References

AWG. (2021). The 2021 Ageing Report: Economic and budgetary projections for the EU Member States (2019-2070). European Economy, Institutional Paper 148, Brussels, pp.398.

Deaton, A. (1991). Saving and Liquidity Constraints. Econometrica, 59(5), pp. 1221-1248.

European Commission, (2020). Country report Luxembourg 2020. 2020 European Semester: Assessment of progress on structural reforms, prevention and correction of macroeconomic imbalances, and results of in-depth reviews under Regulation (EU) No 1176/2011.

Fries, J. (1980). Aging, Natural Death, and the Compression of Morbidity. The New England journal of medicine, 303, pp. 130-135.

Garcia Sanchez, P., Marchiori, L., Moura, A. and Pierrard, O. (2021). Impact de la crise Covid-19 sur l’économie luxembourgeoise – Analyses avec les modèles d’équilibre général LU-EAGLE et LOLA. BCL Bulletin 2021-2, pp. 36-51, Central Bank of Luxembourg.

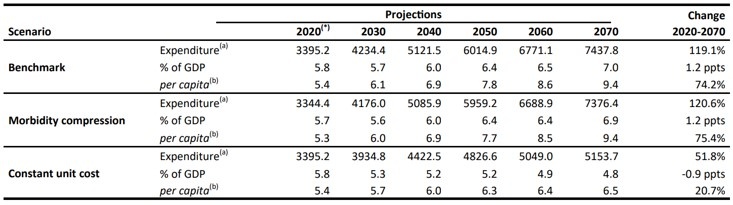

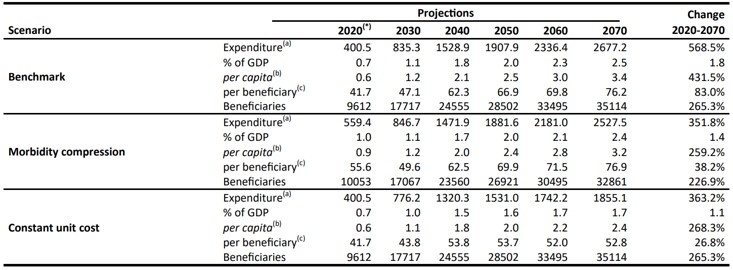

Giordana, G.A. and Pi Alperin, M.N. (2022). Old age takes its toll: long-run projections of health-related public expenditure in Luxembourg. Central Bank of Luxembourg Working Papers 158.

OECD/European Observatory on Health Systems and Policies, (2017). Luxembourg: Country health profile 2017, State of Health in the EU. Organization for Economic Cooperation and Development Publishing, Paris; European Observatory on Health Systems and Policies, Brussels.