risk Committee, aims to preserve economic and monetary stability.

In the euro area, extensive reforms of the financial system and its regulation and supervision have been enacted as well. However, the legacy of the financial crisis remains throughout the banking system in the form of bad debts. It will probably take many years to wind down these high debt levels, including the public debts needed to forestall a complete meltdown of the system.

The central lesson here is that the internal build-up of instability in an economy – be it in the form of excesses in inflation or debt creation – could eventually lead to a crisis. How this plays out, and at which stage of the build-up it occurs, depends to some extent on the exchange rate regime in place. Neither regime in and of itself can prevent such occurrence, however.

For instance, the belief within the EMU, has always been that independent inflation targeting monetary policy, together with strong fiscal discipline in the form of restrictions on both public expenditure and public debt, would suffice to maintain economic stability and prevent endogenous crises. This proved not to be the case as seen in the experience of Ireland.3 After the crisis, a new policy instrument was added, in the form of Community-wide regulation of the financial sector. Will the policy mix thus augmented be sufficient to prevent future build-up of instability? The jury is still out. Even with the new Banking Union in place, credit expansion in the private sector may be insufficiently restrained as long as, for instance, the ECB is obliged to pursue expansionary monetary policy in response to inflation hovering below target. But a bitter insight from the global crisis is that ever-increasing private sector indebtedness can be as devastating for economic stability as a rise in public indebtedness.

Ideally, the fundamental source of internal imbalances should be identified and addressed. This “Holy Grail” of economic research has long been sought. In the meantime, however, we have to live with more credible monetary and fiscal policies, as well as improved supervision and regulation. Indeed, the view has long been prominent that credit crises are connected to some form of policy mismanagement and can be contained by the new measures taken. Granted, they have also aimed at increasing the resilience of the economy. Even so, it appears they are still dealing primarily with the symptoms of macroeconomic and associated financial imbalances. A new theory has emerged purporting to explain the causes of such endogenous imbalances and shocks. This new theory appears to shed new light on ways and means to contain such imbalances at their source, with implications for the choice of currency and related monetary policy arrangements.

In this search for the ultimate causes of instability, economic thinking outside conventional paradigms can often shed new light on age-old questions. In the following we present the research of Professor Batra, who explains the build-up of economic and financial imbalances arising from a disproportionate development in the distribution of factor incomes and that may result in a crisis.4 The fundamental aggregates involved have fluctuated considerably in Iceland over time, so it appears of interest to see whether his conclusions are supported by empirical evidence. Batra’s (2015) macroeconomic model is an extension of the Keynesian model, but focusing on the relationship between real wages and labour productivity. In short, his conclusion is that aligning the trend of wages and productivity improves the performance and stability of the economy. If not, stability is endangered.

In his model, Batra uses a well-known measure to gauge factor income distribution and its changes, namely the “wage-productivity gap”. Equation 1 shows the wage-productivity gap (B) as the quotient of labour productivity (z) and real wage (w).

B = z/w (1)

Batra’s innovation is to integrate this measure into a theory of economic and financial stability. He does so by elaborating the Keynesian model of aggregate demand and supply. A key insight is that when productivity growth differs from real wage growth (dz/z ≠ dw/w), and this imbalance is sustained for a long enough time, this generates imbalances in the economy, in the form of either excess supply or excess demand.

For example, assume the economy to be in equilibrium at B° >1 (to account for profit in companies). Let unit production increase faster than unit wage income. Assuming the propensity to consume is larger in households with mainly wage income than in households with mainly capital income,5 excess supply will emerge. Assuming sticky real wages, a new equilibrium will eventually be reached, albeit at lower employment.

Introducing credit into the model, a new equilibrium at original employment can be reached if the decrease in consumption demand is compensated by debt-funded expenditures. Assuming this to be the case, aggregate demand and original employment are restored, and the wage-productivity gap has risen, and so have profits (at a higher rate than real wages).

Let the process continue over time, with a continuing rise in B. Additional debt-funded expenditures are constantly needed to boost demand. This ensures that all the production is purchased, thereby maintaining economic growth. In a fundamental sense, financial imbalances are found to originate in productive activity. However, they can increase as a financial boom develops. If the process as described above persists, household indebtedness grows more, or until a financial crisis puts a stop to it. At this point, the government must step in with well-known measures to address the crisis and the process may continue, this time supported by the government. A case in point is the accommodative stance of monetary policy in the post-crisis years, when growth, particularly in the USA, was unable to transcend ‘secular stagnation’ in the presence of a continued rise in the wage-productivity gap. Indeed, this is to be expected in an excess supply situation.

