A specific feature of recent asset purchase programmes is the reinvestment policy: the central bank keeps the overall volume of assets on the balance sheet constant for some time. We provide a systematic, model-based analysis of the macroeconomic effects of reinvestments. Conceptually, longer full reinvestments increase the stock effect on inflation. This allows the central bank to substitute between the sum of net purchases and the length of the full reinvestment period for a given monetary policy stimulus. Quantitatively, we find that counterfactually omitting reinvestments in a programme that embeds key features of the Eurosystem’s pandemic emergency purchase programme reduces the effect on inflation by roughly one third. Stochastic simulations reveal that reinvestment policies can mitigate the constraints of upper purchase limits. Introducing bounded rationality attenuates the effects of reinvestment policies.

In the wake of the Great Recession of 2007/08 and the COVID-19 pandemic, central banks in advanced economies have resorted to asset purchase programmes to stimulate the economy. A feature of recent programmes is the announcement of a reinvestment period. This is the period the central bank is going to hold the overall volume of assets, i.e. cumulated net purchases, constant on the balance sheet. For example, the European Central Bank (ECB) announced on 4th June 2020: “The maturing principal payments from securities purchased under the pandemic emergency purchase programme will be reinvested until at least the end of 2022” (ECB, 2020). The length and the size of reinvestments also plays a role in the recent normalisation of the Federal Reserve’s and Eurosystem’s balance sheet (Fed, 2022; ECB, 2022).

In Gerke, Kienzler and Scheer (2022), we provide a systematic analysis of reinvestment policies. Specifically, we assess their qualitative and quantitative effects within a dynamic stochastic general equilibrium (DSGE) model. In this framework, primarily the stock effect determines the macroeconomic effect of asset purchase programmes – in line with empirical evidence (e.g. D’Amico and King, 2013; Sudo and Tanaka, 2021).1 The stock effect is an announcement effect. It implies that financial market participants immediately factor in the central bank’s credible announcement of how the stock of assets on its balance sheet will evolve over time.2 This includes how long the overall volume that the central bank ultimately holds will stay constant on its balance sheet, i.e., how long the central bank will reinvest any maturing assets. As a result, it is the announcement of the whole evolution of the stock of assets on the central bank’s balance sheet that affects financial markets and ultimately the economy at large.

Within our framework, we show that an additional reinvestment period enhances the macroeconomic stimulus of an asset purchase programme. The reason is that the announcement of a longer period of reinvesting maturing assets constitutes an additional stock effect. Figuratively, the area beneath the curve of assets on the central bank’s balance sheet over time captures the stock effect for this programme (e.g. the area beneath the blue line in Figure 1). Accordingly, the central bank can replace higher overall volumes (more net purchases) with longer reinvestments (longer constant balance sheet size). As a result, the central bank has two options to adjust the effectiveness of an asset purchase programme. Next to the announcement of the overall volume of the programme, it can use reinvestments as a separate component.

We systematically quantify the impact of reinvestments by building on a version of the two-agent New Keynesian Model from Gerke, Giesen and Scheer (2020). In this model, financial frictions (especially credit and arbitrage constraints) allow asset purchases to affect the inflation rate and aggregate output. The existence of a second household that lives “hand-to-mouth” mitigates the expansionary effects of future measures.3 This model feature helps to “tame” the forward guidance puzzle relevant in this class of models, see e.g. McKay, Nakamura and Steinsson (2016) or Del Negro, Giannoni and Patterson (2023). We estimate the model based on eight euro area time series for the period 1999Q1 to 2014Q4.

We quantify the macroeconomic effects of reinvestment by incorporating key features of the Eurosystem’s Pandemic Emergency Purchase Programme (PEPP) in our model – a programme that explicitly included a reinvestment policy. We use a piecewise linear solution approach to solve the model. This approach allows us to also run stochastic simulations with a state-dependent purchase programme (the central bank buys assets only when the policy rate is at the effective lower bound). Within our framework, we are able to analyse how reinvestment can mitigate the constraints of upper purchase limits, i.e. the feasibility of a given amount of desired purchases.

We obtain four main results, the first three under rational expectations, the last one with deviations from rational expectations. In either case, the asset purchase programme is fully credible.

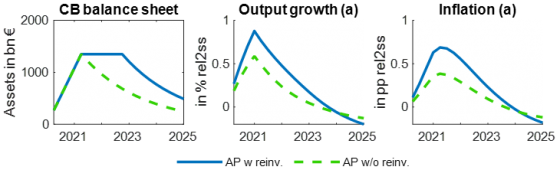

First, counterfactually omitting reinvestments in an asset purchase programme that embeds key features of the PEPP reduces the peak effect on inflation by roughly one third. Yet, it leaves the macroeconomic dynamics largely unchanged. Figure 1 contrasts the impact on output and inflation for an asset purchase programme with reinvestment (blue line) and without reinvestment (green dashed line).

Figure 1: Impact of reinvestment policy

Notes: The figure shows the impact of an asset purchase programme that resembles key features of the PEPP on macroeconomic variables (blue line, “AP w reinv” = asset purchases with reinvestment policy). All results are shown relative to steady state. Output growth and inflation are annualised. The green line isolates the impact of the overall volume when there is no reinvestment period.

