References

EBA. 2015. Guidelines on the interpretation of the different circumstances when an institution shall be considered as failing or likely to fail under Article 32(6) of Directive 2014/59/EU. EBA/GL/2015/07. URL: EBA-GL-2015-07 GL on failing or likely to fail.pdf (europa.eu)

EU. 2014. DIRECTIVE 2014/59/EU OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL. Official Journal of the European Union. L 173 / 190. URL: DUMMY (europa.eu)

FDIC. 2019. Resolutions Handbook. URL: Resolutions Handbook (fdic.gov)

FSB. 2019. Key Attributes of Effective Resolution Regimes for Financial Institutions. URL: Key Attributes of Effective Resolution Regimes for Financial Institutions – Financial Stability Board (fsb.org)

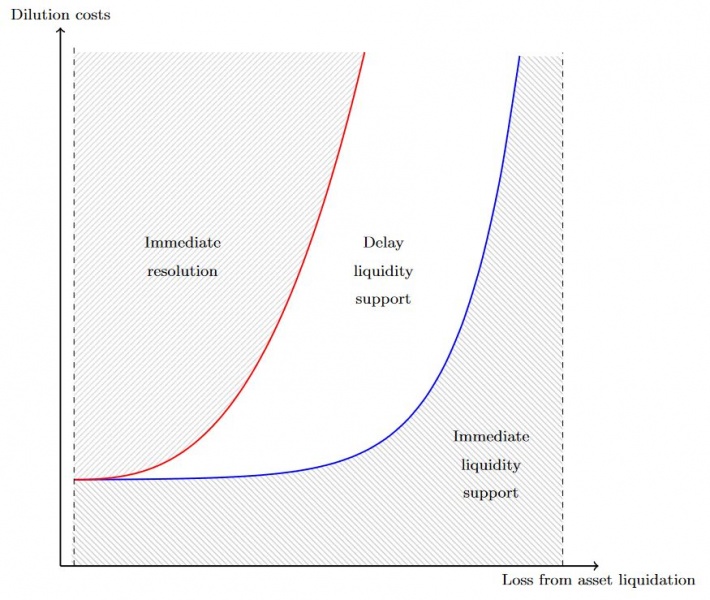

König, P. J., P. Mayer, D. Pothier. 2022. Optimal Timing of Policy Interventions in Troubled Banks. Discussion Paper 10/2022. Deutsche Bundesbank. URL: Optimal timing of policy interventions in troubled banks (bundesbank.de)

Santos, J., Suarez, J. (2019). Liquidity standards and the value of an informed lender

of last resort. Journal of Financial Economics, 132(2), 351 – 368. URL: Liquidity standards and the value of an informed lender of last resort – ScienceDirect.