This policy brief is based on European Central Bank Occasional Paper Series No. 336. The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank (ECB).

In this SUERF policy brief, we analyse the sensitivity of the macroeconomic outcomes under the Network for Greening the Financial System’s (NGFS’s) phase III net zero transition scenarios to different monetary and fiscal policy settings. We do so through the lens of the macroeconomic modelling frameworks underlying the scenario construction (e.g. NiGEM). As regards alternative policy settings within the model, fiscal recycling options become more differentiated in terms of GDP impact in the medium term. Full recycling through government investment yields the highest output multiplier, while recycling through household transfers or reduced income taxes yields the lowest multiplier. Furthermore, the persistence of inflationary pressures in the NGFS scenario appears quite sensitive to the monetary policy conduct specified in the NiGEM simulation. These findings are certainly model-specific but they reflect the policy sensitivity embedded in the NGFS scenarios, within the limits of the model used to construct them up.

The NGFS scenarios combine the analysis of transition, physical and macro-financial risks to shed light on the long-term trade-offs between the costs of climate change mitigation and the consequences of unfettered climate change. To do this, the NGFS scenarios are based on three key features. First, they take a long-term perspective, which is necessary to assess the benefits of reduced physical risk over the coming decades as a result of effective climate policies. In contrast, a scenario focused on the next few years would only capture the costs of climate action, while omitting the future but long-lasting benefits of meeting the Paris temperature targets – which is precisely why climate action and climate scenarios are needed. Second, the NGFS scenarios cover the global economy, thus providing consistent results and comparable applications across geographies and facilitating international climate policy coordination. Third, the scenarios are based on international collaboration between research institutes to combine different models and capture the interactions between transition, physical and macro-financial risks.

The NGFS scenarios are based on a suite-of-models approach to jointly but indirectly capture climate, macroeconomic and financial uncertainties. The models used to derive the NGFS scenarios fall into three broad categories: physical risk models, transition risk models and macro-financial models. The three categories of models are interrelated. The first category includes all the physical risk models that are part of the Inter-Sectoral Impact Model Intercomparison Project (ISIMIP) and CLIMADA and provide climate and economic indicators as a result of climate change. The second category includes three IAMs that derive the impacts of different policy ambitions on the energy sector, emissions and land use. The third and final category includes NiGEM (a version specifically modified for the purpose of producing the NGFS scenarios) to understand the impact of transition and physical risk on key macro-financial fundamentals.

Through the lens of NiGEM, the macroeconomic scenarios reflect the transmission channels from the climate to the aggregate economy by implementing a set of climate shocks to which the macroeconomic responses are generated. Three sets of calibrated shocks are designed to translate the impact of physical damage, transition and fiscal policies into a set of exogenous shocks on both the demand and the supply side, constituting the main scenario wedges that overlay on top of each other.

