Many countries looking to initiate structural adjustment in an effort to mitigate climate change have placed the idea of levying a charge on carbon dioxide emissions high on their political agendas. It is often the case that households’ and firms’ energy use or carbon dioxide emissions are taxed with this aim in mind. However, the implementation of such measures is unlikely to affect production across sectors or final demand in a homogenous manner. We account for heterogeneity in the effects on various variables, such as emissions intensities and the interconnectedness of production through intermediate inputs, using the environmental multi-sector dynamic stochastic general equilibrium model EMuSe. This Policy Brief summarises the effects of higher energy and emissions taxes as a way of financing a labour tax reduction and contrasts the implications with those of an increase in the general consumption tax rate. We find that for a sufficiently high level of economic damage from environmental pollution, energy and emissions taxes are eventually superior (in terms of welfare) to the use of a general consumption tax as a financing instrument.

The consequences of climate change and climate policy may have significant implications for macroeconomic dynamics and monetary policy transmission. In order to take climate-related macroeconomic effects into account, central banks’ analytical toolkit needs to be reviewed and adjusted. This also applies to dynamic stochastic general equilibrium (DSGE) models, which have become standard tools for quantitative policy analysis in macroeconomics. While monetary and fiscal policy issues are addressed regularly within this framework, DSGE models have only recently been adopted for analysing environmental policies and the effects of climate change. Such environmental DSGE (E-DSGE) models range from slightly modified standard setups to integrated assessment type models that combine the economy and the ecosystem in a unified framework. The literature typically uses one-sector or two-sector E-DSGE models, with two-sector models usually consisting of an energy-producing sector and a sector producing non-energy goods. These models, however, are unable to fully capture the differential impact of carbon pricing measures at the sectoral level, the resulting structural changes, the effects caused by input-output linkages between sectors or their implications for macroeconomic dynamics and monetary policy transmission. To address this issue, Hinterlang et al. (2021) introduce the multi-region environmental multi-sector DSGE model EMuSe, which can depict up to three regions and up to 54 sectors.2

The results presented in this Policy Brief are derived from a closed-economy version of the EMuSe model with 54 sectors. This model is used to consider the welfare impact of financing a labour tax reduction by means of (i.) an emissions tax where firms bear the costs of the carbon dioxide they emit, (ii.) a tax on households’ energy consumption, (iii.) a tax on firms’ energy consumption, and (iv.) a tax on both households’ and firms’ energy consumption. These polices are evaluated against a benchmark, which is an increase in the general consumption tax rate.

We do this using two distinct scenarios. The first scenario neglects any feedback effects between carbon dioxide pollution and the economy, whereas the second takes them into account. For this purpose, we introduce a damage function that captures production losses caused by anthropogenic emissions.

2.1 Model description

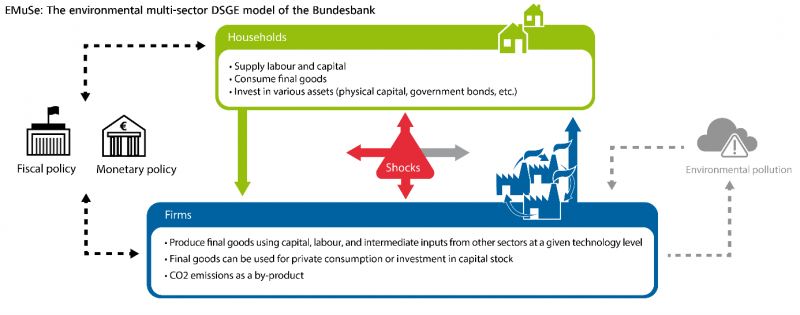

Figure 1 provides a schematic overview of the closed-economy version of the model, which features multiple interrelated production sectors that vary in their carbon dioxide emissions intensity, factor intensity, use of intermediate inputs and contribution to final demand. The sectors interact with each other by using the output of other sectors as intermediate inputs. These intermediate inputs are assumed to be imperfectly interchangeable across sectors. The same applies to labour and capital employed in the various sectors. Prices and wages are fully flexible in this model version.3 Carbon dioxide emissions are a by-product of production. The potential price per unit of emission is uniform across sectors. Firms in each sector can engage in costly abatement activities. In the model variant with feedback between environment and economy, unabated emissions increase the stock of carbon dioxide in the atmosphere, which ultimately results in output losses. Lastly, goods sold by different sectors may be taxed differently, which is a key prerequisite for the analysis at hand. Apart from the production structure and the environmental module, the model features conventional ingredients.

Figure 1: Schematic overview of the model.

Notes: The figure shows a highly stylised closed-economy representation of the EMuSe model.

The environmental damage function that relates the atmospheric carbon dioxide concentration to output losses deserves further discussion. Although a link of this kind between the economy and the climate is frequently included in E-DSGE models, its specification and parameterisation is a contentious topic.4 The damage function used in the analysis presented here is quadratic. Its parameterisation is loosely tied to recent estimates by Kalkuhl and Wenz (2020). The remaining parameters of the model are set to reflect the EU, along with the United Kingdom, at the quarterly frequency using the most recent release of the World Input-Output Database.