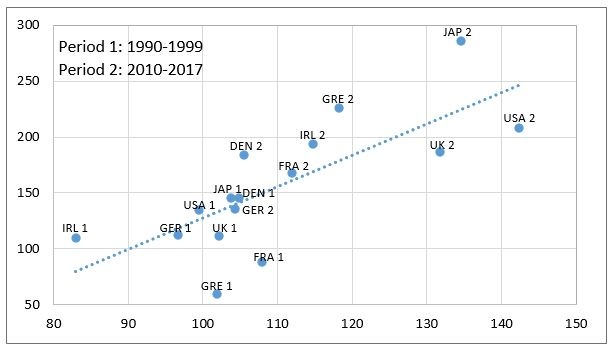

Figure 1: Excess supply and debt in select countries (decade averages)

Y-axis: Household & general government debt, per cent of GDP

X-axis: Wage-productivity gap, average 1970-2017 = 100

Sources: BIS, IMF, OECD and TCB.

Simple as it is, the model nonetheless has profound implications. Moreover, while originally conceived to shed light on the larger economies of Germany, Japan and the USA, the theory appears to have broad support in empirical data. Figure 1 shows the experience of eight countries for which data were available going back to 1990. In all of them, a rise in the wage-productivity gap (index base = 100) from Period 1 to Period 2 was associated with increased household debt ending in a financial crisis, with public debt continuing to rise in its wake, along with monetary policies set to encourage increases in private sector indebtedness, in order to revive growth and bring down unemployment. This is also true for Europe. Moreover, the financial crisis was seemingly more severe in countries with a larger increase in the wage-productivity gap and where inequality was also greater by other measures. Batra’s theoretical explanation for increased debts in the system appears to offer a novel explanation for the increasing ‘financialisation’ of developed economies in recent decades, as well as offering criteria for avoiding excessive and harmful financial development.

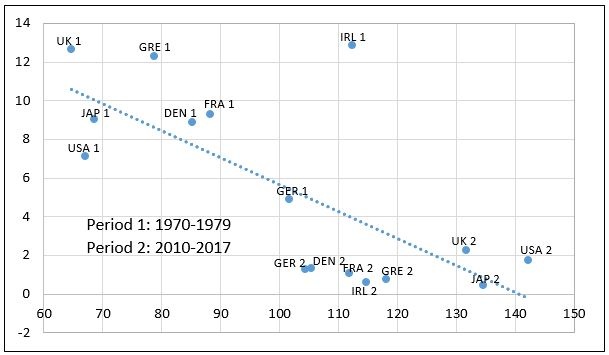

Thorgeirsson (2017b and 2017c) proposes a symmetric case of excess demand, based on data for the 1970s, when the wage-productivity gap was lower than in a latter period. As Figure 2 shows, inflation ranged from 5 percent to 13 percent on average in the 1970s, while it averaged between 0 percent and 2 percent in the 2010s. The disinflation of recent decades is explained by the sluggish growth of labour costs as well as the absence of demand-pull inflation pressures.6 As such, Batra’s theory offers an explanation for the ‘Great Moderation’. Conversely, the high inflation in the 1970s may indicate that excess demand conditions were at work, validated by monetary policy mistakes based on a systematic bias in the assessment of potential output.. However, the stagflation in the USA, when inflation was high but growth slow, complicates the story, especially as it was accompanied by a return to floating exchange rates, the fiscal burden of war and oil price shocks. The case of Iceland appears to be more clear-cut, and to it we turn next.

Figure 2: Excess demand and inflation in select countries (decade averages)

Y-axis: Annual inflation rate, per cent

X-axis: Wage-productivity gap, average 1970-2017 = 100

Sources: BIS, IMF, OECD and TCB.

