This policy brief is based on Danmarks Nationalbank Working Paper No 205. The views expressed are those of the authors and do not involve the responsibility of the institutions to which they belong.

Nonbanks have emerged as a primary source of credit for both firms and households, yet the impact of monetary policy on their lending practices is not well understood. In this policy brief, we present evidence that nonbanks increase their credit supply after a monetary contraction, both relative to banks and in absolute terms. The nonbank credit expansion is driven by long-term debt funding flowing to nonbanks. The attenuation of the traditional bank lending channel of monetary policy has real effects: nonbank credit insulates corporate investment and household consumption from adverse consequences of monetary contractions.

Traditional banks often reduce lending in response to a monetary tightening, a phenomenon known as the bank lending channel of monetary policy (Kashyap and Stein, 1994, and Bernanke and Gertler, 1995). The recent surge in lending by nonbank financial institutions raises questions about how they respond to monetary contractions in terms of lending and how this response impacts the real economy. In this policy brief, we summarize our findings in Cucic and Gorea (2024) where we examine the role of nonbank lenders in the transmission of monetary policy in Denmark, focusing on their impact on corporate investment and household consumption.

Nonbanks are increasingly a force to reckon with in many credit markets. In Denmark, nonbanks accounted for approximately eight percent of total unsecured credit in both corporate and consumer markets between 2003 and 2018. This share fluctuated, particularly around the 2008 financial crisis, but has shown a general trend of stability in the corporate sector and growth in the consumer sector post-2010. Nonbanks in Denmark include a variety of institutions such as specialized finance companies, wealth managers, and financial leasing companies, each playing significant roles in their respective markets. For instance, specialized finance companies dominate nonbank lending in the corporate credit market, while financial leasing companies are the largest nonbank lenders in the consumer credit market.

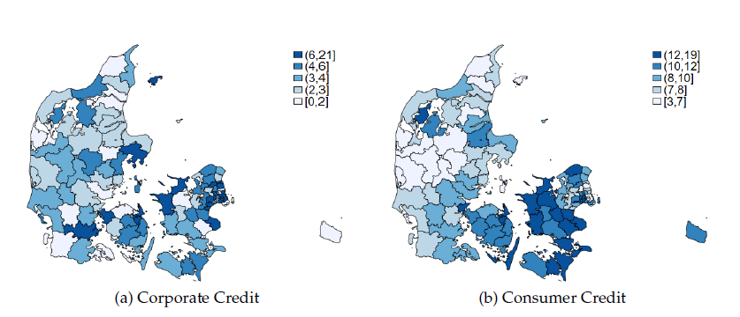

The geographical distribution of nonbank lending also shows regional concentrations, with higher shares of nonbank credit in the Danish Capital Region and the Zealand Region. Figure 1 shows how the share of nonbank credit is distributed across Danish municipalities in both the corporate and consumer credit markets. In many local markets, nonbanks account for close to 1/5 of overall unsecured lending.

Figure 1. Nonbanks hold a significant credit share (%) in some municipalities in Denmark

Given nonbanks’ significant role in credit allocation, central banks need to consider how monetary policy impacts nonbanks’ balance sheets. In Cucic and Gorea (2024), we show that after a monetary policy tightening, nonbanks increase their lending both in absolute terms and relative to banks. Specifically, a one standard deviation increase in policy rates boosts the nonbank credit share by about five percent in both corporate and consumer markets. This shift is primarily due to increased lending to existing nonbank borrowers rather than the formation of new lending relationships.

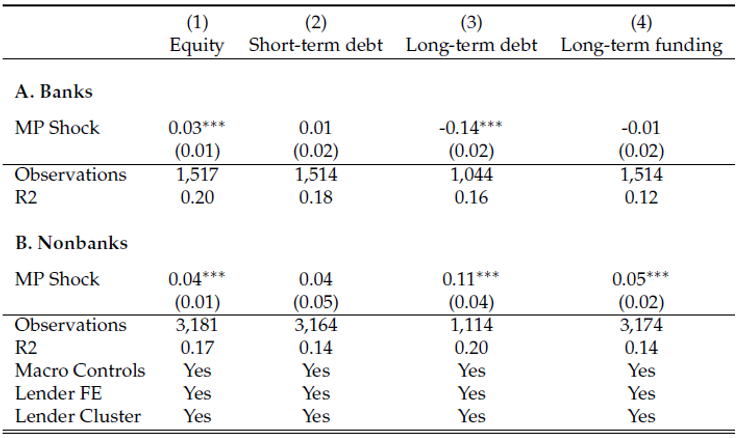

Nonbanks can increase lending after a monetary tightening primarily due to their ability to attract long-term debt funding, which contrasts with the funding challenges faced by traditional banks (Drechsler et al., 2017). In table 1, we show that while monetary contractions typically decrease long-term debt funding for banks, they actually increase it for nonbanks. This inflow of long-term funding provides nonbanks with the necessary resources to expand their credit supply when traditional banks are pulling back following a monetary tightening.