2.2 Simulation design

The simulation scenario rests on a reduction in the labour income tax rate by roughly three percentage points. This implies that a deficit of about 1 % of GDP has to be compensated for by an increase in either

Lump-sum transfers guarantee ex post budget stabilisation, which also holds along the transition.

3.1 Welfare implications

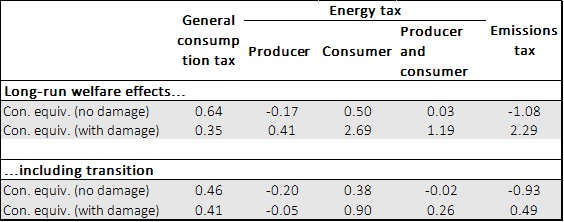

Table 1 shows the implications as measured by the change in welfare following a change in policy (see also Lucas, 2003). Specifically, the welfare computations reported here reflect the percentage gain or loss for the representative household in terms of the final consumption bundle following adoption of a certain tax policy.

Table 1: Welfare effects

Notes: The table shows welfare implications of different tax shifts, expressed as a consumption-equivalent gain for the representative household in line with Lucas (2003), in percentage deviations from the initial steady state.

When damage caused by pollution is neglected, financing a labour tax reduction through higher general consumption taxes is welfare-enhancing and superior to all other instruments considered. A tax on emissions or energy used by producers would even reduce welfare in the long run. The reason is that the distortions (particularly in the production process) resulting from energy or emissions taxes are relatively stronger compared to the beneficial effects of lower labour costs. Taxing the energy consumption of households alone or of both firms and households results in positive welfare effects, but these are smaller than in the case of a general consumption tax. This finding resembles standard results from the literature.

As regards the level of pollution, however, an emissions tax appears to be most effective in driving down emissions.5 Therefore, if pollution-induced output losses are taken into account, the welfare results change. Energy and emissions taxes deliver higher welfare gains than consumption taxes, as the avoidance of carbon emissions reduces output losses. It takes some time, however, for these positive effects to materialise. Hence, the ordering in terms of welfare effects can change if the transition to the new steady state is included.

3.2 Illustrating the effects of production linkages

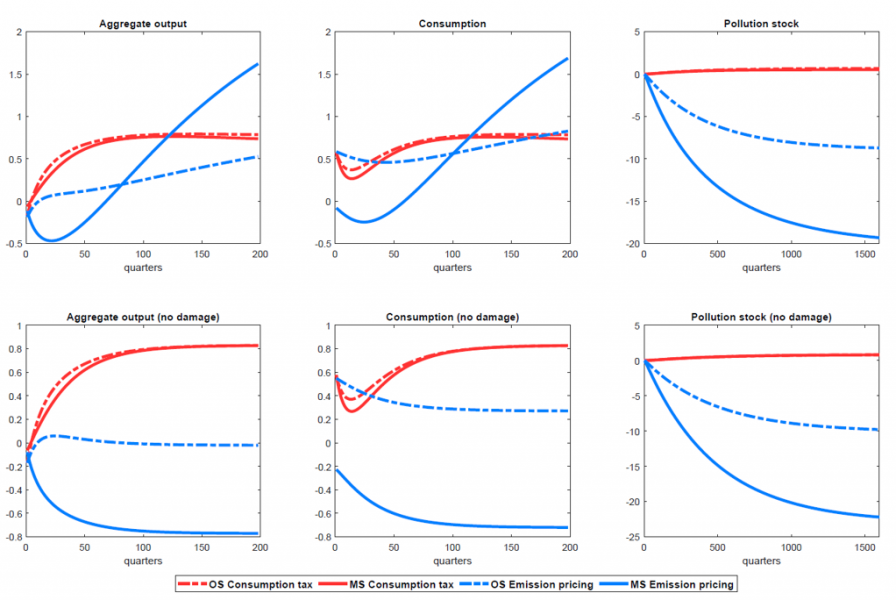

In order to illustrate the role played by the degree of sectoral granularity, Figure 2 displays selected simulation results for two different model versions: a conventional one-sector variant of EMuSe, and another with 54 economic sectors previously presented. For this purpose, the one-sector model (OS) is parameterised such that emissions intensity, labour intensity, capital intensity and factor inputs are equal to the averages across sectors in the multi-sector model (MS). We select an increase in the general consumption tax rate and the introduction of an emissions tax as illustrative scenarios and again consider both cases with and without damages induced by pollution.

Figure 2: Comparing simulation results in a one-sector and multi-sector economy

Notes: This figure depicts the (projected) implications of tax shifts for key macroeconomic variables derived from a prototypical one-sector economy and a benchmark multi-sector model. The vertical axis measures the percentage deviation from the deterministic steady state. Consumption tax (red lines) refers to a case where a general consumption tax rate increase finances the labour tax reduction. Blue lines depict a scenario where an emissions tax is used as a financing instrument. Dashed lines represent the one-sector economy (OS), solid lines the multi-sector economy (MS).

