This policy brief paper studies optimal robust monetary policy when the central bank observes potential output imperfectly and has Knightian uncertainty about the intertemporal elasticity of substitution and the slope of the Phillips curve. The literature on optimal robust monetary policy has focused either on the imperfect observability of some variables or on parameter uncertainty. We characterize robust monetary policy analytically for the two types of uncertainty and show that in general, uncertainty calls for a more aggressive monetary policy reaction compared with the certainty case.

Central banks generally operate under uncertainty, for example about the sources of shocks hitting the economy, the value of some parameters of their models or the measurement of some state variables. Because of uncertainty, it may become extremely difficult to evaluate the appropriate response to shocks and assess the transmission of monetary policy to the real economy. Under the so-called “Knightian” uncertainty the probability distribution of economic outcomes is unknown. The shock to the economy induced by the pandemic can be seen as an example of Knightian uncertainty, as recently highlighted by Stephen Poloz (2020), former Bank of Canada’s Governor.

In a recent paper, we characterize the optimal robust monetary policy when the central bank has Knightian uncertainty about two structural parameters – the intertemporal elasticity of substitution (IES) and the slope of the Phillips curve – and faces a misspecified output gap. We think the latter feature steers the model towards a reasonable direction, as potential output is often observed with noise in reality. Since the central bank is uncertain about the IES and the slope of the Phillips curve, it cannot back out the correct potential output from observing inflation and the natural rate. In this environment, the central bank aims at avoiding the worst realizations of output gap and of the uncertain parameters. The analysis assesses under which circumstances the central bank should act more cautiously or more aggressively in response to shocks to the natural rate of interest relative both to the case with no uncertainty and to the case in which only the parameters of the model are uncertain.

We consider a simple two-equation new-Keynesian DSGE model summarized by a forward looking IS and Phillips curve which allows us to derive the solution in closed form under the assumption of optimal discretionary monetary policy regime. We build on Giannoni (2002), who studies optimal monetary policy under Knightian uncertainty on the IES and on the slope of the Phillips curve and add a misspecified output gap to his model. As in Giannoni (2002), we assume that the central bank faces a trade-off between the stabilization of inflation and the output gap on one hand, and nominal interest rate smoothing on the other hand. Parameter uncertainty makes difficult to quantify this trade-off, while misspecified potential output hampers the effectiveness of monetary policy in closing the output gap.

As in Giannoni (2002), in case of uncertainty about the parameters of the model alone, monetary policy does not completely offset the shock to the natural rate in the discretionary equilibrium. This happens because the central bank cares about fluctuations in inflation, output gap and the nominal rate, and adjusting the latter as much as the natural rate would imply that the other two quantities would be stabilized to a lesser extent. We show that adding a misspecified potential output to uncertainty about the slope of the Phillips curve and the IES yields further interesting results.

Because of measurement errors in potential output, the policy rate does not necessarily adjust in the direction of the shock to the natural rate, as it would be with only parameter uncertainty, but the direction of the adjustment depends on how confident the central bank is of its estimates of the output gap. In other words, uncertainty affects not only the size of the response of the economy to shocks, but also the direction. In general, after a shock to the natural rate, the monetary policy response depends on two features: i) the persistence of the shock, ii) the level of central bank’s confidence of its estimate of potential output relative to the desire to stabilize the output gap.

For example, when the persistence of the shock to the natural rate is relatively low and the central bank’s desire to stabilize output gap is larger than the degree of confidence in the measurement of potential output, a positive shock to the natural rate does not necessarily imply an upward revision of the nominal rate, as it would be without uncertain potential output. Our interpretation is the following: if potential output is highly misspecified and the central bank cares relatively more about stabilizing the output gap, it might misinterpret the source of the shock and believe it is a shock to potential output, hence reducing the nominal rate.

