This policy brief is based on Bank of Italy Working Paper No. 1450. The views expressed in this column and in the paper are those of the author and should not be attributed to the Bank of Italy or the Eurosystem.

The ECB Consumer Expectations Survey shows that in the euro area there is significant heterogeneity between the employed and the unemployed in the share of consumption devoted to energy-intensive goods. Starting from this evidence, this column discusses the optimal conduct of monetary policy in response to a marked increase in energy prices through the lens of a heterogeneous-agent model with frictions in the labour market, in which the share of energy-intensive consumption is higher for the unemployed. When energy prices increase, the jobless reduce their consumption more than the employed; it follows that, in the face of energy shocks, an increase in the share of people without a job would imply a marked worsening of aggregate welfare. Therefore, the optimal monetary policy must be partially accommodative towards inflation so as to contain the rise in the unemployment rate.

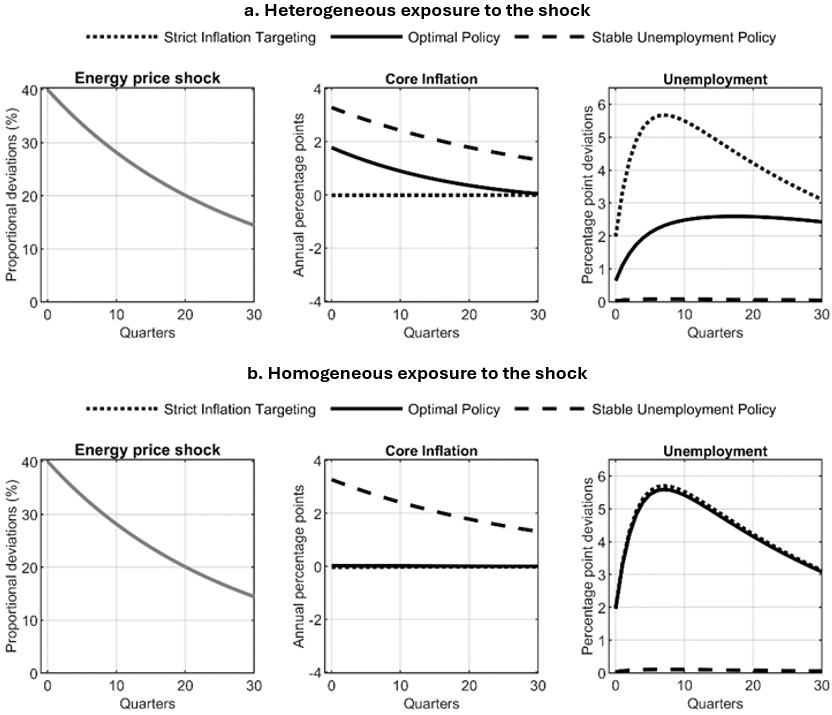

Since the end of 2021 and through 2023, euro-area economies have coped with exceptionally high inflation, both energy and headline, and falling real wages. The recent surge in energy prices has not only depressed workers’ real income but has also had distributional consequences. Indeed, this type of shock affects consumers heterogeneously: as energy is a necessity good — that consumers need to buy regardless of their earnings — poorer households devote a larger share of their income to energy consumption and are hit harder when the price increases. Given that workers suffer substantial losses in income and consumption during unemployment spells, the latter constitute a channel through which households can become more exposed to rising energy prices. Data from the euro-area Consumer Expectations Survey show that, even after controlling for individual-specific observable characteristics, the unemployed allocate a significantly higher share of their overall expenditure in goods and services to energy-intensive consumption (utilities and transport services) compared to the employed (Figure 1).

Figure 1: Weight of energy in the consumption basket of the employed and the unemployed

Note: The figure reports the average energy consumption shares of employed and unemployed individuals over time, controlling for individual-specific observable characteristics (age, gender, birth abroad, education, presence of a partner). Source: Gnocato (2024) elaborations on data from the ECB Consumer Expectations Survey.

Since the exposure of households to energy price shocks depends on their employment status, it is also influenced by monetary policy, as a relatively more accommodative stance of the latter can help to sustain activity and, hence, achieve a lower unemployment rate. This begs the question of whether monetary policy faces a trade-off between stabilising inflation and unemployment as soaring energy prices hit the unemployed harder than the employed. What is the optimal policy response in such circumstances? To answer these questions, in Gnocato (2024) I introduce a tractable heterogeneous-agent framework with frictions in the labour market, where exogenous energy price surges induce producers to cut staff and affect the consumption baskets of employed and unemployed workers differently.

In the model, the unemployed have a lower income and are forced to consume less; in addition, they devote a higher share of their consumption to energy goods compared to the employed. Therefore, higher energy prices end up weighing more on the jobless. Due to the presence of a frictional labour market, employed workers also risk transitioning endogenously to unemployment and, hence, becoming more exposed to the shock. The share of households more exposed to the energy shock is also affected by monetary policy decisions: by trading off higher inflation with lower unemployment, the central bank indirectly influences the share of consumers who are unemployed and, therefore, more exposed to the shock.