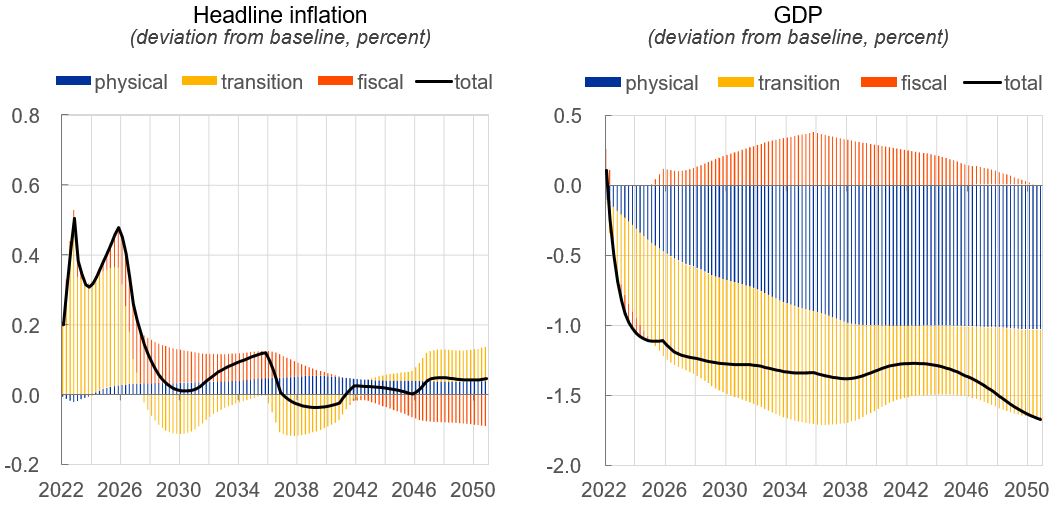

Figure 1 shows the macroeconomic outcomes for the euro area under the NGFS Phase III net-zero 2050 scenario with a temperature rise not exceeding 1.5°C. In this scenario, transition shocks account for the strongest economic impact in the short term, while remaining important in the long term. Transition shocks push inflation upward by imposing higher costs associated with carbon emissions and reduce GDP growth as total energy use, especially fossil fuel consumption, declines. This is only partially offset by energy efficiency gains, for example from lower productive capacity. Demand exceeds supply in the short run, leading to additional inflationary pressures. The physical shocks have a small impact on inflation over the horizon but a large impact on the real economy. The negative impact of physical shocks on GDP increases rapidly over time until it stabilises after 2040. Fiscal shocks push short- and long-term interest rates strongly higher, mitigating the negative impact on GDP to a limited extent, while their impact on inflation is positive as redistribution supports domestic demand. The additional revenues from taxable emissions collected by governments can be used in one way or another to support domestic demand and generate inflationary effects.

Indeed, we first propose a sensitivity analysis according to the options for recycling fiscal revenues, thereby discussing the options available within NiGEM.

Figure 1: Drivers of the net-zero scenario for the euro area

Sources: NGFS, NiGEM and ECB calculations.

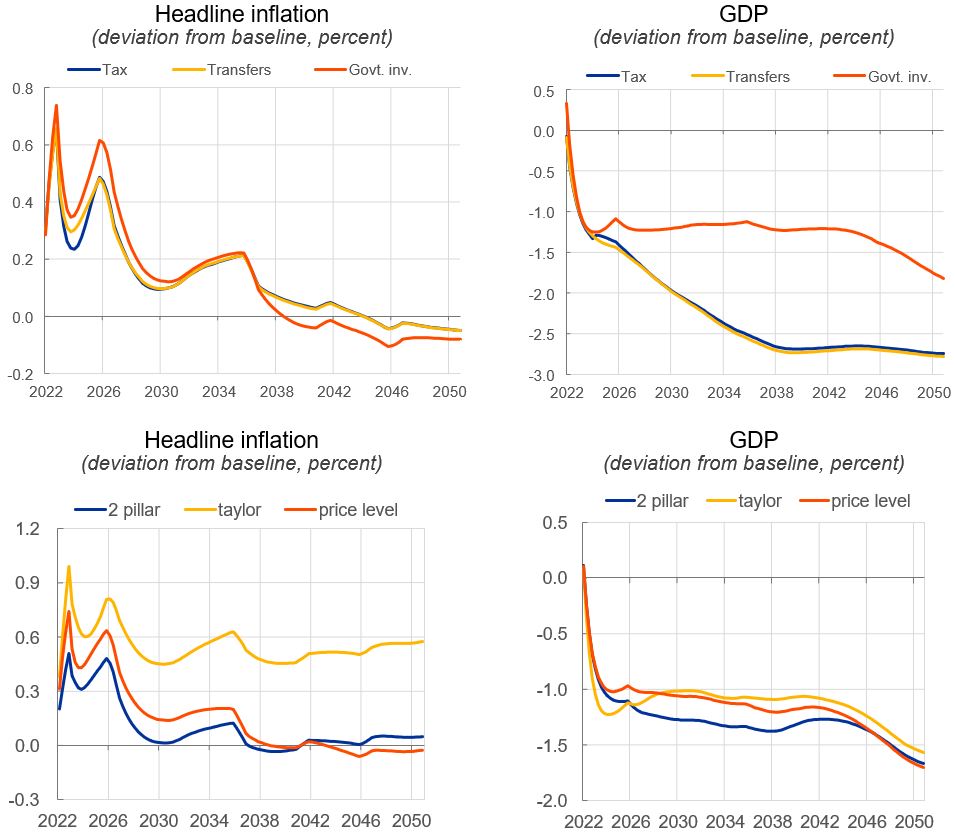

Four different options for recycling carbon tax revenues are considered. In order to properly differentiate the impact of the recycling choices, in this sensitivity analysis we assume that, for each variant, 100% of the carbon tax revenues are used to finance each of the four fiscal policy choices: i) an increase in public investment, ii) a reduction in household income taxes iii) an increase in transfers to households, iv) the repayment of public debt. Figure 2 shows that the recycling through household transfers or reduced income taxes has the most negative impact on growth, while recycling through public investment yields the largest fiscal multiplier in the medium term. Only in the medium term do the recycling options become more discriminating in terms of their impact on GDP, with the full recycling through public investment having the largest output multiplier. The inflation pattern is less discriminant among the recycling options. The inflationary impact of the scenario is somewhat stronger in the short term for the full recycling through public investment.