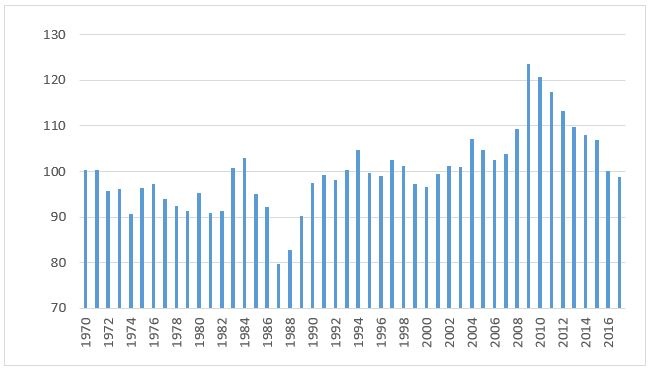

Figure 3 shows the fairly volatile development of the wage-productivity gap in Iceland from 1970 to 2017.

Figure 3: Wage-productivity gap in Iceland

(1970-2017 average = 100)

Source: National Economic Institute, Icelandic Statistics Office and Central Bank of Iceland.

Based on decade averages, Thorgeirsson (2017a) identifies three distinct economic periods, characterised respectively by excess demand, balance, and excess supply:

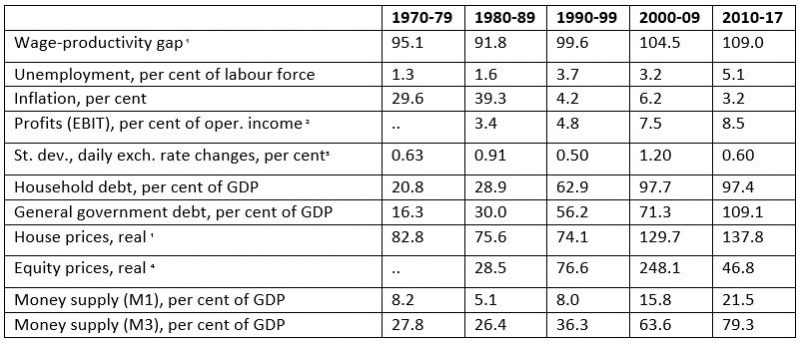

Table 1: Wage-productivity gap and stability in Iceland (decade averages)

1) Average 1970-2017 = 100. 2) 1980-1997 and 2002-2015.

3) Unweighted Av. of ISK vis-a-vis CAD, CHF, DKK, GBP, JPY, NOK, SEK, USD. 4) Av. 1983-2017 = 100.

Sources: Icelandic Statistics Office, Central Bank of Iceland and National Economic Institute.

In sum, Iceland’s rising wage-productivity gap was associated with a shift from excess demand in 1970-1989, via better balance during the 1990s, to excess supply conditions in 2000-2017. These three periods help to characterise economic governance and, among other things, the evolution of inflation (-), unemployment (+), profits (+) and debt (+) with respect to the gap. A salient insight is that the interests of workers were dominant in Period 1. More balance characterised Period 2, while in Period 3, corporate interests were dominant. More recently, with unemployment at low levels, wage growth is outpacing productivity growth again, risking a reversion to the conditions of Period 1. Inflation expectations, which overestimated the outturn when the wage-productivity gap was relatively high may now be increasingly underestimating the future outturn if the gap falls to relatively low levels.

While this categorisation is somewhat simplified, it may serve as a guide to policy formulation based also on consideration of trends in B. Policies affecting the gap — such as competition, trade, terms of trade, immigration, technological change and wage formation — as well as various measurement issues, are wide-ranging enough to require a separate discussion, however.

This structured review of Iceland’s economic history also has relevance for the debate on choice of currency and associated policies. In his earlier writings, Batra alluded to a relationship between distribution and exchange rates as noted in Thorgeirsson (1988).

“The experience with flexible exchange rates, since the early 1970′s, has been fraught with unanticipated excessive variability and overshooting in the exchange rates of the major industrialized nations. A more recent assessment of flexible exchange rates is offered by Batra (1988), who proposes that a new period of instability in foreign exchange markets has begun, reminiscent of the experience of the late 1920′s, where flexible exchange rates contributed to international economic instability. His thesis is that growing wealth disparity leads to increased speculation in asset markets and imbalances in international trade and capital flows, ultimately forcing dramatic realignments in currency values.”

Indeed, Batra’s early insights align with his new theory, and the description matches the exchange rate volatility experienced by the countries caught up in the international financial crisis, especially in autumn 2008.

