We propose a new definition of systemic risk (the probability of a large number of banks going into distress simultaneously) and thus we develop a multilayer microstructural stress testing model to assess empirically the determinants of systemic events in the euro area banking sector. The model is calibrated on the most comprehensive granular dataset for the euro-area banking sector, capturing roughly 96% or €23.2 trillion of euro-area banks’ total assets over the period 2014–2018. The methodology can be used to perform a systemic stress test and to calibrate banks’ capital and liquidity requirements. Our analysis suggests that regulators targeting the reduction of banks’ default probabilities may have very little effect in reducing the probability of experiencing a systemic crisis. Hence regulators need to think whether their policy targets, tools and ultimate objective aim for a reduction of the average bank default probability (less frequent bank default) or of systemic risk (fewer banks defaulting simultaneously). In particular, for reducing systemic risk regulators need to target and reduce correlations among banks’ losses.

The calibration of policies aiming at contrasting the build-up of systemic risk and preserve the stability of the financial system is an increasingly relevant task for regulators worldwide. The development of sound analytical tools for the interpretation and forecasting is therefore of paramount importance. In this respect, microstructural contagion models embody the present and future of stress testing. These analytical frameworks aim to reproduce the complex dynamics of a financial banking crisis by modeling the behavior of credit institutions reacting to different shocks considering the network of exposures among them. Hence, they allow to capture the causal relationships among economic and financial distress events, allowing regulators to target critical junctures in the financial system (risk or entity) and avoid idiosyncratic risk becoming a systemic event.

Interconnections among financial and non-financial corporations allow for the transmission of risks among firms and between sectors, leading to cascade and amplification effects, which undermine the stability of the financial and economic system. Contagion can transmit along multiple channels: among the most studied in the literature are solvency (losses related to credit risk arising from interbank exposures), liquidity (capacity to withstand short-term funding needs) and market-to-market losses (price of securities drop due to fire-sales).

Despite the complexity in terms of methodology and data requirement, microstructural models have the advantage of being extremely flexible. Policy makers may perform via microstructural models counterfactual exercises in order to assess for instance the impact of specific shocks (asset, firm, sector or country-specific) on the system or on single institutions so as to test the effectiveness of alternative micro and macroprudential policies to curb financial stability risks.

One of the limits of such literature is the lack of an agreed and usable definition of systemic risk, leading to a plurality of works that are difficult to compare, or that are suitable only to answer specific research questions. A second limitation is that microstructural models rely heavily on confidential granular exposure-level data that only after the Great Financial Crisis started to become available to regulators.

We propose a multi-layer microstructural model that accounts for the transmission of shocks stemming from direct exposures towards the real economy and for the amplification effects generated within the banking system via financial contagion channels.

Our definition of systemic risk refers to the probability that a large number of banks get into distress or default simultaneously or, more formally, the probability that the percentage of banks’ defaults or other credit events in a certain period is higher than a given threshold. We quantify this threshold as 1.5% of credit institutions within a year timeframe.

