Drawing on the OeNB Euro Survey that is conducted regularly in Central, Eastern and Southeastern European (CESEE) countries, we present new and unique evidence on a dozen forms of bank and nonbank debt, for ten countries of this region. Specifically, we analyze which factors determine whether households hold bank debt versus what we refer to as secondary formal debt, i.e. debt from nonbank financial companies such as payday lenders. Policymakers in many jurisdictions have had a watchful eye on this kind of debt given that nonbank financial companies often target financially excluded or poor individuals by offering small, high-cost loans. In bivariate probit regressions, we show that individuals with characteristics that suggest increased vulnerability – e.g. lower income, unemployment, exclusion from banking services – are more likely to have secondary formal debt. We further find that the relationship with bank concentration is U-shaped. Finally, we provide some preliminary evidence that secondary formal debt is associated with a higher probability of arrears. Our findings highlight the importance of nonbank debt for any discussion of household indebtedness and suggest that policy makers should closely monitor secondary formal debt as borrowers of nonbank financial institutions are more vulnerable.

After the global financial crisis, household indebtedness in Central, Eastern and Southeastern Europe (CESEE) and related vulnerabilities attracted more attention. Analyses usually focused on the most important source of debt in bank-dominated CESEE economies: bank loans. However, not all household debt in CESEE is owed to banks. The share of people with bank products can be low, and use of nonbank financial services high, particularly in emerging economies and among the poorer segments of societies.

In particular, debt from nonbank financial companies (secondary formal lending), such as payday lenders, has moved into the focus of regulators in several jurisdictions over the past years (for the EU, see e.g. the European Commission’s evaluation of the Consumer Credit Directive 2008/48/EC). In some cases, such lenders have even been banned, with a case in point being state payday loan bans in the USA.

The literature that investigates which demand and supply factors influence the decision to borrow from nonbanks is rather scarce. Previous research has shown that secondary formal debt is associated with lower income, lower credit scores, lower levels of education and financial literacy, belonging to a minority and being unbanked (e.g. Gross et al., 2012; Lusardi and de Bassa Scheresberg, 2013; Birkenmaier and Fu, 2016, Seay and Robb, 2013; Robb et al., 2015). Several studies investigate whether nonbank lenders are located in areas where there are no banks and whether these areas are characterized by an above-average share of minority groups or low-income households (Smith et al., 2008, Fowler et al., 2014, Prager, 2014).

In a recent study, we provide evidence on the prevalence and determinants of nonbank borrowing in CESEE-102 (Allinger and Beckmann, 2021). We address the following questions: (1) Do borrowers of secondary formal debt in CESEE have personal and sociodemographic characteristics that mark them as more vulnerable than bank borrowers? (2) Are individuals with secondary formal debt more likely to be excluded from the banking system? (3) How do the factors local banking market, bank competition and concentration affect secondary formal borrowing?

Our data source is the OeNB Euro Survey3 – a cross-sectional face-to-face survey of individuals conducted in ten CESEE countries (CESEE-10). In the 2016 and 2019 waves of the OeNB Euro Survey we included a question on different sources of indebtedness: Bank loan, credit card debt, installment credit at store or company, internet loan, payday loan, pawnshop credit, debt owed to another private lender, debt owed to family, relatives or friends, debt owed to employer, delayed payment of bills to utility provider, and other debt. We assign these different forms of debt to the following broad categories: bank debt, debt from nonbank financial companies (“secondary formal debt”), informal debt, e.g. from family and friends, and utility debt, i.e. money owed to utilities, e.g. for water, gas or energy usage.

On average across CESEE-10, 42% of individuals have some form of debt. Of those with some form of debt, about 61% have only bank debt, 20% only nonbank debt, and 19% have both bank and nonbank debt. The most common debt instruments are bank loans (21%), bank overdrafts (16%) and loans from family and friends (11%). Credit card debt, store credit and utility debt account for shares between 5% and 7%, while all other forms of debt are only held by a small fraction of the sample below 2% each.