Thorgeirsson performed estimates of purchasing power parity and other exchange rate models, and found that exchange rate changes were broadly in line with inflation changes in the 1970-1989 period, with inflation likely causing the exchange rate changes.7 In the 1990s, inflation subsided and with it came more stability in nominal and real variables. In the 2000-2017 period, the causality changed as the financial boom developed, when rising debts, both domestically and across borders, became a source of increased exchange rate volatility, to an extreme degree during the financial crisis. Inflation surged in the wake of the currency collapse, and the economy was destabilised. As seen in Table 1, exchange rate volatility became markedly greater in the 2000-2009 period, followed by that seen in the high inflation period of 1980-1989. Interestingly, Batra’s findings also appear to explain the shifting causality of exchange rate changes in these two distinct periods.

Batra’s theoretical model suggests that it may be possible to reduce inflation and mitigate debt cycles by keeping wage growth targeted on productivity growth. Of course, introducing such a new target – whether alongside or instead of the more common inflation target together with upper limits to public deficit and debt – is easier said than done, but it could become a guiding principle, incorporating ongoing adjustments as new information emerges. Still, aside from exogenous shocks, exchange rate volatility would be expected to become less if B is kept in balance. Furthermore, economic resilience, or the ability to handle shocks, will presumably increase when inflation is low and stable and debts are manageable. Furthermore, the increasing integration of the Icelandic economy with the euro area and the wider global economy could also serve to synchronise domestic and global business cycles. Such changes could reduce the importance of a floating exchange rate (as in the IT framework) in Iceland but also make adoption of a common currency a more feasible alternative.

However, if major imbalances were to develop in a sub-set of currency area members, because of imbalances in the wage-productivity gap or for other reasons, as has been the case lately, this would make membership a less attractive option. Persistent national imbalances are likely to impose future costs on the other, more balanced members of the EMU. More generally, large economies with significant such imbalances could be imposing negative externalities on other economies, as regards their tendency to exaggerate the global financial cycle.

This article has presented the salient elements of the debate on the choice of currency and associated monetary policies in Iceland, highlighting the challenge of generating stable outcomes in a small open economy. At a time when Iceland’s integration into the global economy was still modest, the debate focused on the role of a flexible exchange rate in dealing with asymmetric shocks by emphasising adjustment in prices rather than in output and employment. In recent years, the Icelandic economy has become more synchronised with other countries, rendering a fixed regime more attractive. Non-trivial costs for household finances associated with flexible exchange rate adjustment also came to light in the last financial crisis.

Furthermore, due to the experience from the recent crisis, attention has shifted to the need, irrespective of the choice of exchange rate regime, to reduce endogenous economic instability through careful macro-economic monitoring. If future research gives additional support to this theory, such monitoring could include a focus on maintaining distributional balance. A floating exchange rate regime may then also become less compelling than a fixed one for Iceland. It would also make the adoption of the common currency a more attractive option, although this would need to be considered with an eye to the macroeconomic and financial stability of the current EMU members. Ultimately, however, the adoption of the euro requires membership in the EU, which is a political decision involving other important and evolving considerations.

Agnarsson, Sveinn, Axel Hall, Tryggvi Thor Herbertsson, Sigurður Ingo lfsson, Gylfi Magnu sson, and Gylfi Zoega (1999), “EMU and the Icelandic labour market”, Central Bank of Iceland Working papers No. 3.

Batra, Ravi (2015), End Unemployment Now: How to Eliminate Joblessness, Debt, and Poverty despite Congress, Macmillan.

Batra, Ravi (1988), Surviving the Great Depression of 1990: Protect Your Assets and Investments – and Come Out on Top!, Simon & Schuster.

Buiter, Willem H. (2000), “Is Iceland an Optimal Currency Area?”, Central Bank of Iceland Working Papers No. 10.

Einarsson, Bjarni G., Kristo fer Gunnlaugsson, Thorvardur Tjo rvi O lafsson, and Tho rarinn G. Pe tursson (2016), “The Long History of Financial Boom-Bust Cycles in Iceland – Part II: Financial cycles”, Central Bank of Iceland Working Paper no. 72.

Frankel, Jeffrey and Andrew Rose (2002), “An Estimate of the Effect of Common Currencies on Trade and Income”, The Quarterly Journal of Economics.

Guðmundsson, Már and Thorsteinn Thorgeirsson (2010), “Fault-Lines in Cross-Border Banking: Lessons from the Icelandic Case”, SUERF Studies 05/2010.

