About 541 million years ago, in the space of just 20 to 25 million years, life on earth went through a sudden and remarkable change. In what became known as the Cambrian Explosion, a few simple organisms were replaced by a huge variety of more complex life forms with compound eyes, multiple legs, and sharp teeth. Most of the Cambrian life forms went extinct, but pretty much all animals and plants living today started their evolutionary journey at that time.

It has been argued that a rise in the level of free oxygen above a certain threshold enabled different lineages of complex life forms to develop. These complex creatures used their eyes, legs and teeth to prey on other organisms, which had to quickly learn how to hide or grow shields lest they be consumed as food. The rest is history.

We have seen a similar explosion in crypto assets over the last 10 years. It started with Bitcoin, evolved to a more complex form with Ethereum, had a separate line with Ripple, and then splintered into thousands of crypto tokens.

Like the rising level of oxygen for early life forms, the crypto explosion may have been made possible by Moore’s Law, an observation that over time, ever more computational power is available at the same cost. Due to Moore’s Law, sometime in the late 2000s, computing power seems to have reached a critical threshold – it became possible to solve complex calculations on standalone personal computers, and communicate the solutions to other computers over the Internet.

The result was a decentralised, self-sustaining, computational ecosystem governed by a protocol that issued new crypto assets to those who provided computational resources – blockchain or distributed ledger technology. These assets could be thought of as crypto life forms inhabiting different blockchains. And as before, many crypto assets will not survive just as the post-Cambrian arthropods did not way back when. By some estimates, around twothirds of crypto assets offered through an initial coin offering failed to survive 120 days. However, the ones that do will evolve into a class of financial assets more suitable to the digital era than many of the ones we have now.

As an asset class, crypto assets are probably closest to commodities. According to the U.S. Commodity Exchange Act, there are three types of commodities – agricultural, exempt (such as metals and energy), and excluded (interest rates, exchange rates, credit rates, indices, measures, etc.). Specifically, according to Section 1(a)19 of the Commodity Exchange Act, “excluded commodity” is …

“(iv) an occurrence, extent of an occurrence, or contingency (…) that is

(I) beyond the control of the parties to the relevant contract, agreement, or transaction; and

(II) associated with a financial, commercial, or economic consequence.”

Bitcoin, for example, fits into this definition quite well. It is an occurrence; is beyond the control of the parties to the relevant contract; and is associated with a financial, commercial, or economic consequence. However, some digital assets, including the very Bitcoin could also be considered exempt commodities (like precious metals). While the difference in classification matters for regulatory treatment, it is fair to say that the breadth of the existing statutory definition at least in the U.S. is sufficient for the purposes of regulating crypto assets.

The most important financial attributes of a physical commodity are (i) its storability over time and (ii) ease of its delivery in different locations and under different circumstances (future states of the world). Think of gold – arguably the most financial of the physical commodities. Gold is capable of being stored over very long periods without any loss to its physical properties and it can be easily delivered without any infrastructure. In contrast, electricity—another commodity—is currently very difficult and costly to store and requires considerable (and also very costly) infrastructure for delivery.

Digital records are extremely highly storable and can be delivered over digital communication networks anywhere in the world at extremely low cost. However, while a physical commodity cannot be digitally cloned, a digital record can be, which makes it hard to distinguish between the original and a copy. Blockchain technology uses cryptography and encryption to create and transmit an immutable database of digital records. As a result, it becomes possible to use blockchain to create scarcity of digital objects, and, thus, create an entirely new class of digitally native financial assets – crypto currencies, tokens and coins.

Digital scarcity, however, is necessary, but not a sufficient condition for the survival of a supplied crypto asset. The key to the survival of a crypto asset is the probability of its adoption for some form of use.

In recent work with Silvia Bartolucci, we posit that on the supply side, crypto assets differ from each other by two essential features: security and stability. We argue that security of a crypto asset reflects its technological vulnerability to cyber fraud, manipulation, abuse, and attack. Other things equal, use of a more advanced encryption technology would render a crypto asset more secure relative to other crypto assets at a point in time. In other words, security is a cross-sectional attribute of a crypto asset.

In turn, stability of a crypto asset reflects its potentially faulty governance. Other things equal, greater reliance on elements of regulated or self-regulated governance with legal or procedural recourse would render a crypto asset more stable in terms of the value that can be recovered. Thus, stability is a time series attribute of a crypto asset that reflects its ability to retain value across time for a given level of security by adopting more legal, regulatory, and credible self-regulatory (e.g., consensus) mechanism.

On the demand side, we model the adoption of a crypto asset as a choice between security, stability, and the risk/return tradeoff for given investor preferences. Intuitively, in order to get adopted as quickly as possible, crypto assets have to offer higher expected return. Expected return, of course, is an economic and statistical construct – it is a sum of payoffs weighted by their perceived probabilities. Whether those payoffs actually materialise and whether those perceived probabilities match anything deemed rational is a big and, at times, very technical part of the research agenda in financial economics and should not in any way, be viewed as investment advice.

