How do analysts’ expectations on monetary policy rates relate to their expectations on inflation and economic activity? This is a key question for central banks when evaluating the transmission of monetary policy decisions.

In our recent work (Bernardini and Lin, 2023, 2024), we show that during the 2022-23 tightening cycle analysts’ expectations on ECB policy rates closely mirrored those implied by simple Taylor rules based on their own macroeconomic expectations. We further document that revisions of interest rates expectations were primarily driven by upward shifts in inflation expectations; increases of the expected long-run policy rate also played a smaller but non-negligible role.

Interest rate rules are simple formulas that map measures of inflation and economic activity into monetary policy rate prescriptions. The Taylor rule (Taylor, 1993) is by far the most prominent example. Its logic is simple: the monetary policy rate reacts positively to the deviations of inflation from target (more than one-to-one according to the so-called “Taylor principle”) and negatively to measures of economic slack.

Interest rate rules serve as benchmarks, providing a simplified representation of the complex decision-making process that central banks undertake and do not have normative content. As argued by Bernanke (2015) monetary policy should indeed be systematic, not automatic. Yet, interest rate rules have been successful in representing the historical evolution of official policy rates.1 This makes them a good starting point for forecasting future policy decisions.

In a recent paper (Bernardini and Lin, 2024), we investigate the relationship between financial analysts’ expectations of interest rates, inflation and economic activity using the ECB Survey of Monetary Analysts (SMA). In this survey, which is conducted a few days before each ECB monetary policy meeting, analysts provide their expectations of policy rates, core and headline inflation, economic growth and unemployment, at a quarterly frequency.2 In our analysis, we use a thick-modelling approach to compute a set of Taylor rule-implied interest rate paths (rule-implied rates), based on SMA’s expectations of inflation and unemployment rate.3 We then compare the rule-implied rates with the SMA’s expectations of the deposit facility rate, the key ECB’s policy rate (expected rates). If analysts use a Taylor rule to predict future policy rates, we should expect a broad alignment between the two.

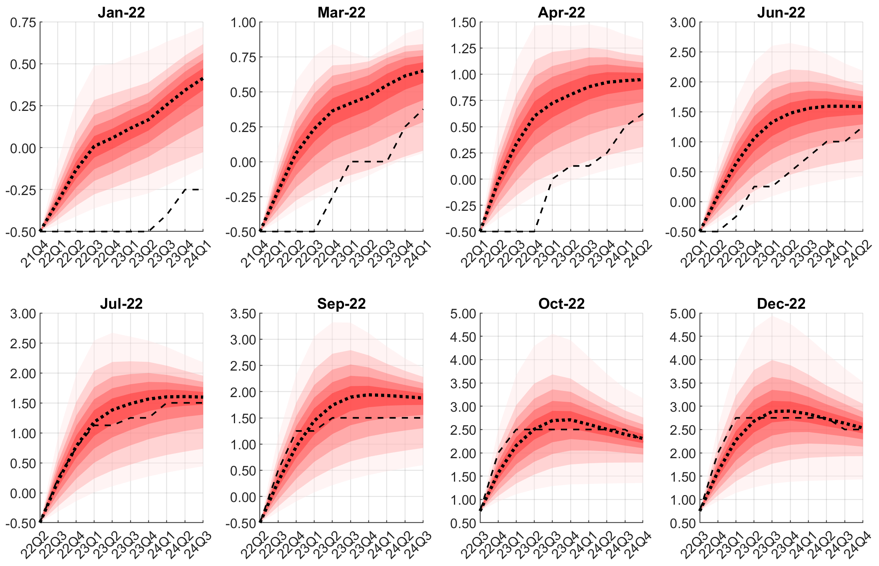

Figure 1 (top row) shows that expected and rule-implied rates were largely unrelated prior to the start of the 2022-23 rate hiking cycle. During this period, analysts did not consider the Taylor rule as the primary factor in forming interest rate expectations. This was likely due to the ECB’s use of other tools, such as asset purchases and forward guidance, to adjust the monetary policy stance. As a result, the policy rate was expected to remain largely unresponsive to macroeconomic developments.

Since the ECB announced the start of the policy rate hiking cycle in June 2022 (i.e., since the July 2022 round of the SMA), expected rates and rule-implied rates became remarkably aligned (Figure 1, bottom row). Our results suggest that analysts may have (re)considered the Taylor rule as a starting point to form their expectations of the future path of the policy rate. This change occurred when policy rates regained prominence in signalling the monetary policy stance and communication on their future trajectory became more limited.