Turning to the sensitivity analysis of monetary policy reaction, we consider three interest rate rules: the standard two-pillar rule of NiGEM, the Taylor rule and price level targeting. Figure 2 shows that, overall, the differences in GDP growth for the different monetary policy reaction functions are limited, but inflation can remain persistently higher when the Taylor rule is applied. The Taylor rule suggests raising short-term interest rates when inflation is above the target and the output gap is positive. Since the climate shocks, which are replicated by productivity shocks, significantly reduce productive capacity and thus the potential output, they create a positive output gap, so that monetary policy reacts more strongly in addition to higher inflation.

Figure 2: Implications of alternative fiscal revenue recycling and monetary policy conduct for the euro area

Sources: NGFS, NiGEM and ECB calculations.

Overall, we open the macroeconomic toolbox to show how the NGFS scenarios could be used for macroeconomic policy analysis. At the same time, we are aware of the limitations of and uncertainties of climate and economic modelling, as acknowledged in the NGFS scenarios. The wider user community has also provided feedback on their shortcomings. In particular, the NGFS scenarios are not intended to be forecasts and the NGFS is working to continuously improve the scenarios further, including with respect to physical risks or the consideration of polycrises. It cannot be excluded that the economic impact of certain tipping points could be much worse than the NGFS scenarios. At the technical level, areas for further development relate to increasing sectoral and geographical granularity of the scenarios, introducing short-term scenarios and improving the representation of acute physical risks. Obstacles to understanding the underlying model assumptions and levels of uncertainty, finding guidance on how to apply the scenarios and translate them into risk assessment and accessing the relevant data in all facets have also been identified. The more accessible the NGFS scenarios become, the more their features can be refined and tested and, consequently, the more useful they will be for future analysis.

Bertram, C., Hilaire, J., Kriegler, E., Beck, T., Bresch, D., Clarke, L., Cui, R., Edmonds, J., Charles, M., Zhao, A., Kropf, C., Sauer, I., Lejeune, Q., Pfleiderer, P., Min, J., Piontek, F., Rogelj, J., Schleussner, C.F., Sferra, F., van Ruijven, B., Yu, S., Holland, D., Liadze, I. and Hurst, I. (2021), “NGFS Climate Scenarios Database: Technical Documentation V2.2”, NGFS, June.

Darracq Pariès, M., Dees, S., Hurst, I. and Liadze, I. (2022), “Climate Scenarios Sensitivity Analysis to Macroeconomic Policy Assumptions”, Technical Document, September.

Darracq Pariès, M., Dées, S., De Gaye, A., Parisi, L. and Sun, Y. (2023). NGFS climate scenarios for the euro area: role of fiscal and monetary policy conduct, Occasional Paper Series 336, European Central Bank.

Financial Stability Board and Network for Greening the Financial System (2022), “Climate Scenario Analysis by Jurisdictions: initial findings and lessons”, November.

Hantzsche, A., Lopresto, M. and Young, G. (2018), “Using NiGEM in uncertain times: Introduction and overview of NiGEM”, National Institute Economic Review, Issue 244, National Institute of Economic and Social Research, May.

Intergovernmental Panel on Climate Change (2022), “Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the

Intergovernmental Panel on Climate Change”, April.

Network for Greening the Financial System (2021), “NGFS climate scenarios for central banks and supervisors”, June.

Network for Greening the Financial System (2022a), “Running the NGFS Scenarios in G-Cubed: A Tale of Two Modelling Frameworks”, NGFS Occasional Papers, June.

Network for Greening the Financial System (2022b), “NGFS climate scenarios for central banks and supervisors”, September.

Network for Greening the Financial System (2023a), “NGFS climate scenarios for central banks and supervisors”, November.

Network for Greening the Financial System (2023b), “Conceptual note on short-term climate scenarios, September.