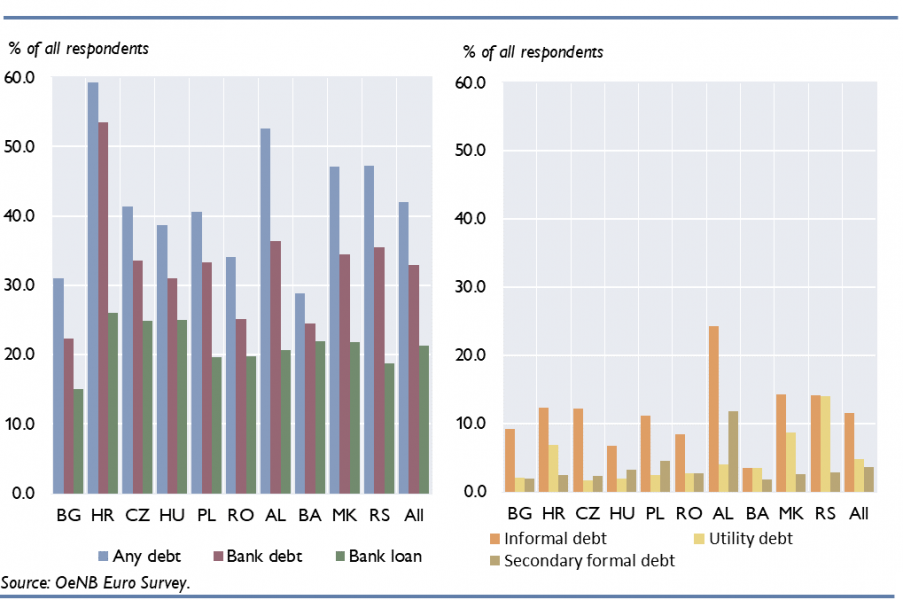

Chart 1 illustrates that the level of indebtedness and how debt is held differ widely between countries. For example, in some countries, the share of bank debt is very close to the share of people with any debt (e.g. Croatia), while in others the gap is wider (e.g. Albania, North Macedonia). Secondary formal debt accounts for the lowest shares in all countries. Albania stands out, with 12% of respondents having at least one form of such debt. In the remainder of CESEE-10, the shares are much lower, ranging between 4.5% in Poland and 1.8% in Bulgaria and Bosnia and Herzegovina.

Chart 1: Country comparison: share of respondents holding particular types of debt

In our econometric analysis, we model the determinants of holding debt in the form of bank debt and/or as secondary formal debt while taking into account that individuals may also hold informal or utility debt. We estimate bivariate probit models, where the two binary outcomes (bank debt and secondary formal debt) are correlated, and their determinants are estimated jointly. We reduce the sample to those individuals that have any debt and analyze what drives their choice of debt source. Our control variables are informed by previous research and comprise socioeconomic controls, controls for other debt, controls for personal beliefs and preferences as well as controls for the local environment. We merge the survey data with the OeNB bank branch data for CESEE (Beckmann et al., 2018), which allows us to analyze how the local banking market affects secondary formal borrowing.

Our estimation results show that individuals are less likely to hold secondary formal debt and no bank debt if they manage household finances, have secondary or tertiary education, own their residence and live in smaller households. People are more likely to hold secondary formal debt if they are unemployed. Regarding personal characteristics, individuals with secondary formal debt are significantly less risk averse and more impulsive.

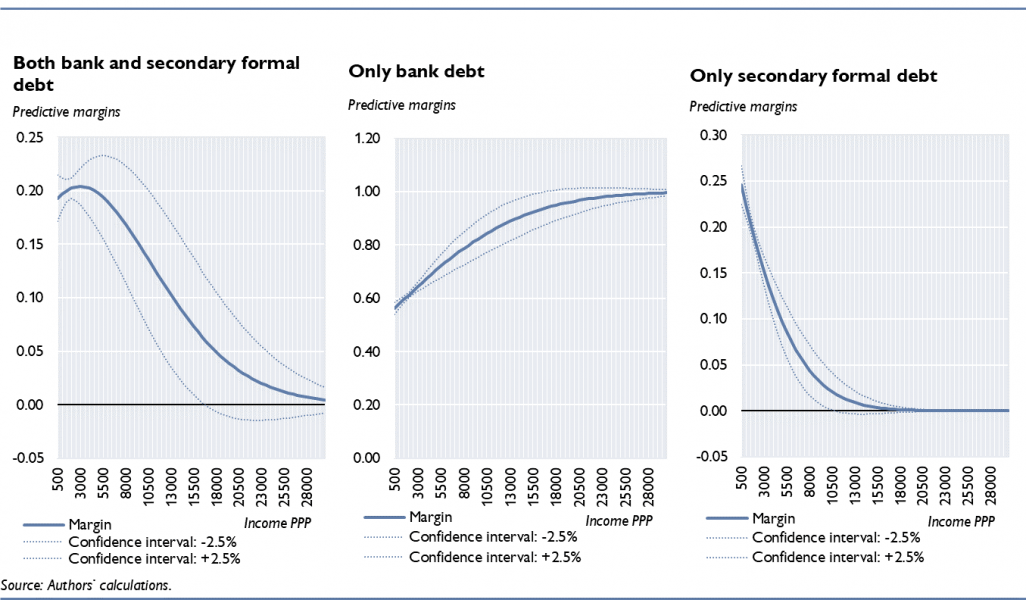

Chart 2. Marginal propensity to hold different forms of debt at representative values of income