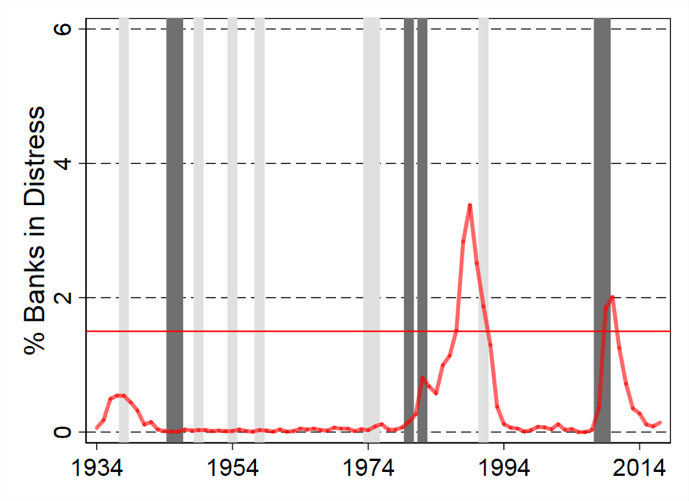

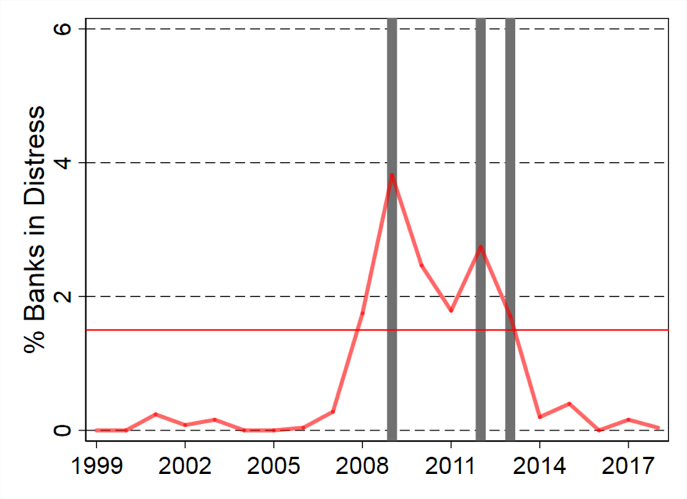

To provide a rationale of our proposed definition, we recall the historical distribution of banks’ distress events, which have been typically concentrated in relatively short periods of time, and have been followed by substantial financial and economic turmoil.

Chart 1 depicts the time series of the fraction of banks that experienced default or other credit events for the US (left panel) and for the euro area (right panel), and the peaks of the series track closely the manifestation of systemic banking crises. The ratio of distressed banks within a year time represents therefore a simple yardstick to classify systemic events.

Hence, a key feature of our financial system and of systemic crises is the correlation of distress events in the banking sector. What’s the source of these correlations in the cross-section? This is the question we intent to answer exploiting the microstructure of the euro area banking system.

Chart 1: Historical series of percentage of distressed banks in the United States (left panel), and in the euro area (right panel).

|

|

Note: Bank distress is defined as one among the following events: capital injection, asset protection scheme, loan guarantee, state aid, bankruptcy. Light grey and dark grey areas represent respectively mild and deep economic recession periods.

Source: Lang et al. (2018) for the European bank distress time series, and Federal Deposit Insurance Corporation for the US time series.

The methodology is calibrated and tested on a unique dataset of granular exposures recently constructed at the European Central Bank’s Financial Stability Directorate and includes bilateral interbank exposures, exposures to non-bank financial corporations, and security holdings issued by banks (CI), Non-financial corporations (NFC), Financial Corporates (FC), and governments (GOV). The dataset covers the period Q1-2015 to Q4-2018 and captures EUR 23.2 trillion, roughly 96% of euro area banks’ total assets.

Table 1: Summary Statistics

| Sector | Edges | Nodes | Total amount (EUR trillion) |

% granular | LGD |

| CI | 8580 | 1175 | 3.6 | 100.0% | 14% |

| NFC | 14497 | 5866 | 3.5 | 74.3% | 22% |

| FC | 7762 | 4324 | 5.9 | 37.3% | 10% |

| GOV | 4823 | 1257 | 4.8 | 100.0% | 24% |

| HH | 820 | 297 | 5.3 | 0.8% | 17% |

| Total | 36482 | 12919 | 23.2 | 57.8% | 18% |

Note: % granular (Gran.) is the ratio of exposures mapped with exposure-specific information, securities (Sec.) refer to the exposure amount mapped with ISIN information, while aggregate exposures (Agg.) refer to the exposure amount mapped on aggregate sector-country counterparty basis. LGD reports the share of total exposure amount used to impute credit risk losses. Reporting period 2018 Q4.

Our analytical framework for the estimation of systemic risk is built on a Monte Carlo simulation scheme and is calibrated on real world data. It can be conceptually divided in two parts: one consisting in the engine for the generation of shocks coming from the real economy (scenarios), and one consisting in the multi-layer contagion model that transmits and amplify the initial economic shocks. The output is the estimation of banks’ losses and in turn of banks’ distress events like in a stress test exercise although we interact multiple risk channels and we provide distributions, not point estimates. This approach allows us to estimate the level of systemic risk as defined in the previous section. Finally, the results can be decomposed into their determinants by performing the Monte Carlo simulations under different specifications of the model. We refer to the paper for more details on the methodology.