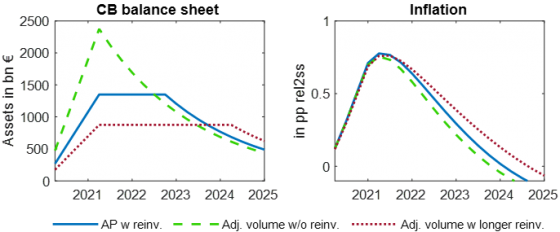

Second, monetary policy can substitute longer reinvestments for more net purchases (i.e., a larger overall volume of assets on the central bank’s balance sheet). Figure 2 illustrates this substitutability in contrast to the baseline purchase programme (blue solid line). In order to achieve the same macroeconomic stimulus (at the peak) as in the baseline, monetary policy can decrease the overall volume by €400bn (or 30%) if it extends the reinvestment period from six to twelve quarters (red dotted line). If it completely abstains from reinvestments (green dashed line), it has to increase the overall volume by €1000bn (or 70%).

Figure 2: Substitutability of overall volume and reinvestment

Notes: The figure illustrates the substitutability of overall volumes (green dashed line; adjusted volume w/o reinvestment) and longer reinvestments (red dotted line; adj. vol. w longer reinvestment) such that the overall macroeconomic impact on inflation is similar to the baseline (blue solid line, AP w reinvestment). Inflation is annualised.

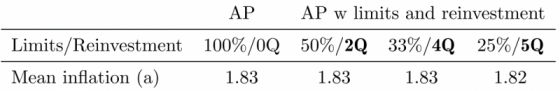

Third, reinvestments can undo the detrimental impact that upper purchase limits have on the inflation bias. Several central banks have publicly announced such limits, e.g. because of legal concerns or to ensure proper functioning of asset markets.4 For an upper purchase limit of 25% (33%; 50%) of outstanding public debt, monetary policy can prolong the reinvestment period by five (four; two) quarters to reach the same inflation bias as in the case without an upper limit (see Table 1). This captures the above-mentioned logic that monetary policy can substitute future reinvestments for present net purchases : while monetary policy cannot increase net purchases above the limit in the present, it can promise to keep the balance sheet constant for longer via reinvestments. This mirrors to some extent a lower-for-longer approach with respect to the interest rate at the effective lower bound (Eggertsson and Woodford, 2003).

Table 1: Substitutability of asset purchases and reinvestments

Notes: Summary statistics based on stochastic simulations for the asset purchases scenario without limit, and alternative reinvestment scenarios. Annual inflation target is 2%, long-run level of the annual real rate is 0.5%, ELB is at -0.5%. The inflation rate is annualised.

Fourth, the quantitative impact of reinvestments are reduced when agents’ expectations deviate from rational expectations. When agents are boundedly rational in the spirit of Gabaix (2020), the macroeconomic impact of asset purchases in general as well as the marginal benefit of reinvestments are lower. Both results appear intuitive: as agents are not perfectly forward-looking, the stock effect is discounted. As a result, the announcement of asset purchase programmes in general and reinvestments in particular are less effective.

Bhattarai, S. and Neely, C. J. (2022). An analysis of the literature on international unconventional monetary policy, Journal of Economic Literature 60(2): 527-97.

D’Amico, S. and King, T. B. (2013). Flow and stock effects of large-scale treasury purchases: Evidence on the importance of local supply, Journal of Financial Economics 108(2): 425-448.

Del Negro, M., M. P. Giannoni and C. Patterson (2023). Forthcoming. The Forward Guidance Puzzle. Journal of Political Economy Macroeconomics.

Eggertsson, G. B. and Woodford, M. (2003). Optimal monetary policy in a liquidity trap, NBER Working Paper Series 9968.

ECB (2020). Press Release, Monetary policy decision, June 4th, 2020.

ECB (2022). Press Release, Monetary policy decision, December 15th, 2022.

ECB (2022): Q&A on the PSPP: https://www.ecb.europa.eu/mopo/implement/app/html/pspp-qa.en.html.

Federal Reserve (2022). Press Release, Plans for Reducing the Size of the Federal Reserve’s Balance Sheet, May 04, 2022.

Gabaix, X. (2020). A behavioral New Keynesian model, American Economic Review 110(8): 2271-2327.

Gerke, R., S. Giesen und A. Scheer (2020), The power of forward guidance in a quantitative TANK model, Economics Letters 186 (2020): 108828.

Gerke, R., D. Kienzler and A. Scheer (2022). On the Macroeconomic Effects of Reinvestments in Asset Purchase Programmes. Bundesbank Discussion Paper No 47/2022.

McKay, A., Nakamura, E. and Steinsson, J. (2016). The Power of Forward Guidance Revisited, American Economic Review 106(10): 3133-58.

Sudo, N. and Tanaka, M. (2021). Quantifying stock and flow effects of QE, Journal of Money, Credit and Banking 53(7): 1719-1755.

Work stream on the price stability objective (2021). The ECB’s price stability framework: past experience, and current and future challenges, European Central Bank Occasional Paper No 269.

For a summary and references to various papers on asset purchases and unconventional monetary policy measures, see Bhattarai and Neely (2022) or Work stream on the price stability objective (2021), chapter 2.5).

In contrast, the flow effect describes the impact of ongoing asset purchases in each period.

The hand-to-mouth household is credit-constrained and thus cannot shift its consumption over time in the event of interest rate changes. Additionally, it receives countercyclical transfers.