Table 1. Long-term debt of nonbanks increases while that of banks drops following a surprise monetary tightening

Additionally, we also show in Cucic and Gorea (2024) that nonbanks tend to be more profitable than banks, both on average and in the cross-section. Higher profitability makes nonbanks attractive borrowers in competitive funding markets, such as those for long-term debt. Consequently, nonbanks can raise additional debt after monetary contractions, as they are perceived as higher quality borrowers. The profitability gap between banks and nonbanks is further amplified by monetary contractions, enhancing nonbanks’ ability to secure long-term funding. Crucially, we also show that nonbanks seem to increase their lending to firms and households that can be perceived as less risky based on their leverage, income, and employment history. This indicates that nonbanks are not using the opportunity provided by tighter monetary policy to take on additional risk, and therefore, their profitability does not suffer following surprise policy rate hikes.

Furthermore, regulatory differences play a significant role in enabling nonbanks to increase lending during periods of monetary tightening. Nonbanks often face fewer regulatory constraints compared to traditional banks, which are subject to various capital, leverage, and stable-funding ratios aimed at making their short-term funding more resilient (Jiang et al., 2023). This differential regulatory environment forces nonbanks to adopt a capital structure that emphasizes longer-term debt and equity, enabling them to secure more stable funding sources.

The increase in nonbanks’ credit supply following a monetary tightening has significant consequences for the real economy. One of the primary effects is the attenuation of the traditional bank lending channel of monetary policy. When banks reduce their lending due to tighter monetary policy, nonbanks step in to fill the gap, ensuring that credit continues to flow to firms and households. While the substitution away from bank to nonbank credit is incomplete, the “spare tire” role played by nonbanks helps to mitigate the adverse effects of monetary contractions on economic activity.

For firms, the availability of nonbank credit translates into higher investment, operating profits, and wage bills. This means that firms with existing nonbank relationships are better able to sustain their operations and growth even when traditional bank credit becomes scarce. Similarly, households with ties to nonbanks experience higher consumption, both durable and nondurable, which helps to cushion the impact of monetary tightening on aggregate demand.

Moreover, the positive effects of nonbank lending extend beyond direct nonbank borrowers, creating beneficial spillover effects within the economy. Firms in industries with a higher share of nonbank credit tend to increase their investment, benefiting even those firms without direct nonbank ties. Additionally, household consumption benefits from the presence of nonbanks in local credit markets, as regions with a higher share of nonbank lending see more robust consumer spending. These spillover effects indicate that nonbanks play a crucial role in maintaining economic stability and growth during periods of monetary tightening. By providing an alternative source of credit, nonbanks help to ensure that the adverse effects of monetary policy adjustments are less severe, supporting both financial and real economic outcomes.

Our study provides robust evidence that nonbanks significantly influence the transmission of monetary policy, thereby affecting both financial and real economic outcomes at the household and firm level. By attracting long-term funding, nonbanks can expand their lending and support economic activity when traditional banks reduce credit supply after a monetary tightening. This has important implications for understanding the full impact of monetary policy and highlights the need for considering nonbank financial intermediaries in economic policy discussions. The findings of this paper contribute to the growing literature on the “shadow banking channel” of monetary policy, as explored by Chen et al. (2018), Xiao (2020), Banerjee and Serena (2022), and Elliott et al. (2022) among others.

Banerjee, Ryan and José María Serena. 2022. “Dampening the financial accelerator? Direct lenders and monetary policy.”

Bernanke, Ben S and Mark Gertler. 1995. “Inside the black box: the credit channel of monetary policy transmission.” Journal of Economic perspectives, 9(4): 27–48.

Chen, Kaiji, Jue Ren, and Tao Zha. 2018. “The nexus of monetary policy and shadow banking in China.” American Economic Review, 108(12): 3891–3936.

Cucic, Dominic and Denis Gorea. 2024. “Nonbank Lending and the Transmission of Monetary Policy.” Danmarks Nationalbank Working Paper 205.

Drechsler, Itamar, Alexi Savov, and Philipp Schnabl. 2017. “The deposits channel of monetary policy.” The Quarterly Journal of Economics, 132(4): 1819–1876.

Elliott, David, Ralf Meisenzahl, José-Luis Peydró, and Bryce C Turner. 2022. “Nonbanks, banks, and monetary policy: US loan-level evidence since the 1990s.” Federal Reserve Bank of Chicago Working Papers.

Jarociński, Marek and Peter Karadi. 2020. “Deconstructing monetary policy surprises – the role of information shocks.” American Economic Journal: Macroeconomics, 12(2): 1–43.

Jiang, Erica, Gregor Matvos, Tomasz Piskorski, and Amit Seru. 2023. “Banking without deposits: Evidence from shadow bank call reports.” National Bureau of Economic Research Working Paper.

Kashyap, Anil and Jeremy Stein. 1994. “Monetary policy and bank lending.” In MonetaryPolicy. 221–261. National Bureau of Economic Research.

Xiao, Kairong. 2020. “Monetary transmission through shadow banks.” The Review of Financial Studies, 33(6): 2379–2420.