Chart 2 illustrates that the probability of individuals having only secondary formal debt is highest for those with low income and practically zero for those with high income (right panel). The probability of having only bank debt shows a reversed picture (middle panel), with those at the lower end of the income distribution having a probability of roughly 75% of owning only bank products. For people with higher income, this increases to above 90%.4 For individuals with both kinds of debts (left-hand panel), the line of predicted margins is mildly downward sloping, but confidence intervals are high for the upper three quarters of the income distribution.

Our regression results further reveal that the probability of holding secondary formal debt increases for people that were rejected by at least one bank when applying for a loan. Individuals who trust banks are more likely to have only bank debt and less likely to have secondary formal debt.

Regarding the effect of the local banking market on the prevalence of secondary formal debt, we find that the objective distance to the next bank is insignificant, while the subjective distance5 is highly significant. This makes sense intuitively as the same objective distance could be harder to overcome for some individuals and in some regions than in others.

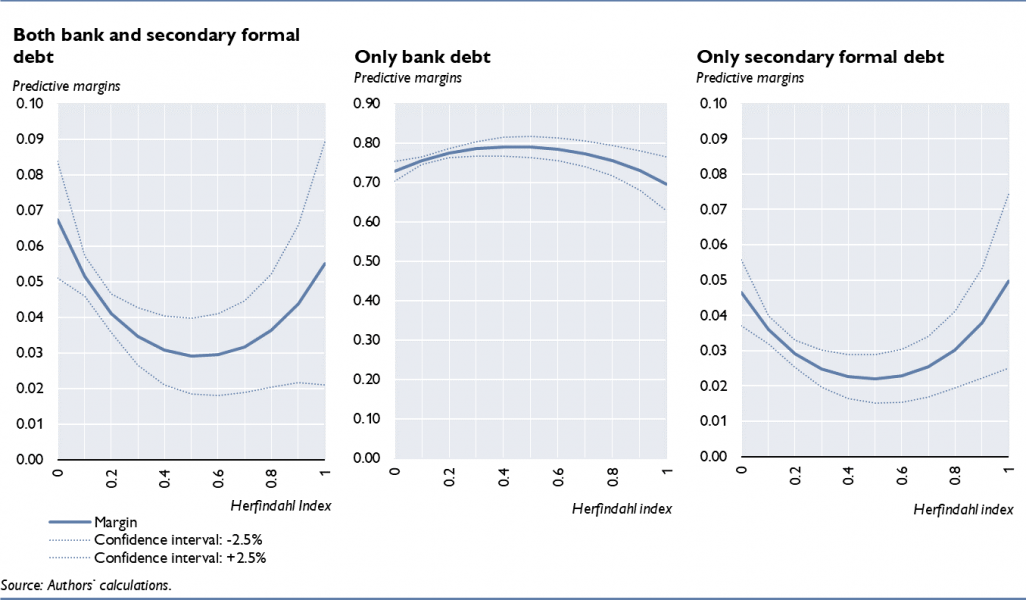

Nonbank lenders are likely to be located either in environments with almost no bank competition (“spatial void hypothesis”, see e.g. Fowler et al., 2014) or in environments with very high bank penetration where banks have substantial market power (e.g., Owen and Pereira, 2018). Indeed, we find a U-shaped relationship between secondary formal debt and bank concentration in our data (Chart 3).

Our data do not allow us to assess the welfare effects of secondary formal debt. However, we can provide some evidence on the sustainability of secondary formal debt based on an additional survey question about arrears. The question reads “Think of all the loans you have, either personally or together with your partner: Have you been in arrears on loan repayments once or more often during the past 12 months?” We estimate probit models where the dependent variable is arrears and the control variables comprise socioeconomic characteristics as well as supply side indicators. In addition, we include the types of debt individuals hold as an explanatory variable.