To answer the question of what is the optimal response of monetary policy, I consider a standard problem where the interest rate is the only policy instrument and the objective of the central bank is to minimise the welfare losses in the economy, taking into account the reactions of households and firms in the market.1 The welfare losses increase both when core inflation deviates from its target and when unemployment diverges from its desired, welfare-maximising level. However, in this setup, monetary policy faces a trade-off: following a rise in energy prices, it cannot minimise the welfare losses by simultaneously stabilising core inflation and maintaining unemployment at its desired level, and it must seek instead to strike a compromise between these two objectives in the short run. Intuitively, rising energy prices induce an increase in the consumption losses upon unemployment; nevertheless, households can be partly shielded from these losses by remaining in employment. As a result, following the energy shock it is optimal for the monetary authority to partly accommodate a rise in core inflation in order to indirectly sustain employment. This helps to limit the increase in unemployment caused by the shock hitting producers, thereby preventing households from becoming more exposed to the shock through unemployment.

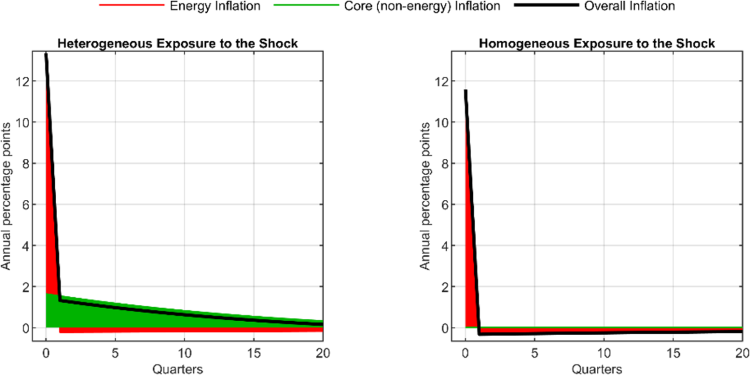

In particular, compared to a strict inflation targeting policy (aimed at fully stabilising core inflation), the optimal policy tolerates higher core inflation but achieves a smaller increase in unemployment (Figure 2.a, right panel). This rise in inflation is, however, smaller than if unemployment were instead fully stabilised (Figure 2.a, middle panel). The trade-off arises, indeed, due to the presence of heterogeneous exposure to the energy price shock between the employed and the unemployed: considering the counterfactual case of homogeneous direct exposure to the shock (Figure 2.b) — i.e., same energy share in the consumption basket of the employed and the unemployed — the trade-off vanishes, and the optimal policy would coincide with one aimed at fully stabilising core inflation (strict inflation targeting in the figure).

Figure 2: Unemployment and inflation effects of an energy price shock under alternative monetary policy regimes

Note: The figure reports model-based impulse responses to a 40% increase in the real price of energy. Solid lines correspond to responses under the optimal monetary policy, dotted lines to those under a strict inflation targeting policy aimed at fully stabilising core inflation, and dashed lines to those under a stable unemployment policy. Middle and right panels report, respectively, the responses of core inflation and unemployment under the alternative monetary policy regimes. The top panels refer to the baseline, heterogeneous exposure case (the energy consumption share is higher for the unemployed than the employed), while the bottom panels refer to the counterfactual, homogeneous exposure case (the employed and the unemployed have the same energy consumption share). Source: Gnocato (2024).

In both the baseline case of heterogeneous exposure to the shock and the counterfactual one of homogeneous exposure, while the monetary authority reacts more or less aggressively to core inflation (which coincides with non-energy inflation in the model), the energy component of inflation is instead fully looked through under the optimal policy (Figure 3). Intuitively, only core inflation endogenously matters for the hiring incentives of producers, being only the core goods produced within the economy. In contrast, energy is treated as a non-produced good, with its (real) price evolving exogenously. This simplifying assumption, in line with the approach of Blanchard and Galí (2007), concisely captures the situation faced by an energy-importing economy such as the euro area.

Figure 3: Overall inflation and its components under the optimal policy

Note: The figure reports model-based impulse responses, under the optimal monetary policy regime, to a 40% increase in the real price of energy. Solid lines correspond to overall inflation, red areas to its energy component, and green areas to its core (non-energy) component. The left panel refers to the baseline, heterogeneous exposure case (the energy consumption share is higher for the unemployed than the employed), while the right panel refers to the counterfactual, homogeneous exposure case (the employed and the unemployed have the same energy consumption share). Source: Gnocato (2024).

Energy price shocks have a greater impact on the unemployed than those in work, as energy costs take up a greater share of the consumption expenditures of the former. Consequently, in the face of a surge in energy prices, the monetary authority optimally accommodates a partial rise in inflation to contain the increase in unemployment and, hence, avoid households becoming more exposed to the shock.

Even if this column discusses a specific dimension of heterogeneity, it can lend potentially broader insights: some accommodation of core inflation might be needed to prevent households from becoming poorer and, hence, more hit by energy price shocks. Also, these insights can easily extend to similar situations when other subsistence goods besides energy, such as food, receive sizeable relative price shocks.

Blanchard, Olivier J., and Jordi Galí. 2007. “The Macroeconomic Effects of Oil Shocks: Why are the 2000s so different from the 1970s?” NBER Working Paper 13368.

Challe, Edouard. 2020. “Uninsured unemployment risk and optimal monetary policy in a zero-liquidity economy.” American Economic Journal: Macroeconomics, 12(2): 241-83.

Gnocato, Nicolò. 2024. “Energy price shocks, unemployment, and monetary policy.” Bank of Italy Working Paper 1450.

See also Challe (2020) for a similar setup.