Figure 1: Expected ECB policy rates against rule-implied rates

(percentages)

Notes: the panels correspond to the 2022 ECB SMA rounds and compare the expected median policy rate path (black dashed line) against its rule-implied counterparts (red bands and black dotted line). The x-axis refers to a given horizon, ranging from the calendar quarter prior to the survey quarter to two years ahead. The red bands show the entire distribution of rule-implied rates across several parametrizations.

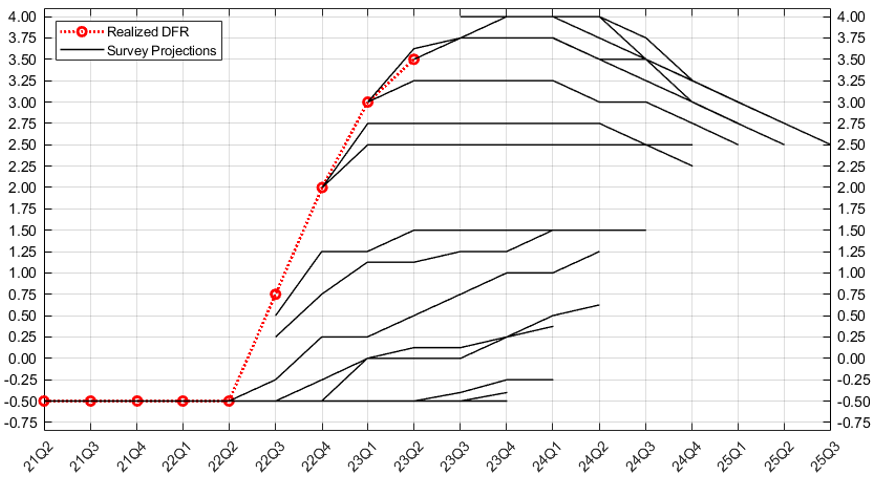

We assess the drivers of the significant and sustained upward revisions of expected rates observed between the July 2022 and the September 2023 SMA (Figure 2).4 The cumulative revision over this period has been substantial, amounting to around 2.5 percentage points, from 1.5% to 4%, when considering the peak rate in each survey round (also known as “terminal rate”).

Figure 3 shows that the bulk of the cumulative upward revision was primarily driven by their revisions of inflation expectations, which accounted for more than half of the overall effect. Another important factor was the revision of the expected long-run policy rate (i.e., i*, the nominal counterpart of the natural rate r*), which was revised up from 1.25% to 2%, accounting for about one third of the overall effect.

Figure 2: Revisions of expected ECB policy rates (2022-23 hiking cycle)

(percentages)

Notes: the figure reports the evolution of the ECB policy rate (DFR; red) and the projections for the same rate under all the available rounds of the SMA (black).

Figure 3: Drivers of revisions of expected ECB policy rates (2022-23 hiking cycle)

(percentage points)

Notes: the figure provides the decomposition of the cumulative revision in expected ECB policy rates between the July 2022 and the September 2023 SMA into the contribution of five factors. Each bar represents the median contribution of each factor across several Taylor rule parameterizations. Bias-related terms summarize variations in the expected rate paths that are not explained by other components.

We document that during the 2022-23 monetary tightening cycle, financial analysts’ expectations of the ECB rate have closely followed those implied by simple Taylor rules.

The substantial upward revision of the expected rate path observed during this period was mainly due to repeated upward revisions of inflation expectations.

Bernanke, Ben (2015). “The Taylor rule: A benchmark for monetary policy?” Brookings Blog, April 28.

Bernardini, Marco and Alessandro Lin (2023). “Out of the ELB: expected ECB policy rates and the Taylor Rule”, Questioni di Economia e Finanza, 810, Banca d’Italia.

Bernardini, Marco and Alessandro Lin (2024). “Out of the ELB: expected ECB policy rates and the Taylor Rule”, Economics Letters, 111546.

Blattner, Tobias Sebastian and Emil Margaritov (2010). “Towards a robust monetary policy rule for the euro area”, ECB Working Paper, 1210.

Taylor, John B. (1993). “Discretion Versus Policy Rules in Practice”, Carnegie-Rochester Conference Series on Public Policy, 39(1), 195-214.

Taylor, John B. (1999). “A Historical Analysis of Monetary Policy Rules”, in J. B. Taylor (ed.), Monetary Policy Rules, Chicago: University of Chicago Press, 319-341.

See for instance Taylor (1999), Blattner, and Margaritov (2010), and Bernanke (2015).

The projection horizon varies across survey rounds but the minimum is 2-years. Furthermore, questions about policy rates expectations have higher frequencies over the first year of the projection horizon. The same frequency is not available for macroeconomic outlook.

Each rule is characterized by time-invariant parameters that are drawn from uniform distributions centered around standard textbook values. See Bernardini and Lin (2024) for more details.

This section builds on an additional exercise discussed in the working paper version (Bernardini and Lin, 2023).