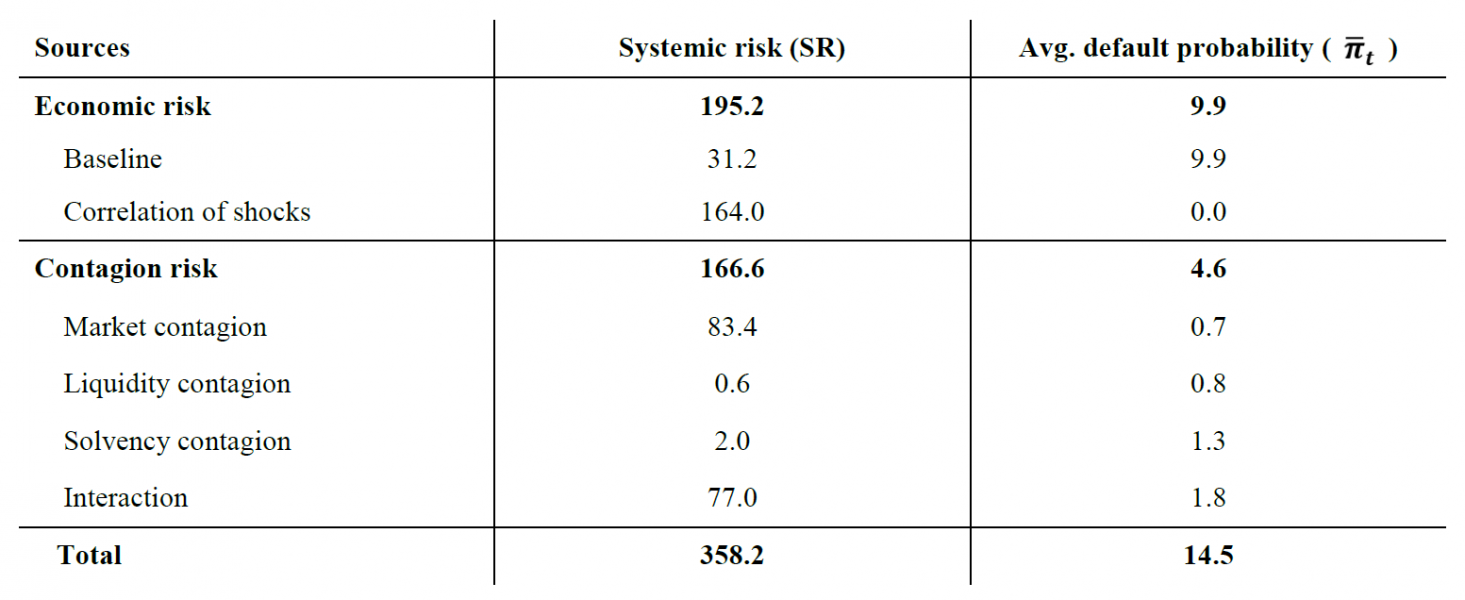

Table 2 presents the estimation and decomposition of systemic risk and of the average default probability in Q4-2018. We see that the main driver of systemic risk in the European banking system are the correlation of shocks stemming from the real economy, followed by market contagion (fire-sales). Other contagion channels (solvency and liquidity) do not provide relevant contribution in isolation, but they contribute to increase the level of systemic risk due to the interaction with other channels.

Our model also allows to compute endogenously the average default probability of banks in the system and to decompose it according to the same determinants considered for systemic risk. By comparing systemic risk to average default probabilities estimated by the model we see a stark difference: average default probabilities are mostly driven by the magnitude of economic shocks (baseline), with contagion and shock correlations playing little or no part.

| Table 2: Decomposition of systemic risk (SR), and of the average bank default probability ( | ) |

Note: All the figures are reported in basis points and refer to Q4-2018. The interaction term is approximated by the difference between each contagion channel and economic risk, thereby providing a conservative estimate of amplification effects (source: own calculation).