Guðmundsson, Már, Thórarinn G. Pétursson and Arnór Sighvatsson (2000), “Optimal Exchange Rate Policy: The Case of Iceland”, Central Bank of Iceland Working Papers No. 8.

Hunt, Ben (2006), “Simple Efficient Policy Rules and Inflation Targeting in Iceland”, Central Bank of Iceland Working Papers, No. 30.

Krugman, Paul (1991), “Iceland’s Exchange Rate Regime: Policy Options”, published in Icelandic in Fjármálatíðindi No. 38, pp. 175-185.

Pétursson, Thórarinn G. (2015), “Valkostir í gjaldmiðilsmálum: Hvað þarf að hafa í huga?” (Choices in currency: What needs to be kept in mind). Fyrirlestur hjá félagi viðskiptagreinakennara í framhaldsskólum (Presentation for Association of commerce teachers in upper secondary schools).

Piketty, Thomas (2014), Capital in the Twenty-First Century, Harvard University Press.

Seðlabanki Íslands (2017), “Peningastefna byggð á verðbólgumarkmiði: Reynslan á Íslandi frá árinu 2001 og breytingar í kjölfar fjármálakreppunnar” (Monetary policy based on inflation targeting: Iceland’s experience since 2001 and post-crisis changes), Special Publication No. 11.

Seðlabanki Íslands (2012), “Valkostir Íslands í gjaldmiðils- og gengismálum” (Iceland’s currency and exchange rate policy options), Special Publication No. 7.

Seðlabanki Íslands (2010), “Peningastefnan eftir höft” (Monetary policy in Iceland after capital controls). Special Publication No. 4.

Seðlabanki Íslands (1997), “Efnahags- og myntbandalag Evrópu – EMU, aðdragandi og áhrif stofnunar EMU” (Economic and Monetary Union in Europe – EMU, prelude and impact), Special Publication No. 2.

Thorgeirsson, Thorsteinn (2017a), “Launa-framleiðnibilið og efnahagslegt jafnvægi” (The wage-productivity gap and economic stability), Vísbending, No. 9, Volume 35.

Thorgeirsson, Thorsteinn (2017b), “Launa-framleiðnibilið og fjármálastöðugleiki” (The wage-productivity gap and financial stability), Vísbending, No. 40, Volume 35.

Thorgeirsson, Thorsteinn (2017c), “Óðaverðbólgu, ofurskuldsetningu eða stöðugleika?” (Hyper-inflation, excess indebtedness or stability?), Morgunblaðið, 20 November.

Thorgeirsson, Thorsteinn (1988), Exchange Rate Determination in Iceland during the Period of a Managed Float, Unpublished MA thesis, Vanderbilt University.

Thorgeirsson, Thorsteinn and Paul van den Noord (2013), “The Icelandic Banking Collapse: Was the Optimal Policy Path Chosen?” Central Bank of Iceland Working Paper no. 62.

Thygesen, Niels (1979), “Exchange Rate Experiences and Policies of Small Countries: Some European Examples of the 1970s”, Princeton University, Essays in International Finance, No. 136.

Wijkman, Per Magnus (1994), “A Role for EFTA in the Wider Europe?” EFTA Occasional Paper No. 46.

The views expressed and any errors or omissions are those of the author. The article was originally published in Prosperity through Trade and Structural Reform. Festschrift in Honor of Per Magnus Wijkman, edited by Emil Ems and Thorvaldur Gylfason, Dialogos, Stockholm, October 2018.

Krugman‘s assessment was made with a view also to Iceland‘s insular labour market and homogenous export sector. With increased global integration, such restrictions have gradually abated.

Greece is a special case, since it disregarded the EMU rules on fiscal discipline.

Piketty (2014) finds, in line with modern notions, that distribution flows from the growth of output. Batra’s idea returns to earlier classical ideas indicating the opposite cause-effect relationship.

Batra uses a simple assumption on this in his model: only the labour force is consuming, and its consumption is at par with wage incomes (thus no savings). Investment is modelled as a fixed share of total consumption.

At a fundamental level, a balanced wage-productivity gap is seen to be helpful in limiting both inflation and unemployment, often viewed as having a dynamic trade-off in the Phillips curve.

Prior to the adoption of the IT policy, the exchange rate policy may generally be described as an adjustable peg, with periods of creeping depreciation, interspersed with sizable devaluations and, rarely, moderate revaluations.