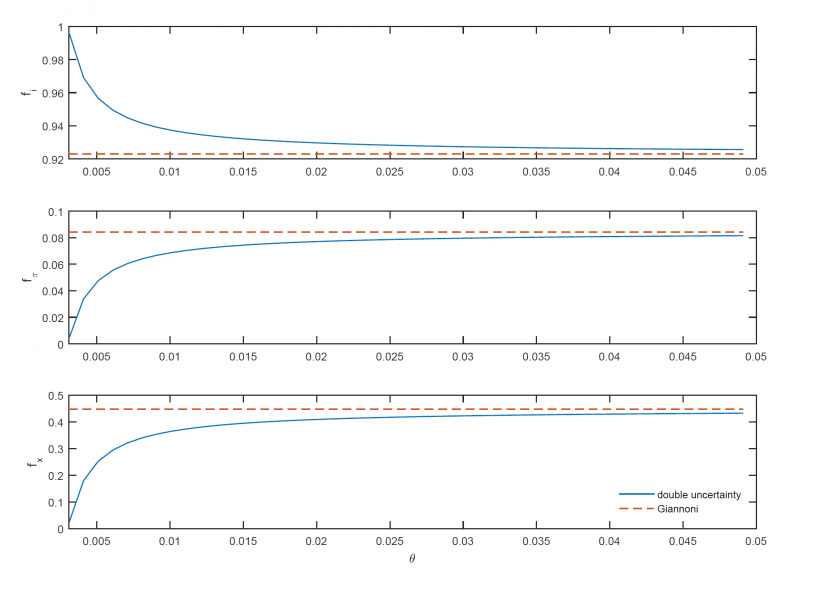

Figure 1: Optimal response of interest rate, inflation and output gap as function of the level of confidence in the measurement of potential output θ. The calibration is such that there’s a positive shock to the natural rate of interest, θ > λx, and fluctuations in the natural rate have a relatively low persistence. The red dashed line shows the optimal coefficients in Giannoni (2002), where the output gap is observed without measurement error.

Figure 1 shows the optimal robust discretionary policy in our model as a function of the degree of confidence in output gap measurement compared to the findings in Giannoni (2002). Here we consider only the cases in which the degree of confidence in the measurement of potential output is larger than the central bank’s desire to stabilize output gap. In terms of magnitude, we observe that the larger the uncertainty surrounding potential output (i.e., towards the left of the x-axis, solid blue line), the more aggressive monetary policy responds in terms of interest rate reaction compared to the case where there is only parameter uncertainty (dashed red line, labelled as “Giannoni”). The more aggressive monetary policy response partially dampens the impact on inflation and output gap of disturbances to the natural rate of interest. Our interpretation is that when central bank faces a misspecified output together with parameter uncertainty, the policymaker cannot quantify the range in which output and inflation can vary and this pushes for a stronger adjustment of the nominal rate for a given shock to the natural rate.

Finally, we consider the case in which the optimal robust monetary policy is implemented through a Taylor rule. We again complement what Giannoni (2002) finds, which is that in general the central bank must respond more aggressively to movement in inflation under parameter uncertainty than in absence of uncertainty, contrary to the so-called “Brainard principle”. Our results point out that the coefficient measuring the interest rate response to inflation is generally increasing in the degree of uncertainty, especially if the central bank becomes less confident in its estimation of potential output. For a very high level of uncertainty on potential output, the equilibrium turns out to be indeterminate, even in the case of a large response to inflation, well above the Taylor principle.

Summing up, uncertainty is a pervasive feature of the environment in which central banks operate. This paper provides insights on how monetary policy may be conducted when the central bank does not know the probability distribution of the economic outcomes. It analyzes the conduct of optimal discretionary robust monetary policy with Knightian uncertainty about the IES and the slope of the Phillips curve and a misspecified potential output. This double dimension of uncertainty affects not only the magnitude of the response of the central bank to shocks, but also the transmission of the latter in terms of inflation, output and nominal rate. We show that under uncertainty caution is not always the optimal policy. Overall, the more uncertain the central bank is about the measure of potential output, the stronger the response of the interest rate to inflation fluctuations will be.

Giannoni, Marc P. “Does model uncertainty justify caution? Robust optimal monetary policy in a forward-looking model.” Macroeconomic Dynamics 6.1 (2002): 111-144.

Grasso, Adriana, and Guido Traficante. “Optimal robust monetary policy with parameters and output gap uncertainty.” Bank of Italy Temi di Discussione (Working Paper) No 1339 (2021).

Poloz, Stephen S. Lecture, Eric J. Hanson Memorial. “Monetary policy in unknowable times.” (2020).