Chart 3. Marginal propensity to hold different debt instruments at representative values of bank concentration

We find that having one secondary formal debt instrument is associated with a 13-percentage-point higher likelihood of being in arrears. This increases to 45 percentage points for having three secondary formal debt instruments. Having bank debt is not significantly correlated with a higher likelihood of arrears.6

Regarding policy conclusions, our results (1) highlight the importance of nonbank debt for any discussion of household indebtedness, (2) suggest that policymakers should pay due attention to secondary formal debt as borrowers from secondary formal institutions are more vulnerable and (3) draw attention to open research and policy questions, e.g.: Do individuals use the secondary formal sector to cope with repayment difficulties with bank debt? If so, what does this imply for the usefulness of credit registers and for pockets of vulnerabilities in the financial system?

Amid COVID-19, nonbank borrowing is becoming even more relevant, as households’ creditworthiness is likely to deteriorate. At the same time, banks’ ability and willingness to lend might decrease, which could cause more households to borrow from nonbanks and worsen debtors’ (financial) situation in the medium term. After the global financial crisis, households in transition economies that had been affected by the crisis resorted to informal borrowing much more frequently compared with Western Europe (EBRD, 2011). In the context of the COVID-19 crisis it seems advisable to closely monitor the developments regarding nonbank debt.

Allinger, K. and E. Beckmann. 2021. Prevalence and determinants of nonbank borrowing in CESEE: Evidence from the OeNB Euro Survey, Focus on European Economic Integration Q1/21. OeNB. 7-35.

Beckmann, E., S. Reiter and H. Stix. 2018. A geographic perspective on banking in Central, Eastern and Southeastern Europe. In: Focus on European Economic Integration Q1/18. OeNB. 26–47.

Birkenmaier, J. and Q. Fu. 2016. The Association of Alternative Financial Services Usage and Financial Access: Evidence from the National Financial Capability Study. In: Journal of Family and Economic Issues 37. 450–460.

EBRD. 2011. Transition Report. Crisis and Transition: The people’s perspective. https://www.ebrd.com/publications/transition-report-archive

Fowler, C. S., J. K. Cover and R. Garshick Kleit. 2014. The geography of fringe banking. In: Journal of Regional Science 54(4). 688–710.

Gross, M. B., J. M. Hogarth, A. Manohar and S. Gallegos. 2012. Who uses alternative financial services, and why. In: Consumer Interests Annual 58(1). 2012–2057.

Lusardi, A. and C. de Bassa Scheresberg. 2013. Financial literacy and high-cost borrowing in the United States. National Bureau of Economic Research w18969.

Owen, A.L. and M.J. Pereira. 2018. Bank concentration, competition and financial inclusion. In: Review of Development Finance 8(1). 1-17.

Prager, R. A. 2014. Determinants of the Locations of Alternative Financial Service Providers. In: Review of Industrial Organization 45. 21–38.

Robb, C. A., P. Babiarz, A. Woodyard and M. C. Seay. 2015. Bounded Rationality and Use of Alternative Financial Services. In: Journal of Consumer Affairs 49(2). 407–435.

Seay, M. C. and C. A. Robb. 2013. The effect of objective and subjective financial knowledge on high-cost borrowing behavior. In: Financial Planning Review 6(4). 1–19.

Smith, T. E., M. M. Smith and J. Wackes. 2008. Alternative financial service providers and the spatial void hypothesis. In: Regional Science and Urban Economics 38(3). 205–227.

CESEE-10 comprises CESEE-EU: Bulgaria (BG), Croatia (HR), Czech Republic (CZ), Hungary (HU), Poland (PL), Romania (RO); and Western Balkan countries: Albania (AL), Bosnia and Herzegovina (BA), North Macedonia (MK) and Serbia (RS).

For more information on the OeNB Euro Survey, see https://www.suerf.orgwww.oenb.at/en/Monetary-Policy/Surveys/OeNB-Euro-Survey.html. In each country and in each survey wave, a sample of 1,000 individuals is polled based on multistage random sampling procedures. Each sample reflects a country’s population characteristics in terms of age, gender, region and ethnicity.

It is important to recall that we only consider indebted individuals in our regression.

Variable constructed from the question: “For me, it takes quite a long time to reach the nearest bank branch.”

Note that the these results do not show a causal relationship. It is possible that individuals first take on debt that is not secondary formal. Having fallen into arrears on the repayment of their primary debt, they then take on secondary formal debt to address these repayment difficulties. It is also possible that individuals run into repayment difficulties because of high installments on secondary formal debt. Our results only show a correlation between loan arrears and secondary formal debt.