Comparing the results, there is hardly any difference between the one-sector and multi-sector economy when an increase in the general consumption tax rate is used to finance the labour tax reduction. This is because consumption costs increase for all goods in each sector (almost) evenly. Hence, demand for these goods is hampered more or less evenly as well. Where the labour tax reduction is financed by an emissions tax, however, sectoral differences matter. Even though marginal costs increase in all sectors due to carbon pricing, sectors with high emissions intensity become less competitive. Demand shifts towards low-emission sectors. This results in a much lower pollution stock, further illustrating the importance of considering a multi-sector framework.

Climate policy measures can have a particularly severe impact on certain economic sectors. This might trigger substantial feedback effects at the aggregate level. Standard dynamic macroeconomic models, which typically lack a deeper sectoral structure, can capture such transmission channels only to a limited extent, if that. Traditional multi-sector models, on the other hand, are usually static in nature and focus on long-term equilibria. Hence, they are unable to capture transition processes adequately. The EMuSe model was developed to address these challenges by merging the dynamic nature of DSGE models with the sectoral granularity of computable general equilibrium frameworks.

A key feature of the EMuSe model is its detailed sectoral production network. Firms use intermediate inputs for production, in addition to capital and labour. These intermediate inputs are sourced from all sectors. This implies that the impact of climate policy measures can be assessed along the entire value chain. When a carbon price is introduced, for example, the energy sector, which is quite emissions-intensive, is hit particularly hard. Consequently, the energy price rises more sharply than other prices. However, energy can be substituted only to a certain degree by other inputs, given complementarities between energy and other intermediate goods. Therefore, over time, a rise in energy prices will eventually weigh on demand for all intermediate goods and services.

Some words of caution are warranted, however. As pointed out by Weitzman (2012), the modelling of damage represents a notoriously weak link in assessing the economic effects of climate change, due to both the difficulty of specifying a functional form a priori and the sensitivity of the model results with respect to a particular specification.

Second, emissions are not only generated within the EU, as assumed here. If emissions in other regions of the world remain fairly constant, or even increase due to carbon leakages, the policy measures analysed here may not be optimal. The stronger this effect, the more relevant the results of the no-damage scenario might become (an even worse scenario than the one considered here is conceivable if emissions in the rest of the world increase sufficiently to offset the domestic emissions reduction).

Third, welfare conclusions are based on a representative household in the economy. This household faces a policy-induced cost increase resulting from energy taxation, but also benefits from the resulting output gains. While this may hold in the aggregate, it may not be true for all individuals in an economy. In a heterogeneous agent framework, low-income households or those who depend heavily on transfers may actually lose out. The same is true in regions where relatively poor households tend to be employed in sectors most adversely affected by emissions and/or energy taxation.

Fourth, the welfare ranking is subject to structural parameter choices in the production and demand functions. If the need to use energy in production, for example, declines, this alters emissions and thus also the damage and its impact. This is also true if we assume that substitutability between production inputs increases. In this latter case, the benefits of taxing energy for final consumers, relative to taxing it in the production process, shrink (but we still need an implausibly high elasticity in the production process for the ranking to change). It is likely that some of these parameters will change in the future as firms adjust to climate policies and increasing prices for both energy and carbon emissions. This also holds, of course, for (the specification of) the damage function.

Hinterlang, N., A. Martin, O. Röhe, N. Stähler and J. Strobel (2021), Using energy and emissions taxation to finance labor tax reductions in a multi-sector economy: An assessment with EMuSe, Bundesbank Discussion Paper, No 50.

Kalkuhl, M. and L. Wenz (2020), The Impact of Climate Conditions on Economic Production. Evidence from a Global Panel of Regions, Journal of Environmental Economics and Management, Vol. 103, Article 102360.

Lucas, R. E. (2003), Macroeconomic Priorities, American Economic Review, Vol. 93 (1), pp. 1-14.

Pindyck, R. S. (2013), Climate Change Policy: What Do the Models Tell Us?, Journal of Economic Literature, Vol. 51 (3), pp. 860-872.

Weitzman, M. L. (2012), GHG Targets as Insurance Against Catastrophic Climate Damages, Journal of Public Economic Theory, Vol. 14 (2), pp. 221-244.

The views expressed in this Policy Brief are those of the authors and do not necessarily reflect those of the Deutsche Bundesbank.

Owing to computational constraints, however, it is not (yet) possible to depict 54 sectors in three regions. Future work will seek to address this limitation.

Nominal rigidities can optionally be included. The results of the analysis conducted turn out to be quantitatively unaffected by this choice, however.

See, inter alia, Weitzmann (2012) and Pindyck (2013).

See Hinterlang et al. (2021) for further details.