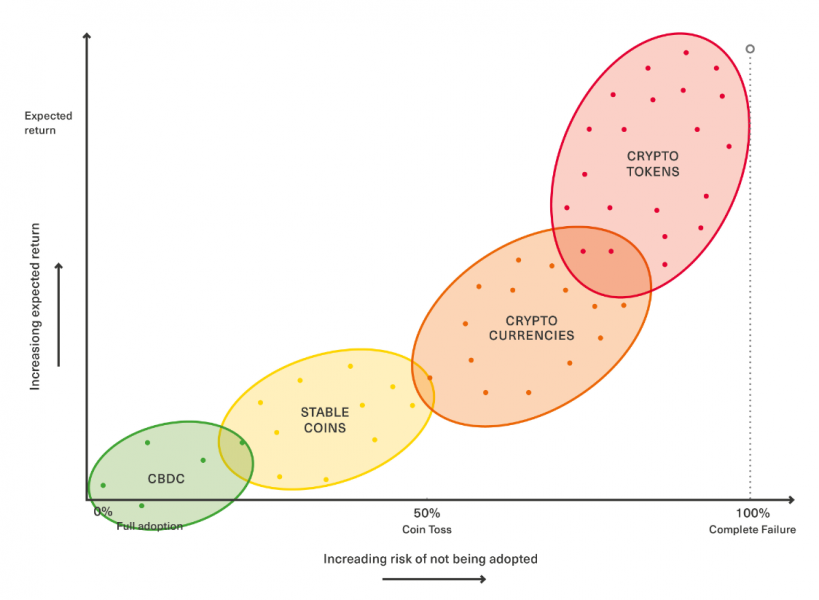

By plotting the expected return of crypto assets against the risk of their not being adopted, we’re able to organise them into four large groups: central bank issued digital currencies (CBDCs), stable coins, cryptocurrencies, and crypto tokens.

Figure 1. Expected return against risk of crypto assets

CBDCs can be used to pay for any good, service or financial asset. Their technological advantage is being digitally native. Their economic advantage is access to a central bank-regulated payment system. The probability of non-adoption for such an asset could be kept very low as a central bank can simply mandate its use within its regulated jurisdiction.

So far, there have been several examples of what could be considered CBDCs, but none in credible jurisdictions. In contrast, countries with credible national payment systems have publicly spoken against opening up CBDCs, often citing financial stability concerns.

I have been asked by a dozen regulators around the world for my views on crypto assets and CBDCs in particular. In my opinion, a CBDC really makes sense in an economic area where the added value is expected to increase in line with affordable computational power. To put it simply, if you have a global platform like Amazon, Alibaba, Google or Facebook operating in your economic jurisdiction, you should seriously study how to give them an ultraliquid, digitally-native asset with access to the payment system that’s suitable for their Moore’s Law driven business processes. Otherwise, don’t worry about it.

Stable coins are so called because they are collateralised by existing financial assets or fiat currencies. Their technological advantage is their ability to be held in crypto wallets alongside existing crypto assets. Their economic advantage is the stability of the underlying collateral. The probability of non-adoption for a stable coin could range from moderate to a coin toss: they need to offer a positive expected return to attract potential users. In so far as a stable coin scales up with Moore’s Law, it could offer a viable transition mechanism from a fiat currency to a crypto asset, provided it is able to reach the necessary adoption threshold.

Cryptocurrencies were designed to scale up with Moore’s law, but their continuing creation to reward the owners of computers that keep track of their use has been proving costly. Their probability of non-adoption fluctuates around 50% and their expected return is high. The adoption of Ethereum is benefitting from its use as a platform for other applications, but the more popular it becomes as a development platform, the higher are the chances that its perceptions of its purpose split, limiting widespread adoption. And, of course, whether or not cryptocurrencies are more fully adopted relies a lot on what regulators in key jurisdictions have to say about them.

Last of all are those crypto tokens. These include utility tokens, security tokens, and other types of crypto tokens. For the purposes of this article, tokens are for the most part viewed as future sales, investment and participation schemes designed to fund software development. Investment in crypto tokens is a high-risk activity, vulnerable to outright fraud, failure, and inadequate performance. To mitigate these risks and profit from intermediation and future use, a vibrant ecosystem of crypto funds, crypto exchanges (where crypto tokens are listed) and crypto custodians (where crypto investments are held) has emerged. Some of these participants will go extinct along with their token investments, but others will survive – and make a lot of sense for a number of digital projects, especially those that have the potential to become global platforms.

In my view, crypto assets have a fundamental technological feature that separates them from previous generations of assets – as the affordability of available computing power increases, so too will their usefulness. This makes them much more suitable for financing activities such as software development, digital payment and settlement platforms, and e-commerce. In contrast, more physical economic activities such as mining, car manufacturing, or running a grocery shop, will do just fine without them.

Lastly, I have a few words on the regulation of crypto assets, which again should not be viewed as legal or investment advice. Regulation of crypto assets has proven to be a non-trivial challenge to regulators around the world.

First of all, regulators have to figure out what aspect of a crypto asset they regulate and why. Is it cryptography/encryption (AML/KYC), P2P (payments/intermediaries), consensus (governance), blockchain (entities/reporting)?

Second, the regulators need to answer why are they regulating crypto assets. Is it due to market failure/manipulation, asymmetric information/rent seeking, financial bubbles/systemic risk?

Third, regulators need to establish under which regulatory mandate is the plan to regulate crypto assets? Do they plan to regulate them under the monetary policy mandate, financial stability mandate, payments mandate, consumer protection, or fair and orderly markets mandate?

In my opinion, regulators ideally should try not to regulate a specific asset, crypto or otherwise. Rather, after defining broad attributes of an asset class, regulators should aim to regulate principled activity – issuance, brokerage, custody, etc. Furthermore, many crypto assets follow a zero trust architecture – “never trust, always verify any node or activity on the inside or outside the network” – so aspects of the regulation of crypto assets might in fact evolve to follow a much lighter touch.