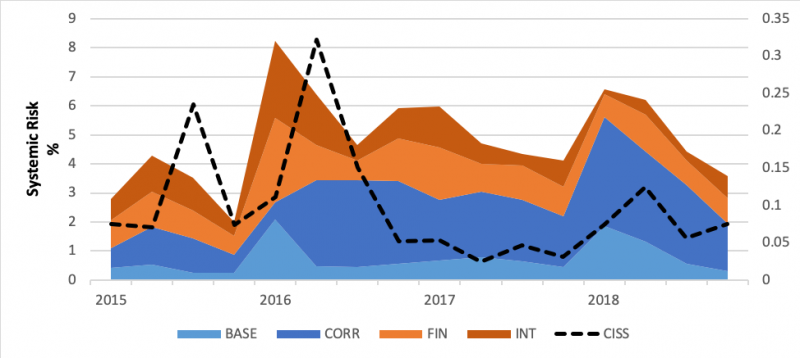

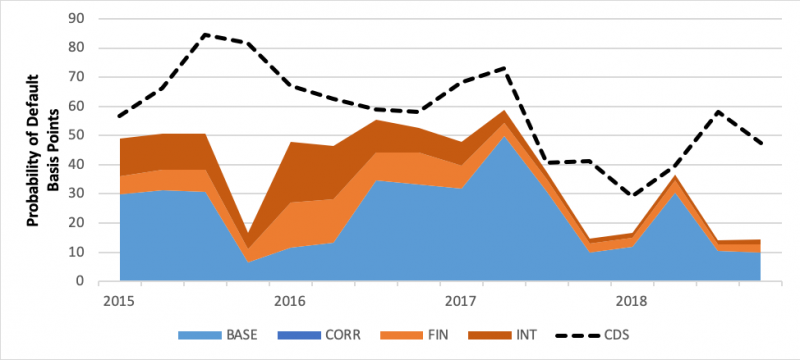

Chart 2 shows the evolution over time of our indicators and compare them with two market-based measures: the Composite Indicator of Systemic Stress (CISS, source: ECB, Hollo et al., 2012) as a benchmark for our systemic risk measure (Panel A), and the average spread for senior CDS for European banks (Panel B), that proxies default risk in the banking sector. Concerning systemic risk, our measure seems to move with the CISS indicator, sometimes anticipating it by one quarter. Whereas, our indicator for the average bank default probability nicely resembles the average senior CDS spread.

Chart 2: Probability of a systemic event and average expected probability of a bank default

Panel A – Probability of Systemic Event

Panel B – Average Probability of Bank Default

Note: BASE refer to the baseline model with no contagion and independent shocks, CORR to the effect of correlation of economic shocks and overlapping portfolios, FIN to the cumulated effect of solvency, liquidity and market contagion (without accounting for their interaction), INT to the interaction of financial contagion channels (source: own calculation). CISS is the level of the Composite Index of Systemic Stress (source: ECB), and CDS is the average credit risk spread for European banks (source: Thomson Reuters Datastream).

From a policy perspective, the model represents a particularly powerful and flexible tool for regulators, thanks to the ability to estimate the level of systemic risk endogenously, the microstructural foundations, and the possibility to run counterfactual exercises by changing individual aspects of the system. It is therefore an effective policy laboratory through which regulators and policy makers may assess the cost-benefit analysis of prudential policies such as the bail-in mechanism, the calibration of regulatory capital and liquidity requirements, exposure limits, and identifying for monitoring purposes which risks/firms are mostly determining fragilities in the banking/financial system.

Concerning the results, our study highlights that systemic risk is largely driven by the presence of correlated shocks from the real economy (related to overlapping exposures, or exposures to correlated assets). We also find evidence of significant risk related to market risk fire-sales and by the interaction of risk across multiple channels highlighting the need of a multi-layer perspective.

Finally, the relevant differences in the determinants of systemic risk and the determinants of average default risk (with the former being much more influenced by correlations of economic shocks and contagion), suggests that regulators targeting the reduction of banks’ default probabilities may have little effect in reducing the probability of experiencing a systemic crisis. Regulators need to think whether their policy targets, tools and ultimate objective aim for a reduction of the average bank default probability (less frequent bank default) or of systemic risk (fewer banks defaulting simultaneously). These two targets differ from one another, and reducing the former does not imply a reduction of the latter. In particular, for reducing systemic risk regulators need to target correlations among banks’ losses focusing on concentration risk and interconnectedness.

Economic and financial systems are becoming ever more integrated and interconnected worldwide leading to a reinforcement of these sources of systemic risks. This common trajectory which has led to a more efficient economic and financial system in normal times, also brings greater fragility during bad times. In such a globalized world, positive and negative shocks spread faster affecting multiple firms and countries simultaneously, thereby requiring a deeper understanding of the sources of systemic events. In this respect, the collection of granular datasets is fundamental to regulators and supervisors in order to shed light upon these phenomena. Massive effort towards this direction has been deployed in the aftermath of the 2008 Great Financial Crisis, but more is needed in order to make these tools operational for policy applications. We hope this work may help the research and policy community to push forward this frontier.