This policy brief is based on Bank of Spain Working Paper No. 2501. The opinions and analyses expressed are those of the authors and, therefore, do not necessarily coincide with those of the Banco de España or the Eurosystem.

Abstract

Public investment spans diverse asset types, including equipment (e.g., vehicles, machinery), structures (e.g., housing, highways), and intellectual property products (IPP, such as R&D and software). Traditional analyses often treat public capital as a single, homogenous entity. We show that this leads to biased assessments of the effectiveness and optimal allocation of public investments.

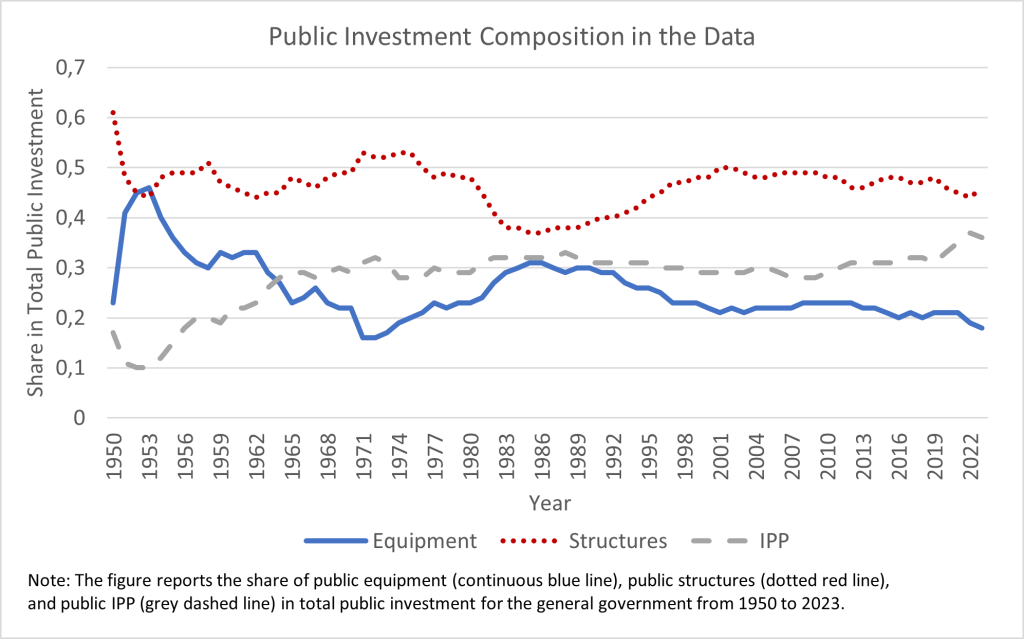

Public investment encompasses diverse asset categories, including equipment (e.g., vehicles and machinery), structures (e.g., highways and housing), and intellectual property products (e.g., R&D and software). These types vary in their productivity-enhancing potential, depreciation rates, and shares in total public investment. For example, IPP has the highest output elasticity but suffers from a relatively small capital stock due to its high depreciation rate and lower share of public investment. Structures, on the other hand, dominate public capital stocks because of their low depreciation rates, while equipment occupies an intermediate position.

In Basso, Pidkuyko, and Rachedi (2025) we start by presenting a simple theoretical framework where multiple types of public capital contribute to aggregate productivity based on their distinct output elasticities and stock sizes. We show that when these types are aggregated into a single measure of public capital, the aggregate output elasticity is a weighted average of individual elasticities, biased by the heterogeneity in capital stocks. If types with higher output elasticities have smaller stocks, the bias becomes negative, leading to underestimation of the effects of public investment.

We then extend this framework into a quantitative New Keynesian model calibrated to U.S. data. The model incorporates three types of public investment—equipment, structures, and IPP—each differing in terms of their output elasticities, depreciation rates, investment shares, and time-to-build or time-to-spend delays. IPP exhibits the highest output elasticity (0.07) but accounts for a small share of public capital due to its high depreciation rate (17%) and modest investment share (29%). Structures, while less elastic (0.05), dominate the public capital stock due to their low depreciation rate (1.9%) and significant investment share (45%). Equipment has the lowest elasticity (0.005) but intermediate depreciation (12.4%) and investment shares (26%).

The analysis reveals that the aggregate output elasticity estimated from homogeneous public capital models (0.0718) significantly understates the true sum of elasticities across types (0.125). This bias arises primarily from the weak correlation between capital stock sizes and output elasticities across types.

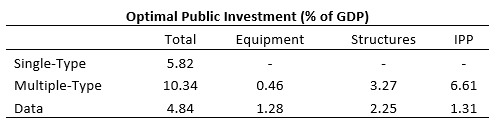

This negative bias significantly alters the level of optimal public investment and fiscal multiplier estimates. The optimal public investment-to-GDP ratio in a multiple-type model is 10.3%, nearly double the 5.8% suggested by a single-type model. When disentangling the implications of the model on optimal public investment across the three types, we find that the optimal amount of public investment as a fraction of GDP equal 0.46% for equipment, 3.27% for structures, and 6.61% for IPP. We also show that the optimal public investment is substantially higher than that found in the data (4.84%). The analysis indicates that IPP is the most underfunded type: the optimal share of GDP devoted to IPP is 6.6%, compared to its actual share of only 1.3%. By contrast, equipment is slightly overfunded relative to its optimal level, while structures align more closely with model recommendations.

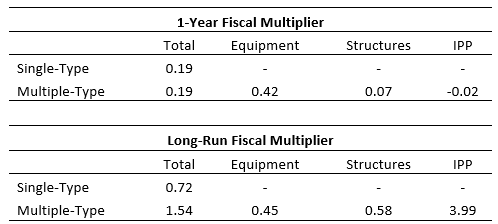

The paper demonstrates that heterogeneity in public investment composition significantly affects fiscal multipliers. In the short run (1-year horizon), the overall multiplier is modest at 0.19, reflecting implementation lags caused by time-to-build and time-to-spend delays. For example, equipment investments, which can be implemented quickly, have a relatively higher short-run multiplier (0.42), while structures and IPP face longer delays, reducing their immediate impact. However, in the long-run, the fiscal multiplier for public investment is substantially higher when accounting for heterogeneity, reaching 1.54 compared to 0.72 in a single-type framework. The analysis reveals that IPP has the highest multiplier (3.99), followed by structures (0.58) and equipment (0.45).

The model also investigates the historical and compositional variations in public investment. Federal government investment, which increasingly prioritizes IPP, yields higher fiscal multipliers compared to local government investment, which is more focused on structures. For example, the multiplier for federal investment reached a peak of 2.75 in 2023, while local investment multipliers remained below one.

Treating public investment as a homogeneous stock leads to severe underestimation of its economic impact and results in suboptimal policy decisions. By accounting for differences across investment types, we show that optimal public investment levels are nearly double those suggested by traditional models and that fiscal multipliers vary dramatically by type.